Reliable prop-firm funding is hard to find, but Atlas Funded seems to have cracked the code.

Built around the motto “Trade Without Boundaries, Profit Without Limits.”, the firm offers traders a flexible path through its Pay After You Pass model and scaling potential that reaches up to $2 million.

In this Atlas Funded review, I explore why so many traders are calling it one of the most transparent and opportunity-driven funding platforms in the market today.

>> Join Atlas Funded Today with A DisCOUNT <<

What is Atlas Funded?

Atlas Funded is a modern proprietary trading firm that gives everyday traders access to simulated funding accounts, starting as low as $10,000 and scaling to incredible heights through consistent performance.

Instead of trading your own capital, you prove your skill through one of several evaluation challenges, and once you pass, Atlas Funded provides the funding while you keep most of the profits.

The product line includes flexible challenge models like the One-Step, Two-Step, Three-Step, Instant Funding, and the innovative Pay After You Pass option, where you only pay after proving you can perform.

Each path offers different levels of accessibility, making it appealing to both cautious beginners and confident pros.

I’m blown away by the amount of freedom you get here, allowing you to plug in at a level you’re comfortable with and making changes down the road if you so choose.

Who Owns Atlas Funded?

Atlas Funded operates under Atlas Funded Ltd., a registered company based in Saint Lucia.

While the firm keeps its ownership structure lean and professional, its leadership has been public about the company’s purpose: to make trading capital more accessible to talented individuals who don’t have deep pockets of their own.

Even though the team doesn’t heavily promote individual founders across marketing materials, their operational footprint, verified company registration, and consistent online presence all signal an established and transparent organization rather than a temporary venture.

Is Atlas Funded Legit?

Yes, Atlas Funded operates as a legitimate prop-firm under Atlas Funded Ltd., registered in Saint Lucia.

The company publicly lists its address, maintains a transparent rulebook, and provides active support. Real trader feedback confirms successful payouts alongside strict rule enforcement, typical of genuine prop-firm operations.

While not a regulated broker, Atlas Funded’s openness, verified registration, and consistent performance make it credible.

Its balanced mix of flexibility, fairness, and public accountability has earned it a solid reputation as a trustworthy option for traders seeking reliable prop-firm funding.

>> Start your Atlas Funded challenge now <<

How Does Atlas Funded Work?

The process is straightforward once you understand the structure. Everything begins with choosing your challenge.

Step 1: Choose Your Evaluation Path

When you sign up with Atlas Funded, the first thing you’ll do is pick the evaluation model that fits your trading style and budget.

Whether you’re comfortable diving straight into a one-step challenge, prefer the two-phase route, or want to try the pay-after-you-pass “Access” option, Atlas Funded gives you choices.

The “Access” model stands out the most to me: you start trading with minimal upfront cost, and only pay the full challenge fee if you pass.

In a sense, you get to pick your pace: fast lane, steady climb, or low-risk entry. It’s a nice touch for anyone who’s serious but doesn’t want to be boxed into a single rigid format.

Step 2: Trade Under Clear Rules

Once your evaluation begins, you trade on a simulated account under defined rules. Atlas Funded spells these out clearly in their help files.

You’ll see restrictions like maximum drawdown, daily loss limits and a minimum number of trading days, depending on the plan.

The cool thing is that most plans have no maximum time limit, so there’s no need to rush.

On top of that, you’re free to hold positions overnight or over the weekend, something that lets swing and longer-term traders feel more at home.

Step 3: Get Funded & Grow Your Capital

Once you’ve met the evaluation targets and followed the rules, Atlas Funded will move you into the funded stage.

You do have to complete a know your customer (KYC) verification process to get this account, but the process is relatively seamless.

From there, you’re trading real capital provided by the firm, sharing profits, and enjoying payouts. You’re looking at a default 14-day cycle for withdrawals, but there are faster options via add-ons or consistency.

And if you keep performing, their scaling plan kicks in, where the possibility of reaching $2 million in capital comes into view.

The idea is simple: do well, keep managing risk, and you get increased allocations.

>> Trade smarter with Atlas Funded funding <<

Atlas Funded Evaluation Models Explained

Each model targets a different kind of trader. Here’s how they compare.

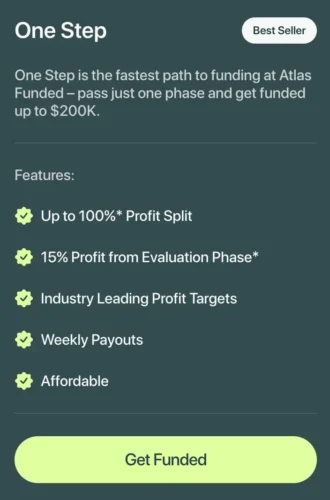

One-Step Challenge

The One-Step model at Atlas Funded is built for traders who want the fastest route to getting capital behind them.

Rather than navigating through multiple phases, you only complete a single stage: meet your profit target, respect the drawdown rules, and you’re eligible for funding.

You’re paying a little more upfront for faster access to real funds, but the tradeoff feels minimal at best.

There’s a pro version of this same plan that seeks to expedite the process if you’re able to navigate more rigorous stop losses.

That can be especially attractive if you’re confident in your strategy and want to skip the longer ramp-up.

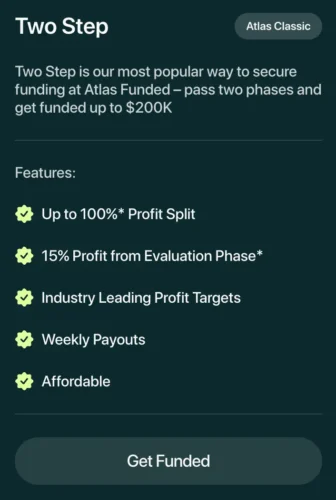

Two-Step Challenge

The Two-Step Challenge is perhaps the most balanced option at Atlas Funded, and its structure has earned it popularity among experienced and intermediate traders alike.

In this model, you jump through two less-stringent hoops to reach the funded level.

Entry fees are a bit more reasonable, and daily and max stop losses give more of a cushion to recover from a bad trade.

Like the One-Step Challenge, there’s a Pro tier here that requires a bit more focus but can lead to bigger rewards.

Here, you’re getting the chance to show consistency to yourself and the team at Atlas Funded as you move toward actual funding.

For people who want structure but don’t want extreme pressure, this model often hits the sweet spot: rigorous, but not overly rigid.

Three-Step Challenge

The Three-Step Challenge offers a more gradual path to funding and is designed for those who prefer a more measured ramp-up or who may still be refining their performance.

You’ll move through three stages, each with its own profit target and drawdown rules, before qualifying for a funded account.

Lower profit targets mean you can advance through the ranks rather quickly, and it’s the cheapest tier to start on.

The more relaxed pace here does appeal to me, allowing wiggle room to breathe while keeping your profits moving in the right direction.

If you value developing consistency and managing risk over speed, this model gives you a comfortable playground rather than feeling like a race.

Instant Funding

Instant Funding flips the script entirely: there’s no traditional evaluation phase. Instead, you pay a one-time fee (often refundable under conditions) and gain immediate simulated funding from Atlas Funded.

Because you skip the challenge structure, you’re thrown right into rough waters and careful criteria to watch out for.

Yeah, you can make money right away, but a 3% max daily loss doesn’t leave a lot of space for error. You’ll want to weigh the pros and cons heavily.

If you’re confident, disciplined, and want to start trading immediately, this model gives you that option.

Access Challenge (Pay After You Pass)

Atlas Funded’s Access Challenge, is its most innovative evaluation model and lowers the upfront barrier significantly.

You’re able to begin almost immediately with minimal initial cost and only pay the full evaluation fee after you pass both phases of the challenge.

This structure is compelling because it reduces financial risk for the trader and shifts pressure from cost to performance.

It’s ideal for those who want to try their hand at the challenge without committing large sums from day one.

The catch is that it may impose stricter conditions or fewer add-ons, but for many, the “pay after you pass” hook is a strong draw.

>> Unlock your $2M plan at Atlas Funded <<

Key Features That Set Atlas Funded Apart

The features below show how Atlas Funded sets itself apart.

Each one contributes to a trader-friendly structure that emphasizes fairness, flexibility, and real growth potential rather than gimmicks or hidden traps.

Unlimited Trading Period

One of the most appealing aspects of Atlas Funded is that most of its evaluation plans have no maximum time limit.

You’re free to trade at your own pace, take breaks when needed, and wait for the right setups. The firm believes in rewarding consistency rather than speed, allowing traders to approach the markets strategically instead of being forced into high-frequency behavior just to meet deadlines.

The company’s clearly all about discipline, and much less worried about when you finish. It leans right into a patient and calculated strategy that can make a huge difference for long-term success.

Weekly Payouts

Atlas Funded’s payout structure is designed to match real-world trading expectations. Once you become a funded trader, you can request payouts weekly as you develop a consistent rhythm.

Their system processes requests within 12 hours of approval, ensuring quick turnaround and minimal downtime. This feature is ideal for traders who rely on frequent liquidity to reinvest or manage personal expenses.

Instead of waiting for the typical 30-day cycle used by many firms, Atlas Funded’s weekly payouts give you faster access to the profits you’ve earned, a practical advantage for active professionals.

Up to 100% Profit Split

Profit splits determine how much of your trading gains you actually keep, and Atlas Funded is among the few prop firms offering up to a 100% share.

Most traders start with an 80% split, but optional upgrades through add-ons allow higher percentages all the way up to 100%

This generous structure reflects the company’s belief that successful traders should be rewarded in proportion to their results.

For traders accustomed to seeing large cuts taken by firms, this policy can make a measurable difference in motivation and returns.

Add-Ons

Atlas Funded offers optional add-ons that let traders personalize their challenge or funded account to fit their style.

You can select upgrades such as weekly or on-demand payouts, zero minimum trading days, higher drawdown flexibility, or the 100% profit split.

Each comes with a clear fee structure, published on their official help pages.

These add-ons give traders control over how their evaluation feels, whether they want faster access to funds, more lenient rules, or bigger rewards.

It’s a modular approach that puts customization in your hands rather than locking everyone into the same rigid system.

Balance-Based Drawdown

Drawdown management is one of the most important parts of prop trading, and Atlas Funded uses a balance-based drawdown model for fairness.

Outside of the Access Plan, your drawdown limit adjusts with your account’s equity, protecting both the trader and the firm from unnecessary risk.

For example, if you grow your balance, your drawdown expands proportionally.

This system creates realistic conditions that mirror live trading, unlike static drawdown caps that often punish progress.

It rewards consistent risk management instead of penalizing traders for equity fluctuations, a small but important improvement that experienced traders will appreciate.

Low Spreads and 1:100 Leverage

Trading conditions at Atlas Funded are designed to replicate a true market environment.

The firm offers low spreads, fast execution, and leverage up to 1:100 across its platforms.

You can hold trades overnight and over weekends, which makes it suitable for both short-term and swing strategies.

These conditions allow you to scale strategies that depend on small price movements or longer setups without being handicapped by tight restrictions.

For traders transitioning from personal accounts to funded ones, this makes the experience seamless and practical, providing flexibility that supports a wide range of trading styles.

Pay for Your Challenge After You Pass

The Pay After You Pass model is one of Atlas Funded’s biggest innovations. Instead of paying a full challenge fee upfront, you trade first and pay only after you successfully complete both evaluation phases.

You begin with just a small broker fee, and if you don’t pass, you owe nothing more. This setup removes much of the financial risk that usually deters new traders.

It’s a fair, performance-driven structure that shifts focus to skill rather than upfront spending, making it especially appealing to those who want to prove their ability before committing financially.

News Trading

Unlike many prop firms that restrict trading during major news events, Atlas Funded allows you to trade through them.

You can hold positions overnight, over weekends, and during economic announcements. This is an essential advantage for swing traders and macro-focused strategies that depend on reacting to global events.

The company’s philosophy is that traders should be free to execute their systems without unnecessary limitations, as long as they manage risk within the set parameters.

Expert Advisor Support

Atlas Funded also supports automated trading through Expert Advisors (EAs), provided they comply with the firm’s trading rules and are not used for high-frequency or latency arbitrage strategies.

This makes it an attractive option for algorithmic traders who rely on coded systems rather than manual execution.

The ability to run EAs means traders can test proven algorithms in a funded environment without needing to change their process.

For a prop firm, this level of flexibility signals a progressive, trader-first mindset that accommodates both discretionary and automated approaches.

>> Get started with Pay After You Pass <<

Refund and Policy Details

Atlas Funded operates with transparent, easy-to-understand policies that reflect fairness toward traders. Refund eligibility depends on the plan you choose.

In most cases, evaluation fees are refundable after the first successful payout from a funded account, giving traders a financial incentive to stay consistent.

The Pay After You Pass model is even more flexible, requiring only a small broker fee upfront, with the main payment made only after passing the challenge.

If an account violates trading rules, such as exceeding drawdown limits, the evaluation ends, but Atlas Funded makes its policies clear so traders always know where they stand.

Pros and Cons

Through testing what Atlas Funded can do, I came up with these pros and cons:

Pros

- Multiple evaluation types (1-step to 3-step + Instant + Access)

- No maximum time limits on many plans

- Up to 100 % profit split

- Weekly payouts

- Innovative Pay-After-You-Pass model

- Transparent rules and a public Help Center

- Scaling to $2 million for consistent traders

- EAs and news trading allowed

- Several add-ons available

- Competitive spreads and leverage

Cons

- Refund conditions can be confusing if you don’t read the fine print

- An almost overwhelming number of challenge options to choose from

- Instant funding options have higher fees

>> Claim your Atlas Funded account today <<

How Much Does Atlas Funded Cost?

When it comes to pricing, Atlas Funded offers a range of challenge models that cater to different trader budgets and risk tolerances.

For example, the “Access” plan allows you to get started by paying only a $5 broker fee upfront, and the full challenge cost is only charged once you pass — an option designed for those who want minimal upfront risk.

Regarding its standard evaluation options, the pricing varies depending on account size and challenge type. As noted on their checkout page, costs range from around $22 up to $799, depending on factors like account size (e.g., $5K, $10K, $100K) and evaluation steps.

From a value perspective, higher fees unlock larger capital allocations (up to $400K simulated funding) and access to scaling plans that can eventually rise to $2 million.

Ultimately, you get to play the risk level you want here, making so many options a nice treat. It can get a bit overwhelming to know where to start, so study the variables of each carefully before jumping in.

Is Atlas Funded Worth It in 2025?

After going through every part of this Atlas Funded review, it’s clear that the platform offers one of the most balanced and accessible funding programs available today.

Its flexible evaluations, unlimited trading time, and up to 100% profit splits give traders the freedom to perform without unnecessary stress.

The “Pay After You Pass” model, in particular, reduces financial risk and makes the program more inclusive for those who want to prove their ability before investing heavily.

The combination of weekly payouts, balance-based drawdown, and a clear scaling plan up to $2 million creates genuine earning potential for consistent performers.

Atlas Funded is worth it for traders who want a transparent, fair, and. modern approach to prop-firm funding

Verdict: Atlas Funded is legit, well-structured, and potentially profitable for skilled traders in 2025.

If you’re ready to trade without limits and scale responsibly, this firm deserves a serious look.

Tags:

Tags: