Prop firms have become a popular way for skilled traders to access capital without putting large sums at risk, but not all of them are built the same.

BrightFunded claims to offer a cleaner path forward, with no “consistency rule” pressure, clear risk limits, weekly payouts, and a rewards system called Trade2Earn.

>> Start your BrightFunded Challenge Today <<

Quick Verdict: My Take on BrightFunded

BrightFunded comes across as a modern, trader-friendly prop firm built around speed, flexibility, and clear rules.

The evaluation targets are realistic, the lack of consistency rules removes unnecessary pressure, and the fast, weekly payout structure makes it appealing for traders who value efficiency over gimmicks.

It’s not risk-free, but for disciplined traders, it offers one of the smoother paths to a funded account I’ve seen.

Best For

- Anyone wanting flexibility without consistency rules

- Those who prefer unlimited time rather than rushed evaluations

- Traders aiming to scale toward larger funded capital with fast payouts

Not Ideal For

- Complete beginners without solid risk control

- Traders looking for guaranteed income or shortcuts

- Anyone uncomfortable with strict daily and total drawdown limits

Would I Personally Use BrightFunded?

I would use BrightFunded, and here’s why. The combination of simple evaluation rules, no consistency restrictions, and genuinely fast payout processing makes BrightFunded a strong option if you already have a foundation to stand on.

>> Trade smarter with BrightFunded funding <<

What Is BrightFunded?

BrightFunded is a proprietary trading firm for those who want access to meaningful capital without risking their own savings upfront.

If you pass, you’re given a funded account where profits become eligible for real payouts.

The firm offers a range of account sizes, which makes it accessible whether you’re testing the waters or aiming to scale toward larger capital over time.

I like how the platform shines, thanks to a straightforward evaluation model and lack of deadlines that take a lot of the pressure off.

On top of that, the firm supports multiple professional platforms and a broad mix of markets, which helps traders stick to strategies they already know.

>> Join BrightFunded and Scale Your Trading <<

Who Owns and Runs BrightFunded?

BrightFunded is led by a publicly identified leadership team, which immediately sets it apart from many anonymous prop firms that are ambiguous at best.

He’s joined by a stacked deck of leaders who each bring unique talent into the mix.

Behind the scenes, BrightFunded is supported by an international team covering technology, operations, and risk oversight.

That structure shows up in practical ways, from platform stability to payout execution.

Is BrightFunded Legit?

BrightFunded demonstrates legitimacy through execution across multiple categories.

Among them, weekly payouts are the norm instead of being treated as exceptions.

Rules are apparent and to the point so you know precisely what you’re getting into before an evaluation, which is critical in a prop firm environment.

The firm also shows signs of long-term intent through features like Trade2Earn, which rewards continued participation instead of relying solely on challenge fees.

It’s easy for me to lean into a prop firm with such a focus on consistency with a design to scale over time.

>> Claim your BrightFunded funded account <<

How Does BrightFunded Work?

You’ll kick things off by selecting an evaluation account and proving they can trade profitably while respecting predefined risk limits.

There’s no rush to complete the process, and no requirement to trade in a specific style, which helps remove a lot of the artificial pressure seen at other firms.

Let’s look at each step of the process now:

Evolution Phase

BrightFunded gives you unlimited time to reach your profit targets, which allows strategies to play out naturally instead of forcing trades to meet deadlines.

There’s a lot of flexibility around preferred platforms, instruments, and approaches, provided you stay within daily and overall drawdown limits.

Luck won’t get you far here, requiring you to lean into repeatability to reach a handful of reasonable goals.

Funded Phase

There are no fixed profit goals at this stage, giving you the freedom to focus on execution and risk management rather than chasing numbers.

Profit splits apply here, with the potential to scale capital and improve terms over time – that’s a major draw for me.

Keeping a controlled environment and steady growth can keep the profits rolling indefinitely.

As long as you keep that rhythm going, you can scale your wins over time and unlock even greater shots at wealth.

Payout Phase

BrightFunded is designed to process profits quickly, something that feels critical but doesn’t always pan out in a prop firm.

Alongside regular payouts, BrightFunded includes incentives like Trade2Earn, which rewards continued trading activity.

If you care about reliability and momentum, this payout structure makes the overall experience feel practical and worth committing to long-term.

>> Trade with confidence using BrightFunded <<

BrightFunded Trading Rules (No Sugarcoating)

BrightFunded keeps its trading rules straightforward, leaving little doubt about how to participate.

The framework is built to reward control and punish overexposure, which is exactly what you’d expect from a firm focused on longevity rather than lucky streaks.

If you’re comfortable trading within defined limits, the rules feel fair. If you rely on aggressive recovery tactics, they will feel restrictive.

Profit Targets

The evaluation is split into two phases with clearly defined profit targets.

Traders must reach an 8% target in the first phase and a 5% target in the second, all while staying within drawdown limits.

There’s no profit target once funded, which removes the pressure to constantly chase gains.

This structure encourages traders to focus on quality setups during evaluation and sustainable performance afterward.

Drawdown Rules

Risk management is where BrightFunded draws a firm line. Daily drawdown is capped at 5%, while total drawdown is limited to 10%.

These limits apply consistently across phases and are designed to prevent excessive risk-taking.

Given my experience and history with other prop firms, these rules are manageable if you keep position size and emotion in check. Folds with high-risk styles will struggle to survive long-term.

Time Limits & Trading Days

One of BrightFunded’s strongest rule advantages is the absence of strict time limits. You’re given unlimited time to complete both evaluation phases, removing the need to force trades just to meet a deadline.

There is a minimum number of trading days required, but once funded, there are no timing constraints at all.

Consistency Rules (Or Lack Thereof)

Unlike many prop firms, BrightFunded does not enforce consistency rules tied to daily profits or lot sizing.

That frees you to trade naturally without worrying about distribution requirements. That said, the absence of consistency rules doesn’t mean a lack of oversight.

Risk limits are still strictly enforced, and disciplined execution remains essential.

>> Unlock capital through BrightFunded today <<

BrightFunded Review: All The Core Features Explained

Most prop firms treat the evaluation as “prove it first, earn later.”

BrightFunded flips that by offering a 15% profit share during the Challenge Phase, meaning profits you generate while completing Phase 1 and Phase 2 can still have value attached to them.

I’ve never seen anything like this from any other prop firm I’ve checked out, and you can earn your registration fee back with successful completion as well.

That’s a smart incentive for disciplined traders, because it rewards clean execution even before you’re funded, instead of making the entire test feel like sunk cost.

Scale Limitless (Up To 100% Profit Split)

BrightFunded leans hard into scaling. The platform says you can scale to an unlimited account size and push your profit split up to 100% as you prove consistency over time.

The big appeal here is the runway: rather than “pass and stop,” there’s a clear avenue to improving your terms the longer you stay steady, which is exactly what serious traders want.

No Consistency Rules

This one matters more than you might think.

BrightFunded states there are no consistency rules, so you’re not stuck managing odd daily profit caps, lot-size ratios, or forced distribution rules that punish normal strategy variance.

That freedom is especially helpful for traders whose edge comes in bursts, because you can trade your plan without worrying that a strong day will disqualify you later.

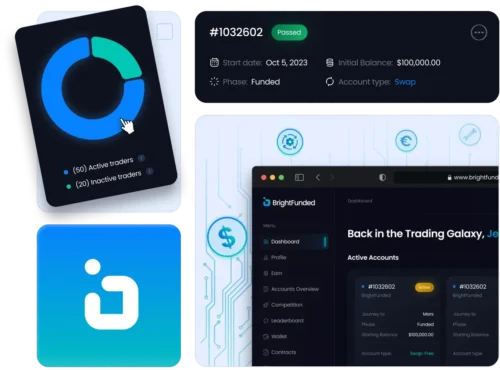

Multiple Trading Platforms

Multiple Trading Platforms

Platform flexibility is a quiet advantage, and BrightFunded checks that box well.

They support cTrader, MetaTrader 5 (MT5), and DXtrade, so you can stay inside the interface you already know instead of learning a new setup mid-evaluation.

That also helps if your strategy depends on specific order types, execution feel, or platform tools. Less friction usually means fewer avoidable mistakes.

Real Trading Expertise

Real Trading Expertise

On the branding side, BrightFunded showcases leadership with backgrounds tied to central banks, major brokers, and top proprietary trading firms.

That doesn’t replace your own due diligence, but it does signal intent: they’re positioning the firm as infrastructure-driven, not “challenge-first.”

I’ll take that any day over prop firms with a mysterious team any day. There’s a strong sense of legitimacy that helps me believe BrightFunded will be around for the long run.

>> Scale faster using BrightFunded capital <<

Multi-Asset Trading

A lot of traders fail evaluations because they’re locked into one market that isn’t behaving well.

Their materials also reference 150+ trading instruments, which helps if you rely on rotating opportunities rather than forcing setups.

Lightning-Fast Payouts

Lightning-Fast Payouts

Payout speed is one of BrightFunded’s loudest differentiators, and they attach a concrete claim to it.

The platform promises to offer payouts within 24 hours, and their own materials repeatedly frame withdrawals as fast and reliable.

That short turnaround reduces stress and makes the funded phase feel more tangible. It also sets a clear standard you can hold them to once you qualify.

24/7 Live Fast Support

24/7 Live Fast Support

When something goes wrong in a prop environment, platform issues, account questions, payout timing, you don’t want slow email chains.

BrightFunded advertises 24/7 live support with responses “in seconds,” which is the kind of promise that matters during live trading hours.

Even if you never need it often, knowing help is always available can make the overall experience feel smoother, especially during evaluation.

Global Presence

BrightFunded positions itself as a global operation, not a small local shop.

At the time of writing, BrightFunded lists 27,500+ active traders worldwide and over $11 million paid out, alongside a global team structure.

They also describe multiple offices and a worldwide team of 30+ professionals, which reinforces that they’re building something meant to operate at scale, not a short-term challenge site.

>> Access funded capital via BrightFunded <<

Pros and Cons

Here are the top pros and cons I came up with while reviewing BrightFunded:

Pros

- Clear evaluation rules with no consistency restrictions

- Weekly payouts with fast and reliable processing

- Unlimited time removes pressure from evaluation phases

- Trade2Earn rewards ongoing trading activity and loyalty

- Multiple platforms support different trading styles

Cons

- Strict drawdown limits require disciplined risk management

- Evaluation fee refunded only after specific conditions are met

- Not ideal for inexperienced or impulsive traders

Refund & Cancellation Policy

Refund & Cancellation Policy

BrightFunded treats the evaluation fee as a performance-based cost rather than a traditional subscription.

Once you sign up for an evaluation, don’t expect to get your challenge fee back unless you meet the specific criteria to do so.

That applies to failing the evaluation, breaching risk rules, or canceling your account early.

There are no recurring monthly charges, and once you’ve purchased an evaluation, you’re free to continue until you pass or violate the rules.

In practice, this means you should approach the challenge seriously and view the fee as a business expense, with any refund earned through proper execution rather than guaranteed upfront.

>> Prove your edge with BrightFunded <<

BrightFunded vs Popular Alternatives

As I weigh BrightFunded against other known prop firms, the key differences tend to show up in rules, payout speed, flexibility, and trader experience. Here’s how it compares to three alternatives I’ve reviewed:

FTMO is one of the longest-standing names in prop trading and is often a go-to comparison. It uses a two-step evaluation and a solid scaling plan, and its reputation for reliable payouts is widely cited by active traders.

FTMO typically enforces stricter time limits and more detailed consistency requirements than BrightFunded, which can make it tougher for traders who prefer to set their own pace.

The 5%ers appeals to traders focused on steady, long-term growth with conservative drawdowns and moderate targets.

The program supports incremental scaling, and its structure is seen as friendlier to swing trading styles.

Compared with BrightFunded, The 5%ers is more about slow, consistent performance over time rather than fast payouts and loyalty rewards.

FundedNext has carved out a niche by combining fast payout processing with customizable evaluation paths.

Like BrightFunded, it often promotes quick withdrawals and flexible challenge options, but its profit targets and leverage structures can lean toward high-frequency styles.

Traders who value speed and liquidity may find FundedNext attractive, while those who want a balance of flexibility with discipline may lean toward BrightFunded.

>> Trade bigger accounts with BrightFunded <<

Trade2Earn: BrightFunded’s Loyalty System

Trade2Earn is BrightFunded’s way of rewarding traders for staying active and engaged, not just for passing an evaluation once.

Instead of focusing only on profit milestones, this system assigns value to trading activity itself.

Every trade placed contributes toward earning Trade2Earn points, regardless of whether the position ends in profit or loss.

This method encourages consistent participation and disciplined execution rather than reckless risk-taking to hit short-term goals.

What makes Trade2Earn appealing is how practical the rewards are.

You can redeem points for meaningful advantages inside the ecosystem, such as improved profit splits, reduced profit targets, higher drawdown limits, or even free evaluation accounts.

BrightFunded Reviews & Testimonials

BrightFunded Reviews & Testimonials

I sought out some third-party reviews to back up my assessment of BrightFunded and was happy to discover a 4.4 out of 5 rating on TrustPilot after nearly 500 reviews.

Several of the comments back up quick payments and smooth experiences.

Beyond written reviews, BrightFunded also showcases video testimonials where traders report real payout figures ranging from a few hundred dollars to well over $100,000.

Customer service gets frequent positive mentions, with traders appreciating responsive support and clarity around rules during both evaluation and funded stages.

That said, not all feedback is uniformly glowing; there are isolated complaints about execution nuances and slippage under certain conditions.

Still, the broader trend across independent reviews is that BrightFunded delivers on its core promises, making it a credible and trader-friendly option in the prop firm space.

>> Earn weekly payouts through BrightFunded <<

How Much Does BrightFunded Cost?

BrightFunded uses a one-time evaluation fee model that scales with the account size you choose.

Entry-level plans start as low as €55 for a $5,000 account, while larger options like $25,000, $50,000, $100,000, and up to $200,000 come with higher upfront fees that increase proportionally.

These fees cover the full evaluation process, with no recurring subscriptions or monthly charges once you’re in.

From time to time, BrightFunded runs discounts or promotional offers that lower the entry cost or enhance value, such as reduced pricing or improved challenge terms.

Considering the access to funded capital, weekly payouts, and long-term scaling potential, the pricing is competitive for traders who approach the process seriously and plan to stay active.

Who Is BrightFunded Best For?

BrightFunded is best suited for traders who already have a defined approach and understand the importance of risk control.

No matter where you are on your journey, I think you’ll like the clear drawdown limits and an environment free of time constraints.

This platform also fits traders who are thinking beyond a single challenge. Features like scaling opportunities and Trade2Earn rewards make BrightFunded more attractive for people who plan to stay active and grow over time.

On the other hand, absolute beginners or traders still experimenting with strategy may find the rules unforgiving. BrightFunded works best when discipline is already in place.

Is BrightFunded Worth It?

Is BrightFunded Worth It?

After breaking everything down in this BrightFunded review, the value is clear to me if you’re prepared and have a long-term approach.

The absence of consistency rules, unlimited evaluation time, and clear profit targets allow you to trade without unnecessary pressure.

Weekly payouts and fast processing also make the funded phase quickly come alive, so you’re not having to wait weeks or months for a deposit.

That said, it isn’t designed for shortcuts. Drawdown limits are strict, and the evaluation fee only makes sense if you approach it seriously.

If you treat the challenge like a business expense and focus on consistency, BrightFunded can be a worthwhile option.

>> Build funded trading income with BrightFunded <<

BrightFunded FAQs

How fast are payouts with BrightFunded?

BrightFunded offers weekly payouts, with withdrawal requests typically processed within 24 hours once approved, helping traders access profits without long waiting periods.

Does BrightFunded enforce consistency rules?

No, BrightFunded does not apply consistency rules, allowing traders to trade naturally without daily profit distribution or lot-size restrictions, as long as drawdowns are respected.

Is the evaluation fee refundable?

The evaluation fee is refundable only after specific conditions are met, usually tied to reaching the funded stage and completing an initial successful payout.

Can beginners use BrightFunded successfully?

BrightFunded is better suited for traders with experience and risk discipline, as strict drawdown limits can be challenging for beginners still refining their strategies.

Tags:

Tags: