Tim Bohen believes the biggest profits from Artificial Intelligence won’t come from chatbots or chipmakers, but from the hidden “AI Tolls” Big Tech pays to keep their systems running.

His “AI Tollbooth” strategy, shared through the StocksToTrade Advisory, could help everyday investors tap into this overlooked cash stream.

In this Tim Bohen AI Tollbooth review, I break down his game plan and findings so you can decide if this unconventional path to profit from the AI boom is worth your attention.

>> Join Tim Bohen’s AI Tollbooth Today! <<

What Is StocksToTrade Advisory?

What Is StocksToTrade Advisory?

StocksToTrade Advisory is Tim Bohen’s flagship research service built for everyday people who want a smarter, simpler way to find consistent trading opportunities.

It combines education, weekly market insights, and carefully researched stock ideas drawn from the same tools and analysis used by professional traders on the StocksToTrade platform.

Each week, members get fresh trade ideas, short video breakdowns of market setups, and step-by-step guidance designed to help them recognize profitable trends on their own.

What makes it stand out is its practical approach and how Tim reveals where momentum and money are really flowing.

Tim’s goal is to help members navigate today’s fast-moving markets with confidence, using clear insights rather than complex jargon.

Without further ado, let’s take a closer look at the guru.

>> Unlock profits with StocksToTrade Advisory now! <<

Who Is Tim Bohen?

Tim Bohen is the Lead Trainer at StocksToTrade, where he’s built a reputation as one of the most practical voices in market education today.

In a previous life, Bohen was a tech entrepreneur who led multiple startups in the 1990s.

He played with large-caps shortly after the turn of the century, but quickly realized day trading was his calling.

His fascination with market volatility led him to develop structured trading systems that focus on momentum, technical analysis, and data-driven decision-making.

Over the past decade, he’s taught tens of thousands of aspiring traders through live webinars, workshops, and the StocksToTrade platform.

With his success, Bohen has been featured on major outlets such as Charles Schwab Network, NASDAQ TradeTalks, and Forbes, where he regularly discusses market psychology and short-term trading setups.

Is Tim Bohen Legit?

Yes, Tim Bohen is the real deal, and his track record proves it.

With over 20 years of experience in both entrepreneurship and active trading, he’s earned a reputation as a results-focused educator rather than a salesman.

Through his role at StocksToTrade, he’s helped shape a platform used by more than 100,000 traders worldwide, providing data analytics and trade alerts backed by years of testing and refinement.

Bohen’s educational programs have been praised for turning complex trading ideas into simple, repeatable strategies.

His market commentary has appeared in respected outlets like Forbes and Yahoo Finance, and his trading insights are frequently highlighted on NASDAQ TradeTalks.

Beyond media appearances, what makes him credible is consistency. He’s spent years refining one goal: helping regular people gain control over their financial future through structured, intelligent trading.

>> Start your AI Tollbooth journey today! <<

What Is “The AI Tollbooth” Presentation?

Tim Bohen believes the biggest opportunity in Artificial Intelligence isn’t in the obvious places.

While everyone else is chasing chipmakers or headline-grabbing tech firms, he’s focused on the companies quietly earning money every time AI is used. He calls them the “AI Toll Collectors.”

These are the firms providing the backbone of the AI revolution, the hardware, data pipelines, and infrastructure that every major player relies on to keep their systems running.

Bohen’s point is simple: you don’t need to build AI to profit from it. You just need to own a stake in the companies that make it possible.

The Problem Most Investors Miss

What most people see are the results, chatbots, image generators, and massive AI launches.

What they don’t see, Bohen says, is the enormous cost behind them.

Each new AI model requires endless computing power, storage, and energy. Big names like Microsoft, Google, and Meta are spending hundreds of billions to feed their AI systems, with projected “toll” payments exceeding $758 billion in 2025 alone.

That money doesn’t disappear; it flows to the companies managing the infrastructure. According to Bohen, this shift represents one of the most overlooked wealth transfers of the decade.

The market is rewarding the “builders of the highway,” not just the drivers using it.

Timing is Everything

Bohen believes the window to benefit from this shift is narrow. He references how every major technological boom, from the early internet to the mobile era, had a short period when the biggest fortunes were made by early movers.

He points to data centers springing up across the U.S., AI training facilities consuming record amounts of power, and energy providers reporting soaring demand.

That power must travel from source to destination, and that’s where Tim’s insight really pays off.

He explains that just as every driver pays to use a highway, every AI company pays to use these critical systems.

These trends all feed into one central story: a handful of companies now control the access points that every AI project must pass through.

And the beauty of it, he says, is that you can own a piece of that revenue stream from your regular brokerage account.

The Opportunity for Everyday Users

There are plenty of roads that companies can take, but some of them are bumpier than others.

Through his StocksToTrade Advisory, Bohen shares exactly how he’s approaching this trend, identifying the sectors and stocks poised to benefit most from the surge in AI spending.

Based on Tim’s analysis, one company in particular could be on the verge of a major revaluation, with an upcoming event that could push it into the spotlight.

He makes the full story available, but only to members of his StocksToTrade Advisory platform.

You can sign up for immediate access to these findings and also get your hands on a plethora of tools simply by signing up.

Next, join me as I unpack all these features and see how they can work for you.

>> Claim your spot in Tim Bohen’s Program! <<

AI Tollbooth Review: What Comes With AI Tollbooth StocksToTrade Advisory?

Here’s what you’ll receive after subscribing to the platform:

StocksToTrade Advisory Newsletter Subscription

Each month, Tim Bohen delivers a deep-dive issue focused on a major market trend, whether it’s the rise of AI infrastructure, new developments in energy, or opportunities tied to the digital economy.

These issues go beyond naming stocks; they teach you the logic behind every recommendation.

Bohen breaks down what’s driving the trend, why certain companies are well-positioned, and how to approach them for maximum reward and minimal risk. Each write-up is designed to be clear, data-backed, and immediately useful, even for readers with little trading experience.

Over time, these monthly issues build a valuable archive that helps members understand how institutional capital is flowing and where the next opportunities could emerge.

StocksToTrade Advisory’s Weekly Watchlist

To cover the gap between newsletter issues, Bohen releases his Weekly Watchlist video, one of the most anticipated features among subscribers.

In it, he highlights five stocks that his proprietary screening tools and market analysis suggest could move in the coming days.

Each video runs through the tickers, charts, and catalysts driving those moves, giving members an inside look at how professional traders prepare for the week ahead.

These watchlists are filtered through the same real-time data and systems used by the StocksToTrade platform, which tracks billions of market data points daily.

Bohen’s commentary focuses on actionable insights, clear price zones, momentum signals, and upcoming catalysts, so you can use them to plan your own entries and exits.

Tim Bohen’s Pre-Market Updates

Another cornerstone of the service is Bohen’s Pre-Market Updates, sent out three times a week—Monday, Wednesday, and Friday, before the opening bell.

These briefings help members start their day informed, focused, and ready to trade with confidence. Each update covers overnight market developments, key headlines that could move stocks, and early technical setups Bohen is watching closely.

He often shares chart insights or commentary on trading psychology, why certain levels matter, how news impacts momentum, and where opportunity might emerge next.

For members balancing trading with a full-time job or busy schedule, these three weekly updates serve as a reliable guide to stay ahead of market shifts without information overload.

Full Access to the StocksToTrade Advisory Research Library

Subscribers also gain complete access to the StocksToTrade Advisory Research Library, an expanding collection of special reports and deep-dive analyses curated by Tim Bohen and his team.

Inside, you’ll find detailed research on sectors that are reshaping the market—from Artificial Intelligence and clean energy to digital finance and biotech innovation.

Each report explains the market thesis, the catalysts behind it, and how to position yourself for potential upside.

The library serves as both a reference and an educational resource, providing members with the context they need to make informed decisions.

It’s continually updated as new trends emerge, ensuring you always have relevant, timely information at your fingertips.

>> Discover the AI Tollbooth opportunity now! <<

AI Tollbooth Bonuses

Along with a full year of access to StocksToTrade Advisory, members also receive a collection of in-depth research reports and training materials from Tim Bohen:

Special Report: The AI Toll Collector Playbook

Inside this featured report, Tim reveals the details behind the company he believes sits at the heart of the AI infrastructure boom—the one collecting “tolls” every time Big Tech runs its AI systems.

He lays out how this firm powers the flow of data that companies like Microsoft, Amazon, and Google depend on, and why its unique business model allows it to profit no matter which AI project dominates.

The report includes a full analysis of the company’s role, recent financial performance, and catalysts he expects to drive future growth.

Bohen’s thesis is simple: if AI is the new superhighway, this company owns the tollbooth, and that could make it one of the most reliable beneficiaries of the coming AI surge.

Special Report: The $500 Billion Stargate Power Play

In this research report, Bohen dives into what he calls the “Stargate Project,” a massive new AI infrastructure initiative reportedly backed by the White House and several major tech firms.

The project aims to create the most advanced network of data centers ever built, and one company appears to be at the center of it all.

This firm, according to his research, could secure billions in new contracts to supply and manage the energy fueling AI’s global growth.

Bohen connects the dots between government support, rising electricity consumption from AI data centers, and the growing need for specialized energy providers.

Special Report: Three Stocks Set To Meltdown From The AI Revolution

While Bohen is bullish on AI’s future, he’s equally clear that not every company will benefit. In this defensive research report, he highlights three major firms he believes are on the wrong side of the technological shift.

These are businesses that could see their dominance fade as automation, AI efficiency, and new infrastructure render their legacy models obsolete.

Bohen explains the warning signs investors should look for —shrinking margins, slowing innovation, and unsustainable growth —and how to position themselves safely.

This report serves as a valuable complement to his bullish recommendations, helping members protect their portfolios from potential landmines.

Bonus Report: 10 Trading Patterns You Need To Know

One of the biggest advantages of learning from Tim Bohen is his ability to teach actionable trading techniques.

In this training-focused bonus report, he shares ten of his most effective chart patterns; setups he personally uses to spot opportunities before they move.

These include both bullish and bearish formations designed for different market conditions.

Bohen walks readers through how to recognize each pattern, what market signals confirm them, and how to set realistic entry and exit points.

The guide is short, visual, and beginner-friendly, making it ideal for anyone new to technical analysis.

More importantly, it reflects Bohen’s belief that trading success isn’t about luck—it’s about consistency and structure.

Bonus Report: The Freedom Portfolio — How A Small $5,000 Portfolio Could Put You In Trump’s New “Freedom Class” By The End Of His Four-Year Term

In this politically inspired bonus report, Bohen shifts focus from technology to opportunity tied to upcoming U.S. policy changes.

He explores what he calls the “Freedom Class” movement, an economic trend expected to accelerate under the next Trump administration, driven by proposed tax cuts, deregulation, and pro-growth initiatives.

The Freedom Portfolio report outlines five stocks Bohen believes could thrive as capital flows back into energy, manufacturing, and infrastructure—industries expected to see renewed government support.

It’s a forward-looking, strategic piece that complements his AI research by helping investors diversify into areas that stand to benefit from real-world policy and economic cycles.

>> Subscribe to StocksToTrade Advisory and profit! <<

Refund Policy

Tim Bohen’s AI Tollbooth through StocksToTrade Advisory comes with a 60-day, 100% money-back guarantee, giving new members the freedom to explore the service completely risk-free.

If at any point within the first two months you decide it’s not what you expected, you can simply contact StocksToTrade’s U.S.-based customer support team for a full refund, no questions asked.

What’s more, you’ll still keep all the special reports and bonuses as a thank-you for giving the program a try.

This refund policy reflects Bohen’s confidence in his research and commitment to transparency, ensuring every subscriber feels secure about their decision to join.

Pros and Cons

I’ve given Tim’s AI Tollbooth bundle a spin around the block, and these are my top pros and cons:

Pros

- Clear, video-based weekly watchlists

- Three detailed market updates weekly

- Includes five in-depth special reports

- Beginner-friendly trading education

- Strong refund policy (60-day money-back)

- Backed by StocksToTrade platform

- Led by an experienced educator

- Covers both offensive and defensive AI plays

Cons

- No live chatroom or community forum

- Focuses primarily on future happenings

StocksToTrade Advisory Member Reviews

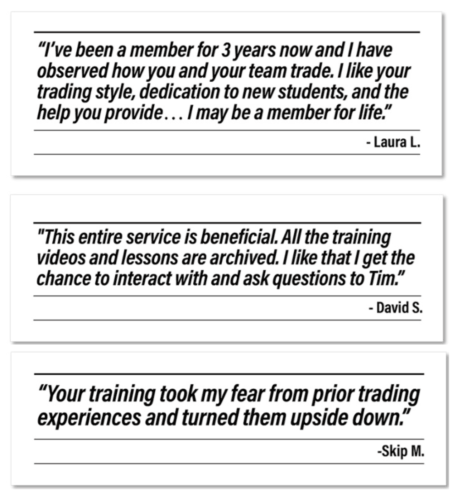

Many members of StocksToTrade Advisory have shared positive feedback about their experiences with Tim Bohen’s guidance and research.

I did pull them from the promo, but these testimonials reflect a consistent theme: members appreciate the practical education, clear communication, and supportive mentorship that come with StocksToTrade Advisory.

In all, they reinforce the credibility and effectiveness of Tim Bohen’s AI Tollbooth approach.

>> Don’t miss Tim Bohen’s AI Breakthrough! <<

StocksToTrade Advisory Track Record

Tim Bohen’s StocksToTrade Advisory has built a notable track record for identifying powerful market trends long before they hit the mainstream.

Over the past several years, Bohen has highlighted multiple breakout opportunities that delivered substantial returns for members.

His past recommendations include Plug Power, which surged more than 1,500% in just nine months, Nio Inc., which climbed 1,600% in about a year, and Remark Holdings, which rocketed 2,200% in roughly ten months.

In addition, his short-term watchlist ideas have also shown impressive momentum.

For instance, in late 2024, Bohen urged members to buy Rocket Lab, which jumped 175% within eight months, and Rigetti Computing, which soared 222% in under four weeks.

While past performance never guarantees future results, the consistency of Bohen’s research and the data-backed reasoning behind each pick really speak volumes.

>> Get lifetime access to AI Tollbooth today! <<

How Much Does StocksToTrade Advisory Cost?

Right now, access to Tim Bohen’s StocksToTrade Advisory is available at a heavily discounted rate compared to its regular price.

Normally, a one-year membership to the service costs $297 per year, but through the AI Tollbooth special offer, new members can join for just $49 for 12 months, an 83% discount off the standard price.

This plan includes full access to every feature of the advisory: the weekly watchlists, pre-market updates, monthly research issues, and all bonus reports released during the membership term.

For those looking for long-term access and even greater value, Bohen also offers a two-year plan for $79, giving members 24 months of uninterrupted research and updates.

>> Learn Tim Bohen’s AI Tollbooth strategy today! <<

Is Tim Bohen’s AI Tollbooth Worth It?

After reviewing every part of the service, from the research reports to the educational material, I can confidently say that StocksToTrade Advisory offers strong value for its cost.

What makes this program stand out is how Tim Bohen blends actionable stock analysis with real education so you know why you’re making each move.

His “AI Tollbooth” strategy introduces a refreshing way to profit from the Artificial Intelligence boom while cutting through the noise.

As I found while preparing this Tim Bohen AI Tollbooth review, the service delivers consistent, data-backed insights that can help everyday investors approach volatile markets with more structure and confidence.

The newsletter, frequent updates, and bonus reports all support breakthrough trends that can lead to some serious gains.

For anyone seeking a trustworthy entry point into growth sectors like AI and energy, StocksToTrade Advisory feels like a practical and affordable resource that’s well worth considering.

Tags:

Tags: