Gold has long been a place people turn to when uncertainty rises, but Sean Brodrick believes the precious metal is about to do a whole lot more.

With global instability building and Central bank buying still strong, gold could offer protection from the chaos and create new avenues for wealth at the same time.

In this Golden Paradox review, I dig into Brodrick’s claims so you can decide if his approach deserves a closer look.

>> Join Sean Brodrick’s Golden Paradox Today <<

What Is Golden Paradox?

Golden Paradox is built around a simple idea that Sean Brodrick has seen play out again and again in past gold cycles.

That’s where the paradox comes in – gold looks great, but Brodrick says other avenues actually offer the biggest shot at gains.

Knowing where that capital rotates next and why that shift takes place can matter even more.

The Golden Paradox itself is a solid concept, but it’s actually an entry point into Brodrick’s broader work inside Wealth Megatrends.

Members gain access to ongoing research, select market insights, and a structured way to follow the trends Brodrick believes are shaping the next phase of the gold story.

The service also includes supporting reports and guidance designed to help us spot opportunities tied to precious metals without having to track every headline ourselves.

>> Get Golden Paradox With Wealth Megatrends <<

What Is Inside Sean Brodrick’s Golden Paradox?

Mainstream media tends to shout gold from the rooftops, and why not? It’s a stable metal with a ton of value.

The problem is that gold has already done what it tends to do during uncertain periods: it has climbed, drawn attention, and reassured those worried about currencies and governments.

He explains that gold’s initial surge is often followed by a quieter phase that most people overlook, even though that’s where some of the most meaningful opportunities have historically emerged.

Why Gold Alone Often Disappoints

There’s nothing wrong with owning gold, but it’s important not to draw the line there.

What’s even worse for me is how loud gold is. Everyone talks about it, and dilution can quickly become a problem.

These factors make gold less appetizing, but what option does that leave us?

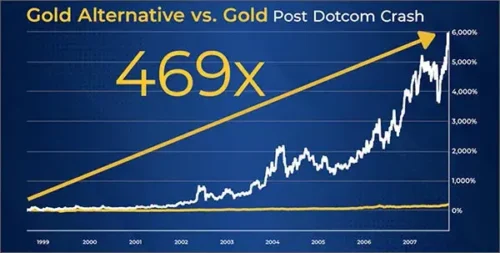

The Golden Paradox actually highlights the timeframe where silver crosses gold’s rise and subsequent fall, often growing far more than its yellow cousin.

I like Sean’s thought process because it takes the focus off gold alone, but he shows with real data that the pattern repeats time and again.

Silver tends to be quieter, too, so Brodrick’s research lines right up with my line of thinking.

>> Start Sean Brodrick’s Gold Strategy Now <<

Not All Silver Is Shiny

Several miners may have all the credentials to create profits, but end up going nowhere because of a poor business structure or red tape.

That’s why Sean’s expertise on the subject is so crucial, using a GOLD acronym to find only the best opportunities.

First, he pokes around for companies sitting in good geographic climates, not simply for ore access but also away from red tape.

One thing I appreciate about Brodrick is that at times he goes boots on the ground to some of these locations, sussing out more quality and leadership to ensure they have what it takes to succeed.

Lastly, it’s crucial for these miners to have discovered an abundance of precious metals for long-term prospects.

Making Sense of the Golden Paradox

I mentioned it once already, but it’s worth mentioning again: Sean Brodrick actually has taken the time to visit some of the miners he’s interested in to see if they have what it takes to turn a profit.

He’s currently sharing what he knows about these lucrative miners as part of his Golden Paradox bundle, which he’s making available right now.

You’ll find it rolled up into his Wealth Megatrends service, which I’d like to take a closer look at now.

>> Unlock Golden Paradox Before Next Phase <<

Golden Paradox Review: What Comes With Wealth Megatrends?

Joining Wealth Megatrends gives you ongoing access to Sean Brodrick’s thinking well beyond the core Golden Paradox idea:

12 Months of Wealth Megatrends

12 Months of Wealth Megatrends

A full year of Wealth Megatrends is the foundation of this offer.

Each monthly issue focuses on major economic, resource, and geopolitical shifts that Brodrick believes can shape markets for years, not weeks.

Metals may be the current craze, but I’ve found Wealth Megatrends to pursue the hottest sectors at any given time.

You’ll get at least one new recommendation every time an issue hits your inbox, so you can read up on the trend as it unravels while investing in it at the same time.

I appreciate the deliberate pacing, making it easier to stay aligned with long-term opportunities without feeling overwhelmed.

ASAP Alerts and Updates (Flash Alerts)

ASAP Alerts and Updates (Flash Alerts)

Markets don’t always wait for the next monthly issue, and that’s where Brodrick’s alerts come in.

I receive a timely update any time something materially changes, such as a shift in outlook, a new development affecting an existing idea, or an opportunity that requires timely attention.

They’re not long, so I can get through them quickly and then make whatever necessary move to dodge a potential pitfall or scoop up some breakout company.

You’ll want to keep tabs on these any time they come out, since Brodrick only sends information when he believes it really matters.

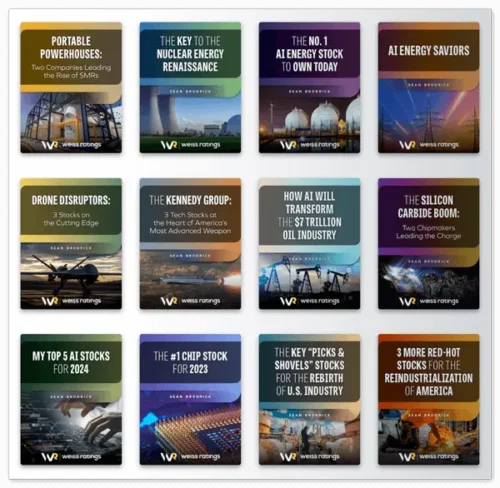

Access to the Complete Research & Report Library

Access to the Complete Research & Report Library

Membership also includes access to an extensive archive of past reports and research.

This library gives you context, allowing you to see how Brodrick has approached similar environments in the past and how his thinking has evolved over time.

It’s especially useful if you want to dig deeper into specific trends like precious metals, energy, or global cycles.

Rather than starting from scratch, you can build on years of prior analysis and use it as a reference point when new opportunities emerge.

>> Try Golden Paradox Risk-Free Today <<

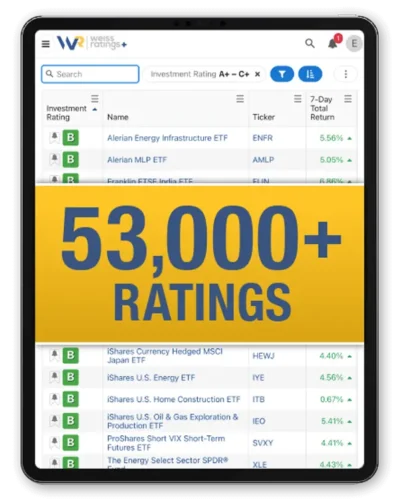

Access to 53,000 Weiss Ratings

Access to 53,000 Weiss Ratings

One of the biggest advantages of Wealth Megatrends is its connection to the Weiss Ratings system.

You can view ratings covering more than 53,000 stocks, ETFs, funds, and banks worldwide with nothing more than a few clicks.

While the data is quite quantitative, the system also provides a clear rating so there’s little question about how to act.

Brodrick often uses this data as a filter to support his research, and having direct access lets you independently evaluate ideas or explore alternatives that fit the same trend.

Weiss Ratings Daily E-Letter

Weiss Ratings Daily E-Letter

In addition to Brodrick’s research, Wealth Megatrends members receive the Weiss Ratings Daily E-Letter.

This publication keeps you in the loop on broader market developments, rating changes, and emerging risks across asset classes.

It’s a quick way to stay grounded in what’s happening across the financial landscape without having to scan multiple news sources.

Over time, this daily perspective complements Wealth Megatrends by helping you connect individual ideas to the larger market environment.

Confidential Online Briefings

Confidential Online Briefings

From time to time, I’m handed an invite to confidential online briefings where Brodrick and the Weiss team discuss major developments in more depth.

These sessions often expand on themes already covered in the newsletter and provide additional clarity on how current events may affect ongoing trends.

The format feels more conversational and timely, offering insight that doesn’t always fit neatly into a monthly issue.

For me, there’s nothing better than hearing directly from a guru while watching how he performs on the screen.

I wish more services did something like this, but at least we have access to it here.

>> Access Sean Brodrick’s Wealth Megatrends <<

Golden Paradox Bonus Reports

Along with the core research, Golden Paradox includes several bonus reports designed to round out Sean Brodrick’s thinking on gold and related opportunities:

Bonus Report #1: Ride the Silver Bull: 5 Stocks to Beat Gold

Bonus Report #1: Ride the Silver Bull: 5 Stocks to Beat Gold

As the crux of Brodrick’s current research, this report focuses on silver’s tendency to outperform gold during certain phases of precious-metal bull markets.

You’ll learn about why silver often lags early, then accelerates once momentum builds.

Rather than discussing silver in the abstract, he highlights a small group of companies he believes are positioned to benefit if that familiar pattern plays out again.

In typical Sean Brodrick fashion, you’re getting the why behind a trend alongside five promising opportunities that could beat gold’s rise by a landslide.

Bonus Report #2: 5 Essential Gold Stocks for the Bull Market

Bonus Report #2: 5 Essential Gold Stocks for the Bull Market

Gold may not be the major winner this season, but that’s no reason to ignore it.

Like he did with silver, Sean shares five gold stocks that meet his criteria for greatness as he anticipates the next gold bull run so you can be right there with him.

Brodrick looks at balance sheets, production profiles, and leverage to rising gold prices to explain why certain companies tend to hold up better during bull markets.

Don’t let that scare you; having data to back up his claims is a big win in my book.

>> Don’t Miss Sean Brodrick’s Golden Paradox <<

Bonus Report #3: Guide to Buying Physical Gold and Silver

Bonus Report #3: Guide to Buying Physical Gold and Silver

For those who still want direct ownership, this guide covers the practical side of buying physical metals.

Brodrick walks through common options, typical costs, and mistakes people often make when purchasing gold or silver for the first time.

Not every avenue for acquiring these precious metals pans out, so knowing the best ways to hold and protect your assets is key.

He also explains how physical metals fit into a broader strategy rather than acting as a stand-alone solution.

Bonus Report #4: Mission Critical: The 3 Companies the Government Is Counting On to Take Down China

Bonus Report #4: Mission Critical: The 3 Companies the Government Is Counting On to Take Down China

Precious metals often serve as the backdrop for emerging technologies, and the country with the largest supply gains a huge advantage.

Brodrick examines how rising tensions and supply-chain concerns are pushing governments to rely on specific companies in strategic industries.

He explains why these firms matter, what role they play, and how policy decisions can influence their prospects.

Once you understand why they’re important, Sean shares three companies helping to lead this charge and ways to partake for a shot at returns.

>> Explore Sean Brodrick’s Golden Paradox <<

Refund Policy

Refund Policy

The Golden Paradox offer is backed by a full 365-day, no-risk money-back guarantee.

That means you have an entire year to review Sean Brodrick’s research, follow along with Wealth Megatrends, and decide whether the approach fits your expectations.

If at any point during that time you feel the service isn’t right for you, you can request a refund and receive your subscription cost back, no questions asked.

Few services offer this level of guarantee, showing that Brodrick really believes in his research.

>> See Why Golden Paradox Matters Now <<

Pros and Cons

Here’s my balanced take after reviewing Golden Paradox and Wealth Megatrends.

Pros

- One full year of Wealth Megatrends

- Frequent alerts and updates

- Focuses on early-stage market positioning

- Built on repeatable historical patterns

- Clear, easy-to-follow research approach

- Multiple bonus reports

- Exclusive online briefings

- Backed by a 365-day refund policy

Cons

- No community chat or forum

- Limited appeal for active traders

Golden Paradox Track Record and Past Performance

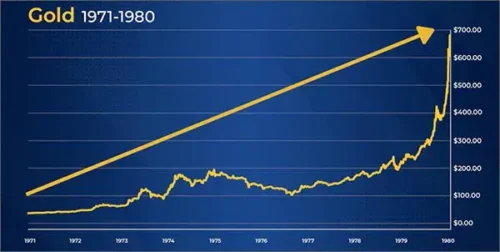

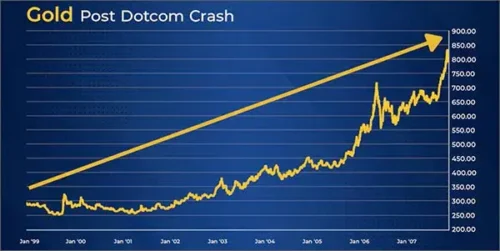

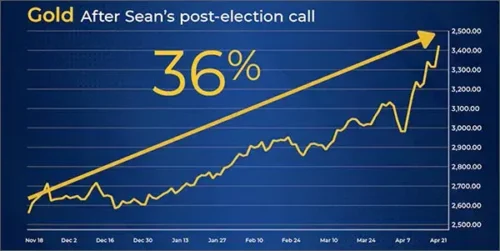

The strength of Golden Paradox rests largely on the historical evidence Sean Brodrick points to rather than hypothetical projections.

He walks through multiple gold bull markets going back decades, including the 1970s, early 2000s, the post-2008 period, and the COVID-era surge.

In each case, gold delivered solid gains first, but the more dramatic returns showed up later in closely connected areas once gold began to level off.

He cites past cycles where these secondary opportunities outpaced gold by wide margins, sometimes by multiples rather than percentages.

Brodrick also highlights examples from recent years where select precious-metal equities significantly outperformed bullion during the later stages of gold rallies.

While he’s careful not to frame these outcomes as guarantees, the consistency of the pattern is the core of his argument.

>> Discover Sean Brodrick’s Golden Paradox <<

How Much Does Golden Paradox Cost?

Access to Golden Paradox is available through Wealth Megatrends, and there are currently two membership options depending on how you prefer to receive the research.

The Standard Membership costs $49 for the first year and includes digital-only delivery of the monthly Wealth Megatrends newsletter, along with all alerts, research access, Weiss Ratings tools, and the full Golden Paradox bonus report package.

For readers who prefer physical copies, the Premium Membership with print delivery is priced at $99 for the first year.

This tier includes everything in the digital plan, plus a printed version of each monthly issue mailed directly to you.

>> Learn Sean Brodrick’s Gold Cycle Strategy

Is Golden Paradox Worth It?

Is Golden Paradox Worth It?

After going through everything, Golden Paradox lines up well if you already believe in gold but don’t want to stop there.

I appreciate that he’s not zeroing in on a fad or short-term trend, but a cycle that repeats with incredible potential for wealth each time it does.

The real value comes from the ongoing guidance inside Wealth Megatrends, not just the initial idea.

With a full year of research, alerts, and supporting data, you’re given time to see whether Brodrick’s framework holds up in real market conditions.

Add in the long refund window and low introductory price, and it becomes a low-pressure way to decide if this long-term, cycle-based approach fits how you want to navigate precious metals.

Gold’s move has already started, but history suggests the biggest gains often come after the spotlight shifts. Golden Paradox shows how to prepare for that next phase before it becomes obvious.

If you want access to Sean Brodrick’s full strategy and bonus research, now is the time to secure the offer before this window closes.

Tags:

Tags: