The Motley Fool seeks to make waves with new service tiers designed to make grabbing gains easier than ever. Does this new structure land or simply muddy the water further? I investigate in this Motley Fool review.

What is The Motley Fool?

The Motley Fool is a financial services company first launched in 1993. It follows the logic that investing in great businesses over time is the best path to wealth.

The platform’s name is a play on the court jester, an individual tasked with bringing joy to those around him. This character could also speak truthfully about important matters without fear of retribution from royalty.

Twenty years later, it still follows these same guidelines, now offering both free and premium investment recommendations and research to millions of individuals around the world through distinct services.

I’ll dive into each of these services in just a bit. First, let’s take a look at the two brothers who made this all possible.

>> Join Motley Fool One for unlimited access to Fool research! <<

Who Are the Gardner Brothers?

The Gardner Brothers are two of the founders of The Motley Fool and chief visionaries for its future direction.

They’ve remained major players in the platform’s success over the last 20 years, serving as lead advisors on a number of services to this day.

Let’s take a moment to look at each guru in more detail.

David Gardner

David Gardner graduated from the University of North Carolina at Chapel Hill in the late 80s, deciding to pursue a career in finance.

His desire to help others achieve financial success led him away from Wall Street, instead choosing to start his own on-paper newsletter.

After initial failure, David shifted his focus to the internet, publishing content on America Online at the time.

It quickly became a hit, prompting David and Tom to brand their site the Motley Fool and provide market insights from there.

Now, 20 years later, David remains on the Motley Fool as Chief Rule Breaker and Co-Chairman.

Tom Gardner

The younger brother of David, Tom Gardner attended Brown University before doing graduate work in geography and linguistics at the University of Montana.

Upon seeing his brother’s attempt to start a financial newsletter, Tom was the one to realize the potential the internet could have on its success.

From that point on, he worked with David to launch the site and turn the platform into the raging success it is today.

Like David, Tom still holds a vital role within the Motley Fool’s ranks, serving as its CEO and Co-Chairman.

He also still creates content for many of the site’s services and owns several portfolios he funds with his own money.

Is Motley Fool Legit?

The Motley Fool is indeed a legit platform, broadcasting more than 20 years of stock picks and gains. Its successes over the years have caught the eye of the millions of people who turn to the service on a regular basis.

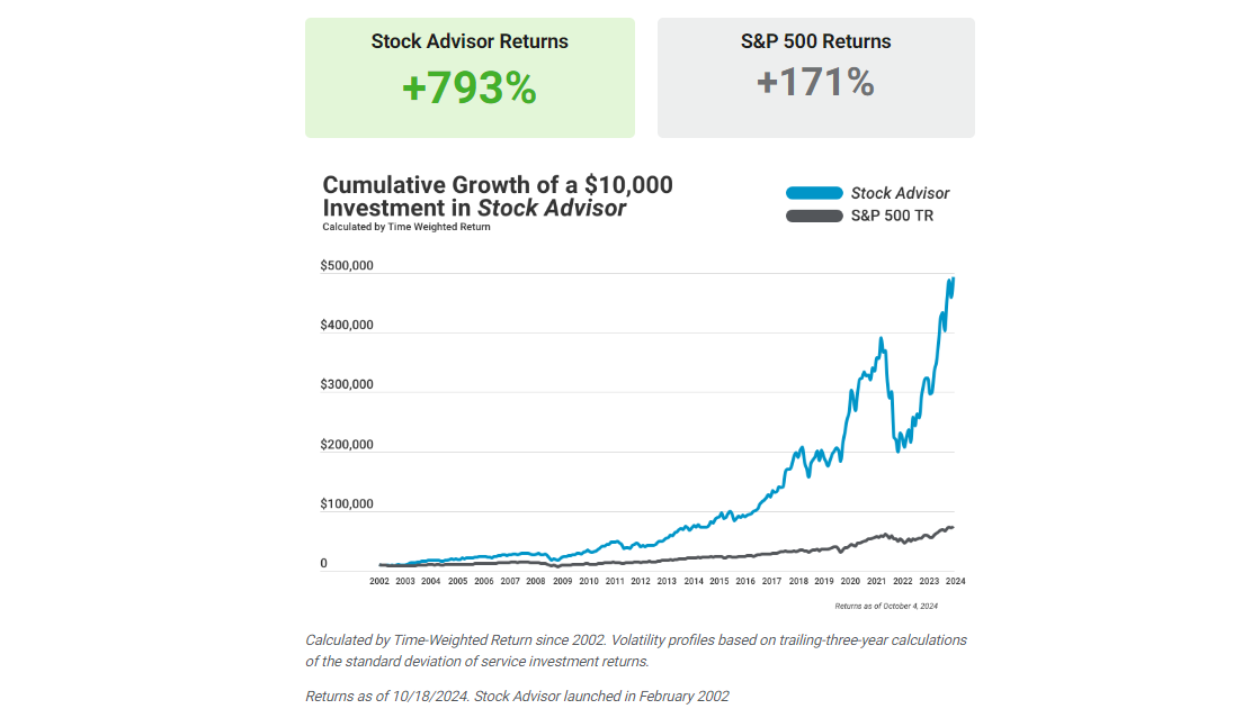

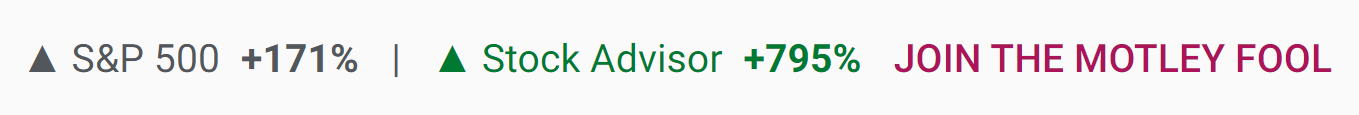

Stock Advisor has more than quadrupled the S&P 500’s returns since its inception, thanks to strategic recommendations from every corner of the industry.

Some of its most significant wins came from companies overlooked by the market before they went big.

The site recommended Amazon and Netflix back in 2004, with each company going on to quintuple-digit gains in the years since.

Motley Fool was also one of the first to add Nvidia to its portfolio, a move that could have brought in 82,000% returns for careful listeners.

Motley Fool’s New Service Tiers

The Motley Fool now showcases five service tiers, a huge deviation from its previous offerings.

This change moves the platform away from the more than 40 options it had in the past, creating thousands of plan combinations that could prove overwhelming for current and new members alike.

Each new stock-picking service is designed to cover specific types of investment strategies without the need to overlap.

It feels much more approachable now, hopefully allowing more individuals to get plugged in and take advantage of various Motley Fool stock picks each month.

Stock Advisor

Motley Fool’s Stock Advisor is just that, providing a plethora of stock research and picks for subscribers.

Stock Advisor stocks typically come from the entire stock market, as the service scans for companies with the potential to beat the market over a multi-year span.

The overarching goal is to slowly buy 25 Stock Advisor picks during your time on board, adding new money regularly to grow your pool of returns.

In most cases, you’ll hold these securities for a minimum of five years, weathering stock market storms to target long-term gains.

Members receive two new stock picks on the first and third Thursday of each month alongside concise but clear guidance explaining each recommendation in detail.

Newcomers can choose between three entry strategies, ranging from cautious to aggressive levels of risk. It also offers a GamePlan financial hub chock-full of planning articles for your future.

Best For

Anyone looking to set out on a marathon with Motley Fool will find something of import here.

Motley Fool’s Stock Advisor has more than 20 years of market-beating success, faithfully announcing two new stock picks each month that can fit with any long-term vision.

There’s plenty of educational material here as well, lending itself to those a bit fresh to stock-picking services like this one.

The multiple strategy options are a boon for those with a certain risk tolerance in mind but allows for adjustment as needs change down the line.

As the lowest-priced of Motley Fool’s investment services, it’s an excellent place to get your feet wet without having to commit a large swath of funds.

-

Stock Advisor: Ideal for beginners or those with $25 K–$50 K to invest who want two monthly picks and foundational planning via GamePlan.

-

Epic: Suited to semi-active DIY investors ($50 K+) who seek five picks/month and deeper analytics via Fool IQ+.

-

Epic Plus: Best for tech-focused allocators ($100 K+) wanting nine picks (including AI playbook) and options strategy education.

-

Fool Portfolios: Geared toward experienced allocators ($250 K+) who prefer 11+ curated model portfolios and real-money tracking.

-

Fool One: Tailored to high-net-worth investors ($500 K+) desiring all services plus quarterly rebalances, VIP events, and direct access to analysts.

>> Click here to get started with Motley Fool Stock Advisor NOW <<

Epic

Epic is the new name for a combination of former Motley Fool services that, in conjunction, really speak to folks going it alone.

It offers an impressive five stock picks per month, sharing recommendations that blend growth, dividend, and under-the-radar opportunities to construct a diverse yet optimized investment portfolio.

These additional opportunities go a long way, but Epic‘s other offerings are what make the platform really stand out.

Starting with all the best features of Stock Advisor, Epic sprinkles in a number of proprietary tools that go even deeper with more analytics and research.

These include the Fool IQ+ toolkit with ways to uncover information that helps make educated stock assessments that even the Fool’s analysts trust and use.

Furthermore, members get to play with Motley Fool’s Quant projections across all current recommendations that reveal scores and rankings for each one.

Previously Titled

Epic was previously called “Epic Bundle” and consisted of 4 products: Stock Advisor, Rule Breakers, and Real Estate Winners. The new Epic features the following services: Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor.

Best For

Epic requires some skill with investing to understand all the tools at your fingertips. Therefore, it may not appeal to folks just getting their feet wet.

If you can take full advantage of at least the majority of these offerings, Epic can be a massive boon to your investing game.

While it comes with a moderate price tag, you’ll want a big enough portfolio to offset this cost so it doesn’t cut too heavily into your returns.

Similarly, five new stock picks sounds great on paper but can be a bit daunting for those with little time or money to maximize their potential.

>> Click here to join Motley Fool Epic NOW <<

Epic Plus

As the name implies, Epic Plus adds even more content to the already robust platform we looked at just a moment ago.

Its most notable feature is perhaps the AI playbook, designed specifically to categorize and score artificial intelligence stocks riding the wave of this innovative new tech.

The system locates the best opportunities from the sector without losing focus on gains from other industries as well.

Users get nine unique stock picks per month from the top value, international, and trending securities. The platform also delves into options trading strategies and the merits of such an investment approach.

CEO Tom Gardner introduces his portfolios here as well, allowing you to see a snapshot of where he’s placing his real money at any given time.

Folks hungry for education have even more articles and earnings coverage to peruse in the expanded universe of stocks Epic Plus broadcasts.

Previously Titled

You’ll find inspiration for Epic Plus from former Motley Fool products like Market Pass, Options, Augmented Reality, and Trendspotter.

Best For

Tom Gardner doesn’t want any of his followers to miss out on the money-making potential of the game-changing AI sector, making Epic Plus the perfect place to go for anyone wanting to jump on the trend.

It doesn’t stop there, giving an access point to international markets and undervalued opportunities written off by the masses that many other platforms fail to do.

That said, you’ll want to maintain a portfolio of at least $100,000 or you may not earn back enough to justify Epic Plus‘s hefty price tag.

>> Click here to get started with Epic Plus <<

Fool Portfolios

Fool Portfolios compiles the features of several other Motley Fool investment platforms here, including the AI Playbook, GamePlan hub, and Fool IQ+.

It goes beyond these traditional services by highlighting the site’s comprehensive list of portfolios and stock picks located within.

In total, that’s more than 200 stocks immediately at your fingertips from Tom Gardner’s own research and a handful of investors using more than $30 million of the Motley Fool’s own cash.

Some of these portfolios even dip into areas other platforms dare not go, such as cryptocurrency and microcaps.

You’re likely to see at least a dozen new additions to these lists on a monthly basis, keeping the number of recommendations available to you fresh.

Previously Titled

Folks used to have to look into Digital Explorers and Mogul for comparable listings.

Best For

Once you reach Fool Portfolios level within Motley Fool’s services, you’re playing with the big dogs.

Diving in here requires a solid grasp of investing and your portfolios, as well as a willingness to pursue alternative investments such as cryptocurrency and much-feared microcaps.

For those interested, these additional avenues can come with higher returns at the cost of additional risk.

The portfolios here hold millions of dollars in active assets, requiring subscribers to manage at least $250,000 of their own to make the platform worthwhile.

>> Click here to get started with Fool Portfolios <<

Fool One

As the one to control them all, Fool One is the culmination of every bit and bob that Motley Fool has to offer.

It gives full access to everything, from the toolkit to portfolios and Motley Fool’s stock picks from the 40 services formerly on offer.

You can only view the One Portfolio from here, managed by the entire team of investors, quants, and financial planners the platform has on hand. The crew rebalances recommendations quarterly.

Members here receive early access to new features and tools and invites to both live and virtual events others aren’t allowed to attend.

Fool One also serves as a special connection point to the Motley Fool team. Expect more interaction with the individuals responsible for the platform and an ear for your thoughts and concerns.

Best For

Only individuals wishing to get the absolute most out of what the Motley Fool has to offer will find themselves here.

The amount of research you have access to is off the charts, as is the laundry list of services you can glean those insights from.

You’re going to receive over a dozen new recommendations each month, and you’ll want to make the most of these stock picks for the service to pay for itself in time.

>> Join Fool One for instant access to ALL Motley Fool services <<

Does Motley Fool Offer a Guarantee?

Each Motley Fool service has some form of guarantee, but they vary based on the specific subscription you choose.

For Epic Plus, Fool Portfolios, and Fool One, you’ll receive a credit in the amount of the platform’s subscription fee. From there, it’s only possible to downgrade your subscription to the service directly below it, and only within the first 30 days.

Stock Advisor and Epic appear somewhat different, boasting a 30-day membership fee-back guarantee on your purchase.

In any case, these guarantees give you a clear exit strategy if that particular service isn’t for you.

Honestly, it’s impressive that Motley Fool has any kind of refund policy at all, given the amount of high-value research and stock picks you can check out the moment you join.

What’s the Best Motley Fool Service for Me?

Motley Fool services have a lot to offer. Here are my top picks according to these categories:

Best Starting Point

Despite shrinking its catalog to five service tiers, jumping into the Motley Fool for the first time can still feel overwhelming.

For that reason, it’s best to start with Stock Advisor, the most user-friendly both in terms of content and amount of material afforded to subscribers.

You’re handed two stock picks each month to whet your whistle but can still tap into rankings and one of three strategies to enter into the game.

In addition, it’s the most price-friendly while suggesting a smaller portfolio size to manage than the other tiers.

Stock Advisor also introduces Motley Fool’s investing philosophy so you’re fully aware of what you’re getting into and any expectations you can carry along the way.

Most Variety

Epic is laid out to give users the most variety in terms of both stock picks and qualitative tools for making accurate assessments about your holdings.

The five stock opportunities made available to you every month come from various sectors and contain a healthy mix of growth stocks, dividends, and securities not showing up in mainstream news.

This spread helps create an optimized portfolio built upon long-term gains, steady income, and a few speculative options as well.

Epic also hosts a diverse toolkit allowing for more thorough analysis and research behind recommendations as you need it.

Best All-Around

If you desire a bit of everything in your investment strategy, look no further than Epic Plus.

This single service looks into stocks from growth, value, upcoming trends, and international markets while providing a foray into options trading as well.

One of the biggest draws here is the AI-powered Playbook that investigates breakthrough tech stocks and their potential as an investment.

It also contains an impressive amount of articles and earnings coverage on just about the entire gamut of stocks.

Epic Plus sits firmly in the middle of the Motley Fool’s umbrella in terms of price and commitment required, enabling individuals to play these opportunities as they see fit.

The Total Package

Fool One IS the total Motley Fool package, packed to the gills with every tool, feature, stock, portfolio, and research report you can imagine.

Here, you’ll get the most monthly stock picks and the inside scoop on hundreds of opportunities revolving through various portfolios from one session to the next.

This platform also provides a behind-the-scenes peek at everything the Motley Fool is currently working on, allowing members to play with these new features and tools before anyone else.

There are also regular invitations to exclusive online events and in-person experiences that only Fool One subscribers are privy to.

>> Sign up for Fool One and unlock everything Motley Fool has to offer <<

Motley Fool Reviews by Members

Motley Fool users have had plenty of amazing things to say about the service over the years. Here are just a handful of them:

As you can see, folks have seen life-changing success within the platform’s many offerings and are now able to live a life they’d previously only dreamed of.

Of course, not every story ends up like these, but it’s really encouraging to hear that such an outcome is possible.

Are Motley Fool Services Worth It?

I’ve been working through Fool One‘s services and toolkit for a while now, and I can honestly say it’s a top-tier service.

You’d be hard-pressed to find another platform with so many tools and recommendations all in one place, and over 20 years of market-beating returns is nothing to scoff at.

There’s a ton of content here, but The Motley Fool has finally done a stellar job of stuffing it into buckets that speak to all levels of the investing spectrum.

It’s extremely helpful that you have five tiers to pick from so you can dial in to exactly what you’re looking for in the moment. When it’s time to move up or down, all the work you’ve put in travels with you.

No matter where you’re currently at in your investing journey, The Motley Fool is definitely worth a closer look.

Sign up today to utilize all these incredible features and kick your investments into high gear.

>> Sign up to Fool One for instant access to the ENTIRE Motley Fool universe! <<

Tags:

Tags: