A quiet policy shift tied to U.S. mineral security may be positioning a handful of overlooked companies for outsized attention, far from the usual headlines.

Trump’s Chosen Few centers on a single executive action and its possible downstream effects, cutting through short-term market noise to question how serious the push for American resources really is.

In this Trump’s Chosen Few review, I examine Angel Publishing’s thesis to see whether the case for domestic resource independence holds up under scrutiny and how to make it work for you.

>> Get Brian Hicks’ Trump’s Chosen Few <<

Who is Brian Hicks?

He is the founder of Angel Publishing, a firm he started after recognizing that many of the biggest financial opportunities are born outside traditional Wall Street analysis.

Hicks’ background is rooted in macroeconomic research and financial writing rather than trading floors, which shaped his ability to focus on long-term structural themes.

Over the years, he has overseen teams of analysts covering energy, natural resources, geopolitics, and alternative assets.

His role today is largely editorial and strategic, setting research direction and framing complex government actions in plain language so readers can understand why certain moments matter before markets fully react.

Is Brian Hicks Legit?

Yes, and his credibility comes from being early and being right on big structural shifts.

Brian Hicks built Angel Publishing into a multi-million-subscriber research business by identifying policy and macro trends before they entered mainstream discussion.

He warned readers about systemic risk ahead of the 2008 financial crisis, highlighted Bitcoin years before institutional adoption, and consistently focused on U.S. energy and resource themes long before supply-chain security became a political priority.

Hicks has authored multiple investment books, published thousands of long-form research pieces, and his analysis has been cited across alternative financial media for more than two decades.

What sets him apart is not one lucky call but a repeatable ability to spot government-driven shifts early and explain their financial consequences clearly, which is exactly the skill set this idea relies on.

>> Access Brian Hicks’ Mining Play Now <<

What Is Inside Angel Publishing’s Trump’s Chosen Few Presentation?

Demand for lithium, copper, uranium, gold, and antimony has climbed in recent years, yet domestic supply lagged while foreign dependence has grown.

These materials sit at the center of essential technologies, from our electronics to infrastructure and defense systems.

It’s been a challenge to access them up to this point due to government red tape and increasing tension with foreign powers, but word on the street is that’s all about to change.

For us, that means the timing here is key to taking advantage of a shift that few people see coming.

>> Unlock Trump’s Chosen Few Research <<

Why the Old System Finally Hit a Wall

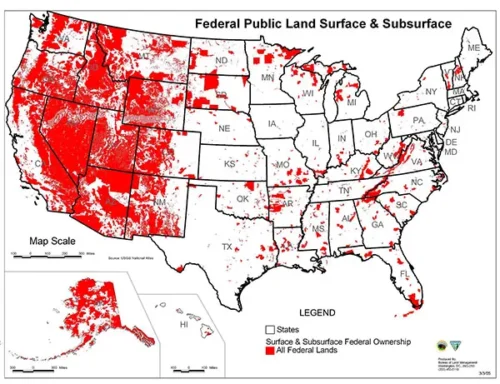

This problem was never about a lack of resources.

Viable projects stayed undervalued simply because nothing appeared to be happening. Meanwhile, reliance on overseas producers increased costs and weakened control over critical inputs.

As global supply chains tightened, that dependency became harder to ignore.

That’s bad from an investment standpoint alone, but it clearly impedes our ability to get these crucial materials in a timely manner.

If other countries decide to stop sending us materials, it could be all but impossible to build products that we rely on nowadays to function.

Something had to be done, and that shift appears to be happening now.

Digging Into a New Initiative

Love him or not, President Trump recently signed a new executive order to free up a massive swath of resources right under our feet.

The White House follows up with ten projects granted FAST-41 status to push quickly through approval processes while getting billions in capital support.

All those initiatives once buried in bureaucracy can now see the light of day, and it looks like we’ll see them very quickly.

This isn’t theoretical, either – the Thacker Pass lithium project in Nevada got its permits in under three months.

Money’s moving quickly, and you definitely don’t want to miss out on where it’s going.

>> Access Brian Hicks’ Mining Research <<

Turning Policy Into a Measurable Edge

Not every mining company’s going to see some of that $100 trillion wealth transfer, so knowing just how to move on this dramatic shift is key.

That’s where Angel Publishing comes in. They’ve done the hard work of locating stocks they’re confident will benefit most from Trump’s mining push.

The team calls these “Trump’s Chosen Few”, and they’re aligned with the government for this fast-tracking that should push them into the spotlight.

You can get the names of these companies and the full playbook by grabbing this Trump’s Chosen Few bundle available for a short time.

Next, let’s look at everything included.

>> Secure Trump’s Chosen Few Today <<

Trump’s Chosen Few Review: What Comes With It?

Check out the reports you’ll receive for adding Trump’s Chosen Few to your repertoire:

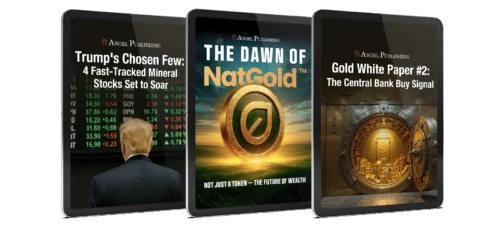

Featured Report: Trump’s Chosen Few: 4 Fast-Tracked Mineral Stocks Set to Soar

Featured Report: Trump’s Chosen Few: 4 Fast-Tracked Mineral Stocks Set to Soar

This featured report breaks down the Trump Administration’s domestic mining focus and why it’s something you want to listen to.

Inside, you’ll learn about four specific U.S.-based mining companies, all trading under $15, that are directly tied to projects granted FAST-41 fast-track status.

Each one pulls from a unique niche, tapping into stockpiles of precious metals and rare earths in our own soil.

I don’t want to tease too much, but two of them are big lithium discoveries that could make big waves in electric vehicles.

The other companies lean heavily into defense and AI opportunities that are set to explode as these projects grow.

Not only do you get the names and ticker symbols of these ventures here, you also get clear explanations on why each one looks like a solid investment as U.S. mining goes full swing.

>> Follow Brian Hicks’ Mining Blueprint <<

Trump’s Chosen Few Bonus Reports

You’ll also get the follow bonus materials if you snag that featured report right now:

Bonus #1: The Dawn of NatGold

This bonus steps outside traditional mining stocks and looks at a new way gold exposure could evolve.

The Dawn of NatGold introduces the idea of tokenized gold backed by certified, unmined U.S. reserves.

A somewhat new concept, NatGold represents real gold still in the ground that’s carefully recorded on the blockchain.

By tokenizing those reserves, NatGold aims to create a new class of digital gold asset that blends scarcity with modern liquidity.

I admit that it sounds a bit far-fetched, but this report shows how it all works – and why Big Tech already has its eye on it.

It’s really appealing because it’s like Bitcoin but has ties to actual assets that many digital tokens lack.

Bonus #2: Gold White Paper #2 – The Central Bank Buy Signal

The other bonus takes a macro view of the gold market and all the hangups companies face with mining operations.

Declining mine supply, rising production costs, and long permitting delays have tightened the physical gold market.

Add in scarcity to broader forces like growing U.S. debt, de-dollarization, and shifts in global reserve strategy, and you’ll see why gold is such a hot commodity right now.

Because of these red flags, banks are already scooping up gold like it’s going out of style.

Inside, you’ll see why current conditions parallel some of the bull markets we’ve seen that generated big wealth for those prepared, and how you can tap into that same potential this time around.

>> Don’t Miss Trump’s Chosen Few <<

Refund Policy

Refund Policy

Because this is a one-time bundle and not any sort of subscription package, Angel Publishing isn’t allowing any refunds.

That makes perfect sense to me. Otherwise, folks would buy the content, read through it, and return it, which simply wouldn’t be fair.

Just keep that in mind when you make your purchase, since this is different than a lot of other bundles I review.

>> Explore Brian Hicks’ Resource Strategy <<

Pros and Cons

After reviewing the service in full, here are our top pros and cons at a glance.

Pros

- Clear focus on U.S. mineral security

- FAST-41 fast-tracked project research

- Targets four sub-$15 mining stocks

- Lines up with current government initiatives

- Comes with two bonus reports

- Special introductory price

Cons

- Narrow theme, limited diversification

- Final sale, no refund option

>> Act On Trump’s Chosen Few Today <<

How Much Does Trump’s Chosen Few Cost?

Trump’s Chosen Few is a one-time research package rather than a recurring subscription.

The price at the time of this review is $99, which grants immediate access to the full special report along with both bonus reports.

There are no monthly or annual renewal fees attached to this offer, which sets it apart from most Angel Publishing services that operate on a subscription model.

Reports like these usually sell for significantly higher costs on their own, so this is clearly a limited-time promotional price.

>> Learn From Brian Hicks’ Mining Thesis <<

Is Trump’s Chosen Few Worth It?

Is Trump’s Chosen Few Worth It?

After digging into the research, Trump’s Chosen Few definitely scratches the domestic mining itch.

It’s clear that the government believes we need to tap into domestic resources to remain a major world player, and this is one of the best ways I’ve seen to access that sector.

The fact that you’re getting three laser-focused reports for one low price is a huge win too. There’s no sorting through newsletters that may or may not land.

If you’re comfortable with a narrow thesis and understand that outcomes depend on how quickly government actions translate into real approvals, the value is there.

It won’t support your investment plans on its own, but it’s a solid supplement to other areas you’re pursuing.

I’d definitely settle in here if you’re looking to capitalize on major mining moves within our borders before it’s too late.

Tags:

Tags: