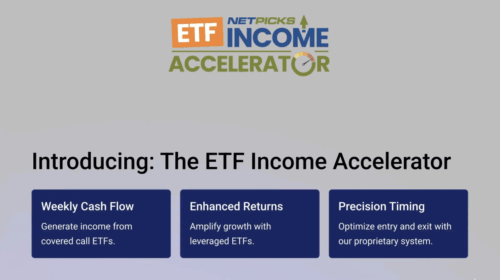

ETF Income Accelerator is NetPicks’ income‑focused program from Mark Soberman, built to generate weekly or monthly cash flow with minimal effort.

It’s designed for people who want weekly or monthly cash flow while keeping their workload to just a few minutes a week, but does it really work?

In this ETF Income Accelerator review, I’ll walk you through all aspects of the platform so you can make an educated decision on whether it’s worth checking out.

>> Join Mark Soberman’s ETF Income Accelerator <<

What is ETF Income Accelerator?

ETF Income Accelerator (EIA) is a step‑by‑step income system built around what NetPicks calls the “income trifecta” to teach members how to use exchange‑traded funds to create steady payouts.

Instead of sifting through hundreds of ETFs on your own, the service narrows the list to a manageable handful and shows you exactly how to put them together into a working portfolio.

People are drawn to this because it’s designed to be simple enough to learn in under an hour and flexible enough to work with any account size.

Whether you want extra cash for expenses or a reinvestment plan to grow wealth faster, this service lays out a structure that takes only minutes a week to follow.

I’ll perform a deep dive into all the service offers shortly, but first I want to take a closer look at the guru behind it all.

>> Start NetPicks ETF Income Accelerator Today <<

Who is Mark Soberman?

Mark Soberman fell in love with trading more than 40 years ago and hasn’t looked back.

Thus, in 1996, he founded NetPicks with a focus on providing signals for stocks and options.

Over nearly three decades, Soberman has curated his platform for day trading, swing trading, and now income investing, drawing from both his own trading career and the feedback of thousands of students.

His work has been featured in outlets such as CNBC, Fox Business, and Financial Times, and he has written extensively on trading discipline and systems.

Beyond building programs, he actively trades the very methods he teaches, including the ETF Income Accelerator.

Is Mark Soberman Legit?

With over 40 years of experience, Soberman has been in the education space since before most brokers went online.

His credibility comes from a rare combination of longevity and transparency in an industry where many educators come and go quickly.

With nearly 30 years running NetPicks, he has guided tens of thousands of members worldwide and developed a reputation for strategies that are practical and easy to follow.

His programs have been profiled in financial media, and his articles on trading psychology and risk management are widely circulated in trading communities.

While he does not promise overnight riches, he consistently presents the trade-offs of each strategy, like capped upside in covered call ETFs, so members know what to expect.

This balanced approach makes him one of the more reliable names in the trading education space.

>> See Mark Soberman’s Income Strategy <<

What is the ETF Income Accelerator Presentation About?

Most people chasing income rely on dividend stocks or interest accounts, but those rarely provide more than a few percentage points a year.

I think you’d agree with me when I say that returns that small simply isn’t enough. It leaves a gap for anyone who needs steady cash flow to cover expenses or supplement retirement.

That’s where the ETF Income Accelerator comes into the picture, finding a way to turn ETFs into a weekly paycheck system that actually fits into a busy lifestyle.

The question is, how does it all work?

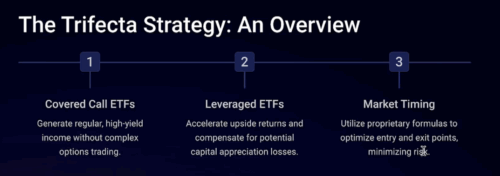

The Power of the Trifecta

Dividend yields have been shrinking, and even bonds or CDs lock you into long commitments with limited upside.

Soberman aims to solve that problem by introducing a trifecta strategy using a combination of covered call ETFs, leveraged ETFs, and market timing.

These elements balance a consistent income pool with growth through gains, all while minimizing risk.

The two-pronged approach serves to address both long and short-term needs in your portfolio while continually setting you up for success.

Simplicity is Key

What really stood out to me about ETF Income Accelerator was how easy it is to use.

It introduces a traffic light system for determining when it’s time to act: green for buy, yellow for caution, and red when it’s time to sell.

I also fell in love with the short amount of time it takes to actually make the system work.

Soberman suggests that you can learn everything you need to know in just 30 minutes, requiring only a handful more to actually put the strategy to its paces.

Once you’re going full steam, it only takes around five minutes per week to keep the plates spinning.

Touting a powerful strategy and simple setup, I couldn’t wait to find out more.

How to Put ETFs to Work for You

At the end of the day, the attraction here isn’t just higher yields; it’s about building consistency with minimal effort.

If you want to explore how this system works in full detail, you can join the program and see the same signals I do each week.

It’s a clear way to build regular cash flow without juggling dozens of trades, and it leads right into what you’ll actually receive when you become a member.

>> Unlock Cash Flow with ETF Income Accelerator <<

ETF Income Accelerator Review: What Comes With It?

Here are all the features and tools you’ll have access to as an ETF Income Accelerator member:

Full Access to the ETF Income Accelerator Course

The training is structured so that anyone, regardless of background, can get started quickly. It consists of a complete series of short videos that walk you step by step through setting up an income‑focused ETF portfolio.

What stood out to me is that you don’t just learn theory, you see actual ETF examples, payout schedules, and scenarios where the timing model would have avoided large losses.

By the time you finish, you’re equipped to log into your brokerage account and confidently place your first trades, knowing exactly what to buy and how to manage it going forward.

ETF Mastery Modules

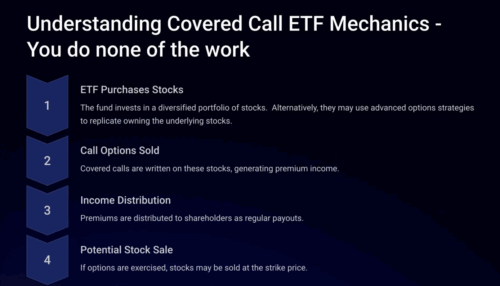

This part of the program shows you exactly how to turn ETFs into a steady stream of weekly or monthly payouts.

Many of these ETFs pay distributions every single week, which means you can actually see cash flow hitting your account on a consistent schedule.

What makes this valuable is that you know not just what to buy, but also when to expect income, and how to reinvest it if you choose.

For someone looking to replace or supplement a paycheck, this module takes the guesswork out of income planning and gives you a clear path to predictable results.

Weekly Market Timer Alerts

The market timing element is what keeps this strategy from being just another high-yield income play.

It translates into a simple color-coded system: green means stay invested, yellow signals caution, and red tells you to step aside.

This model is built on years of testing and has shown its ability to flag downturns early, including before the COVID crash.

For members, the benefit is straightforward: you don’t have to guess when the market is safe or risky.

You get a clear signal that helps protect capital while maintaining income flow, and that makes it easier to stick with the plan through good and bad markets alike.

Portfolio Blueprints

One of the most helpful parts of the program is the inclusion of portfolio blueprints that give you a clear starting point.

Each blueprint is designed to match a specific goal, whether that’s producing steady income with minimal volatility, balancing income with long-term growth, or pursuing faster compounding through reinvestment.

The templates also illustrate how much to allocate to each type of ETF and when to rotate in or out based on timing signals.

For members who might feel overwhelmed by too many choices, these blueprints make the process much easier, letting you plug in a proven structure and then adapt it over time as your needs change.

Ongoing Support

Support is a central part of this program, and it goes beyond just sending out signals.

If you can’t attend live, every session is recorded and archived for easy access later.

On top of that, the Owner’s Club portal provides a hub of resources, including guides, updates, and weekly market analysis, so you’re never left wondering what to do next.

This continuous feedback loop helps you stay aligned with the strategy and gives you the confidence that you’re applying it the right way week after week.

>> Enroll in NetPicks’ Income Accelerator Now <<

Refund Policy

Unlike many trading services that advertise money-back guarantees, ETF Income Accelerator does not offer a standard refund window.

It simply wouldn’t make sense for people to access his content, learn how to use the system, and then ask for a refund while retaining everything they’ve learned.

>> Get Started with Mark Soberman’s System <<

Pros and Cons

After reviewing all that ETF Income Accelerator has to offer, here are my top pros and cons:

Pros

- Set up to give weekly and monthly payouts from covered call ETFs and other investments.

- Takes minimal time per week to manage

- Training is quick and beginner‑friendly

- Includes ready‑to‑use portfolios

- Transparent about risks like capped upside

- NetPicks has nearly 30 years of credibility

Cons

- No standard cash refund offered

- Requires consistent reinvestment discipline

ETF Income Accelerator Reviews by Members

Member feedback gives a clearer picture of how this program works in real accounts. Here are a few recent member snapshots:

Still, the testimonials show that real users are finding both confidence and consistency through the ETF Income Accelerator.

>> Claim Your Spot in ETF Income Accelerator <<

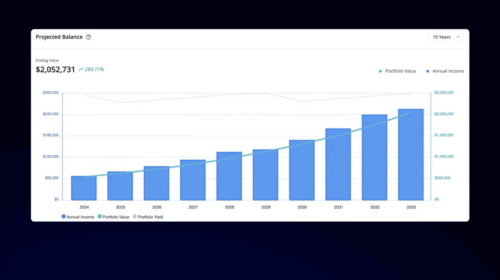

ETF Income Accelerator Track Record

The track record of ETF Income Accelerator is tied to the actual ETFs and timing tools it uses rather than hypothetical models.

For instance, one of the highlighted funds, QQQY, delivered an average yield of 52% in 2023 by paying out weekly distributions.

Another example, JEPQ from JPMorgan, consistently produced around 12% annual yield along with growth from its underlying holdings.

These examples show that the approach is not built on speculation but on real, transparent numbers.

While no system eliminates risk, the data suggests that combining high‑yield ETFs with disciplined timing can provide both consistent income and a level of downside protection.

>> Try NetPicks’ ETF Income Accelerator <<

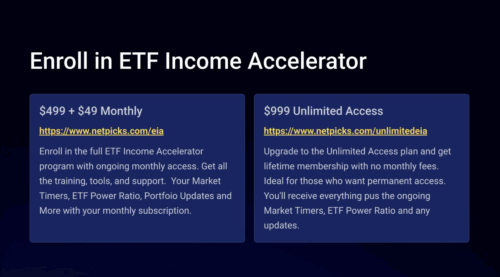

How Much Does ETF Income Accelerator Cost?

NetPicks currently offers two enrollment choices, each designed to fit different preferences.

The second option is a one-time payment of $1,297, granting unlimited lifetime access with no recurring fees.

Many members choose this route for the long-term value since it locks in all future updates and support without worrying about renewals.

Compared to other programs charging thousands annually, both plans are competitively priced, especially considering the ongoing resources and community support included.

By committing once, you gain a structured way to generate weekly income without hidden costs.

>> Join NetPicks ETF Income Program Now <<

Is ETF Income Accelerator Worth It?

In this ETF Income Accelerator review, the service proves itself as a straightforward way to create steady income without the demands of daily trading.

What makes it stand out is the balance of simplicity and transparency. Mark Soberman is upfront about trade-offs like capped upside and the need for discipline.

At $797 or $1,297 for unlimited access, it is priced lower than many similar programs, yet includes ongoing training, updates, and support.

For anyone looking for consistent cash flow in a practical, manageable way, this program is worth serious consideration.

Sign up today for your chance to cash in on strategic ETF options plays.

Tags:

Tags: