Tim Plaehn claims his ETF Income Maximizer can produce significant monthly income from stocks like Nvidia, Coinbase, and Tesla without traditional dividends.

Does his under-the-radar strategy actually work? I explore the details and potential in this comprehensive ETF Income Maximizer review.

>> Try ETF Income Maximizer Now At A Special Deal <<

What is ETF Maximizer?

ETF Income Maximizer is a unique service created by Tim Plaehn, brought to you by Investors Alley.

Plaehn shares stock tips and research to help you earn potentially significant monthly income, even from stocks that don’t typically pay dividends. Personally, I find the idea of steady cash flow from these non-dividend-paying stocks enticing in today’s market.

Everything comes neatly packaged in the service’s newsletter and a handful of other goodies that download Tim’s extensive experience into your own hands.

This innovative approach has certainly piqued my interest, so let’s learn more about the man behind the service.

>> Join now for Tim’s strategy for steady monthly cash flow <<

Who is Tim Plaehn?

Tim Plaehn boasts an impressive background that sets him apart in the finance world. Before he began his financial career, he served as an F-16 fighter pilot and instructor in the United States Air Force, which undoubtedly instilled a level of discipline and precision that’s invaluable in his current role.

Tim also holds a degree in mathematics from the United States Air Force Academy, giving him a rock-solid analytical foundation.

After transitioning from the military, Tim worked as a stockbroker and Certified Financial Planner. What really caught my interest though was his unique approach to generating monthly income without the need for risky trading strategies like options or futures.

It’s this perspective that has made Tim a go-to expert in the income investing space – so I had to learn more.

Tim Plaehn Net Worth

There’s not a whole lot to go off of when trying to assess Tim Plaehn’s net worth. The guru hasn’t revealed any information about what he might have stored away in his account.

As a successful income investor for the past 30 years, it’s safe to assume he’s doing quite well for himself. Thousands of readers wouldn’t follow his advice otherwise.

Fighter pilots don’t typically do badly for themselves either, so Plaehn likely has some of that old income to fall back on.

Some estimates put Tim’s net worth at around $3 million, but I have no way to corroborate that data unless Plaehn releases a statement himself.

Is Tim Plaehn Legit?

When I further evaluate Tim Plaehn’s legitimacy, several key factors immediately stand out to me. First and foremost, his impressive 40 years of investing experience speaks volumes about his expertise and dedication to the field.

On top of that, his role as one of the key players in Investors Alley is a major plus. The fact that he edits popular newsletters like Weekly Income Accelerator, The Dividend Hunter, and Monthly Dividend Multiplier – among others – only reinforces his credibility in my eyes.

Moreover, Tim contributes to well-known publications such as USA Today, The Motley Fool, and Seeking Alpha, further cementing his reputation.

And when I discovered that he’s a sought-after speaker at events like the MoneyShow, where he provides live training on income investing, I knew he was the real deal.

I’ll get to more of my Tim Plaehn review in a bit, but first, let’s look at another guru.

>> Access Tim Plaehn’s latest strategies NOW <<

Who is Jay Soloff?

Meet Jay Soloff, a seasoned options trader and financial analyst with a deep understanding of the markets. With over two decades of experience, he’s built a reputation as a trusted guide in the complex world of options trading.

As I reviewed Jay’s credentials, I was struck by the breadth of his expertise. He started his career at the Kansas City Board of Trade where he traded in the Wheat Futures pit before moving to the Chicago Board Options Exchange (CBOE).

Additionally, Jay has written several articles for Entrepreneur magazine that caught my eye.

Today, he’s dedicated to educating traders and combining income-generating strategies with targeted buying opportunities. Partnering with Tim Plaehn to create the ETF Income Maximizer service gives us two gurus for the price of one.

Jay and Tim are also Chief Income Officers at Investors Alley – let’s look at it further.

>> Get Jay Soloff’s options and income strategies now! <<

What is Investors Alley?

Founded in 1998, Investors Alley pioneered innovative investment research and publishing, predating mainstream publications like Motley Fool and MarketWatch. Today, they offer actionable insights and practical strategies through newsletters like “The Market Cap,” which provides weekly market updates and research.

Tim and Jay leverage their finance expertise at Investor’s Alley, offering a clear view of economics and finance. Their premium services deliver detailed analyses and stock recommendations, helping subscribers achieve profitable returns.

A New Way to Pay Your Bills with Monthly Dividends

ETF Income Maximizer introduces an intriguing concept: generating monthly income through innovative investment strategies.

I don’t know about you, but I’m finding inflation to be really eating into my income at the moment. As someone constantly seeking new ways to cover expenses and pay bills, I found this idea worth exploring further.

Tim and Jay’s product could be a game-changer, but is it right for your finances? Let’s dig in and uncover if it has the potential to help you reach your goals.

>> Join now for complete details on this strategy <<

How the Strategy Works

ETF Income Maximizer taps into Single Stock ETFs, which cleverly use options to squeeze out higher returns from stocks that usually don’t pay much, if anything at all.

We’re talking yields like 140.07% on Coinbase, 51.15% on Tesla, 36.78% on Amazon, and 27.36% on Apple.

What stood out to me is that the regular yield on Apple shares is usually only 0.56% – that’s quite a difference!

The beauty of this service lies in its simplicity. You don’t need to be a trading expert or understand complex options strategies. Tim and Jay do the hard work for you, identifying the most promising Single Stock ETFs and presenting their findings in easy-to-understand language.

Morgan Stanley warns that if stocks only return 2.4% per year, you’re losing money to inflation. They predict that a $250,000 account could be depleted in just 9 years.

ETF Income Maximizer offers a solution by combining the fast potential of leveraged options with the stability of dividend payments, making it as easy as buying a normal stock.

>> Get Tim and Jay’s top stock recommendations NOW <<

How Much Can You Earn?

Let me guess – you have a savings account making next to nothing, right?

What if instead of making a piddly sum on interest, your money could earn you an extra $500 to $1,000 per month?

That’s the real potential of ETF Income Maximizer.

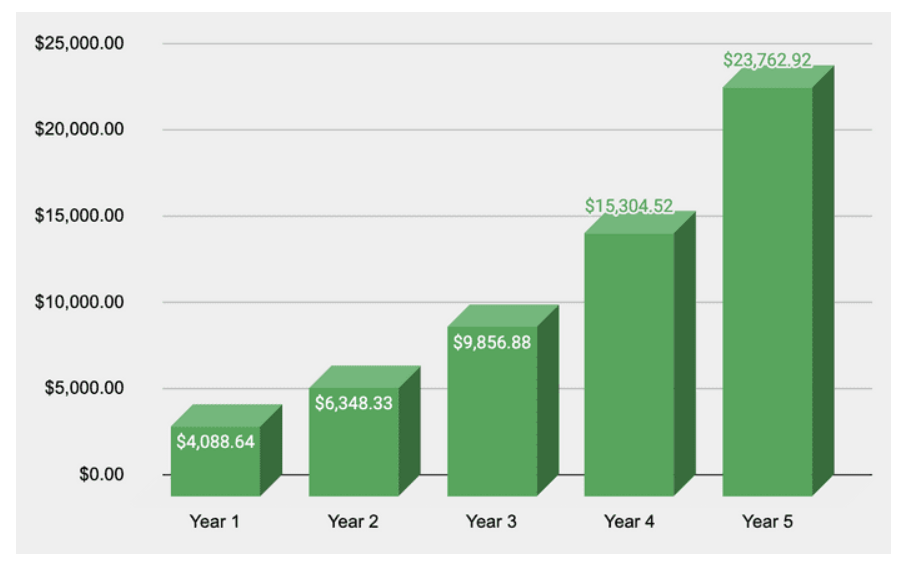

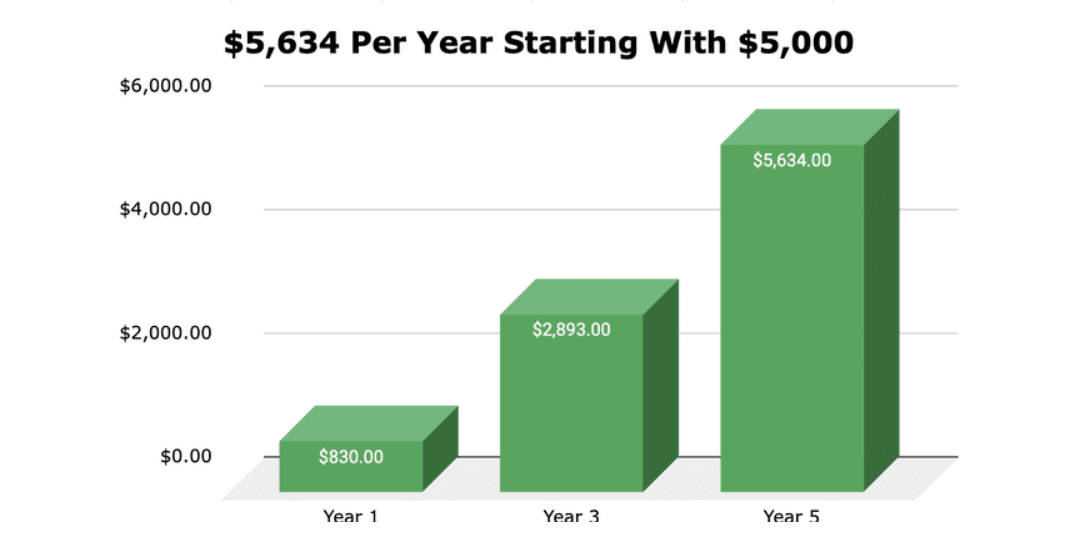

Let’s say you start with $5,000 and add a bit more each year. After five years, you could be looking at an extra $5,634 annually.

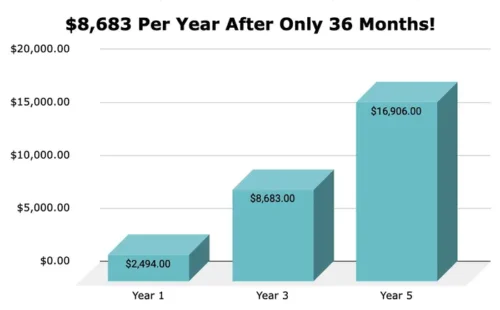

But now imagine lifting that starting sum up to $15,000 and matching it each year. After just 36 months, you could collect $723 monthly.

Even better, with a $25,000 initial investment and annual contributions, your yearly income could jump by $8,683 in 36 months

>> Sign up now for similar potential earnings <<

ETF Income Maximizer Review: What Comes with it?

You’ll get instant access to ETF Income Maximizer and extra bonus materials if you join under the current deal.

A 12 Month Subscription to ETF Income Maximizer

So, what exactly do you get when you sign up for ETF Income Maximizer? I was curious to see if it lived up to the hype, so I decided to take a closer look.

Turns out, there’s quite a bit included in the subscription. From monthly ETF reports to bonus resources, it seems like Tim and Jay have put together a pretty comprehensive package.

Let’s break down each feature and see how it can help you uncover potentially profitable opportunities.

Monthly ETF Reports

When I received the Monthly ETF Reports, I found them to be a valuable resource for staying informed about promising ETF opportunities. Each month, Tim and Jay send an update with a curated list of their top ETF picks, which was a huge win for me.

One of the benefits I experienced was how efficiently I could use this part of the service. If I was pressed for time, I could quickly scan their recommended ticker symbols to get a sense of what they favored without having to spend hours researching.

Member’s-Only Portal

The members-only portal is another handy feature – giving you access to a whole library of past reports and research.

Sometimes a new ETF pick would spark my interest, and I could easily go back and find the initial analysis for more details. It was like having a research assistant that was always there when I needed it.

One thing I’d like to see is maybe some live Q&A sessions with Tim and Jay in the portal. It would be a great way to ask questions about specific ETFs. But I’m sure it’ll come in time.

>> Get all these features now at 92% off <<

Shortcut to Big Monthly Income with Single Stock ETFs Bonus Report

This report was one of the main reasons I decided to try ETF Income Maximizer. It’s a clear, concise guide that explains how these ETFs generate income and what sets them apart from other investments.

They even break down the jargon you find in those complicated prospectuses, which I found really helpful.

I mean, who really has the time to decipher mazes of legalese anyway?

You’ll also find a list of here of the ETFs Tim is currently excited about that can help you pull funds from the likes of Apple and Amazon.

It’s a standalone guide for understanding how Plaehn’s strategy works alongside the recommendations you need to put it into action.

>> Get the inside scoop on Single Stock ETFs <<

BONUS Access to Magnifi AI

Magnifi AI offers in-depth research on funds, their peers, recent performance, inflows, and turnover.

It also provides advisor-level tools like FI 360 and Morningstar Ratings, usually reserved for professionals, to help you confidently handle your research.

I found the comparative analysis feature particularly helpful. It let me compare my chosen funds against others across dozens of parameters like returns, volatility, and fees.

This clear interface made understanding the market and updating my portfolio a breeze.

>> Get your bonus access now! <<

Refund Policy

The 365-day money-back guarantee from Tim and Jay is a pretty sweet deal. You get a full year to try out ETF Income Maximizer, risk-free.

If it’s not for you, just ask for your money back – no hassle, no questions asked. Plus, you even get to keep the bonus reports.

That’s much better than the usual 30-day trial you see with similar services. It gives you plenty of time to really put it to the test and see if it’s a good fit for you.

And if it’s not, you can walk away without losing a dime.

To me, that shows the team behind ETF Income Maximizer is confident in what they’re offering, and they’re willing to back it up.

Pros & Cons

Here are some of the most notable pros and cons of the ETF Income Maximizer research service.

| Category | Details |

|---|---|

| Pros |

• Comes with one year of service • Veteran gurus in Tim Plaehn and Jay Soloff • Jam-packed with valuable research and educational resources • One-year money-back guarantee • New picks every month • Focuses on income strategies |

| Cons |

• No community chat or forum • Somewhat specialized focus |

>> Try risk-free with a one-year moneyback guarantee <<

ETF Income Maximizer Review by Users

Actual members using the service alongside me have some great things to say about it too:

However, I did find these testimonials in Investor Allery’s presentation, so take them with a grain of salt.

>> Save 92% when you join now <<

Historical Performance & Backtest

I’m still blown away by the yields ETF Income Maximizer can bring in. I’ll let the numbers do the talking.

The service uncovered a 122% yield for Nvidia and 148% for Coinbase that you could be taking advantage of. Even companies with normally minimal payouts like Apple and Tesla brought in double-digit yields here.

I can’t verify the stat, but the promo refers to a member collecting $42.435 per year. That’s not chump change.

What equally grabs my attention is that more than 230,000 readers use ETF Income Maximizer every month. I know I wouldn’t stick around if the system didn’t work for me.

Who It’s Best For

I feel like Tim frames his promo toward folks thinking about retirement, which, quite frankly, we all should be.

However, anyone looking for some extra income each month can benefit here. Since the strategy steps out of normal investing circles, you can walk into the concept fresh and follow its guidelines to get up to speed quickly.

It’s helpful to have some knowledge of ETFs and risk management, but Tim and Jay teach on the topics you need in material that’s part of this bundle. All you need is a willingness to learn and an ability to follow a blueprint.

Risks & Downsides

Like anything on the stock market, there’s no guarantee of gains with this strategy, even if it’s more consistent than a lot of others out there. Enter into trades aware of that fact.

In my research, ETF Income Maximizer tends to focus on income more than total returns, so you’ll want to keep an eye on whether share prices are eroding that can offset payouts.

It’s always best practice to follow Tim’s recommendations in my experience, but I’ve found myself wanting to veer from the course and try other ETFs. The platform sometimes suggests rather unproven ETFs that can either be huge or a bust.

Alternatives to ETF Income Maximizer

If you’re not jiving with what ETF Income Maximizer can deliver, consider these alternatives I’ve looked at:

Investing Daily’s Utility Forecaster

Utility Forecaster pursues income in a slightly different way, turning to stable utility companies for consistent payouts. It can remove some of the stress ETFs can bring by looking at industries we can’t survive without.

Stansberry’s Retirement Millionaire

Another retirement-minded service, Retirement Millionaire hunts for safe income plays that can sustain you into your golden years. Its focus on defensive stocks and conservative wealth building through various methods (including income ETFs) can be quite appealing.

Oxford Income Letter

I’ve found the model portfolios in Oxford Income Letter to line up well with my long-term investment plan. You’ll find answers to instant income, high-yield strategies, and a number of alternatives to help build wealth for the long haul.

ETF Income Maximizer Cost / Subscription Details

Normally, Tim and Jay value their ETF research at $595. However, through this special offer today, you can get a full year of access for just $49.

That’s a hefty 92% discount off the regular price. To break it down further, it comes out to about 13 cents per day for a 12-month subscription.

Keep in mind, this is a limited-time offer exclusively available through this page. It’s a one-time payment that grants you a full year of access to the service, including all the features and benefits we’ve discussed.

The service auto-renews at $99, which is still a heavy discount and well-worth the material inside.

>> Get a full year of access for only $49! <<

Final Verdict: Is ETF Income Maximizer Worth It?

Final Verdict: Is ETF Income Maximizer Worth It?

As someone who’s always on the lookout for innovative ways to generate monthly income, I’ve been impressed by the concept behind ETF Income Maximizer.

After taking a closer look at what Tim and Jay are offering, I’m convinced that their service provides a unique and valuable opportunity for those seeking to diversify their income streams.

The potential returns are noteworthy: 140.07% on Coinbase, 51.15% on Tesla, and 36.78% on Amazon, all delivered on a monthly basis.

Moreover, the possibility of transforming a $5,000 initial investment into an additional $5,634 per year after five years, or $15,000 into $723 per month in a mere 36 months, is undeniably appealing.

Single Stock ETFs can be challenging to understand, but that’s where ETF Income Maximizer really proves its value.

Tim and Jay’s combined 60 years of experience, monthly reports, and curated stock picks can save you weeks, maybe months of research.

With a 92% discount, accessing a full year of this valuable service for just $49 is an opportunity that’s hard to ignore.

Plus, the one-year satisfaction guarantee provides peace of mind, allowing you to explore this income-generating strategy with minimal risk.

>> That’s it for my review. Claim your 92% discount HERE <<

ETF Income Maximizer Frequently Asked Questions (FAQ)

How much time per week is needed to follow ETF Income Maximizer?

The strategy is designed for part-timers, and most users spend about 1–2 hours per week reviewing recommendations and adjusting their portfolios.

Is ETF Income Maximizer suitable for beginners with no prior investing experience?

Yes, beginners can follow the system, but some basic understanding of ETFs, risk management, and portfolio allocation is recommended for optimal results.

Can international investors use ETF Income Maximizer?

Yes, but availability may depend on local brokerage accounts and trading rules. International users should ensure they can access U.S.-listed ETFs recommended by the system.

How frequently are ETF recommendations updated?

The system typically updates recommendations monthly or quarterly, depending on market conditions and ETF performance.

Does ETF Income Maximizer include risk management guidance?

Yes — the strategy provides suggestions for position sizing, stop-loss limits, and diversification to protect capital and manage volatility.

Can the system be used on mobile devices?

Yes — subscribers can access reports and recommendations via smartphones or tablets, though portfolio analysis may be easier on a desktop.

Are there ongoing strategy updates or changes?

The system is regularly updated to reflect market conditions, new ETFs, or shifts in income-focused investing strategies. Subscribers are notified via email or member dashboards.

Does ETF Income Maximizer provide sample portfolios or historical performance data?

Yes — many users have access to historical income tracking, sample ETF allocations, and projected yields to better understand potential outcomes.

Can ETF Income Maximizer trades be executed inside retirement accounts?

Yes, some recommendations are suitable for IRAs, Roth IRAs, or other retirement accounts, depending on brokerage rules. Users should verify account eligibility.

How does ETF Income Maximizer differ from traditional dividend investing?

Unlike standard dividend strategies, this system focuses on high-income ETFs with potential capital appreciation, combining income generation with strategic growth opportunities.

Is there a learning curve for new subscribers?

Most users report a 2–4 week learning period to understand ETF selection, income optimization strategies, and portfolio balancing.

Are there any community support or discussion groups for subscribers?

Some subscription levels may offer access to private forums or member groups, where investors can share strategies, ask questions, and discuss results.

Are trades automated or manual?

All trades are manual — the system provides guidance and recommended allocations, but execution is up to the investor.

Are there restrictions on minimum account size?

No strict minimum is required, but smaller accounts may need to adjust position sizes to manage risk effectively.

How does ETF Income Maximizer handle urgent market changes?

Subscribers may receive email alerts or updates if major market events impact recommended ETFs, ensuring timely portfolio adjustments.

Final Verdict: Is ETF Income Maximizer Worth It?

Final Verdict: Is ETF Income Maximizer Worth It? Tags:

Tags: