StockInvest.us has become one of the fastest-growing stock research platforms in recent years, known for delivering AI-driven technical analysis and daily trading signals.

With coverage of more than 45,000 companies across dozens of global exchanges, it aims to help everyday people make smarter trading decisions.

But is it really as good as it sounds?

In this in-depth StockInvest.us review, I’ll walk through its features, credibility, pros and cons, and whether it’s worth adding to your trading toolbox.

>> Click Here for StockInvest.us’ Best Stock Picks <<

What is StockInvest.us?

Launched in 2016 in Vilnius, Lithuania, StockInvest.us is an online stock research and analysis service operated by UAB Exigam that’s designed to simplify investing decisions.

Instead of overwhelming you with raw data, it packages technical stock analysis, AI-generated insights, and trading signals into a clean and approachable platform.

The service includes watchlists, screeners, portfolio tools, and daily forecasts among others, that appeal to anyone wanting more clarity in the markets.

What makes it attractive is how it incorporates powerful features like the Golden Star signal, pivot points, and AI Analyst reports without requiring you to be a professional trader to understand them.

In many ways, StockInvest.us stands out because it strives to find the sweet spot between beginner-friendly usability and professional-grade analysis.

Who Owns StockInvest.us?

StockInvest.us is owned and operated by UAB Exigam, a fintech company headquartered in Vilnius, Lithuania.

Under UAB Exigam’s leadership, StockInvest.us has expanded from covering only U.S. equities to offering analysis on more than 45,000 stocks across Europe, Asia, and Australia.

The company has earned recognition in the Global Fintech Index 2020 as one of Lithuania’s top fintech firms and was nominated for “Fintech Innovator of the Year” in 2024.

People are drawn to StockInvest.us because UAB Exigam continues to innovate with features like AI-driven forecasts, conversational analysis, and curated trading signals, making it an attractive option for folkswho want more clarity without steep learning curves.

Is StockInvest.us Legit?

StockInvest.us is considered a legitimate and trustworthy platform in the fintech space.

It has been around since 2016 and is backed by UAB Exigam, a registered company in Lithuania that has earned recognition in the Global Fintech Index and industry award nominations.

The platform is transparent about how its signals are generated, updating forecasts daily with end-of-day data, and it provides both technical and fundamental insights in a user-friendly format.

While it doesn’t replace the need for personal research, users appreciate that its AI-powered analysis, broad market coverage, and responsive support team add credibility.

For many, this combination of recognition, transparency, and practical tools makes StockInvest.us a reliable option worth considering.

>> Click Here To Get Started Today!! <<

What Makes Stockinvest.us Special?

Here’s what jumped out at me the most during my Stockinvest.us review.

AI-Powered Stock Analysis

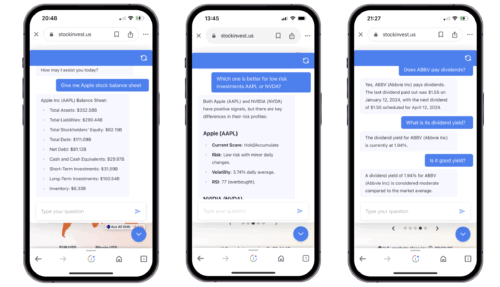

StockInvest.us leans heavily on artificial intelligence to give users insights that used to require years of experience or access to expensive platforms.

For someone who doesn’t want to sift through spreadsheets or decode dense market jargon, this makes it much easier to quickly understand what’s driving a stock.

You can even ask your AI analyst questions and filter your data any way you want.

I love the flexibility here and being able to set up scenarios that most fit my investing style.

Actionable Trading Ideas

With successful trades at the top of anyone’s list of goals, StockInvest.us does a great job of setting you up.

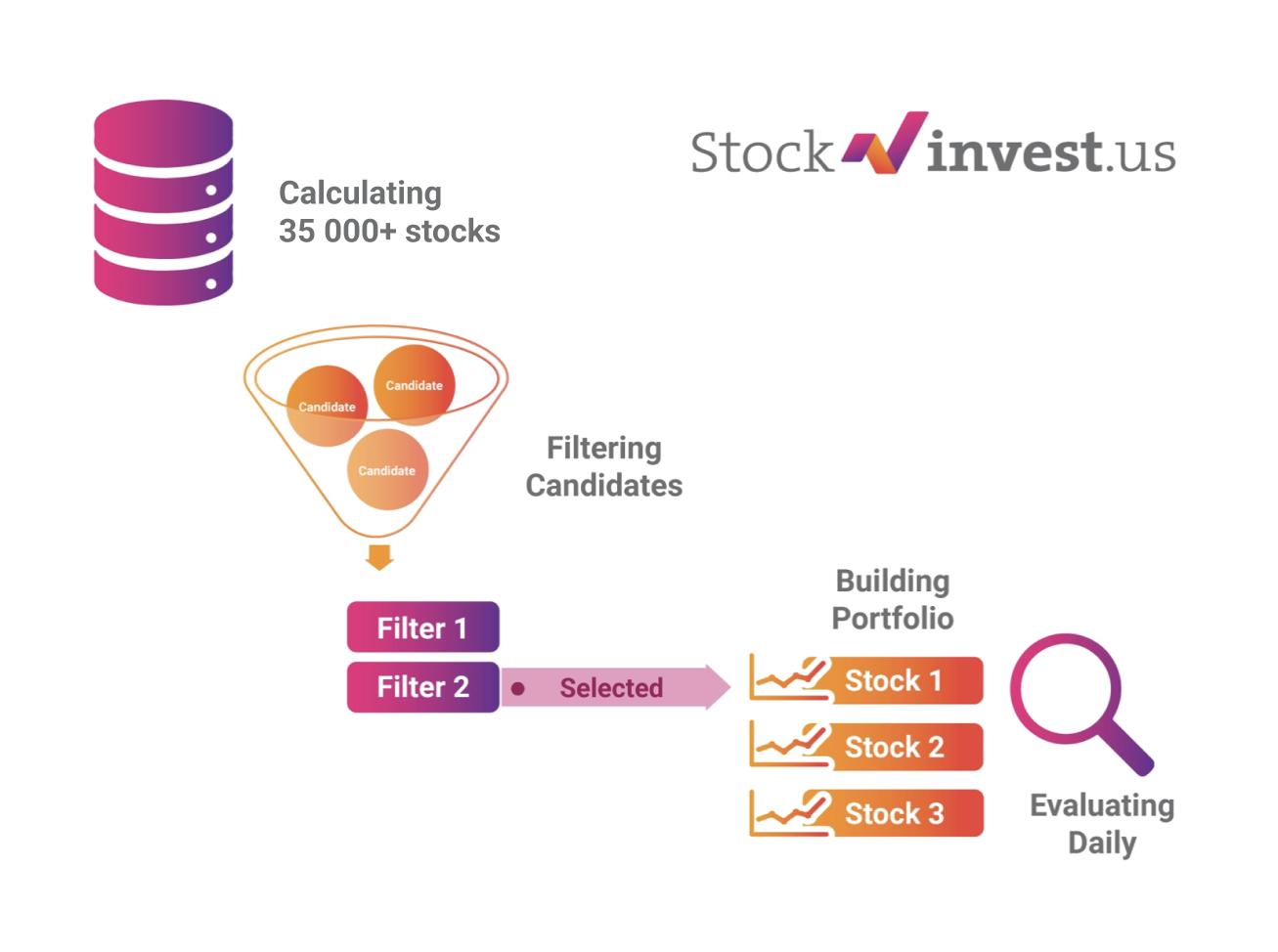

Using its proprietary scoring system, the platform highlights top buy candidates and ranks stocks based on multiple technical and fundamental factors.

Instead of leaving you buried under a mountain of indicators, it simplifies the outcome into straightforward signals that are easy to interpret.

You’re looking at clearer direction without overcomplication, giving you a solid starting point for locating positions that suit your needs.

In-Depth Technical Analysis

Beneath its user-friendly interface is a robust technical analysis engine that evaluates more than 45,000 stocks daily.

From moving averages and RSI to MACD and support/resistance levels, the platform incorporates many of the same tools professional traders rely on.

What’s different is how StockInvest.us brings these insights together with fundamentals like earnings and dividends, offering a fuller picture of each company.

This combination is appealing because it saves time, as users don’t need multiple platforms to get both technical and financial perspectives in one place.

>> Click here to experience StockInvest.us <<

StockInvest.us Review: Most Notable Features

These features stood out as most notable to me when testing out the software:

Proprietary Stock Score

The Stock Score is at the core of the platform. It condenses complex data from multiple signals and indicators into a single rating of 0 to 10.

For folks who want clarity without crunching numbers themselves, this scoring system offers a quick snapshot of a stock’s short‑term outlook.

It’s especially useful when comparing several companies side by side, giving you an easy way to identify which ones deserve more attention.

Once you’ve done your analysis alongside this score, you should have a clear idea of how to make a move.

Daily Buy/Sell Signals

Each trading day, the system processes end‑of‑day price data and produces updated buy and sell signals.

This feature helps you spot momentum shifts and reversal points quickly, making it ideal for individuals who rely on timing.

It’s admittedly almost an overwhelming number of options for someone new to the game, but you’ll quickly learn which signals speak to you the most with a bit of effort.

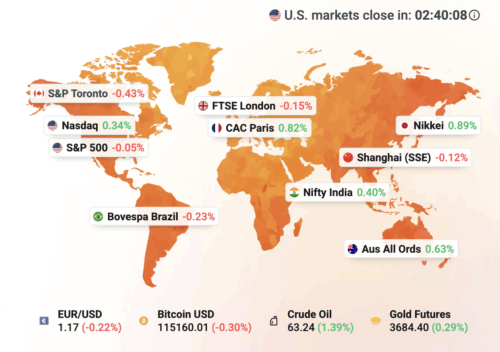

Global Stock Coverage

Unlike many platforms limited to U.S. markets, StockInvest.us tracks over 45,000 tickers across global exchanges, including Europe, Asia, and Australia.

You’re no longer locked into the economic struggles of the United States and have the ability to look outside our shores if and when the market takes a turn for the worse.

For anyone looking to diversify internationally, it’s a valuable one‑stop resource.

Smart Portfolios

Premium subscribers can create automated portfolios that track groups of stocks based on selected criteria.

This saves time and ensures you always have a watchlist aligned with current analysis.

There are a number of opportunities to pick from, each with a chart indicator and the portfolio’s performance since it began so you’re not coming in blind.

In my experience, some of the best automations were sealed away behind a premium paywall, so keep that in mind.

>> Unlock Smart Portfolios Now <<

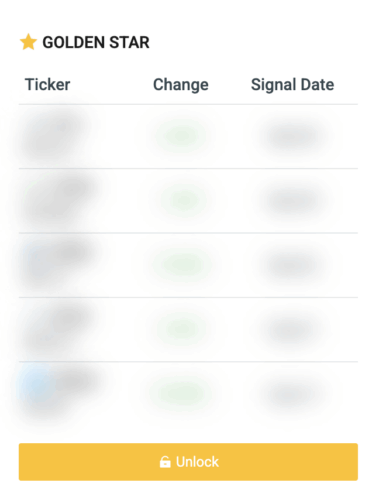

Golden Star List

The Golden Star signal highlights the most bullish technical setups for the day, based on advanced technical analysis.

It does so by combining several factors into one indicator, flagging stocks that show strong upward momentum.

For folks who prefer focused opportunities rather than sifting through thousands of tickers, this feature acts as a shortcut to high‑potential ideas.

Top 5 Buy Candidates

Every day, StockInvest.us updates its list of the five strongest buy opportunities.

These picks are based on the proprietary scoring system and highlight stocks with bullish short‑term outlooks that you can take right to the bank.

Clicking on those picks opens a new window with all the technical details you’ll ever need, including a nice explanation of why the stock made the list in the first place.

It’s a simple way to identify candidates worth a closer look, especially if you want actionable ideas without deep manual screening.

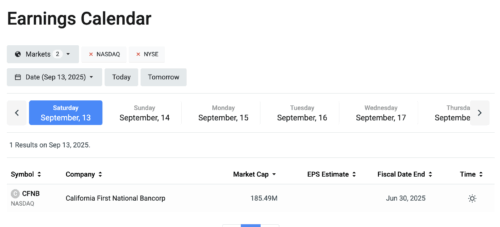

Earnings and Dividend Calendars

StockInvest.us includes earnings and dividend calendars that keep users updated on upcoming financial events.

This helps traders anticipate potential volatility around earnings releases and plan ahead for dividend strategies.

By integrating this feature directly into the research process, StockInvest.us makes it easier to align technical signals with fundamental catalysts, which can improve decision-making.

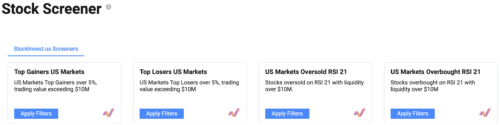

Stock Screener

The stock screener gives folks the ability to filter thousands of stocks based on technical and fundamental criteria.

Whether you’re looking for stocks showing bullish momentum, undervalued companies, or those approaching support or resistance levels, the screener allows you to set parameters and quickly find matches.

This feature saves time by narrowing down the universe of more than 45,000 global tickers into a shortlist of actionable opportunities that fit your exact trading strategy.

>> Get Stock Screener Today <<

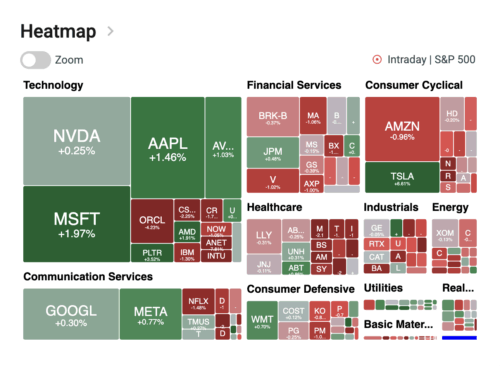

Stock Heatmap

For those who prefer a visual overview of the market, StockInvest.us offers an interactive stock heatmap.

This feature provides an at-a-glance snapshot of where money is flowing in the market.

It’s particularly helpful for identifying emerging sector trends or spotting overbought and oversold areas, making it a practical complement to the platform’s other data-driven tools.

YouTube Market Commentary

StockInvest.us also runs an active YouTube channel with regular updates, tutorials, and commentary.

It’s a valuable companion for those who learn best through guided explanations, often offering insight into matters you won’t find elsewhere on the site.

Future Growth Prospects

Looking ahead, StockInvest.us is well-positioned to benefit from the growing demand for AI-driven investment research.

As folks increasingly seek tools that combine simplicity with professional-grade insights, the platform has room to expand even further into global markets.

The company has already shown momentum, scaling from U.S. coverage to more than 45,000 stocks across Europe, Asia, and Australia, and it continues to add new features such as auto portfolios and conversational analysis.

With AI adoption accelerating in fintech, StockInvest.us could strengthen its role as a go-to solution for many of us.

A potential dedicated mobile app and improved backtesting would further enhance its competitiveness against rivals like Finviz or Trade Ideas if the company takes on the challenge.

Given its track record of innovation and recognition within the fintech community, its future growth prospects look promising for both the company and its expanding user base.

My Experience with StockInvest.us

I found StockInvest.us especially useful for identifying short-term momentum opportunities. The Golden Star and Top Buy lists provided clear, actionable signals without the clutter.

However, I noticed that some signals were highly reactive, meaning they work best when paired with disciplined risk management.

The conversational AI analyst was another standout feature, allowing me to ask quick questions without digging through charts.

In all, each of these features served to save my time and sanity when looking for new areas to invest.

I thoroughly appreciated having an action plan after just a few clicks instead of spending hours reading reports while trying to glean if a position is worth getting into.

Pros and Cons

After a thorough StockInvest.us review, here are my notable pros and cons:

Pros:

- Covers 45,000+ stocks globally

- Daily updated signals and alerts

- Top 5 buy candidates and Golden Star lists

- Wide range of research tools

- AI-powered insights

- Excellent customer support

- Strong trust and credibility ratings

Cons:

- Signals can be quite reactive

- Limited chances to interact with other users

Cancellation and Refund Policy

StockInvest.us makes it simple to manage your subscription.

You can cancel anytime directly from your Profile Settings, and your Premium access will remain active until the end of your current billing cycle before reverting to the free version.

To initiate a refund, users need to contact help@stockinvest.us with their registered email address, and processing usually takes a few business days depending on the bank.

This straightforward approach ensures you know exactly where you stand, giving peace of mind when trying out the service.

>> Trade Risk-Free with StockInvest.us <<

Who Should Use StockInvest.us?

StockInvest.us is best suited for folks who fall into the middle ground between beginners and professionals.

For beginners, the technical terms and variety of signals might feel overwhelming at first, but those who already understand the basics of market movements will find the platform incredibly helpful.

The sweet spot is for intermediate users who want more depth than free screeners can offer, but who don’t need or want the complexity of high-end institutional tools.

With so many features, there’s just about something for everyone, whether you’re tapping into lists or utilizing AI for locating long-term positions.

No matter where you find yourself in your investing journey, StockInvest.us offers a balance of accessibility and advanced insights that fills that gap perfectly.

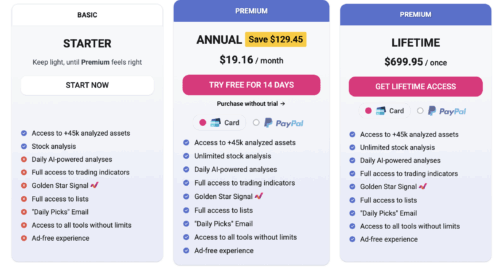

How Much Does StockInvest.us Subscription Cost?

StockInvest.us keeps its pricing structure straightforward, with options that suit both casual and committed users.

This trial is helpful for testing daily signals, Golden Star lists, and auto portfolios before committing.

After the trial, the most popular entry-level plan is the Premium subscription at around $30 per month.

For those who want better value, there’s a discounted annual plan or even a lifetime membership that can save you a lot of money in the long run.

These paid tiers include ad-free browsing and unobstructed access to the gamut of the platform’s features.

Once a subscription is canceled, your account reverts to the free version with limited features.

The combination of a risk-free trial and flexible pricing makes it easy to find a plan that matches both your budget and trading needs.

StockInvest.us Review: Is It Worth It?

Based on this StockInvest.us review, the platform delivers solid value for folks who want practical insights without the complexity of institutional tools.

I thought leaning into AI would be a crutch, but the platform seamlessly weaves the feature into everything it does.

In addition, its global coverage and daily signals make it a reliable companion for a wide range of individuals.

You’ll find no shortage of research here, and you’re free to pick and choose those that work best for you.

Having that extra flexibility allowed me to increase my investing knowledge over time as I incorporated more technical analysis into my strategy.

For those wondering, the best way to decide where you fit in is to try the 14-day free trial, explore its features, and see if it fits your trading style before committing to a subscription.

At the end of the day, StockInvest.us is definitely worth a closer look no matter who you are, thanks to all these features and generous price points for its content.

Tags:

Tags: