Every year, I pay close attention to Seeking Alpha’s annual “Top Stocks” events because, quite honestly, they have a habit of delivering.

Seeking Alpha Top Stocks 2026 brings that focus back again, this time led by Steven Cress and his data-driven Quant Strategy.

I’ve used Seeking Alpha for years, including its Quant Ratings and Alpha Picks, and I’ve seen how this system adapts as conditions shift.

My question is: How does it all hold up as we head into 2026?

>> Enroll for Join Seeking Alpha Top Stocks 2026 Webinar Today <<

What Is Seeking Alpha Top Stocks 2026?

What Is Seeking Alpha Top Stocks 2026?

Seeking Alpha Top Stocks 2026 is a once-a-year stock selection event built around Seeking Alpha’s Quant framework and led by Steven Cress.

It’s a forward-looking look at which stocks currently score highest across multiple quantitative factors as we slide into a new year.

The team thinks a bit outside the box here, foregoing predictions or narratives to show how the data stacks up right now and which names rise to the top when the numbers are run consistently.

What makes this especially interesting is how it ties into the broader Seeking Alpha ecosystem.

Access to the event comes through Seeking Alpha’s paid product line, including Premium and Alpha Picks, adding even more value.

I love that, since the top stocks list was never meant to stand alone. Combined with the tools, ratings, and research Seeking Alpha is known for, you’re getting a full package and not just a one-off idea.

>> Watch Steven Cress Reveal 2026 Picks <<

Who Is Steven Cress?

Who Is Steven Cress?

Steven Cress is a seasoned quantitative strategist with more than three decades of experience analyzing U.S. equities through systematic, data-driven models.

Earlier in his career, he ran a proprietary trading desk at Morgan Stanley, an experience that shaped his focus on repeatable processes and downside awareness.

Steven has also held senior roles at Northern Trust, working on global research strategy and investment analytics.

Cress later founded CressCap Investment Research, where he developed quantitative screening models used by professional market participants until Seeking Alpha purchased it in 2018.

Today, he applies that institutional background to overseeing Seeking Alpha’s quantitative research, bringing structure and accountability to how stocks are evaluated.

Much of his hard work shows up in the platform’s 2026 top stocks list.

Is Steven Cress Legit?

Yes, Steven Cress has earned his credibility through consistency and visibility rather than one-off calls.

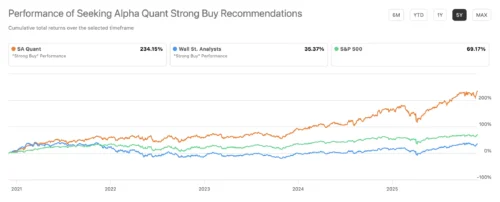

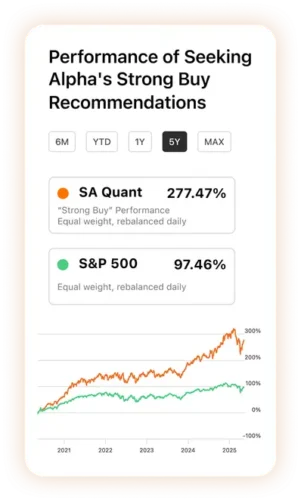

The Quant-driven stock lists he oversees, including Seeking Alpha’s annual Top Stocks selections, have been tracked publicly with performance updates that compare results against the broader market.

Picks from prior years brought in significant gains, with a 184% increase in 2023 and an even more impressive 324% in 2024.

I appreciate that you can go back and see the results of his previous years at any point online, and I’m expecting 2025 data soon.

Steven has also authored and supervised thousands of quantitative analyses on Seeking Alpha, giving readers a long record to judge his work.

That combination of scale, transparency, and repeatable results makes his research worth taking seriously.

>> Get Steven Cress’s Quant stock picks <<

The Core Idea Behind the Top Stocks 2026 Event

The Core Idea Behind the Top Stocks 2026 Event

There’s always a lot of hype around a new year. Things will be different, new, and exciting!

In my circles, many market conversations follow the same route. Folks lean too far into opinion and avoid clear evidence.

That’s the gap the Top Stocks 2026 event is built to cross.

We all know the markets will not remain calm, but there are always tangible data points that help reveal direction before it actually shifts.

Cress’s Quant data seeks to recognize those shifts early, while the data is still doing the heavy lifting.

This event is designed to highlight where multiple signals are already lining up, creating situations that often get overlooked until they become crowded.

What the Numbers Are Already Revealing

From past events, Steven Cress typically walks through how changes in earnings expectations, valuation spreads, and price behavior begin to reshape rankings long before they show up in headlines.

Going into 2026, the focus is on how stocks with improving fundamentals and confirmation from price action tend to separate themselves from the rest of the market.

Plus, Steven emphasizes that relying on one indicator rarely works for long.

When several factors begin pointing in the same direction, that’s when probabilities start to improve.

How the Quant Framework Narrows the Field

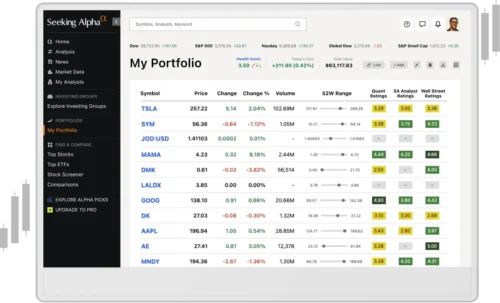

It’s clearly challenging to sift through all the riff-raff, but that’s why I like having the Quant framework doing its thing here.

Instead of starting with themes or predictions, the process allows rankings to surface naturally based on measurable factors such as valuation, growth, profitability, momentum, and earnings revisions.

As part of Seeking Alpha’s member pool, I’ve used this approach as a filter to avoid chasing ideas that sound compelling but lack confirmation.

You can’t eliminate risk, but you can stack the odds by focusing on stocks where multiple strengths appear at the same time.

Turning Insight Into Action

When I look at the Top Stocks 2026 event as a whole, the real value isn’t just the list itself.

It’s seeing how a repeatable process adapts as conditions evolve and learning how to apply that thinking beyond a single moment.

If this kind of structure appeals to you, the next step is straightforward.

You can learn more by joining the service and attending the event, which also opens access to the broader research tools that support these ideas throughout the year.

>> Access Seeking Alpha Top Stocks 2026 now <<

Track Record Framing Going Into 2026

When I look at the Seeking Alpha Top Stocks 2026 event, it’s essential to know whether the framework has actually delivered results in prior years.

Based on the performance data shared by the Seeking Alpha team, there’s a clear reason these annual releases continue to draw attention.

Steven Cress’s previous Top Stocks lists have shown strong performance during their measured periods, with the 2023 selections up 184% and the 2024 list up 324%.

The 2025 list has also gotten off to a solid start, showing gains of roughly 50 percent at the time of the latest update, while continuing to outperform the broader market.

These results are tied to clearly defined publication windows and tracked openly on the platform, which makes them easier to evaluate rather than simply take on faith.

There’s no attempt to smooth results or hide volatility. The performance is published, updated, and visible to anyone following along.

While no approach works perfectly every year, this kind of consistency helps explain why many long-time Seeking Alpha users continue to pay attention when a new Top Stocks list is released.

>> See Steven Cress’s Quant Strategy in Action <<

Who Gets Access to the Top Stocks 2026 Event?

Folks with paid Seeking Alpha subscriptions get access to the Seeking Alpha Top Stocks 2026 webinar. This includes Premium, Alpha Picks, Bundle, and PRO tiers.

I’ve seen this structure used in previous years, and it tends to be the most cost-efficient way to experience the event if you’re not already part of the platform.

The on-demand replay and accompanying article are published the day after the live session and remain behind the paywall.

>> Attend Steven Cress’s Top Stocks Webinar <<

The Discount Offer and Timing

One of the reasons the Seeking Alpha Top Stocks 2026 event tends to attract so much attention is because it lines up with one of the more meaningful pricing windows of the year.

During this period, Seeking Alpha is offering exclusive 10 percent savings across its major subscription products if you sign up here.

That lowers the barrier for folks who have been considering the platform but haven’t committed yet.

From my experience, this timing is intentional. It gives new members a chance to explore the research tools while also gaining access to the event itself.

Premium access includes a free seven-day trial followed by annual pricing at $269, giving users a path to Quant Ratings, stock screeners, and the broader research library.

Alpha Picks, priced at $449 per year during the offer, appeals to those who want a more structured stream of stock ideas built around the same quantitative framework discussed in the event.

The Bundle, available at $689 annually, combines multiple research products into a single subscription for users who want deeper coverage.

For more advanced users, PRO access starts with an $89 one-month paid trial and renews at $2,149 per year, offering the highest level of tools and data access on the platform.

>> Start with Seeking Alpha Top Stocks 2026 Event <<

What You Get Beyond the Webinar

It’s important to understand that the webinar itself is just one piece of the value.

With Premium access, you get full visibility into Quant Ratings, factor breakdowns, earnings revisions, and analyst sentiment.

Alpha Picks adds a more structured cadence, with two new stock ideas each month selected using a similar quantitative framework.

I feel that these two plans really complement Cress’s 2026 picks and can start you off on a successful course for the new year.

Bundle and PRO tiers, on the other hand, are designed for heavy users who rely on Seeking Alpha as a primary research platform.

In my experience, those levels only pay off if you actively use the tools.

>> Follow Steven Cress’s Quant-driven Approach <<

Pros and Cons

Here’s the best and worst of what you get for joining Seeking Alpha through this bundle:

Pros

- Quant-driven stock selection process

- Backed by verified historical performance

- Clear methodology, no narrative guessing

- Useful starting point for deeper research

- Strong alignment with platform tools

- Discounted rates across all platforms

- Budget-friendly trial for certain plans

Cons

- Concentrated list increases volatility

- Best value requires platform usage

>> Don’t Miss the Top Stocks 2026 Event <<

Is Seeking Alpha Top Stocks 2026 Worth Attending?

Is Seeking Alpha Top Stocks 2026 Worth Attending?

Having been involved with prior Top Stocks events and maintaining use of Seeking Alpha’s products, I see Seeking Alpha Top Stocks 2026 as a practical way to reset your research lens for the year ahead.

Don’t think of this as blindly following a list. It’s about understanding which factors are being rewarded by the market and using that insight to refine your own decision-making process.

I believe you’ll benefit if you appreciate structure, data, and repeatable systems just like I do.

With the current discounts in place, the risk-to-reward balance improves even more.

If you’ve been curious about Seeking Alpha’s Quant approach or want a disciplined way to start 2026 with fresh stock ideas, this event is a solid entry point.

The simplest way to participate is to join during the promotional window and attend the webinar live, before the opportunity passes.

Tags:

Tags: