Bernie Schaeffer knows how challenging options trading can be and set out to make the process simple – and profitable.

The idea is simple: use vertical debit spreads on volatile stocks to target gains of up to 300% in just five days.

If you’ve ever wanted a clear, rules-based approach to trading options without tying up money for weeks, this service is designed with that exact purpose in mind.

In this Schaeffer’s Grand Slam Countdown review, I’ll share what I discovered about Bernie Schaeffer’s short-term options service and whether it’s worth checking out.

>> Join Schaeffer’s Grand Slam Countdown Today <<

What is Schaeffer’s Grand Slam Countdown?

Schaeffer’s Grand Slam Countdown is a research service from Schaeffer’s Investment Research designed for individuals who want a defined-risk, short-term strategy.

Each cycle, members receive 3–5 carefully selected trades, released on Sunday evening and meant to be entered Monday and closed no later than Friday.

What makes this service appealing is its balance of speed and structure. You aren’t left guessing when to buy or sell, and you don’t have to tie up cash for long periods.

The trades are clear, the rules are simple, and everything is time-boxed into a single week.

For anyone interested in a disciplined way to approach volatile stocks while keeping potential losses capped, Grand Slam Countdown offers a straightforward framework that can fit into almost any trading routine.

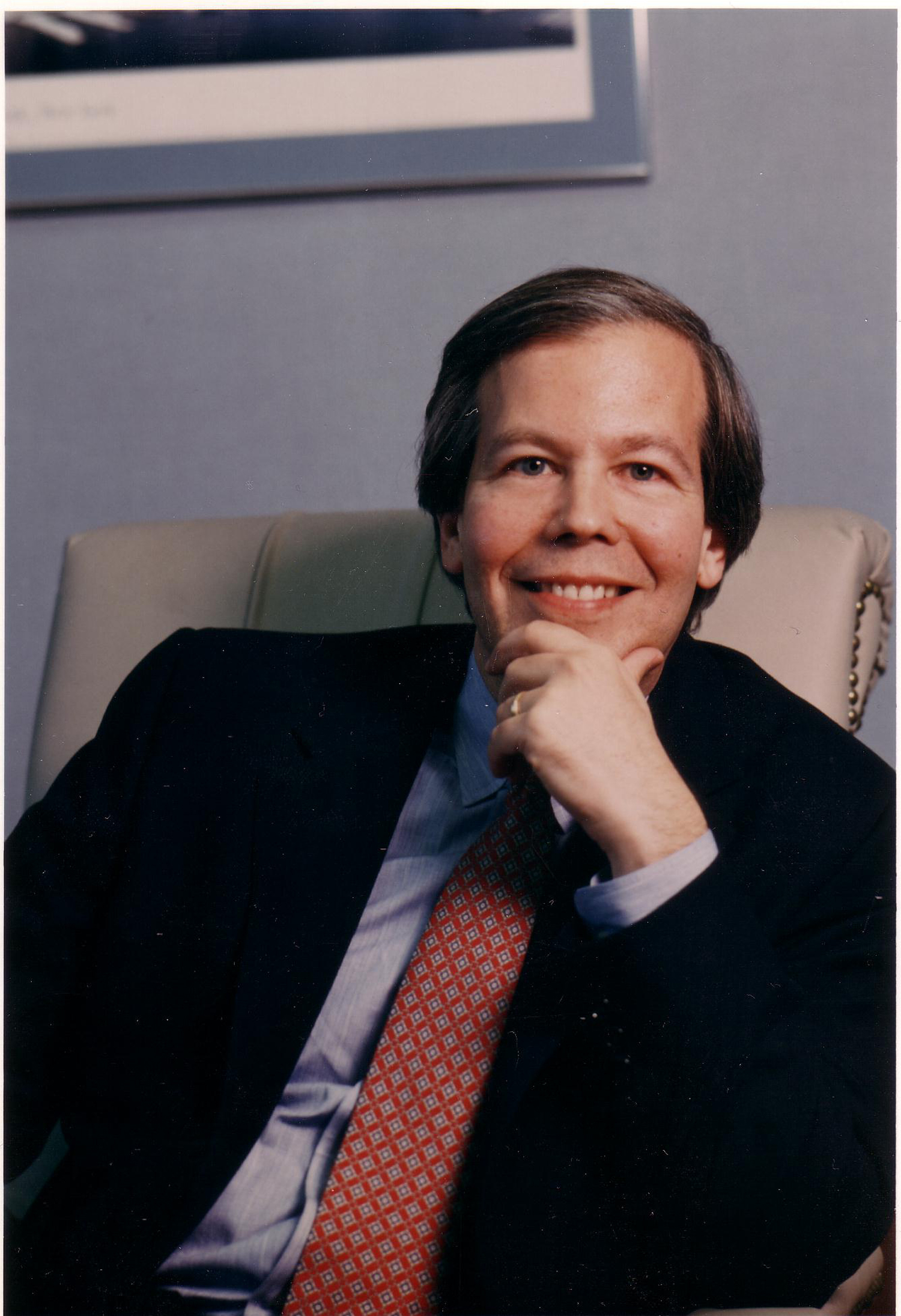

Who is Bernie Schaeffer?

Bernie Schaeffer is the founder and Chairman of Schaeffer’s Investment Research, and he has built a reputation as a respected name in options trading.

A graduate of the University of New York with a degree in mathematics, Schaeffer combined his technical background with a keen interest in market behavior to pioneer sentiment-based options analysis.

Beyond his media presence, Schaeffer has authored several books on options trading, including “The Option Advisor,” and contributed articles to leading financial publications.

His decades of experience and academic foundation make him a credible guide for those navigating the complexities of short-term options strategies.

Is Bernie Schaeffer Legit?

There is little doubt about Bernie Schaeffer’s legitimacy in the world of finance. With over 40 years of experience, he has consistently demonstrated the ability to identify contrarian opportunities before they reach the mainstream.

To that end, he carries a number of accolades, including the Traders’ Library “Trader’s Hall of Fame” award and the Market Technician’s Association “Best of the Best” award.

Schaeffer’s insights have been cited by major financial networks, and his published work has become reference material for professional and retail people alike.

The fact that he built one of the longest-running independent investment research companies in the U.S. further solidifies his credibility.

His combination of education, media recognition, published works, and decades of proven strategies make him a legitimate and authoritative voice in the options trading space.

>> Gain With Bernie Schaeffer’s Strategy <<

What is the Grand Slam Countdown Presentation?

Most people approach options by buying contracts outright, only to see time decay and poor entry points eat away at potential profits.

The Grand Slam Countdown presentation highlights how this problem has kept countless people from ever realizing the real power of options.

At the same time, the market is moving faster than ever, with short bursts of volatility creating windows of opportunity that are often overlooked.

Schaeffer’s take is that these opportunities don’t require holding positions for months; they can be captured in as little as five days.

The Hidden Problem in Traditional Trading

When you simply buy out-of-the-money calls or puts, the odds are stacked against you.

Break-even points can feel like a moving target, and by the time the trade has a chance to work, you’re already battling losses from time decay.

Bernie digs into this issue and shows why relying on one-sided trades makes it harder to generate consistent wins.

It’s an honest look at why so many users get frustrated and walk away, even though the market is full of potential every week.

The Smarter Approach

This is where Bernie Schaeffer’s strategy comes into play. By structuring trades as vertical debit spreads, you can tilt the odds in your favor.

Instead of facing steep break-even levels, spreads provide a more reasonable path to profits while keeping risk defined from the start.

The presentation walks you through how this works in practice, with trades identified on Sunday, entered on Monday, and wrapped up by Friday.

It’s not about chasing home runs; it’s about using a repeatable framework that can deliver substantial gains without tying up capital long term.

Why This Opportunity Stands Out

What makes the presentation compelling is how it frames these short-term setups as both practical and accessible.

You don’t need a massive account or complex tools, just the willingness to follow clear instructions.

The opportunity teased here is the chance to capture triple-digit gains in a single week, over and over again, using a disciplined process.

If you’ve ever wished for a way to profit from volatility without the stress of long holds, this service presents exactly that.

The next step is simple: by joining Grand Slam Countdown, you gain access to these structured trade alerts and can start seeing how the approach fits into your own trading routine.

And as you’ll see in the next section, the service includes everything you need to put this strategy into action from day one.

Schaeffer’s Grand Slam Countdown: What Comes With It?

When you sign up for Grand Slam Countdown, you’ll get the following goodies right out of the gate:

Monthly Trade Recommendations

Every new cycle kicks off on a Sunday evening after monthly options expiration, when members receive a detailed bulletin with three to five trades.

Schaeffer completely sets up these opportunities with exact strike prices, expiration dates, and entry ranges.

By the time Monday morning arrives, you know precisely what to enter and how much capital to allocate.

Once you place those trades, you hold them until Friday, when exit instructions arrive.

This weekly rhythm is designed to create consistency and routine, so even busy people can follow along without spending hours glued to a screen.

I appreciate how there’s clarity every step of the way, so you’re never left guessing what to do next.

>> Get Grand Slam Countdown’s Monthly Trade Recommendations <<

Defined Risk Strategy

When you’re buying single out-of-the-money calls or puts, losses can build quickly and break-even levels can feel out of reach.

With vertical debit spreads, that dynamic changes. Because you are both buying and selling options at different strikes, your cost of entry is lower and your maximum loss is locked in from the start.

You know the exact dollar amount you stand to risk, which removes the anxiety of open-ended losses.

The structure also helps mute time decay, giving your trade a better chance to reach its target before expiration.

Short Holding Periods

One of the most appealing aspects of this service is the quick pace it sets.

Every recommendation is designed to be closed within five trading days, which means you never sit in a position wondering if you should hold longer or cut losses early.

By following the structure, trades open on Monday and are closed no later than Friday, giving you a clear start and finish to the week.

This short cycle helps you avoid the risk of unexpected news events dragging down a trade over weeks or months. It also frees up capital quickly, so your money isn’t tied up waiting for results.

No Margin Trading Required

A major benefit of Grand Slam Countdown is that it never requires margin trading.

Many members hesitate to use advanced option strategies because of the added complexity and the risks tied to margin accounts.

Here, you avoid those hurdles completely. Every trade is structured as a debit spread, which means the only money at risk is the premium you pay upfront.

There are no margin calls or hidden liabilities, and you don’t need special broker permissions beyond a standard options trading account.

This makes the service accessible to a wider range of people, including those who are newer to options.

>> Access these benefits Today <<

Grand Slam Countdown Bonuses

Alongside the main trade recommendations, members also receive access to four recurring bonus resources that keep them informed about the markets and help reinforce the weekly strategy.

Schaeffer’s Market Recap

This is a daily email that arrives after the market closes. It provides a clear breakdown of the day’s biggest moves, from surprising earnings reactions to shifts in market sentiment and unusual trading activity.

Instead of scanning multiple news sources, you get a focused summary of what mattered most and why it could affect upcoming trades.

For anyone following the weekly setups, this recap serves as a valuable way to understand the broader context and identify patterns that might influence next week’s recommendations.

Schaeffer’s Opening View

Sent before the opening bell, this briefing prepares you for the trading day ahead. It includes key overnight developments, technical levels to watch, and sentiment indicators that Schaeffer’s team tracks closely.

By reading it each morning, you start the day with a sense of where momentum may be headed and which sectors or stocks could show unusual activity.

For busy individuals, this feature is a time saver, giving you a quick yet comprehensive look at the most important factors that might drive the session.

Schaeffer’s Midday Market Check

Midway through the trading day, this update offers a real-time pulse on market conditions. It highlights data releases, stock-specific news, and options flow that could influence positions.

Having this information in the middle of the session helps you avoid surprises and gives you context if markets suddenly shift.

It’s particularly helpful for understanding how institutional players might be positioning themselves, and it allows you to compare Schaeffer’s alerts with current market behavior.

Monday Morning Outlook

You’ll want to start your week with the Monday Morning Outlook, which looks at technical turning points, sentiment readings, and key events likely to move the markets.

The forecast goes beyond simple predictions by framing why certain setups matter and how they might play into short-term opportunities.

It’s a resource that helps you mentally prepare for the week ahead, aligning your expectations with the strategies laid out in the trade recommendations.

Over time, these insights also help you recognize the same signals Schaeffer’s team relies on when building the official trades

>> Get Grand Slam Countown’s Bonuses Today <<

Refund Policy

Unlike some advisories that offer money-back guarantees, Grand Slam Countdown operates under a strict no-refund policy.

All subscriptions are billed automatically to ensure uninterrupted service, and renewals will continue unless you cancel before the next billing date.

While some may see the lack of refunds as a drawback, this approach is standard across short-term trading services where the main benefit is immediate access to actionable trade alerts.

The important takeaway is that you can cancel at any time to avoid future charges, but past payments are non-refundable.

Pros and Cons

Every service has its strengths and trade-offs. Here’s a balanced view:

Pros

- 3-5 clearly structured trades per month

- Defined risk with vertical debit spreads

- Potential for 300% gains per trade

- Quick turnaround (5 days max)

- Works in both rising and falling markets

- Backed by a reputable firm with 40+ years of experience

- Includes free market insights and updates

Cons

- No community forum or chat feature

- No refunds once subscribed

Schaeffer’s Grand Slam Countdown Track Record

One of the strongest selling points of Grand Slam Countdown is the performance history that Schaeffer’s team highlights.

Over a recent six-month stretch, the strategy generated a cumulative return of more than 950%.

These results demonstrate how short bursts of volatility, when paired with carefully structured debit spreads, can lead to outsized returns.

The service is built on a repeatable framework, so every trade follows the same rules: enter on Monday, close by Friday, and keep risk defined from the start.

While no track record guarantees future results, the data illustrates the potential power of the approach.

How Much Does Schaeffer’s Grand Slam Countdown Cost?

The subscription cost for Grand Slam Countdown is structured around three plans, each designed to fit different levels of commitment.

The one‑month auto‑renewal plan is priced at $249, giving you immediate access to the weekly trade recommendations and bonus resources.

This option is ideal for anyone who wants to test the service without committing long term, though it comes at the highest monthly rate.

The three‑month plan costs $595, which brings the monthly rate down and offers a balance between flexibility and savings.

For those confident about sticking with the program, the twelve‑month plan is priced at $1,747, which breaks down to roughly $145 per month.

This makes it the most cost‑effective choice, especially if you intend to follow the trades consistently.

All plans include the same features, weekly trade alerts, defined risk strategies, and access to Schaeffer’s bonus research services.

Is Schaeffer’s Grand Slam Countdown Worth It?

After going through the details, this Schaeffer’s Grand Slam Countdown Review makes it clear that the service is designed for individuals who want structure, speed, and limited risk.

The routine of entering trades on Monday and closing them by Friday creates discipline, while the use of vertical debit spreads keeps losses capped.

The strong track record gives confidence that the approach can deliver meaningful results, though no system is foolproof. What stands out is how accessible the strategy is, you don’t need margin accounts or large sums of money to start.

For anyone who wants to capture short-term market moves without overcomplicating things, Grand Slam Countdown offers a compelling path.

It’s not for everyone, but if quick, defined-risk trades sound like the right fit, this service is worth serious consideration.

Verdict: Schaeffer’s Grand Slam Countdown is a legitimate and well-structured service for users who want clearly defined risk and the chance to target triple-digit gains in just one week.

The strategy is disciplined, the presentation is transparent, and the pricing is competitive for the value offered. For those ready to act quickly and follow precise instructions, this service could be a game-changer.

>> That’s it for my Review Join Grand Slam Countown NOW!! <<

Tags:

Tags: