TradingFunds positions itself as “the prop firm built by traders, for traders” that offers a fresh new approach to funded accounts.

The promise of flexible rules and accessible funding caught my attention, so I wanted to see if it holds up in practice.

In this TradingFunds review, I take a closer look at the firm’s claims to help you decide whether this funding model is worth your time.

Quick Verdict: My Take on TradingFunds

TradingFunds strikes me as a flexible, well-structured prop firm with realistic targets, multiple funding paths, and very few trading restrictions.

It isn’t risk-free, but it offers one of the smoother routes to a funded account for disciplined traders.

Best For

- Traders wanting flexibility (expert advisors, news, swing)

- Those who prefer low-pressure evaluations

- Anyone looking for scalable funded capital

Not Ideal For

- Total beginners without a proven method

- Traders expecting guaranteed payouts

>> Get TradingFunds At a Special Deal Today! <<

Would I Personally Use TradingFunds?

It was fun to test, but I’d give TradingFunds a go if I had time to day trade right now. The freedom to trade without restrictions and the realistic evaluation structure make it appealing since I value flexibility and consistency.

What Is TradingFunds?

What Is TradingFunds?

TradingFunds is a proprietary trading firm that gives folks like us access to larger buying power through funded accounts – once we’ve proven we can manage risk responsibly, of course.

Instead of locking users into one rigid path, TradingFunds offers several ways to get funded, including traditional evaluations, one-step models, instant funding for those who want to skip the testing phase, and even a pay-after-you-pass option that removes much of the upfront cost.

This laundry list of options feels more practical than what other prop firms force you into and definitely speaks to me.

There’s no sense of unnecessary restriction, no artificial time pressure, and no forced trading style.

I get to work my own approach while still following clear risk parameters.

Who Owns and Runs TradingFunds?

TradingFunds is operated by Nexdata Solutions B.V., a registered European company with a Dutch address supported by a team of traders and fintech professionals who’ve spent years working behind the screens of real markets.

I can’t find the name of a single public founder, but the structure of the platform makes it clear the team understands how modern prop trading actually works.

Every funding model they offer feels designed by people who’ve dealt with rigid rules and slow-moving systems themselves.

Is TradingFunds Legit?

Yes, TradingFunds shows every sign of being a legitimate prop firm.

They operate under Nexdata Solutions B.V., maintain a real business footprint, and have delivered consistent service since 2022.

That’s not a ton of time, but in the fly-by-night world of prop firms, it’s more than many others can claim.

Some of the biggest perks are that the rules are straightforward, evaluation targets reasonable, payouts smooth, and support helpful.

The platform continues to expand its funding options and upgrade its tools, suggesting a team committed to staying competitive.

I’m sold on their credibility, which is yet another reason why I’d pursue the platform for a shot at personal gains.

How Does TradingFunds Work?

TradingFunds keeps the process incredibly straightforward:

Choosing a Funding Path

Choosing a Funding Path

You begin by picking the type of account you want to pursue.

TradingFunds offers several options, from a traditional one or two-step approach to instant funds or a pay-after-you-pass challenge.

This variety is intentional. The team understands that different traders thrive under different conditions, so they’ve built multiple paths instead of forcing everyone into one rigid challenge format.

It gives you the freedom to choose an approach that fits your trading style and personality.

Trading the Evaluation (or Starting Funded)

Trading the Evaluation (or Starting Funded)

Once you choose your path, you start trading under TradingFunds’ risk parameters.

Evaluations take place on simulated accounts, but they reflect real market conditions and give you room to trade without pressure.

There are clear drawdown limits, realistic targets, and no time constraints known to push you into reckless decisions.

If you choose instant funding, you skip the evaluation and move straight into a live-funded environment.

You’ll pay a bit more upfront, but it can be worth the cost if you’re confident in your strategy.

Unlocking Your Funded Account

When you meet the requirements on a simulated run, you’re bumped right into funded status. You trade with company capital, keep a share of the profits, and request payouts on a predictable schedule.

This is where TradingFunds starts to feel like a long-term partner. The rules stay consistent, support remains responsive, and payouts have a reputation for being smooth.

From here, you can continue refining your performance, grow your account through TradingFunds’ scaling model, and build toward larger buying power without risking personal capital.

>> Sound like a good fit? Sign up NOW! <<

TradingFunds Funding Programs & Account Types

I know I’ve said it before, but TradingFunds gives multiple ways to reach a funded account and the profits therein. Let’s check them out now:

One-Step Evaluation Challenge

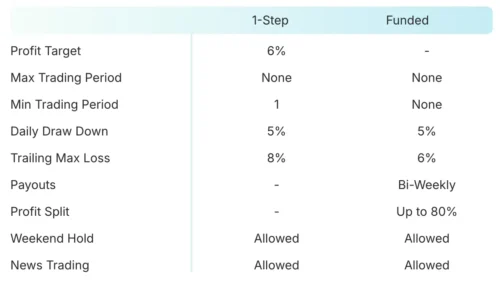

The one-step challenge appeals to traders who want a faster route to funding without dealing with multiple phases.

You only need to complete one evaluation stage, hit the required profit target of 10%, stay within the drawdown parameters, and show you can trade responsibly.

There’s no time pressure here, which removes the frantic pace some prop firms impose. It’s straightforward, and the hurdles aren’t too high.

The profit split becomes 80% once you graduate, and you’re free to trade on news or over the weekend.

Two-Step Evaluation Challenge

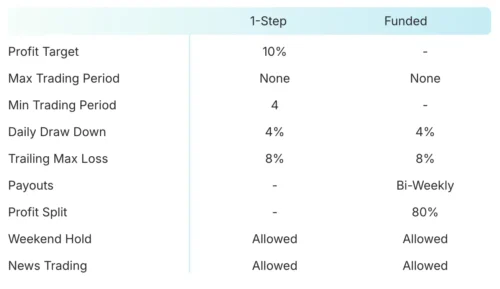

The two-step challenge takes a slightly slower approach to the same goal as the one-step challenge.. Instead of completing everything in one phase, you work through two separate stages with slightly softer controlled targets and risk rules.

The structure encourages consistency rather than fast results, which many traders actually find easier to manage.

In the end, you’ll receive the same 80% profit split once you hit a funded account, so these two strategies wind up at the same reward.

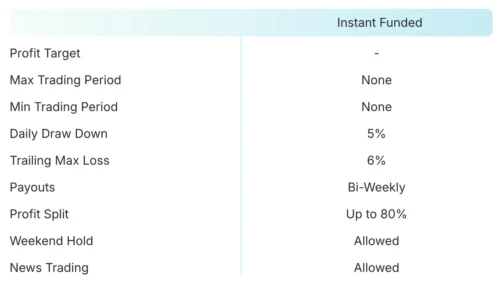

Instant Funding Accounts

Instant funding is exactly what it sounds like. Instead of proving yourself through an evaluation, you start with a funded account right away.

I’d only choose this route if you have a proven system and don’t want to spend weeks in an assessment phase.

It does require a higher upfront cost, but the payoff is immediate access to firm-backed capital at the same 80% split.

The absence of delays and the ability to trade freely from day one make this model appealing to those who value time over testing.

You won’t find a minimum trading period here, but the trailing max loss is a feisty 6% that you’ll want to avoid at all costs.

Flex Challenge (Pay After You Pass)

The Flex Challenge has become one of TradingFunds’ most talked-about features because it removes most of the financial risk upfront.

It’s a structure that clearly reflects the firm’s trader-first philosophy.

The pressure shifts away from money and back onto performance, which often leads to better decision-making and the same reasonable limitations.

It’s a safer upfront alternative to TradingFunds’ other options, but you will pay for it on the back end, I assure you.

That said, you’re still set to receive up to an 80% profit split should you make the cut.

>> Access TradingFunds’s latest insights now! <<

TradingFunds Review: All The Core Features Explained

TradingFunds builds its platform around practical features that actually matter, that you can put to work.

Here’s a closer look at what makes the service stand out.

Built to Last

The company maintains a visible business presence in the Netherlands and Dubai, and its products evolve rather than get abandoned.

There are regular updates to account models, rules, and technology, suggesting a team investing in long-term infrastructure rather than short-cycle hype.

Get Funded Faster

The one-step challenge cuts out unnecessary phases, the two-step process keeps targets realistic, and instant funding lets experienced traders bypass evaluations entirely.

The absence of time limits means no pressure to trade aggressively, and consistent execution, not speed, is what gets rewarded.

This creates an environment where skill matters more than rushing targets.

No Limits or Restrictions

These flexible rules let traders rely on their natural style instead of adjusting to forced constraints.

The platform supports both short-term and long-term strategies, and because there are no time limits, traders don’t need to force trades just to stay active.

Lower Profit Target

The firm’s evaluation requirements are intentionally achievable.

Their two-step challenges use modest targets, and even the one-step model keeps the objective practical compared to prop firms demanding 10%–15% in tight windows.

Pair this with the no-time-limit policy, and traders can reach targets at a pace that matches their strategy.

This approach improves pass rates and reduces the stress that often comes from racing to hit numbers during volatile market conditions.

>> Experience TradingFunds’ Perks Today! <<

Account Sizes & Scaling Up to $600K

The maximum you can jump into out of the gate is $100,000, but

As you demonstrate consistency and manage risk effectively, you unlock access to bigger accounts through the firm’s scaling plan.

Reaching the upper tiers, up to $600,000, takes discipline, but it’s achievable with steady performance.

I appreciate not getting stuck in a rut that plateaus over time, making this one of the features that makes TradingFunds feel like a genuine partner rather than a challenge mill.

Fast & Flexible Payouts

The payout process is streamlined through the dashboard, and traders frequently comment on the reliability of withdrawals.

Profit splits remain competitive, often starting around 80% and increasing with certain account structures or scaling levels.

The speed and predictability of payouts help traders treat their funded account as a regular income source rather than an occasional bonus.

Exclusive ‘Traders Area’ Dashboard

The Traders Area dashboard is designed to give a clean, organized view of everything a trader needs.

Performance metrics, drawdown tracking, evaluation status, payout requests, and account management tools are all laid out clearly.

The real benefit is how quickly traders can see where they stand without digging through cluttered menus.

It supports accountability and helps prevent rule violations by keeping key metrics front and center during active trading sessions.

Live Chat Support

Response times have been quick for me, and the guidance is on point.

Whether it’s account setup questions, evaluation clarifications, or payout timing, the support team provides direct, helpful responses rather than generic automated replies.

This level of accessibility reduces confusion and helps avoid mistakes that could jeopardize accounts.

A Comprehensive Knowledge Base

The TradingFunds website includes a detailed help center that answers common questions about rules, funding paths, drawdown structures, payouts, and account progression.

The explanations are simple, practical, and free of jargon, which helps users understand the system before risking any capital.

You’ll want to head here first when you have a question about leverage or how a certain tool works.

>> Discover More of TradingFunds NOW! <<

Pros and Cons

After seeing what TradingFunds can do, here are my top pros and cons:

Pros

- Multiple funding paths for different trading styles

- No time limits on evaluations

- EAs, news, and weekend holding allowed

- Competitive payouts with bi-weekly withdrawals

- Practical, realistic evaluation targets

- Scaling available up to $600K

Cons

- Instant funding can be expensive

- Founders not publicly highlighted

- Prop-firm stability is never guaranteed

How Much Does TradingFunds Cost?

TradingFunds structures its pricing depending on the challenge type and account size.

For example, with the “Flex Challenge (Pay After You Pass)” model, you start with a setup fee as low as $9, regardless of whether you pick a $5,000 or a $100,000 account.

Once you pass the evaluation, you pay the remaining evaluation fee to activate the funded account.

For the “One-Step” and “Two-Step” evaluation paths, upfront fees depend on account size.

Smaller accounts begin with modest fees (roughly $41 for a small account under certain promotions) and scale from there for larger fund access.

Instant funding begins at $76, but climbs pretty quickly to get higher amounts of funded cash.

Overall, TradingFunds offers pricing across a spectrum: from low-risk entry points to premium instant capital access.

This flexibility allows you to choose a model that suits their budget, risk tolerance, and trading goals, making the platform relatively accessible compared to some high-cost prop firms.

Who Is TradingFunds Best For?

TradingFunds works best for disciplined traders who want access to larger buying power without risking significant personal capital.

Its flexible rules make it a good fit for people who rely on EAs, trade news, or hold positions over weekends, since the platform doesn’t force a specific style.

The variety of funding paths also works well for individuals with different comfort levels, those who want a traditional evaluation, those who prefer faster funding, and those who want to limit upfront costs through the Flex Challenge.

It may not be ideal for complete beginners or anyone expecting guaranteed payouts, but for traders with a tested strategy and a steady approach, TradingFunds offers a realistic and supportive path to long-term capital growth.

Is TradingFunds Worth It?

Is TradingFunds Worth It?

After working through this TradingFunds review, the firm stands out as a practical option for traders who want flexible rules, fair evaluations, and a clear path to funded capital.

The no-pressure environment, combined with the ability to trade without restrictions, makes the experience smoother than what many prop firms offer.

You can pick your entry point and determine your course through carefully executed trades, which can put up to 80% of any earnings you accrue right into your own pocket.

You’ll still need discipline and a steady approach, but for those who trade with structure, TradingFunds delivers real potential through consistent payouts and long-term scaling opportunities.

TradingFunds FAQs

Is TradingFunds a real prop firm?

Yes. TradingFunds operates under Nexdata Solutions B.V., maintains transparent rules, consistent payouts, and a stable track record since 2022, making it a credible prop-firm option.

Can I trade news, hold positions overnight, or use EAs?

Yes. TradingFunds allows news trading, overnight and weekend holding, and automated systems, giving traders full freedom to use their preferred strategies without unnecessary restrictions.

How long does it take to get funded?

Funding speed depends on your chosen path—instant funding is immediate, while evaluations have no time limits, letting disciplined traders progress at their own pace.

How do payouts work on funded accounts?

TradingFunds offers bi-weekly payouts with competitive profit splits. Traders request withdrawals through the dashboard, and payouts are processed reliably once all rules remain intact.

Tags:

Tags: