Marc Chaikin’s prediction about the top stock for 2025 is building up a bit of buzz online.

But is he really onto something, or are his projections missing the mark? Stick around for a look at his predictions, warnings, and popular newsletter, Power Gauge Report.

Marc Chaikin Predictions & Warnings for 2025 Revealed

We’ve all seen what artificial intelligence (AI) can do, but some question the technology’s long-term impact.

Marc not only believes AI is still a rising star, he predicts it’s here to stay. In fact, Chaikin estimates it will create a new class of very wealthy individuals who get in right now.

Similar to how the Power Gauge saw signals for home improvement and crypto companies back in 2020, it’s picking up on certain clues pertaining to the not-so-distant future.

Even Marc was shocked by the Power Gauge’s results. These bullish plays incorporate AI in ways most of us would likely overlook if left to our own devices.

That’s the power of the system.

After all, you’re too late if you invest in what’s hot right now. The Power Gauge gives insight into AI’s next phase in America.

Moreover, he compares the profit potential of these under-the-radar stocks to the massive gains we’ve seen from the likes of Netflix and Amazon. These are potentially game-changing opportunities that, with the Power Gauge, you can get in on the ground floor.

>> Get the scoop on Marc’s LATEST prediction <<

Who Is Marc Chaikin?

If you follow the stock market closely, there’s a good chance you’ve heard of Marc Chaikin and his company, Chaikin Analytics.

He has had a long history in the world of finance, and he’s survived and thrived during several bear markets.

You may have even seen Marc on Fox Business News and CNBC’s Mad Money show with Jim Cramer. Many members of the media respect him for his uncanny ability to spot huge market events.

He made his Wall Street debut back in 1965 as a stockbroker, and he’s been working closely with the stock market ever since.

Marc quickly earned a reputation among stock traders, hedge funds, and portfolio managers for finding quality stocks that many institutional investors overlooked.

He made a name for himself in the 80s, when he began developing proprietary technical indicators to find institutional-grade investment opportunities.

This work eventually solidified him as a technical analysis genius. But he really hit his stride at the advent of the PC era.

Marc began utilizing computer algorithms to advance his technical analysis work. And his efforts ultimately led him to the biggest breakthroughs of his career.

>> Sign up now and SAVE 60% <<

Marc Chaikin Power Gauge’s Past Predictions

Over the years, Marc and his Power Gauge have predicted many market events and accurately gauged the potential of several stocks.

Let’s take a look at some of his previous forecasts and the opportunities spotted by his powerful software.

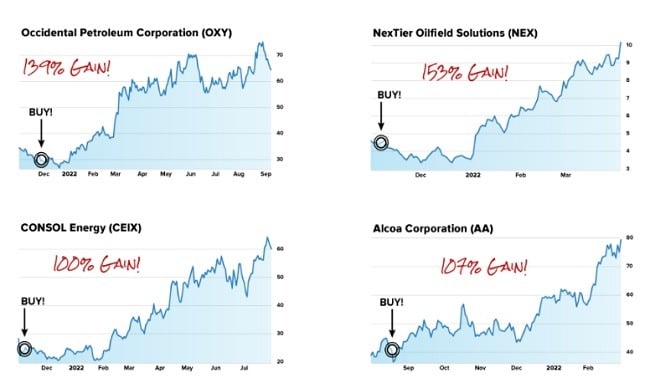

In 2021, his team’s work identified four separate stocks with the potential to double an investment. These include Occidental Petroleum, NexTier Oilfield Solutions, CONSOL Energy, and Alcoa Corporation.

As you can see, the Power Gauge has a knack for pinpointing opportunities with profit potential. However, the software can also help warn about stocks that could slip.

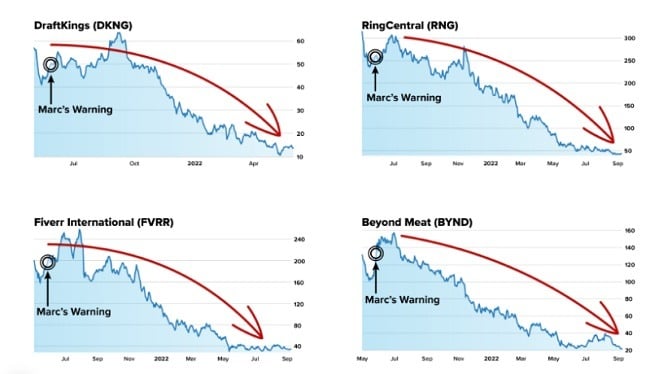

Back in April 2022, Marc warned that he spotted signs a bear market was looming overhead just before the S&P 500 fell by 20%.

He and his team’s research also pointed to the 2020 stock market crash, when Covid-19 was barely talked about by the press. This also included a warning about 21 different stocks that later dropped by up to 81% in the fallout.

Among them were Beyond Meat, Draft King, Fiverr International, and RingCentral.

With a track record like this, it’s no wonder why many on Wall Street consider Marc a living legend.

It’s important to keep in mind that these results are not typical, and past performance is not an indicator of future results.

Still, these examples give an idea of what is potentially at stake with a talented researcher and powerful software in the mix.

Speaking of the software… What is the Power Gauge, and how does it work?

Marc Chaikin’s Top Stock Picks for 2024

In a rare twist, Chaikin actually reveals the name of his favorite bullish recommendation for the next phase of the AI era. It’s none other than Q2 Holdings, ticker symbol QTWO.

The stock is already considered a strong buy in the Power Gauge, having outperformed the market for the past ten months straight.

As a leading provider of digital banking solutions, the company already works with several regional financial institutions. Its clientele continues to grow, playing along perfectly with Chaikin’s findings.

A recent positive earnings surprise shed some light on QTWO, prompting three analysts to raise price targets for the coming quarter. That makes now the perfect time to play this stock before big buyers swoop in and drive up the price further.

Q2 Holdings is just one of many bullish recommendations from the Power Gauge right now. You’ll need to sign up for the Power Gauge Report to uncover more.

>> Access Marc Chaikin’s top recommendations now <<

How Does the Chaikin Power Gauge Work?

Since we’re on the subject of Marc Chaikin’s predictions, it makes sense to look into his popular future stock ratings system, The Power Gauge.

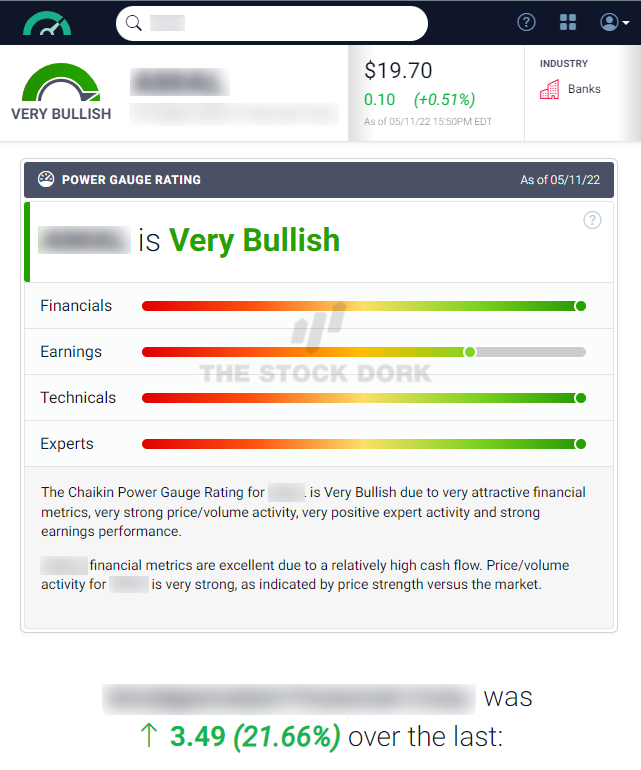

The Chaikin Power Gauge is a proprietary stock rating system that leverages 20 fundamental and technical factors to gauge the future outlook of 4,000 stocks. And these factors are spread across four distinct categories:

- Financials

- Earnings

- Technicals

- Experts

Depending on how a company fares, it’s given a Bullish, Very Bullish, Neutral, Bearish, or Very Bearish rating.

It’s important to note that the ratings do not offer buy or sell recommendations. They gauge a stock’s future outlook, but timing is still key.

A membership to Power Gauge Report comes with a really helpful special report that breaks down in detail how to put the system to work and timing an entry or exit.

I’ll pull up an example stock through the Power Pulse software to demonstrate how the system presents its findings.

The info is members-only, so I can’t tell you what the stock is.

However, if you sign up for Power Gauge Report, you’re free to check out high-potential stocks like this.

To start, simply type in a stock ticker or company in the search bar, and you’ll get an instant overview.

Here’s what a Chaikin Power Gauge rating looks like:

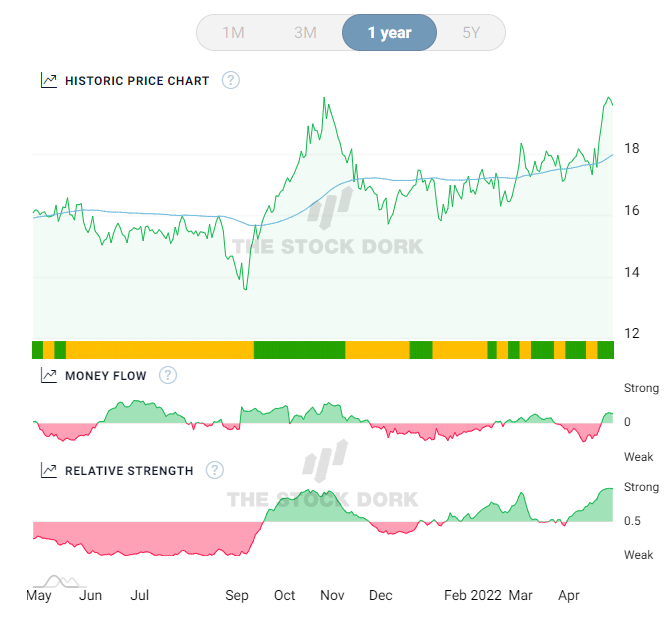

If you keep scrolling down, you’ll find even more data and a handy historical chart that shows price trends from a one-month to five-year period.

One of the underrated features of this system is its slick UI and intuitive design.

Underneath the price chart and rating, you’ll find each category mentioned earlier (Financials, Earnings, Technicals, and Experts).

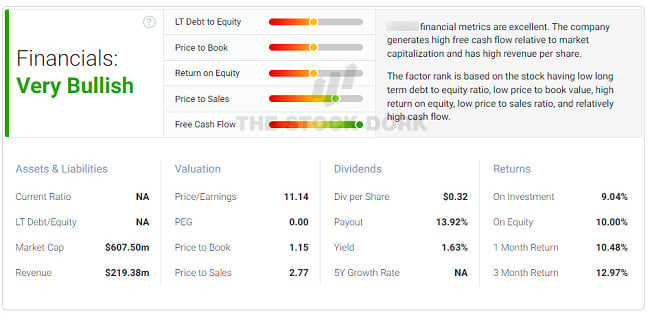

First, on the list is Financials:

- LT Debt to Equity

- Price to Book

- Return on Equity

- Price to Sales

- Free Cash Flow

This stock scores high marks in the Financials department, and the Power Gauge is giving it a Very Bullish rating based on its performance on these five factors.

For more insights, there’s a box in the upper-right corner to help make sense of the data. It’s a nice touch that could help smooth the learning curve.

After Financials is Earnings:

- Earnings Growth

- Earnings Surprise

- Earnings Trend

- Projected Price/Earnings Ratio

- Earnings Consistency

Our mystery stock is performing well in Earnings, locking in a solid Bullish rating.

There are also some accompanying charts with this category that show Annual EPS, Quarterly EPS, Earnings Announcement, and Annual Revenue.

This is my favorite feature of the software, as this data can be a pain to collect by hand, especially when trying to check in on a small cap stock.

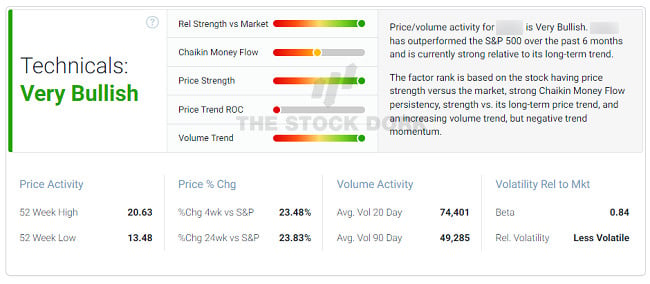

Time to switch gears and take a look at Technicals:

- Strength of an Individual Stock vs the S&P 500

- Chaikin Money Flow

- Price Strength

- Price Trend Rate of Change

- Volume Trend

A lot of the data here is something you’d find in a standard stock price chart, but the real draw is that top right box mentioned earlier. .

If you’re new to these concepts, it’s fantastic to have a breakdown in plain English that tells you everything you need to know.

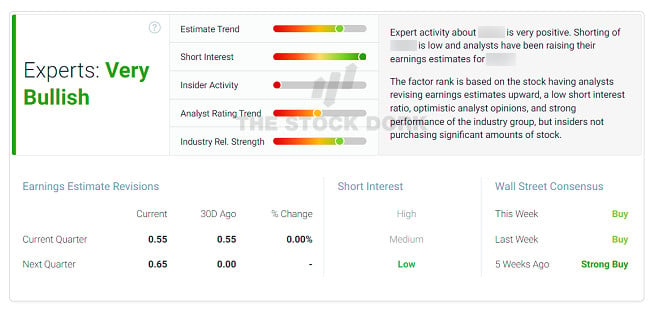

Finally, there’s the Experts category:

- Earnings Estimate Revision

- Short Interest

- Insider Activity

- Analyst Opinions

- Strength of Industry Group vs the Market

If you’re big on tracking expert consensus, this might end up being your favorite indicator. It’s helpful to know what analysts are saying about a stock to get a feel for market sentiment.

All in all, the Power Gauge is a rock-solid tool that’s as simple to use as it is informative.

Something to keep in mind is that my example was a stock the system rated Very Bullish.

But it can also help dodge potential duds.

There’s no such thing as a stock market crystal ball that knows when stock prices will rise or fall. That said, the system could help you make more informed decisions about what companies might stand a strong chance in the markets.

Marc Chaikin’s #1 Stock to Buy

For his latest prediction, Marc Chaikin is focusing on the AI sector. He called this stock “a solid way to take a stake in today’s AI craze.”

Marc shares this free recommendation as part of his latest presentation featuring his “AI warning.” He doesn’t provide many details on why he favors it, but he lists it as his #1 free trade recommendation.

He also offers it with the caveat that you need to subscribe to Power Gauge Report to get his “highest-conviction recommendations.”

I read some analysis on PSTG, and, so far, it appears Marc’s pick was spot o. The stock has performed well this year, with a 43.6% YTD gain as of November 19th, 2024.

It’s another striking real-world demonstration of the Power Gauge’s ability to pick winning stocks from across the market.

What Comes with Power Gauge Report?

Power Gauge Report includes access to Chaikin’s latest research and other limited-time bonuses. Here’s what you get when you sign up under the latest deal.

12 Months of Power Gauge Report Monthly Newsletter

This great newsletter provides a direct line to the team’s latest insights and market commentary.

Every month, they deliver a new stock pick (mid or large cap) that’s locked in a strong rating from the Power Gauge.

But again, the rating is just one piece of the puzzle.

The recommendations are also backed by a ton of easy-to-follow supporting analysis that explains exactly why this company landed on the team’s radar.

And all the stock picks are conveniently logged into the service’s model portfolio.

Altogether, this is a solid resource and a great place to get the scoop on what Marc’s predicting next.

Special Updates and Alerts

Another fantastic feature offered by the service is its email alerts.

The team lets members know the moment they believe it’s time to lock in gains, add to a position, or exit to protect capital.

It could be a big comfort to know that the team is keeping a diligent watch on the markets while you’re out and about.

Power Gauge System

In the past, Marc charged $1.99 per search from his Power Gauge system. Now, he includes one full year of unlimited access as part of this bundle.

The value you get from this Power Gauge System alone is absolutely off the charts.

You can type in any of the 5,000 different stocks within, and the system provides a rating based on 20 unique factors. In moments, you’ll know whether the security is bullish or bearish.

In effect, you’re seeing a prediction of how these tickers will look in the near future, before Wall Street or the big banks get involved.

>> Access all features now at 60% off <<

Marc Chaikin’s AI Warning Bonuses

A membership to Chaikin’s service also comes with a few add-ons. Here’s what you get.

Chaikin’s AI Power Picks

Marc Chaikin’s new special report, Chaikin’s AI Power Picks, offers a focused shortlist of the most promising AI stocks identified by the Power Gauge.

Each selection is handpicked for its potential to deliver significant gains—up to double or triple in the next year.

This report leverages the Power Gauge’s advanced 20-factor rating system to pinpoint opportunities in the fast-growing AI sector, providing clear, data-driven insights.

Whether you’re an experienced trader or a new investor, this report gives you a critical edge in capitalizing on the AI boom, saving time on research and enhancing your portfolio’s growth potential.

Tomorrow’s 10X Power Trends

The special report Tomorrow’s 10x Power Trends unveils emerging opportunities beyond today’s AI buzz, highlighting future trends identified by the Power Gauge’s proprietary analysis.

These trends are poised to dominate tomorrow’s markets, offering early investors a chance to position themselves for potentially explosive gains.

With the Power Gauge’s 20-factor system as its backbone, the report identifies sectors and stocks with the highest growth potential.

For those seeking to stay ahead of the curve and capture the next wave of innovation, this report provides a clear, actionable roadmap to uncovering tomorrow’s most lucrative opportunities before the mainstream catches on.

Top 5 Stocks to Avoid During the AI Boom

The special report Top 5 Stocks to Avoid During the AI Boom is an essential tool for protecting your portfolio in today’s volatile market.

Marc Chaikin uses the Power Gauge to spotlight five dangerously overhyped stocks that could devastate your returns.

His track record speaks for itself—investors who heeded his warnings in 2022 avoided losses of up to 75%.

This report not only identifies stocks to steer clear of but also equips you with insights to navigate the AI frenzy wisely.

It’s a must-read for safeguarding your investments while pursuing growth in a rapidly changing market landscape.

>> Get a free year of Stansberry’s Investment Advisory NOW <<

100% Satisfaction Guarantee

Under the latest deal, new members have 30 days to test out the service.

If you feel it’s not a good match during this time, simply reach out to support and request your money back on the cost of your subscription.

A month is the industry standard. So typically, I wouldn’t give extra points. That said, this service offers much more upfront value than most I’ve seen at similar price points.

Many companies would never dream of offering money-back refunds on a valuable tool like Marc Chaikin’s Power Gauge.

However, the team proves once again that they stand by their research with this guarantee.

>> Join under Marc’s Guarantee <<

Pros and Cons

The latest bundle looks great, but there are a few downsides to the service.

Pros

- Great price with 75% discount

- Access to proprietary ratings tool

- Features Marc Chaikin’s top AI stock picks.

- Full access to the Power Gauge

- 30-day money-back guarantee

- Led by legendary guru Marc Chaikin

Cons

- No community features

- No options or short plays

How Much Does It Cost?

For a limited time, you can sign up under the latest deal for the bargain-basement price of just $149.

The bundle also includes a one-year subscription to the Power Gauge Report and all the other bonuses covered in this review.

That’s more than a fair price for the opportunity to take a page from the Marc Chaikin book of analysis.

Typically, this collection costs $199, so you’re getting one heck of a discount if you get in now.

Are Chaikin’s Top Stock Picks Worth It?

Marc Chaikin’s insights are well regarded on Wall Street, and his latest research release doesn’t disappoint.

If you join his paid service now, you’ll get full access to the Power Gauge, plus special research featuring Chaikin’s top AI picks for the year.

You’ll also get access to several valuable updates and alerts, such as Bubble and Bust Updates and Power Feed daily email alerts.

The deal also includes a one-year subscription to Power Gauge Report, which features new research, analysis, and Marc Chaikin’s stock picks.

Best of all, you get ongoing access to Power Pulse ratings for an entire year, which could help you find your own opportunities.

At just $199, it’s hard to beat this bundle deal, but, with the way this market is moving, it might not last.

Act fast as per the Marc Chaikin prediction to lock in your savings before it’s too late.

Tags:

Tags: