Seeking Alpha is one of the most respected research platforms on the market, but are paid memberships worth the price? My Seeking Alpha review takes an in-depth look at the platform so you can see for yourself if it’s worth your time.

What Is Seeking Alpha?

Seeking Alpha is the world’s largest investing community, with over 6.5 million active readers.

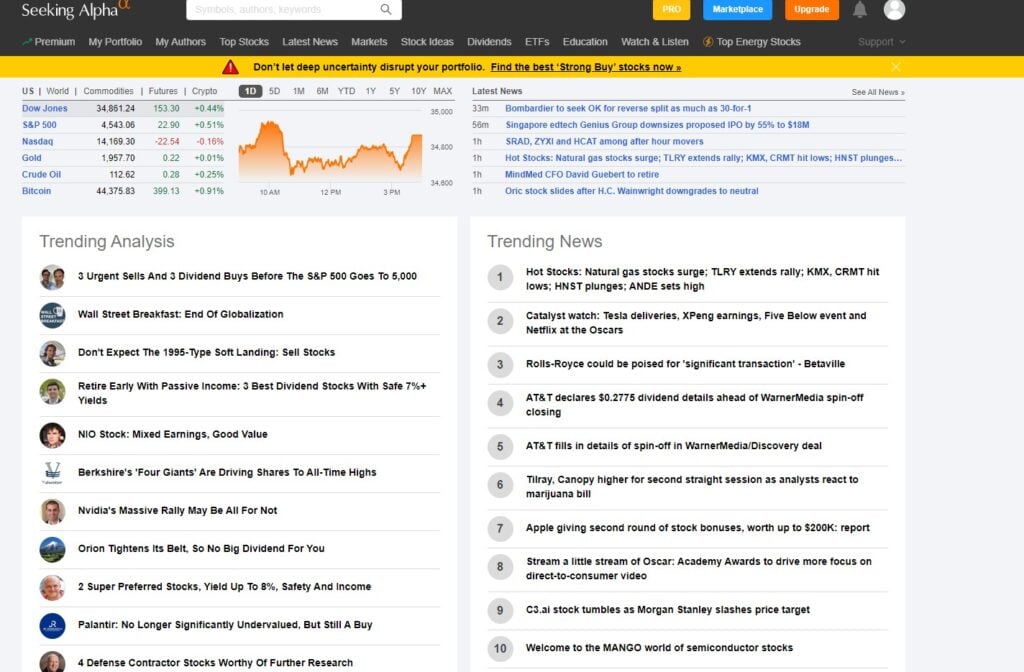

The platform is known for its stock market research, investor insights, and quantitative analysis on stocks, bonds, commodities, real estate, and more.

The platform has three membership tiers: Basic, Premium, and Pro, each with different features and resources.

Seeking Alpha aggregates tons of the third-party data for you into actionable intelligence with a team of expert contributors and analysts.

The site also features a robust news section covering market-moving news, along with independent research on how these stories will impact your investments.

Seeking Alpha also has an excellent community.

Its forums are full of active users who are eager to share their experience and insights. It’s a great source for outside-the-box opinions on the market.

Seeking Alpha has a lot of resources in one place, but I’ve only scratched the surface of its functionality so far. Keep reading to see what else this popular platform can do.

>> Access the latest financial news and developments with Seeking Alpha Premium <<

Is Seeking Alpha Free?

Seeking Alpha is free for Basic members, but you have to upgrade to a paid package to take full advantage of the platform.

Free members can access some monthly newsletters, blog posts, and author, but a paid plan unlocks more features, which I’ll talk about later in my Seeking Alpha review.

Is Seeking Alpha Legit?

Seeking Alpha is indeed a legitimate platform and one I often turn to for market research and news.

It was first founded back in 2004 and now has a following all across the globe. More than 20 million people use Seeking Alpha every month, with some 18,000 analysts contributing ideas on a regular basis.

What makes the site really stand out is its crowdsourced approach to content. This not only allows for deeper forays into stocks but also allows inclusion into less-pursued investment opportunities such as commodities and crypto.

Reviews remain largely positive among third-party sites such as TrustPilot and Capterra, lending one more layer of credibility to its ability to perform.

What comes with Seeking Alpha?

Here’s just a taste of the tools you have at your fingertips when you join Seeking Alpha.

Keep reading our Seeking Alpha review and learn more about these outstanding features.

>> Get started now for instant access to these cutting-edge features <<

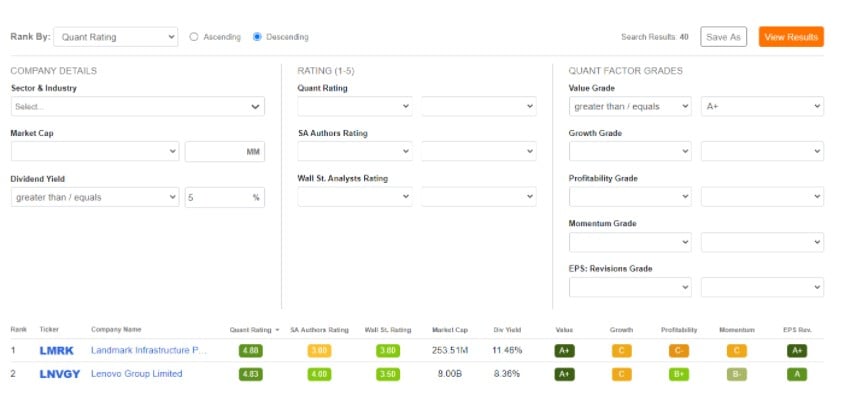

Stock Screener

The stock screener is an incredibly valuable tool only available to Seeking Alpha Premium members.

It lets you filter popular stocks by quant ratings, author ratings, analyst ratings, and more, so you can organize your results according to your priorities.

Seeking Alpha quant ratings are produced by a computer algorithm that analyzes over 100 data points related to a stock. They’re purely objective and rooted in facts.

On the other hand, Seeking Alpha’s author ratings are compiled by analysts and everyday investors.

Many Seeking Alpha authors are extremely qualified, and they spend hours conducting extensive research on each stock they write about.

Finally, Wall Street ratings come from Wall Street analysts and other finance pros.

These ratings come from professional analysts with a full assortment of powerful research and analysis tools at their disposal. Therefore, they might be the most authoritative of the three options.

Once you understand the differences between each, you can use the stock screener tool to get a complete picture of each stock with just a quick glance.

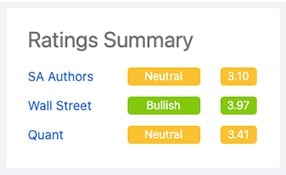

Wall Street Ratings

Wall Street Ratings are one of the few features available to Basic members. To access Quant and Author ratings, you’ll have to upgrade to Pro or Premium.

Each rating is developed using models built by analysts on Wall Street.

The models predict earnings forecasts, target prices, expected performance, and more.

Collectively, analysts take all this information and condense it down into an estimate, so customers can quickly digest their take on a particular stock.

Seeking Alpha collects all of these estimates from third-party sites and aggregates them into a Wall Street rating.

As a member, you can compare this rating to all the others to see if an investing idea is worth pursuing.

>> Access Wall Street Rankings for thousands of stocks with Seeking Alpha <<

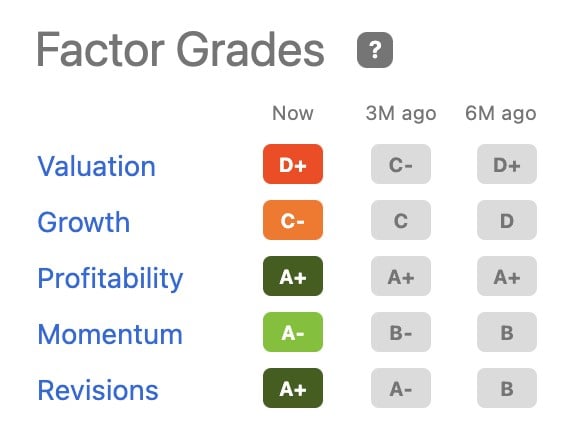

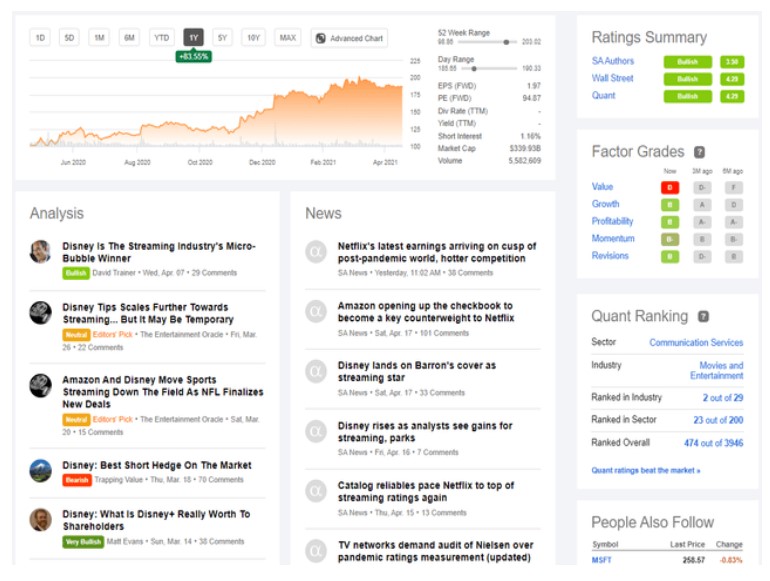

Factor Scorecard

Factor investing is an investment strategy that involves picking stocks based on specific characteristics, or “factors.”

There are many factors that can be used when selecting stocks, but the five Seeking Alpha uses are Value, Growth, Profitability, Momentum, and EPS Revisions.

These scorecards are assigned grades of A+ to F,

Seeking Alpha also has factor scorecards for both stocks and REITs.

The REITs factor scorecard features additional data that only applies to real estate — such as funds from operations (FFO) and adjusted funds from operations (AFFO).

There’s also a dividend stock scorecard that rates how good a company’s dividend is compared to its competitors.

Additionally, the dividend stock scorecard also highlights whether those dividends are predicted to stick around for the long haul. This could help you avoid overpaying for high dividends that won’t pan out.

Stock Comparison

When researching investments, many people prefer to compare options side by side.

If that sounds like you, Seeking Alpha has you covered with a handy stock comparison tool that lets you compare up to six stocks at once.

This tool has limited functionality for Basic members, so you won’t be able to view a lot of the data it aggregates.

However, Premium and Pro members have access to the feature’s full functionality.

You can compare stocks across industries and sectors, or use some of the pre-made comparisons that Seeking Alpha has put together, such as FAANG Stocks or Big Pharma Stocks.

You can also compare things like how much these stocks are worth, how fast they’re growing, how profitable they are, potential dividend yields, and more.

And the best part is, you get to see the quant rating, author rating, Wall Street rating, and factor scorecard for every stock — all in one place.

You can also create your own filter that can be exported to a PDF or Excel for further analysis.

>> Get pro-grade research tools with Seeking Alpha Premium <<

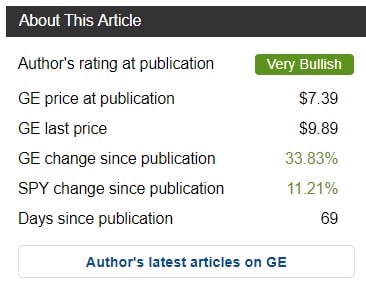

Analysis from Published Authors and Ratings

There are thousands of Seeking Alpha authors who publish data and insights for the site.

These contributors could be active investors, analysts, hedge fund managers, or everyday folks who are passionate about diving into the latest investing ideas.

As a Seeking Alpha member, you get to read all of these publications.

And if you find a contributor you really like, you can “follow” them to receive notifications every time they release new content.

Seeking Alpha contributors also give each stock they’re reviewing an “author rating,” so you can see their sentiments at a glance.

The authors analyze numerous factors to determine a final rating of either: Very Bullish, Bullish, Neutral, Bearish, Very Bearish.

Key Metrics

You can also see all the stats for a particular stock, including its price at the time of publishing, the current stock price, and how much time has passed since it’s been published.

For example, in the screenshot above, you can see that the author rated this stock as “Very Bullish.”

It was $7.39 at the time of publishing and has since risen to $9.89 since the article was published.

In other words, the author’s predictions played out.

These articles also include links to other articles the author has written on a particular stock or ETF, so you can browse more investment insights from authors you like.

>> See why traders everywhere trust Seeking Alpha <<

Earnings Call Transcripts and Audio

A Seeking Alpha Premium subscription also gets you access to past conference call recordings about earnings, forecasts, and more.

Conversely, basic members can only read transcripts of these calls.

If you’d rather listen to earnings calls than read them, you should go with a premium subscription.

Having direct access to earnings calls is a valuable feature. You’ll hear updates from top company executives, and you’ll also get to listen to them answer questions from top analysts

Pro and Premium members get to listen in on these calls live, so they can act quickly on any new information that comes out.

When you join, you’ll be the first to know when a new earnings calendar is released, so you know when to listen to the next call.

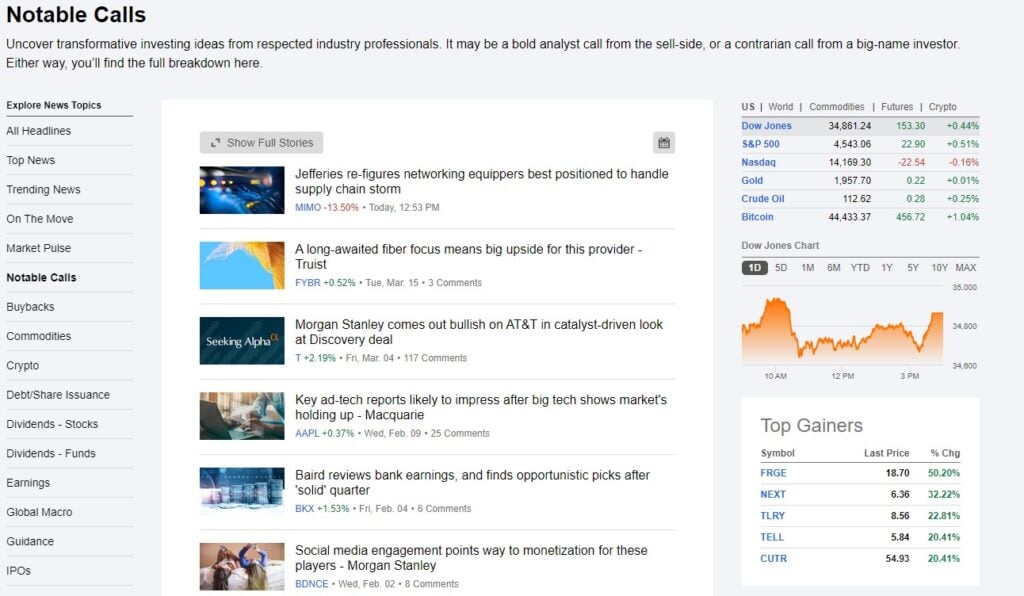

Other Notable Calls

Notable calls is another feature reserved just for Pro and Premium members.

It’s a curated list of the very best investment ideas from top Wall Street gurus and hedge fund managers.

These “notable calls” come from Seeking Alpha’s world-class analysts, and they’re a great way to stay on top of the latest Wall Street trends.

Some common things typically featured in the notable calls section are “state of the market” addresses, recaps of recent purchases by hedge fund managers, and more.

>> Get instant access to great resources like these when you JOIN NOW <<

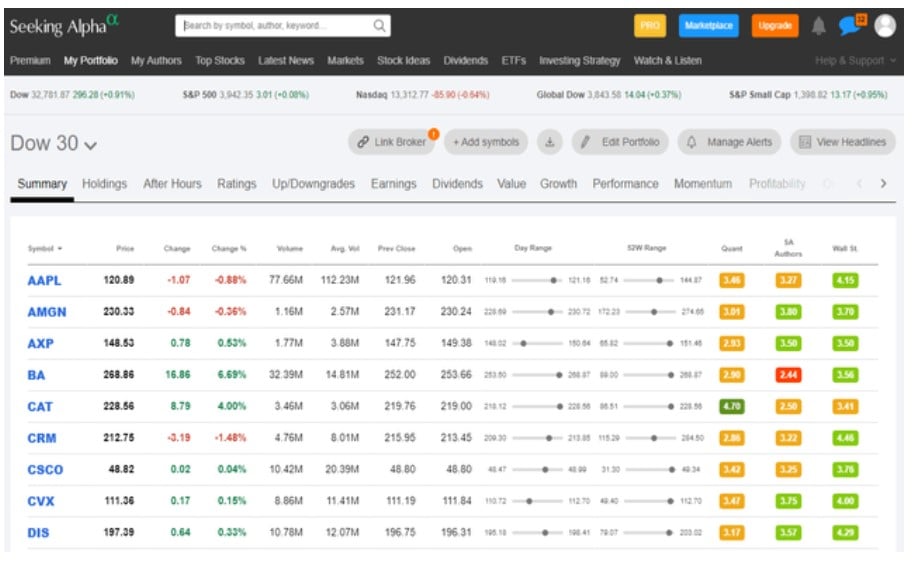

Portfolio Monitoring

Seeking Alpha’s portfolio monitoring capabilities could be its most valuable feature.

This tool gives you the ability to connect and integrate your personal investment portfolio with the Seeking Alpha dashboard.

That way, you can track your holdings right on their platform, and laser in on which investing ideas you want to pursue next.

Once you connect your portfolio to the Seeking Alpha dashboard, you’ll begin to get custom tips and alerts about the ticker symbols in your account.

You’ll get notified when a new article is published about one of your holdings, and you’ll also get breaking news alerts relating to your portfolio.

Seeking Alpha’s portfolio integrations can help you stay on top of the latest news affecting your portfolio so you’ll never miss a beat in the market.

>> Enjoy these benefits and more with a subscription to Seeking Alpha Premium <<

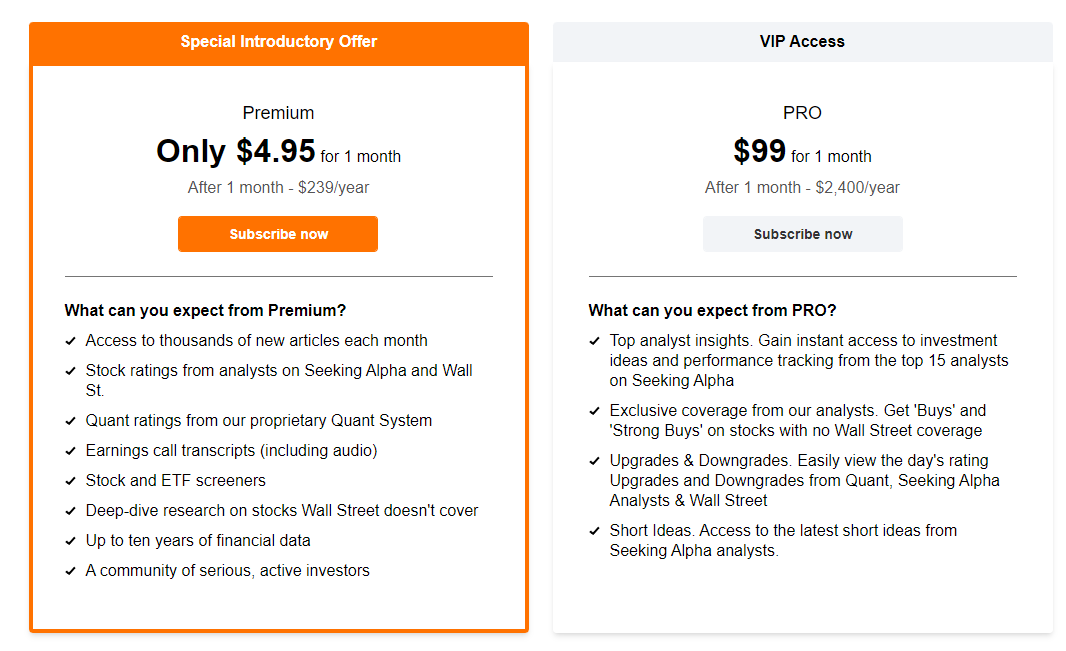

Seeking Alpha Membership Plans Explained

Seeking Alpha offers three different membership plans and we analyzed all of them.

Check out what they have to offer in our Seeking Alpha review.

Seeking Alpha Basic (Free)

Seeking Alpha Basic is totally free, so you won’t pay a dime to use this service.

Register for an account, and you’ll gain access to these helpful features:

- Seeking Alpha Stock Analysis Alerts – Get email alerts whenever Seeking Alpha publishes news articles on stocks, EFTs, and more.

- Real-Time News Updates – See all the latest and trending news in your Seeking Alpha dashboard.

- Investing Newsletters – Subscribe to 15 different investment newsletters on topics ranging from “Wall Street Breakfast” to “ETF and Portfolio Strategy.”

- Stock Prices and Charts – The sidebar of the Seeking Alpha website contains all the key data, stock ratings, and chart information you need to know about a particular investment.

- Wall Street Ratings for Every Stock – See how Wall Street truly feels about a particular stock.

- Limited Access to In-Depth News and Quantitative Analysis – Get a taste of what it would be like to be a Seeking Alpha Premium or Pro member.

Seeking Alpha Premium

Seeking Alpha Premium costs $19.99 a month and comes with everything you see in the Basic plan, plus:

- Premium Content – Unlock Seeking Alpha‘s full library of content and enjoy the best in financial news and analysis.

- Author Ratings – From “Very Bearish” to “Very Bullish,” see an author’s opinion of a particular stock at the time of publishing.

- Author Performance Ratings – View an author’s rating history to see how their track record has held up over time. See who’s hot and who’s not.

- Stock Quant Ratings – Helps you find the best opportunities in the market based on data-driven analyses and a hard-thinking computer algorithm.

- Dividend Grades – The proprietary dividend grades feature helps you choose the strongest, safest dividend investments.

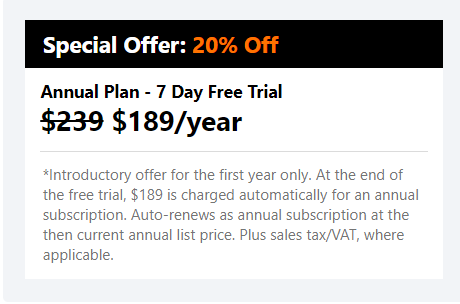

- >> Click here to save 20% on a Seeking Alpha Premium membership <<

Seeking Alpha Pro

As a Pro member, you unlock all the features of a Seeking Alpha Premium subscription, plus:

- Top Ideas – The best ideas from the top minds in investing. Seeking Alpha editors and analysts find the most compelling investment ideas and deliver them to you first.

- PRO Content & Newsletters – Get access to bonus Seeking Alpha content, including trading alerts, in-depth webinars, personal interviews, and more.

- Short Ideas Portal – Filter through thousands of short-selling ideas from Seeking Alpha‘s community of contributors — even share your own short ideas with the community!

- Stock Ideas Screener/Filter – Filter through thousands of stock ideas by theme, industry, market cap, group, or price range to find the best stocks for your portfolio.

- VIP Service – Get matched with a VIP editor who will help you find investing ideas that match your interests — designed just for Pro members.

- Refund Policy – Seeking Alpha’s Premium and Pro plans have a 14-day free trial period.

Is Seeking Alpha Right for Me?

One thing is sure based on our Seeking Alpha review, this platform proves to be an invaluable service for a wide range of individuals looking to get more out of their investments. There are plenty of opportunities to deepen your understanding of the stock market and bring more depth to your portfolio.

Folks preferring to conduct all their own research will feel right at home here. The plethora of tools from stock screeners to Quant ratings offer the type of analysis needed to enter into securities with the right amount of risk.

Pros and Cons

Seeking Alpha has built a community of over 20million like-minded people — but nothing’s perfect. Here are the top pros and cons of the service:

Pros

- More than 20 years of history

- Multiple proprietary features, such as Quant Ratings and the Factor Scorecard

- Earnings call information from several companies all in one place

- Built-in portfolio monitoring

- Analysis from published, legitimate authors

- Several tiers of service to choose from

- Free option available

Cons

- Top-tier plans can get costly due to the number of features

- Can feel overwhelming at first to sift through all available information

>> Get all these benefits at 20% discount when you join now! <<

How Much Does Seeking Alpha Cost?

How Much Does Seeking Alpha Cost?

Seeking Alpha has three pricing models designed to fit any budget.

Folks wanting to test the waters can sign up for a Basic membership completely for free. There’s limited access to Seeking Alpha’s plethora of tools, but it offers a chance to see stock analyses, read through charts, and check ratings.

A Premium subscription renews at $239 per year after an introductory month at $4.95. This tier allows unlimited expert investor content, an open door to Seeking Alpha’s amazing community, portfolio health checks, and Quant Ratings.

Finally, Pro members get everything the platform has to offer, from exclusive analyst coverage to key insights and short ideas from the team. At the top, expect to pay $2,400 annually after a $99 introductory month.

You can access this discount by clicking on any of the links in this review.

Seeking Alpha Pro vs Premium

Both Pro and Premium members get access to a wide breadth of tools to help you find new investing ideas and monitor your portfolio.

For most, a Seeking Alpha Premium service is the best option. It costs just $119.99 for a full year and gives you access to Seeking Alpha’s full range of content, ratings, investing ideas, and more.

However, serious investors who need professional-grade market intelligence and state-of-the-art features should consider Seeking Alpha Pro.

Pro members get exclusive trading alerts and interviews with executives, plus VIP editorial services, and a dedicated hub of Pro trade ideas for $199 a month.

If you are a pro investor who trades for a living, Pro might be the better choice, but Seeking Alpha Premium is generally a more suitable option for everyday investors.

>> Join now to save 20% on an annual subscription! <<

Seeking Alpha Recent Performance and Track Record

Seeking Alpha uses a groundbreaking quant ratings system and algorithmic approach to locating the best stocks to invest in.

It filters these down, rewarding only the top opportunities a “Strong Buy” based on metrics such as growth, value, EPS revisions, price momentum, and profitability.

Over the last 13 years, Seeking Alpha’s specialized platform has resoundingly defeated the S&P a total of 12 times.

Those Strong Buys led to roughly 600% more returns than the index, with a stark increase since 2020.

Similarily, aggregate analyst ratings with or without a Wall Street rating of their own returned roughly 100% since the beginning of the decade.

Keep in mind these particular features are only available to members of Seeking Alpha’s Premium and PRO membership tiers.

Are Seeking Alpha Premium and Pro Worth It?

Based on our Seeking Alpha review, without a doubt, Seeking Alpha’s Premium and Pro services are an excellent value and well worth the price.

Basic members only get access to rudimentary stock analysis, news updates, and Wall Street ratings.

Some beginners may find this is enough, but they’re missing out on some of Seeking Alpha’s most valuable features, including Seeking Alpha’s quant ratings, screeners, and top-tier analysis.

If you’re serious about building wealth in the stock market, check out Seeking Alpha’s Premium or Pro membership.

Fortunately, our readers can access a 14-day free trial of Seeking Alpha Premium.

If you’re still undecided, try the service for two weeks, risk-free, with no commitment, and see for yourself if it’s worth the cost of admission.

With over 6.5 million readers and 200,000 active Seeking Alpha subscribers, this rich community of serious investors is a testament to the platform’s quality and value.

Get started today with this special free trial offer for Stock Dork readers and see if Seeking Alpha is right for you.

>> That’s it for my review! Sign up now and claim your 20% discount <<

Tags:

Tags: