Artificial intelligence has quickly become one of the most talked-about forces in the market, and many folks have walked away with unprecedented returns.

JC Parets believes something is happening with the boom beneath the surface, and anyone unprepared could get blindsided.

Does his claim actually carry any weight?

In this AI Boom review, I take a close look at his research to determine if we really should be sounding the alarm.

>> Join AI Boom By JC Parets <<

What Is The Primary Trend?

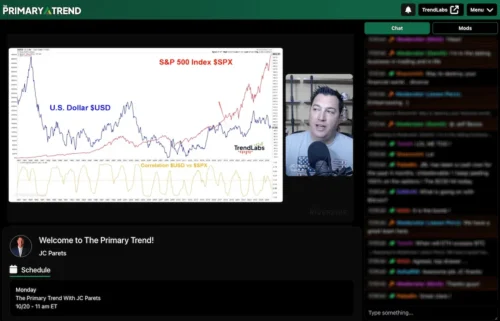

The Primary Trend is JC Parets’ core research service built around one simple idea: markets move in cycles, and price action tells the truth long before headlines do.

Instead of guessing where things should go, the service focuses on identifying where money is actually flowing and staying aligned with those trends while they remain intact.

Members receive ongoing market research that highlights areas of strength, flags emerging opportunities, and calls out when risk starts to rise.

That includes regular written updates, new recommendations added over time, and a model portfolio that shows how ideas fit together in real conditions.

JC also shares timely alerts and live breakdowns where he walks through current setups and explains what he’s watching next, which is a huge win for me.

He’s currently looking into the AI boom, though, so let’s focus our attention there.

>> Start The Primary Trend With JC Parets <<

What Is Inside JC Parets’ “AI Boom” Presentation?

Artificial intelligence has been the easiest story to repeat for months.

JC Parets warns that all that excitement should come with concern. AI has been so high for so long; is there a cliff coming that we’re about to run off of?

On top of that are all the folks late to the party who are wondering if they’ve missed the boat.

The last thing anyone wants is to sink a bunch of money into investments only to watch them plummet.

Is it time to leave AI for greener pastures?

Are We In a Bubble or Not?

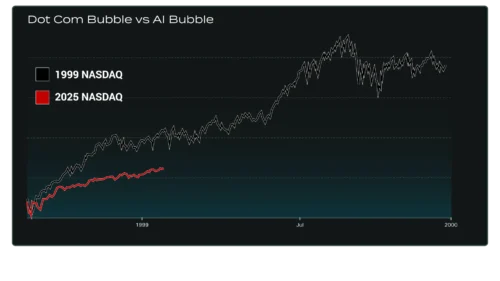

If you’ve been around for a little while, you’ve seen the impact of a bubble burst. First was the dot-com bubble 25 years ago. Then the real estate market went through it in 2008, and I’m guessing you all remember the “everything bubble” shortly after Covid hit.

Sadly, I know people who still haven’t recovered from one (or more of those). If the AI bubble bursts, it could be the worst one yet.

Fortunately, Parets shares that there’s still light at the end of the tunnel. AI hasn’t finished its moment in the sun, and there’s still time to profit.

It’s not speculation, at least from what I gather. He outlines three factors still contributing to the rise that you want to be aware of:

>> Get AI Boom Access Today <<

The Data Doesn’t Lie

AI stocks (among others) are still enjoying a nice rise, and JC says that’s not because of bloat.

His first indicator is lower interest rates, which point to more upside ahead.

On top of that, AI spending hasn’t slowed in the least. Large companies like Google and Microsoft are spending more than ever before, and all that money has to go somewhere.

Parets’ third factor is something he calls the primary trend, which is what he bases a lot of his research on. He has a bit of a secret sauce here, but the main point is that AI’s long-term direction based on these calculations is still going up.

How to Take Advantage of the AI Boom

If JC’s right, now’s an excellent time to participate in the AI boom, whether you’re new or have already been along for the ride.

That said, not every stock out there will get the memo. Knowing where to invest, even now, is key.

The good news is that we have access to Parets and his primary trend signal, which offers rare insight into which companies are set to capitalize on the boom.

You can get immediate access to these recommendations by joining his Primary Trend service, along with a slew of other tools you can put to work for you.

Next up, I’d like to share my research on the platform so you know exactly what you can get out of it.

>> Follow JC Parets AI Boom Strategy <<

AI Boom Review: What Comes With It?

Here’s everything included in JC’s Primary Trend, featuring a close look at the AI boom:

Access to JC’s The Primary Trend

At the center of the membership is access to The Primary Trend, which is built around a simple but important commitment: at least one new recommendation every month.

Each issue introduces a fresh idea JC believes has the potential to benefit from dominant market trends, including fast-moving themes like artificial intelligence.

JC uses a proprietary NOW score to unlock these recommendations, each based on actual data instead of guesswork.

You’re not just handed a name here, either. The research reveals entry and exit points along with why this is a stock you’ll want to look into.

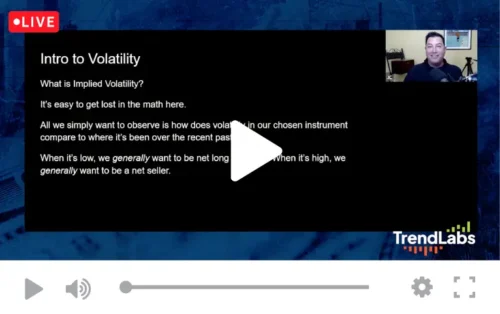

Monthly Sessions with Live Breakdowns and Analysis

The promise here is straightforward: he shares the most important setups he’s found and flags high-probability trades on camera when they trigger.

You’re (virtually) face-to-face with the guru himself, learning by watching through setups and analysis that are hard to glean from a newsletter alone.

If you’re the kind of person who learns faster by seeing how someone reacts to live price action, what gets ignored, what gets attention, and what level actually matters, this is designed to fill that gap.

>> Unlock The Primary Trend Now <<

Access to the NOW Score

The score runs from 0 to 100 and is built from three inputs: trend (is the stock in a clean uptrend across time frames), relative strength (is it outperforming the broader market), and momentum (is the move accelerating or stalling).

Each component gets scored using multiple indicators, then blended into one score that updates in real time.

The big practical use is that it pushes you toward stocks already showing strength instead of hoping a weak chart magically turns around.

The Trading Lab

To me, these feel like educational sessions where he teaches what he’s learned about technical analysis, risk management, and trading psychology, specifically calling out that some of it was learned “the hard way.”

It’s a nice way to hear from someone who’s “been there, done that” so you don’t make the same mistakes, either with Primary Trend or elsewhere.

If you’re joining because you want help navigating a fast cycle without being glued to the screen every day, a Friday rhythm makes sense as another checkpoint to refine your strategy from

>> Try AI Boom By JC Parets <<

The Primary Trend Video Training Course

The language here is very “show, don’t tell”: he says he’ll show you how to spot and trade primary trends using real examples and real setups.

While the primary trend setup is actually quite simple, this is still the best spot to start with the service so you’re not caught off guard.

I admittedly come back and check out the material from time to time so I don’t miss something important, and having real examples to walk through really helps.

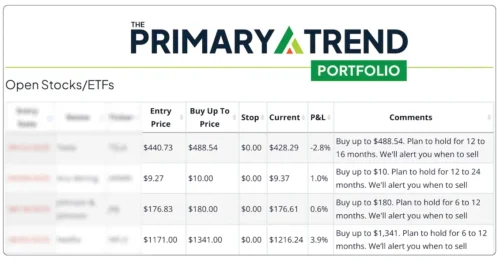

24/7 Access to JC’s Model Portfolio

That sounds basic, but it solves a real problem: most people don’t lose money because they never find ideas; they lose money because they don’t manage the ideas once they’re in.

It’s nice being able to pop in and see all the stocks JC currently watches so you can add them to your own portfolio or keep a close eye on ones you’re interested in.

Instant Access to Best Ideas Vault

Some services keep a library of material that collects dust, so it’s nice to see that JC continuously adds new content here, like his AI boom reports.

Another practical benefit is that you can revisit past ideas, compare how different setups behaved, and pull research when a theme comes back into focus.

It also helps if you join mid-cycle and want to quickly get context on how JC has been thinking about leadership, risk, and sector strength without waiting months for enough new issues to accumulate.

>> Access JC Parets’ Primary Trend Today <<

Updates & Urgent Alerts

So the alert system is built around moments that matter, when it’s time to open a trade, close a trade, or take profits.

Even if you don’t act on every alert, this feature gives you a real-time sense of when JC thinks conditions have shifted enough to require action, not just commentary.

It’s a stress reliever for those of us who don’t live in the markets all the time, knowing that someone is watching primary trend investments so you don’t have to.

Professional U.S.-Based Customer Support

You can call or email Monday through Friday, 9 a.m. to 6 p.m. Eastern, and the team is there to help you get the most out of the membership.

They also include an important boundary: they’re not allowed to give individual investment advice.

The checkout page even lists phone numbers for support and order-by-phone options, plus international numbers, which is useful if you’re outside the U.S. and need help accessing digital delivery.

>> See AI Boom Before Momentum Shifts <<

AI Boom Bonus Reports

Beyond the ongoing research, the AI Boom package includes a set of bonus reports designed to give immediate context, guardrails, and direction:

Bonus Report #1: The 2026 AI Model Portfolio: Five Stocks Set to Skyrocket

Bonus Report #1: The 2026 AI Model Portfolio: Five Stocks Set to Skyrocket

This is the main bonus and the one I’d suggest starting with after you’ve gone through the training course.

Inside, you get a focused five-stock model portfolio built specifically around how JC sees artificial intelligence evolving into 2026.

Rather than casting a wide net, it narrows attention to a small group of names that already show strong trend characteristics, relative strength, and institutional participation.

He explains each stock in terms of why it belongs in the portfolio now, what role it plays, and what would need to change for that view to break down.

Bonus Report #2: Top 3 Mining Stocks for 2026

Bonus Report #2: Top 3 Mining Stocks for 2026

AI isn’t the only trending sector right now. This report shifts attention away from technology and toward a sector many people overlook during AI-driven markets.

Here, JC looks into mining stocks that could benefit from longer-term supply constraints, demand trends, and improving price behavior heading into 2026.

Parets looks at each of the three picks in terms of trend strength, relative performance, and why it stands out from its peers.

It’s the reminder that major market opportunities don’t always come from the loudest narratives, and that diversification across themes can matter more than chasing whatever is getting attention.

>> Join The Primary Trend Today <<

Bonus Report #3: The Toxic Ten: Ten Stocks Set to Crash in 2026

Bonus Report #3: The Toxic Ten: Ten Stocks Set to Crash in 2026

This report is designed as a defensive counterpart to the upside-focused material.

Instead of highlighting winners, JC walks through ten stocks he believes are especially vulnerable heading into 2026 based on weakening trends, deteriorating relative strength, or structural issues in their price behavior.

After all, there’s nothing worse than having returns from a winning pick washed out by a position you kept too long.

Parets spells out early warning signs so you can avoid holding names that look strong on the surface but are already breaking down beneath the surface.

Bonus Report #4: NOW Score Primer

Bonus Report #4: NOW Score Primer

The NOW Score Primer is meant to demystify one of the core tools used throughout the service.

Instead of assuming we will automatically understand the scoring system, this report walks through what the NOW Score measures, why it exists, and how to interpret it in real situations.

JC explains how trend, relative strength, and momentum combine into a single score and what different ranges imply about opportunity and risk.

The emphasis stays practical. This is about knowing when a stock deserves attention and when it’s better left alone.

Having this insight was key for me to really understand the tool and how its ranking system works so I could make accurate assessments.

>> Learn JC Parets’ AI Timing <<

Bonus Report #5: The Primary Trend Handbook

Bonus Report #5: The Primary Trend Handbook

The handbook serves as a foundational guide to JC’s overall approach.

It brings together the core principles behind how he views markets, manages risk, and thinks about timing.

Rather than focusing on any one trade or sector, it explains the mindset and rules that guide decisions across different environments.

Topics like identifying primary trends, respecting market structure, and avoiding emotional reactions are covered in a straightforward, instructional way.

I see this as one more way to look inside JC’s brain and really understand his strategy, a tactic few other services dare to do.

>> Get Primary Trend Insights Now <<

Refund Policy

Refund Policy

The Primary Trend comes with a 30-day money-back guarantee, giving you just about a month to explore the service in real time.

During those 30 days, you can review the monthly issues, follow the model portfolio, read the bonus reports, and see how updates and alerts are handled as markets move.

If you decide the service isn’t the right fit, you can request a full refund within that window, no questions asked.

While 30 days is ample time to draw a conclusion about the service, it does feel a little on the short side.

>> Act On AI Boom With JC Parets <<

Pros and Cons

After exploring all that this AI Boom bundle can do, here are my top pros and cons:

Pros

- Access to the Primary Trend newsletter

- One new recommendation every month

- Live monthly market breakdowns

- Real-time alerts during market shifts

- Transparent model portfolio access

- Practical tools like NOW Score

- Backed by JC’s 30-Day Guarantee

- Multiple bonus reports included

- Tons of educational support

Cons

- Requires active attention from members

- Technical analysis can feel a bit heavy

>> Discover AI Boom With JC Parets <<

Track Record and Past Performance

JC is no slouch when it comes to naming stocks, and his track record backs that up.

He points to calling Nvidia as far back as 2017, long before artificial intelligence became a mainstream theme, with the stock climbing as much as 3,852% from that period.

More recently, his research highlighted Meta Platforms ahead of a 217% advance, IONQ before an 824% surge, and AI infrastructure firm Vertiv prior to a move of more than 390%.

He also points to lesser-known names like Celestica, which climbed roughly 1,274%, and established players such as Broadcom, which rallied around 334%.

While no service hits every move perfectly, these examples show a consistent pattern: focusing on trend strength and timing rather than reacting after momentum is obvious.

>> Join JC Parets’ Market Timing Edge <<

How Much Does AI Boom by JC Parets Cost?

Right now, AI Boom by JC Parets gives you two clear ways to access The Primary Trend, depending on how much commitment you want up front.

The shorter option is a 3-month subscription priced at $49, which lets you test the service through multiple updates, alerts, and live sessions without locking into a long-term plan.

After those three months, the subscription renews at $99 unless you cancel beforehand.

For those who already feel aligned with JC’s approach, there’s also a full one-year option.

This plan is currently discounted to $297, reduced from the regular $499 price, giving you a $200 instant savings.

>> Start JC Parets Trend Research <<

Is AI Boom by JC Parets Worth It?

Is AI Boom by JC Parets Worth It?

After going through everything, this AI Boom review offers amazing insight into the artificial intelligence craze that I don’t think you’ll want to miss.

I thoroughly enjoyed JC’s take on AI’s positioning and the points he makes about room for additional growth.

AI may be all the rage right now, but it’s equally exciting to know that the service follows other major trends, and that’s where The Primary Trend really earns its keep.

The combination of regular research, real-time alerts, and tools like the NOW Score makes the service feel practical rather than theoretical.

Plus, the currently discounted rate and money-back guarantee keep the barrier to entry really low.

If you don’t want to miss out on what’s happening with AI, this AI Boom bundle is definitely worth a closer look.

Don’t wait any longer than you have to though, as even this trend won’t last forever.

Tags:

Tags: