Tim Melvin has built a name for spotting solid income investing plays. But do his latest insights live up to his reputation? Tune into my The 20% Letter review for the full scoop.

What Is The 20% Letter?

The 20% Letter is an investment research service helmed by Tim Melvin and published by Investors Alley.

Members receive dividend-centric stock picks, market commentary, bonus reports, and much more.

As the name suggests, the team targets the opportunity for 20% gains with every investment idea. This includes share price appreciation and dividends.

The potential for twenty percent growth might not sound particularly flashy, but it’s not meant to be. The team focuses on grounded dividend plays that could outpace inflation and steadily grow portfolios over time.

As mentioned, this research package offers even more features, including income strategies carefully curated by the team.

I’ll dig into the details as we go, but let’s start with a look at the mind behind the service.

>> Sign up for 75% off HERE <<

Who Is Tim Melvin?

Tim Melvin is a great analyst who specializes in income investing.

He got off to a humble start, raised in a poorer area of Baltimore by a single mother. Unable to afford college, he began his career as a door-to-door vacuum salesman.

Tim knew the real money was in the stock market and used his hard-earned cash to become involved in the investment scene.

He became a vice president at Ferris Baker Watts, where he began to understand the power of deep value investing.

A shift to the private sector led him to new opportunities as a portfolio manager, advisor, and stockbroker.

With his time as a salesman a distant memory, he now has over 30 years logged managing money for wealthy individuals around the globe.

>> Discover the team’s latest recommendations <<

What Is Investor’s Alley?

Debuting in 1998, Investors Alley publishes independent investment newsletters from six of the best minds in finance.

Its free newsletter, The Market Cap, reaches more than 300,000 readers who rely on its research to make informed decisions in the stock market.

In addition to the free newsletter, Investors Alley has ten premium publications dedicated to specific market niches.

The $4.5 Trillion Energy Revolution

If you’re like me, you’re always looking for the next big sector to invest in. Tim Melvin believes it’s not artificial intelligence or some other fancy new technology.

His consensus? Energy’s the answer.

There’s been plenty of talk about renewable, clean sources of the stuff. Our politicians have been talking about it for years.

However, Tim’s all but certain we’re still decades away from reaching 100% renewable energy. The cost of eliminating “dirty” fuels from America’s shores? Estimates place the number at $4.5 trillion.

After all, we still use oil, natural gas, and coal for 80% of our total energy consumption. Fossil fuels are still essential and will actually lead the way into an eventual net zero.

Several oil and gas stocks are already dominating the market. Devon Energy is up 180% over the last few years, with ExxonMobil right behind it at 141%.

We’re looking at a game-changing era for the oil and gas industry. Billionaires Warren Buffett, David Tepper, and Ken Griffin are already getting involved.

Not every energy stock will reap the benefits, though. Fortunately, Tim Melvin has done the research and found what he feels is a once-in-a-lifetime opportunity. It won’t be around forever though.

>> Get the name of Tim’s top energy stock here <<

“Why It’s Critical to Move Now”

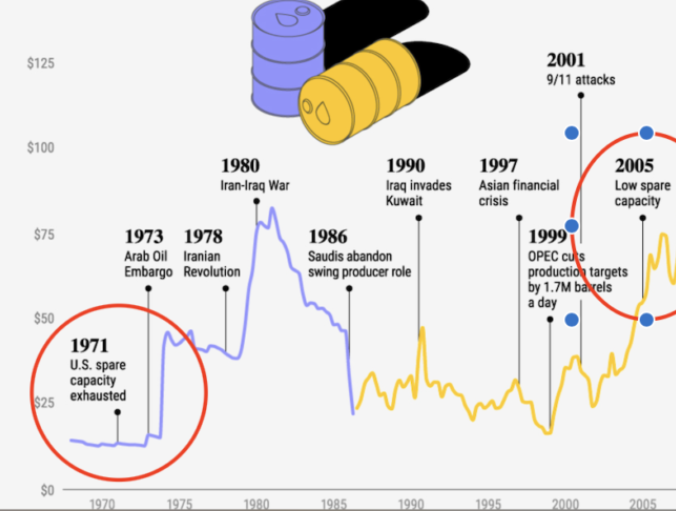

It may be a long road to 100% renewable energy, but that doesn’t mean you shouldn’t act fast. Melvin predicts we’re at the beginning of a multi-year bull market for oil.

I read that as some money already missed since I didn’t invest in this earlier. There still appears to be plenty of growth on the horizon if we jump in now.

In fact, oil prices could see a $100 high and hang out there for quite a while.

What’s causing the bull market?

Simple economics – oil inventories are at an all-time low, and demand has reached an unprecedented high.

This isn’t the first time something like this has happened. The U.S. burned through its spare supply in 1971 and 2005.

Both instances caused a similar jump in price to what Melvin is anticipating today.

We’re not the only country increasing demand, either. China alone accounts for more than 70% of that growth. Other nations are following suit.

You’ll want to buy in before oil prices really start to climb if you’re hoping to earn some nice returns from the sector. There’s one other variable, though, that sets Melvin’s energy stock apart.

>> Act now to capitalize on the oil bull market <<

The Quick Income Window

We’ve also been handed a rare quick income window that just opened up, unique in the sector to Melvin’s energy stock.

This past summer, the company announced it’s splitting its stock in two. Announcements like these usually lead to a price dip for months after the fact.

That’s precisely what we’re seeing with Melvin’s stock. Shares have tumbled nearly 25% since the news first came out, and they’re still trading at a low.

A drop may seem like bad news at first, but look at the big picture. You can pick up shares at a discounted price, and there could be an even steeper ride to the top. Those words are music to my ears and should be for you too.

It’s not like this is the first time a stock split has happened. Zimmer Biomet Holdings did the same thing in March 2022. The rebound after the dip led to 37% gains. Encompass Health Corp did the exact same thing.

We’re likely sitting on the very best time to buy this particular stock, but I doubt we’ll stay in this perfect storm for long. Even if shares don’t immediately rise, this company pays out a healthy dividend in the meantime.

A “Dirty” Stock That Could Skyrocket

Let’s take a moment to look at Melvin’s “dirty” energy stock itself and how it’s fueling our need for fossil fuels.

You need gathering and processing for sure, but you also need pipelines. This company controls one of the largest collections of pipelines in all of North America.

Four of those pipelines are among the ten longest on the continent. Soon, it will be able to move gas from Northeast British Columbia all the way to the Yucatan.

I don’t need to tell you how crucial these pipelines are and how crippled we’d be without them.

What’s more, the company collects a fee on every gallon of oil or gas passing through one of its processing centers. A portion of those fees trickle back to shareholders as dividends.

Melvin’s energy find is as much a dividend stock as it has growth potential. Talk about a win-win.

Like I said before, this opportunity isn’t going to be around for long. Considering the direction our economy looks to be heading with fossil fuels, it can’t be.

You can get immediate access to this energy stock pick the moment you sign up for Tim’s latest deal. Join me as we check out everything you get when you join.

>> Get access to Tim Melvin’s #1 Energy Stock Pick here <<

What Comes with the Service?

Tim Melvin’s The 20% Letter provides an array of investment research to help folks navigate the income-investing landscape.

Read on to find out everything on offer.

One-Year Subscription to The 20% Letter

Members can tap into monthly market analysis and a new trade idea curated by The 20% Letter team.

The newsletter also explores other topics, such as the Federal Reserve’s latest moves and booming sectors to keep an eye on.

This is a great place to get a sense of where the markets are heading, as well as strategies to tackle emerging events on the stock market.

As mentioned, the goal is to find opportunities with the potential for 20% returns.

While this number may seem modest, it could double the value of portfolios if the investment thesis holds up for three years.

>> Sign up now and save 50% <<

Model Portfolio

The model portfolio keeps members in the loop about the team’s open positions.

If you’re new to the service, you might want to make this your first stop for picks.

Members have unlimited access to the portfolio, so you can revisit this resource as much as you want during your subscription.

Trade Alerts

The best trade opportunities don’t wait until The 20% Letter monthly issue drops. Fortunately, the team keeps subscribers up to date with to-the-minute trade alerts.

You’ll get clued in when stocks appear to be reaching the bottom and when to sell for an opportunity to maximize profit.

Weekly Video Updates

Each week, the service releases a video update that covers current stock positions and market trends.

You’ll get to hear and see Tim’s reactions to market shake-ups and any big news happenings.

Where each monthly issue of The 20% Letter is a deep dive into income investments, these video updates are the highlight reel.

>> Access all these features and more<<

Energy Stock Bonuses

This limited-time deal also provides new members with additional trade ideas and educational materials.

Let’s take a look at the bonuses on offer.

The #1 Energy Income Stock to Buy and Hold Forever

This special report has the answer to your most burning question. It contains the name and ticker symbol for the energy stock Tim Melvin is so excited about.

Inside, the guru shares the best price you should buy in at and all the research he’s done on the company. He even lays out his potential roadmap for the company’s future and how current trends can carry it to unimaginable heights.

Both the continued need for fossil fuels and the quick income window work solidly in our favor. Don’t be surprised if you end up with four-digit returns.

The icing on the cake is that this company trades for under $40 right now.

Not sure about you, but I never invest in businesses I know nothing about. Concise reports like these that have all the information I’m looking for are my bread and butter.

>> Access Tim’s top energy stock pick now <<

Collect an Ultra-High 9.68% Dividend From American Oil

Tim Melvin has the lowdown on another big dividend stock helping to lead the charge on America’s oil boom.

This one company produces upwards of 315,000 barrels of oil and 150,000 barrels of liquid natural gas per day. It just so happens to also churn out more than one billion cubic feet of natural gas.

Even though supplies are dangerously low, this energy supplier is clearly doing its part.

The long road to renewable energy saturation means we’ll likely have to rely on this company for quite a while. That means this stock could experience massive growth in the coming months and years.

To top it all off, this is a dividend stock paying out nearly 10% yields right now. This rate is only expected to grow in the years to come.

You’ll get all the details on this stock, including name, ticker, and how much to pay, right here in this bonus report.

The ‘Holy Grail’ Dirt-Cheap Energy Stock for 172% Gains

The ‘Holy Grail’ Dirt-Cheap Energy Stock tells the tale of an energy company currently trading for less than $15 on the stock market. It’s completely off the radar right now, so most folks don’t even know to check it out.

In actuality, the company has assets in key basins throughout the lower 48 states. Eagle Ford, Rockies, Barnett, Permian, and Mid-Con are just a handful of the more notable ones.

This stock is especially appealing right now because all signs point to it being so undervalued. Shares could nearly triple as they catch up, leading to 172% gains for anyone investing now.

You’ll want to read through this report to get the name, ticker, and a full analysis.

EXCLUSIVE Energy Portfolio

We’ve talked a lot about oil and natural gas, but renewable energy stocks will soon share the spotlight. Tim is well aware and chose to build this model portfolio capturing the best of both worlds.

Subscribers get unlimited access to the portfolio, which includes the fossil fuel stocks we covered earlier, among others. This should also be your go-to place for renewable energy stocks the moment they become viable.

Melvin himself keeps tabs on the list, adding new picks when it’s time to buy. You’ll never have to worry about missing out on the top stocks from this essential industry.

He’ll also alert you when the time comes to sell one of his recommendations for the biggest gains.

12-Month Money-Back Guarantee

Under the latest deal, The 20% Letter is offering a 12-month money-back guarantee on the subscription cost.

For reference, the industry standard is about one month for similar newsletter services.

So the current refund policy provides 12 times more coverage.

This is a good sign that the team stands by their work.

And unlike most newsletters, this refund window could provide more than enough time to see a position to its conclusion.

>> Sign up under Tim’s guarantee <<

Is Tim Melvin Legit?

Tim Melvin is a legit income investing analyst. He’s made some excellent predictions in the last 15 years, calling the top in 2007 and the bottom in 2009.

He was also one of the first to recommend buying real estate in 2019 and to dump tech stocks in 2021. In June 2022, he called a short-term bottom on the exact day it took place.

Today, Tim targets income stocks in his popular publications Underground Income and, more recently, The 20% Letter.

Pros and Cons of The 20% Letter

The 20% Letter has a lot to offer, but it isn’t perfect. Check out the pros and cons of this service.

Pros

- Great price with 50% discount

- Incredible 12-month money-back guarantee

- Weekly video updates

- Time-sensitive trade alerts delivered to your inbox

Cons

- A narrow focus on dividends

- No chat room or discussion forum

How Much Does The 20% Letter Cost?

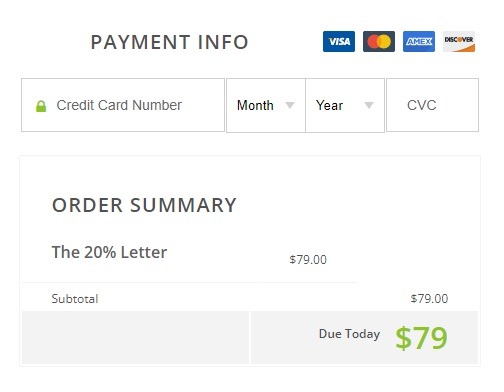

An annual subscription to The 20% Letter typically costs $149. However, the team is offering a limited-time deal that dramatically cuts down the sticker price.

Right now, members can sign up for just $79. This shakes out to a 50% discount (not too shabby).

Considering that the bonus features are worth $500 on their own, this is an excellent deal.

One solid stock pick could offset the price of the subscription.

>> Sign up now and save 50% <<

Is The 20% Letter Worth It?

After completing my The 20% Letter review, I can confidently say this is a great newsletter that’s well worth the price of admission.

The $79 price tag stacks up to about 21 cents a day, which is a small price to pay for expert analysis. And the latest deal offers even more bang for your buck.

There’s a lot to like about the package.

Tim reveals a new energy-focused trade idea every month, and new members also receive additional research through complimentary reports.

All in all, if you’re looking for quality energy stock picks with solid upside potential, Tim and the team have you covered. Check out The 20% Letter to get promising new stock picks every month.

Tags:

Tags: