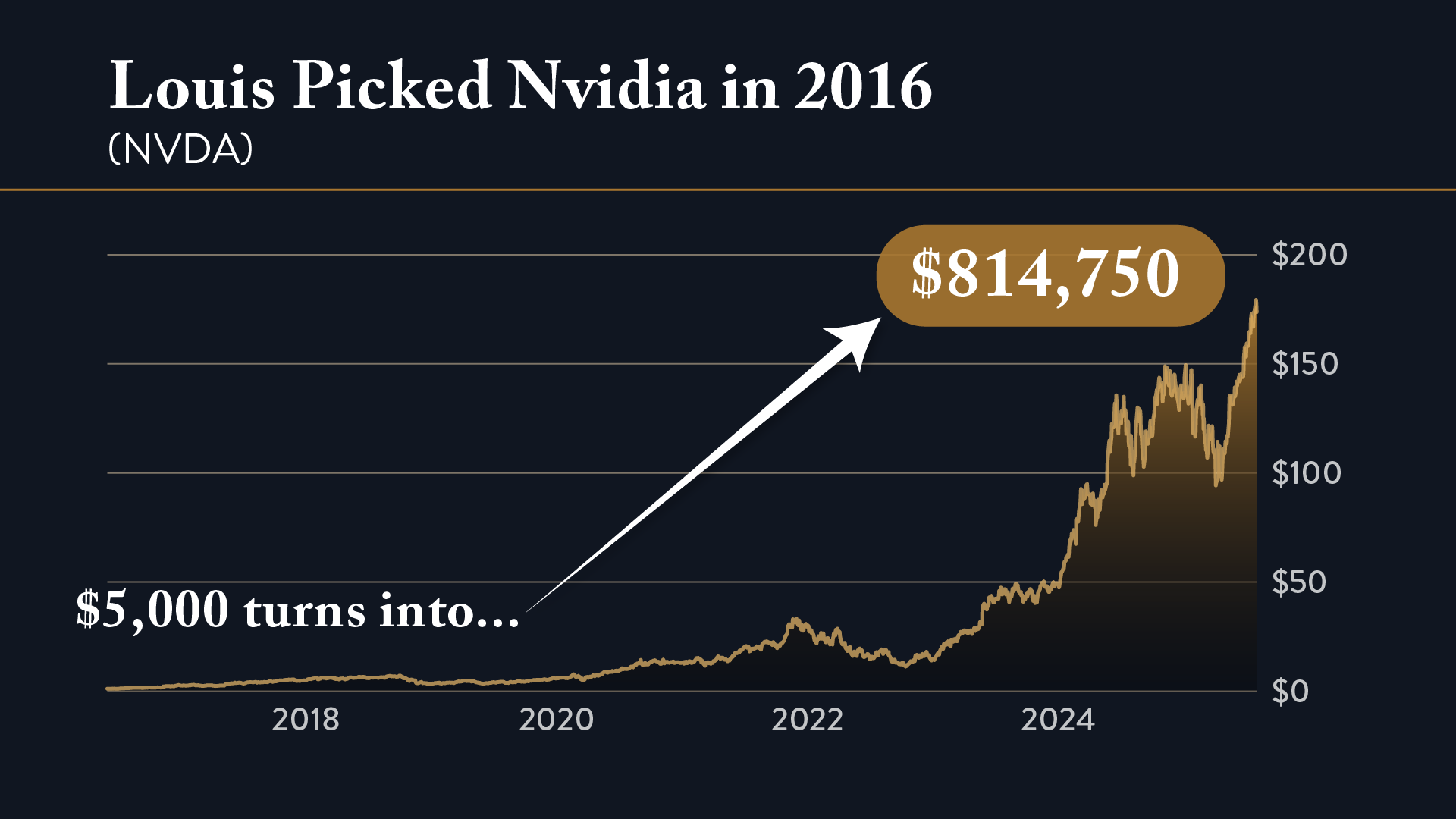

When Louis Navellier speaks, smart investors tend to listen. His call on Nvidia back in 2016 turned a little-known chipmaker into one of history’s biggest success stories.

Now, he’s back with what he calls the next 150X opportunity, a breakthrough tied to Nvidia’s newest innovation in quantum computing.

In this Nvidia’s Quantum Partner review, I’ll show you how his Growth Investor research is positioning readers ahead of what he believes will spark the third great computing revolution.

>> Join Nvidia’s Quantum Partner Today <<

What Is Growth Investor?

Growth Investor is Louis Navellier’s flagship advisory that focuses on uncovering the market’s strongest large- and mid-cap stocks before they explode in value. What makes it stand out is Navellier’s data-driven approach, a strategy refined over four decades using his proprietary stock-grading system that tracks both fundamentals and institutional buying activity.

Subscribers receive regular research that blends quantitative analysis with clear, actionable guidance, the kind of insight once reserved for pension funds and high-net-worth clients.

Each issue helps readers understand where the “smart money” is flowing, which sectors are heating up, and which stocks could be poised for their next big run.

In short, Growth Investor is about finding high-quality companies with explosive growth potential, the same method that helped Navellier identify Nvidia long before it became a household name.

Without further ado, let’s see what the service’s next big focus is.

What Is “Nvidia’s Quantum Partner”?

When Louis Navellier starts talking about a breakthrough that could be 1,000 times more powerful than AI, it’s hard not to pay attention.

Navellier believes this technology will change how the world processes data, just like Nvidia’s graphics chips once did for AI.

The big takeaway? Nvidia isn’t the whole story this time.

According to Navellier, there’s a small partner company quietly working with Nvidia on this powerful new invention, and that’s where he sees the real upside.

The Problem Most Investors Don’t See Coming

Navellier doesn’t shy away from his belief that the world is reaching the limits of what artificial intelligence can handle.

Some problems, like drug discovery, clean energy, or weather prediction, are simply too complex for even the most advanced supercomputers.

That’s where quantum computing enters the picture. Unlike traditional processors that handle one task at a time, quantum computers can solve billions of calculations simultaneously.

It’s a shift so significant that Bank of America has compared it to the discovery of fire. Navellier says this is why Nvidia is already pouring resources into quantum development, even building a dedicated lab in Boston.

He’s convinced this leap forward will spark a massive transformation across industries, and he wants everyday investors to be ready before Wall Street catches on.

Why This Could Be the Next 150X Opportunity

The most compelling part of Navellier’s message is the urgency.

While Nvidia remains the headline name, Navellier argues the biggest gains will likely come from smaller companies that are solving quantum’s biggest technical challenges.

He even highlights one Nvidia partner that has already developed technology to reduce quantum computing errors, something researchers have struggled with for decades.

Backed by billionaires like Jeff Bezos, Bill Ackman, and Ray Dalio, this company has drawn massive institutional attention. Navellier says moves like these are a signal that the smart money sees what’s coming, and it’s moving fast.

How to Position Yourself Before the Quantum Boom

As someone who’s followed Navellier’s research for years, I can say his logic is consistent with how he spotted Nvidia early, by finding where technology and profitability intersect before the mainstream realizes it.

What really stands out to me is that he’s pointing toward data, trends, and insider buying patterns that suggest a quiet revolution is already underway.

If you believe in investing before the headlines, this might be one of those rare moments where timing actually matters.

Navellier reveals all the details, including how to identify the key players in this unfolding revolution, inside his Growth Investor research service.

Now, let’s look at what comes with membership and how it can help you take advantage of this fast-moving opportunity.

Joining Louis Navellier’s Growth Investor gives you access to all the following perks:

Every month, members receive a fresh issue of Growth Investor packed with Louis Navellier’s latest market insights and one new high-conviction stock recommendation.Each stock is chosen using Navellier’s proprietary quantitative model, the same process that helped him identify winners like Apple, Amazon, and Nvidia long before they became household names.

Recommendations come with a detailed explanation of why the stock passed his system’s strict filters, how it fits into the current market climate, and what kind of growth potential it shows ahead.

You’ll get a steady stream of actionable research focused on strong fundamentals and real earnings power that you can move on as you see fit.

Access to The Stock Grader System

The Stock Grader is a proprietary online rating system that grades over 6,000 publicly traded stocks based on two factors, fundamental strength and institutional buying activity.

You can simply type any ticker symbol into the platform and instantly see whether it’s rated an “A,” “B,” or lower.

This isn’t a static database; the grades update regularly as market conditions change.

For readers who prefer independent confirmation before acting, this feature turns complex analysis into clear, practical insights in seconds.

>> Access The Stock Grader System NOW <<

Weekly Updates

Markets don’t stand still, and neither does Navellier’s research.

Every Friday, members receive his Weekly Update, a concise but information-packed briefing that cuts through market noise.

In these updates, Navellier breaks down the most important events of the week, earnings trends, inflation reports, interest rate movements, and sector shifts, and explains how they could affect the Growth Investor portfolio.

He also discusses any buy or sell recommendations, giving readers a heads-up on potential adjustments before the next issue arrives.

You’re even given a futurecast of what could be coming down the pipeline so you can stay ahead of the curve instead of trying to catch up.

Special Market Podcasts

To complement his written updates, Navellier records short market podcasts several times a week.

Each episode runs about five to ten minutes and is designed to give subscribers a quick edge on breaking developments.

Whether it’s a surprise Fed announcement or a major earnings release, these recordings are timely and to the point, with no filler and no jargon.

Navellier uses them to share his real-time reactions, insights, and occasionally, tactical guidance for the days ahead.

For busy readers who prefer to learn on the go, these podcasts make it easy to stay informed and confident in volatile markets.

Honestly, it’s like having direct access to Navellier’s thought process whenever the market moves.

Complimentary TradeStops Basic

Every new member also receives six months of TradeStops Basic, a complimentary bonus designed to help manage portfolio risk and protect gains.

What makes it powerful is its Volatility Quotient (VQ), a proprietary metric that measures how much a stock typically moves and helps set precise stop-loss levels.

Instead of reacting emotionally to every market dip, members can use TradeStops to establish consistent, disciplined exit strategies that fit their personal risk tolerance.

The system also tracks each Growth Investor recommendation automatically, alerting you when it’s time to trim profits or re-enter a position.

>> Enter Growth Investor Today <<

Nvidia’s Quantum Partner Bonuses

Alongside his flagship publication, members receive four exclusive research reports that each focus on a different corner of this emerging tech revolution:

Featured Report: Nvidia’s Quantum Partner — How to Profit From the Next 150X Tech Breakthrough

In this report, Naveillier uncovers a small, little-known company working directly with Nvidia on a breakthrough quantum processor known as a QPU, a chip that could be 1,000 times more powerful than today’s AI chips.

The company’s technology could unlock practical, real-world quantum computing far sooner than expected.

The guru calls it his next 150X opportunity, a chance for us to potentially ride the same type of explosive growth he once predicted with Nvidia in 2016.

Bonus Report #2: The Quantum Moonshot With 100X Potential

Louis uses this bonus to point at a “quantum moonshot”, a smaller, fast-growing player in the quantum space that could mirror Nvidia’s early trajectory.

Its technology has direct applications in energy optimization, AI modeling, and government research, sectors poised to scale quickly as quantum adoption accelerates.

This company’s current size, which is roughly 360 times smaller than Nvidia, leaves plenty of room for exponential growth as it looks to become one of the key suppliers in the next phase of computing innovation.

Bonus Report #3: The Amazon of Quantum Computing

This report shifts focus from hardware to services, highlighting a company building what Navellier calls “the cloud backbone of quantum computing.”

It already provides cloud-based quantum access to major corporations such as Google, Lockheed Martin, and Mastercard, positioning itself as a vital middleman between cutting-edge tech developers and enterprise users.

What gives it an edge is its portfolio of more than 200 U.S. patents, offering strong protection in a field still in its infancy.

Bonus Report #4: The Physical AI Revolution — 5 Robotics Innovators Set to Dominate

Last but not least, Navellier explores how quantum computing can supercharge artificial intelligence, and more specifically, robotics.

He calls this next evolution “Physical AI,” where machine learning escapes the digital world and takes shape in real-world devices.

Navellier identifies five companies positioned to benefit from this transformation, each at the intersection of robotics, AI, and quantum processing power.

By combining quantum speed with physical automation, these firms could define the next decade of industrial and consumer tech and create opportunities that mirror the early days of the AI and semiconductor booms.

>> Get these BONUS Reports Now <<

Refund Policy

The service includes a generous 90-day money-back guarantee.

That means you can try out the newsletter, Stock Grader system, and the slew of bonus reports before ever having to commit.

You’re even able to keep the content you’ve received up to that point as thanks for giving the service a try.

Navellier and his crew are taking on the vast majority of the risk here, effectively offering a safe way out.

That speaks volumes about Louis’s faith in his service and the kind of success it can bring to your portfolio.

>> Trade Risk-Free with Growth Investor <<

Pros and Cons

After spending a substantial amount of time in Growth Investor, here are my top pros and cons:

Pros

- Backed by a proven investor with 40+ years of experience

- Includes multiple reports on cutting-edge quantum computing and AI stocks

- Weekly updates to stay in the know

- Transparent stock grading system based on institutional data

- 90-day satisfaction guarantee

- Historically strong newsletter performance vs. the S&P 500

- Affordable entry price

Cons

- Quantum computing adoption remains somewhat speculative

- No community chat or forum available

Growth Investor Reviews by Members

One of the strongest validations of Growth Investor comes directly from its members.

The subscribers have shared numerous success stories over the years, often crediting Louis Navellier’s research for game-changing results. Here are a few, taken directly from his promo:

However, the consistent theme across testimonials is that Navellier’s research delivers actionable, data-backed opportunities that help readers make smarter long-term decisions.

>> Join these Members Today! <<

Growth Investor Track Record

Louis Navellier’s Growth Investor has one of the most verifiable and consistent track records among financial advisories today.

According to the official data, Navellier’s quantitative system, which grades over 6,000 stocks weekly, has helped uncover some of the biggest market winners of the past four decades.

His model identified Apple in 1988 before it soared 617X, Microsoft in 1988 before its 1,000X run, and Amazon in 2003 before it multiplied nearly 100X.

Between 1998 and 2020, Growth Investor reportedly outperformed the S&P 500 by almost three to one.

Navellier’s long-term record also includes identifying 171 stocks that delivered over 1,000% gains, with 22 of them reaching 10,000% or more.

While no advisory wins every time, Growth Investor’s decades-long performance clearly reflects Navellier’s strength in blending data science with disciplined market timing.

How Much Does Growth Investor Cost?

A six-month Growth Investor membership normally costs $499, but under this promotion, new members can join for just $49.

That breaks down to less than $2 per week, far cheaper than even a decent cup of coffee.

Despite the steep discount, members receive all the content I covered above, six months of Growth Investor, access to Navellier’s Stock Grader system, weekly updates, special market podcasts, and all four premium research reports, valued collectively at over $2,395.

What makes the deal particularly appealing is that there are no restrictions on access.

New subscribers get every feature, from the monthly stock recommendations to the real-time grading tool and the complimentary TradeStops Basic risk management software.

The subscription automatically renews every six months at the same discounted rate unless canceled, and InvestorPlace even sends an email reminder before renewal.

After diving into this Growth Investor Nvidia’s Quantum Partner review, it’s clear that Louis Navellier offers far more than bold predictions.

The current $49 entry point gives full access to six months of Growth Investor, Navellier’s Stock Grader system, and over $2,000 worth of exclusive quantum computing reports.

You’re getting a ton of content for that low price, something you’ll rarely see in today’s competitive market.

Plus, with a 90-day money-back guarantee, the risk is minimal.

If you’ve ever wished you’d acted on Nvidia early, this service gives you a realistic second chance to be positioned ahead of what Navellier calls “the third computing revolution.”

Quantum computing may indeed be the next big frontier — and this service is a practical way to follow it with professional guidance.

Sign up today before this opportunity makes the jump to light speed.

Bottom Line:

Louis Navellier’s Nvidia’s Quantum Partner presentation delivers an exciting (and surprisingly credible) roadmap for investors looking beyond AI. For anyone serious about tech-driven wealth building, Growth Investor is one of 2025’s most compelling research advisories.

>> Start Building your Wealth with Growth Invester NOW!!! <<

Tags:

Tags: