With the explosion of artificial intelligence and robotics, finding the right tech investments early could be the difference between financial freedom and missed opportunity.

That’s exactly what Luke Lango aims to help readers achieve with his flagship advisory, Innovation Investor.

In this comprehensive Innovation Investor review, I’ll introduce you to Lango’s latest message and whether the hype around Elon Musk’s Optimus AI 2.0 play is worth your attention.

>> Join Innovation Investor Today at A Special Deal <<

What Is Innovation Investor?

Innovation Investor is a monthly investment research service and newsletter led by Luke Lango and published by InvestorPlace.

It features Lango’s latest research, analysis, and stock picks, and is built around the core principle of identifying emerging tech trends early and capitalizing on them before they hit the mainstream.

The focus is on transformative industries like artificial intelligence, robotics, clean energy, and biotechnology.

What differentiated Innovation Investor for me from typical stock newsletters is the emphasis on “venture-style” research.

Luke dives deep into companies’ fundamentals, technological innovations, market position, leadership quality, and potential catalysts.

He shares his findings via monthly newsletter and a stack of tools designed to set you up for success.

Innovation Investor’s Strategy & Methodology

The service’s investment strategy ranges from moderate to aggressive on the risk-reward spectrum, and it primarily focuses on mid to large-cap stocks, although he sometimes recommends small-cap stocks as well.

It is tailored for readers who are eager to ride major innovation waves, especially those who may have missed out on early gains in companies like Tesla, Shopify, and Nvidia.

And with each recommendation, Luke not only shares what to buy but also outlines why the company matters in the broader narrative of disruptive change.

We’ll get into the nitty-gritty of the service in a moment, but I first want to take a closer look at our guru.

Who Is Luke Lango?

Luke Lango is a former venture capitalist with a passion for all things tech.

This led him into a ten-year career in Silicon Valley, where Luke was an active part of a range of start-up ventures.

He developed a vast network of big-name contacts over his years as a tech analyst, and he has unique insights into many tech-focused growth stocks as a result.

Currently, he works as a senior investment analyst with InvestorPlace, one of America’s most respected investment research firms and the publisher of his Innovation Investor newsletter.

Luke Lango is best known for his legendary ability to hone in on game-changing growth stocks and super trends, and he has earned huge praise from his followers over the years.

He’s since built a large following through his work at InvestorPlace, where he manages multiple services, including Innovation Investor, Early Stage Investor, and Exponential Growth Report.

Is Luke Lango Legit?

Luke Lango has a deep understanding of the factors that move markets, and his knack for spotting trends has made him a market legend.

There’s no disputing that Luke Lango is legit. His background in tech startups offers him a unique perspective in the industry compared to many of his peers.

His past performance includes numerous recommendations that have achieved gains of over 1,000%, including well-known winners like AMD, Tesla, and NIO.

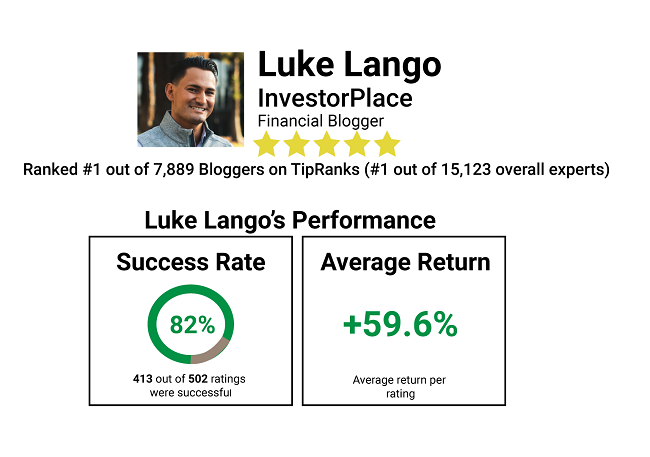

In 2020, TipRanks, a community of more than 15,000 investing experts, named Luke as its “#1 Stock Picker” for the year, cementing his status as a leading growth stocks guru.

As I mentioned earlier, he picked many breakout opportunities—including AMD, Shopify, and Tesla—well before the broader market caught on.

Lango is a smart analyst with a finger on the pulse of the market, and he has everything I look for in a guru.

He has an impressive, analytical mind and a penchant for picking good stocks, so you know you’re in great hands if you decide to get started with Innovation Investor.

Elon Musk’s AI 2.0 Rollout: The Wealth Shift Few Are Ready For

According to Luke Lango, something monumental is about to hit the tech world, and hardly anyone is paying attention.

He believes that Elon Musk is about to unveil Optimus, a humanoid robot that marks the beginning of what Lango calls “AI 2.0.”

My mind immediately went to a science-fiction movie, but this is bona fide reality.

What makes this moment really powerful is that it’s not just about robotics, but a new phase of AI that moves from behind-the-scenes code to machines that can walk, think, and act.

Luke believes that the few who take notice and move quickly could be on the right side of the next massive wealth creation wave.

Why AI 2.0 Is Bigger Than Software

AI 1.0 gave us smart algorithms and chatbots. AI 2.0, however, takes that intelligence and puts it into hardware. We’re talking robots that can do physical labor, respond in real time, and work around the clock.

Lango zeroes in on Musk’s Optimus robot as the poster child for this shift. The technology is already real, with working prototypes being demonstrated, and the infrastructure behind it is rapidly scaling.

What’s shocking is that most investors are still focused on software applications like ChatGPT, while Luke says the true upside lies in the hardware that makes AI physical.

These machines won’t just supplement labor; they’ll replace repetitive tasks in warehouses, retail, and even homes.

And behind all that progress is a need for powerful, custom-built chips.

The Hidden Gatekeeper of a Trillion-Dollar Trend

Every Optimus robot, and virtually every future robot like it, will rely on one thing: the chips that give it a brain.

This is where Lango sees the real investment opportunity. He hints at a tiny company that’s producing these specialized chips, which could be to robotics what Nvidia became to graphics processing.

The demand for these components could skyrocket once the robots go mainstream, and those of us ready for the shift could stand to make game-changing gains.

Lango paints this not just as a smart investment idea, but as a rare second chance to ride the kind of innovation wave we saw with Tesla or Apple.

If you’ve ever wished you could go back in time and buy early, this sure feels like your moment.

How You Can Ride the Wave Before the Surge

The cool thing is that you don’t need to be a tech expert or a Wall Street insider to act on this opportunity.

Luke Lango has laid out a clear roadmap that anyone can follow, especially if you’re someone who wants a front-row seat to the next big disruption.

By joining Innovation Investor, you’ll learn the exact steps needed to position yourself for what could be one of the biggest tech booms of the decade.

Next up, I’d like to unpack the service in detail so you can see everything that comes with a membership.

>> Cash in on the “everything app” revolution—sign up today! <<

Innovation Investor Review: What Comes With the Optimus Deal?

The latest Innovation Investor deal includes a treasure trove of in-depth research, stock picks, and more:

6 Months Of Innovation Investor Monthly Newsletter

Each month, I receive an in-depth research issue from Luke Lango with new research from the guru and his team, a brand new stock recommendation, along with expert analysis of the latest market conditions, and other valuable insights.

You’re getting at least one promising stock pick with each new send, so you’ll consistently have something new to explore.

What piqued my interest here was the level of detail you receive. Luke walks readers through the company’s market opportunity and key components like its innovation pipeline, leadership team, and financials.

I always worry about dry content, but Lango keeps his info light while still conveying a clear message.

Model Portfolio

Like most research services, Innovation Investor maintains a model portfolio that you can jump into at any time to follow along with the latest picks.

I’ll come here often to see the list of active stock picks, along with price points, and current performance.

This is the perfect place to get a bird’s-eye view of every Luke Lango stock recommendation, and, although it’s not a particularly unique feature, the dashboard is exceptionally functional and user-friendly.

All in all, the model portfolio is an undeniably useful tool, and it makes it much easier to follow the latest trade recommendations.

Trade Alerts

Trade alerts are your ticket to staying informed whenever you need to take action on a portfolio recommendation.

This works exceptionally well for me, so I don’t have to stay glued to my computer or wait a month for updates.

Instead, I get immediate alerts via email every time a buying or selling opportunity emerges, especially if a catalyst is approaching or a major market shift could impact a position.

Plus, Luke doesn’t just tell you to buy or sell, he explains why. The alerts often include a mini deep-dive on what’s changed, whether that’s an earnings surprise, a new product launch, or industry disruption.

Member Portal

As a subscriber, you’re also handed the keys to a secure, easy-to-navigate member portal that acts as the central hub of the Innovation Investor experience.

Whether you’re someone who likes to check in daily or prefers to review everything on weekends, the portal makes it convenient to stay informed at your own pace.

It houses every monthly issue, past stock recommendations, current holdings in the model portfolio, and all trade alerts.

What I personally liked is how beginner-friendly the layout is. Even if you’re new to stock research or subscription services, you won’t feel overwhelmed.

You also get direct access to all the bonus reports, including those focused on Elon Musk’s AI rollout, right inside the portal.

Complimentary 6-Month Subscription to TradeStops Basic

Signing up right now also nets you a complimentary 6-month subscription to TradeStops Basic.

If you’ve ever struggled with knowing when to sell a stock or how to set proper exit points, this tool could become your new best friend.

TradeStops is designed to help you manage your portfolio with less stress by using sophisticated algorithms to track data important to you based on your personal risk tolerance.

It took almost no time to link to my brokerage account, and now it monitors my positions in real time.

Considering TradeStops alone usually costs more than the discounted Innovation Investor package, getting it for free is a significant value add.

>> Explore the opportunities with Innovation Investor today! <<

Luke Lango’s Innovation Investor Bonus Reports

The latest deal from Luke Lango includes an impressive collection of bonus research reports and other extras that I got to play with as well:

The Optimus Backdoor: How to Get In on Elon’s New AI 2.0

The Optimus Backdoor is your private doorway into the AI 2.0 boom before the crowd catches on.

At the heart of the report is one small, little-known company that Luke believes makes the high-performance chips designed to power Elon Musk’s Optimus robots.

Inside, you’ll see the science behind it all as Luke explains how their chips are custom-designed for high-efficiency AI processing and are already being tested in robotics applications.

While it’s full of technical data to help you assess the opportunity, Lango does an amazing job of keeping it all down to earth.

I could see this venture being today’s version of Nvidia, primed for explosive growth as the AI revolution accelerates.

In this report, Luke shares three additional robotics companies poised to benefit from the rise of automation.

Forget Optimus, here Lango explores the broader ecosystem supporting the AI and robotics explosion.

If the chipmaker in the first report is the brain behind AI 2.0, the companies in The Supporting Cast are the hands and legs that will bring the technology into everyday use.

As before, the guru lays out his picks in a clear but concise fashion that you can invest in or poke holes in as you see fit.

The AI Melt-Up Playbook: 5 AI Software Companies for 1,000%+ Gains

This final bonus report takes a fascinating turn into what Luke Lango calls the “invisible layer” of the AI revolution: the software companies powering productivity and transformation from the inside out.

Think logistics automation, dynamic pricing models, virtual staffing, and even AI-generated content.

The focus here is on five under-the-radar software firms that could mirror the kind of transformation Netflix went through in 2007 when it pivoted to streaming.

Reading through the data, these companies are already profitable or scaling fast, providing a great onramp for us to take.

I appreciated where Luke lays out real-world scenarios where these firms are already making an impact instead of just sharing theory.

90-Day 100% Satisfaction Guarantee

All new memberships come with a 90-day satisfaction guarantee, so you have roughly three months to “test drive” it.

If you feel the service isn’t a good fit, you can get a refund on the subscription cost.

Considering that the industry standard for similar services is about a month, this is a huge step up from the norm.

It might also provide a long enough window to see some investment ideas through to their conclusion, which a month usually does not afford.

You’ll also get to keep all the bonus reports and materials you received. This makes trying the service virtually risk-free and a smart move for anyone even remotely curious.

Overall, I’m impressed with this refund policy. It shows the team stands by its work.

>> Take advantage of Luke’s guarantee NOW. <<

Strengths & Weaknesses of Innovation Investor

Innovation Investor has a lot to offer, but there are a few drawbacks to consider.

| Category | Details |

|---|---|

| Pros |

• Great price with 85% discount • Excellent 90-day refund window • Investment strategy focuses on high-upside growth stocks • New stock picks in every special report • Daily notes on the market • Easy-to-use model portfolio for tracking stocks • 4 research reports featuring several promising opportunities • Legendary guru research from Luke Lango • Respected publisher in InvestorPlace Media • Features in-depth artificial intelligence research |

| Cons |

• No community chat room or message boards • Doesn’t cover options or shorts |

Who Should Use Innovation Investor?

Innovation Investor sits best with folks in search of ground-floor tech opportunities.

As the name indicates, Luke targets innovative companies, many of which come from the tech sector, so the service is a good fit if you favor a growth investment philosophy.

The service is also extremely affordable, so it’s an excellent entry-level option for anyone looking to get a leg up in the stock market at minimal cost.

I find Luke’s style fresh and engaging, and he has no trouble keeping things interesting from month to month.

Ultimately, Innovation Investor appeals to a broad audience, and I’d suggest it to beginners, market veterans, tech fans, and growth enthusiasts at the very least.

Innovation Investor Historical Performance

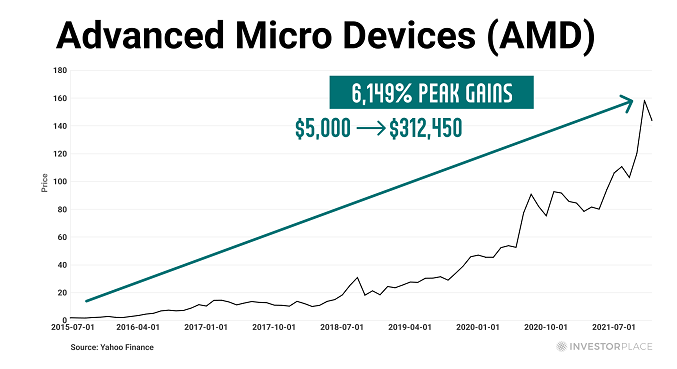

Over the years, Luke has shown a knack for hitting home runs in the stock market.

Let’s look at some of his past picks across his services.

Here’s Advanced Micro Devices (AMD), which produced the opportunity for a gain as high as 6,149% following his recommendation.

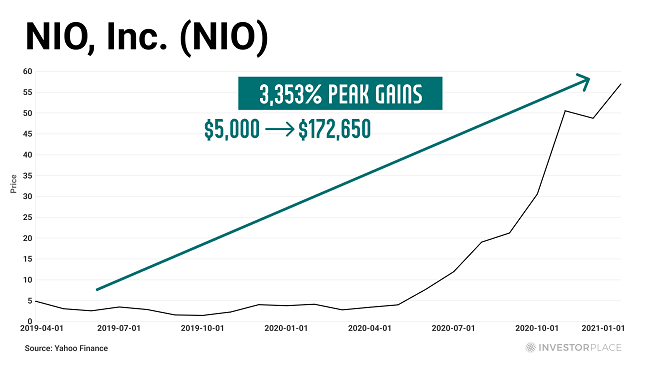

Another one of his most notable picks is NIO, a China-based EV stock, which soared as high as 3,353% after he made his call.

That’s only a small sampling of his winning picks, but you get the idea.

He’s a highly rated guru for a reason.

It’s important to remember, however, that past permanence is not an indicator of future results.

Innovation Investor Reviews by Real Users

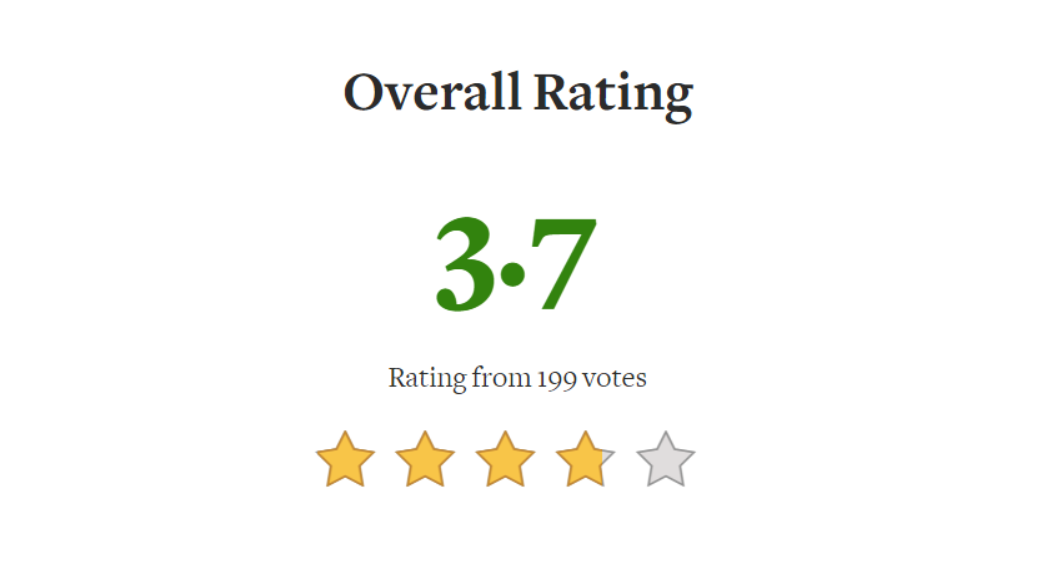

As I write this, Luke Lango’s Innovation Investor has earned an overall rating of 3.5/5 on Stock Gumshoe.

This is out of over 200 reviews, which is a solid sample size in the investment research space.

There is one caveat, however. These Innovation Investor reviews come from a third-party review site, so I cannot verify whether these ratings come from genuine customers.

That said, it’s a good sign that the service appears to have earned a positive reception since its launch.

>> Find out why so many trust Luke Lango’s insights. <<

Innovation Investor Pricing & Plans

A one-year subscription to Innovation Investor typically costs $299, but the team is offering a massive discount along with Elon Musk’s AI 2.0 opportunity.

For a limited time, you can join with a one-year membership for just $49. At that rate, you’re saving roughly 85% on the full sticker price.

With the discount, your average cost comes out to less than $2 per week.

In return, the membership includes the monthly newsletter, access to the model portfolio, all three bonus reports, and a complimentary 6-month subscription to TradeStops Basic, a portfolio tracking tool that helps set smart exit strategies.

Given the depth of content and the bonuses included, it’s one of the better deals in the financial research world.

Is Innovation Investor Worth It?

After a thorough Innovation Investor review, I can confidently say this is a great newsletter, and it’s an excellent value even at its full price of $299.

That said, I’m happy to take the 85% discount that makes this service a downright bargain at just $49.

The deal includes a full membership, alerts, TradeStops access, and the gamut of bonus features.

Luke Lango is an absolute legend with incredible stock-picking ideas. I’ve perused his research on many occasions, and I’m always impressed with his insights and analysis.

He has shown how to spot winners before the crowd, and his AI 2.0 thesis tied to Elon Musk’s Optimus robot is timely and compelling.

Best of all, your membership is covered with a 90-day satisfaction guarantee, so you can get your money back at any time during the first three months of your subscription if you’re unsatisfied.

Luke is one of the most talented young gurus in the game today, and I appreciate his research insights and relatable writing style.

If you’re looking for promising growth stocks from a rock-star guru, you can’t go wrong with Luke Lango and Innovation Investor.

>> That’s it for my review. Sign up for 60% off TODAY! <<

Innovation Investor Frequently Asked Questions (FAQ)

Is Innovation Investor suitable for beginners with limited experience in tech or growth investing?

Yes — although the service focuses heavily on cutting-edge technology trends, Luke Lango explains each recommendation using beginner-friendly language. He breaks down the catalysts, the business model, and the long-term potential in a way that doesn’t require a finance background. Beginners may still need to get comfortable with volatility, but Innovation Investor is structured to help new investors learn as they follow along.

What types of innovation sectors does Luke Lango emphasize most in Innovation Investor?

Lango consistently focuses on emerging technologies with multi-decade growth runways. The sectors he highlights most include artificial intelligence, robotics, gene sequencing, autonomous systems, green energy innovation, semiconductor technology, and digital infrastructure. The newsletter shifts sector weightings as new themes emerge, but the central focus always stays on disruptive, high-growth industries.

Does Innovation Investor help subscribers understand when to sell a position?

Yes. Each recommended stock includes ongoing guidance, including sell alerts when fundamentals break down, price targets are reached, or better opportunities emerge. Lango also uses volatility-based risk guidance, helping subscribers avoid emotionally driven exits. This is especially valuable in innovation sectors that tend to experience large swings.

How long is the typical holding period for Innovation Investor recommendations?

Innovation Investor is designed around multi-year holding periods, not short-term trades. Many of Lango’s picks are based on transformational technology cycles that may take three to seven years to fully mature. While some shorter-term adjustments occur, most positions are intended to be held through market noise to capture long-term innovation trends.

Can Innovation Investor be used alongside traditional, income-focused portfolios?

Absolutely. Many subscribers pair Innovation Investor with dividend or conservative portfolios to balance risk. Lango’s approach is specifically framed as a growth engine—a way to introduce high-innovation exposure without replacing a core retirement or income strategy. It complements rather than competes with more conservative asset allocations.

How transparent is Luke Lango about the performance of his stock picks?

Innovation Investor maintains a transparent model portfolio where subscribers can see each open and closed recommendation, including winners and losers. Lango provides updates on performance, new developments in each company, and whether he’s adjusting conviction levels. This visibility helps readers understand not only returns but the reasoning behind portfolio changes.

Does Innovation Investor include any educational content beyond stock picks?

Yes — subscribers receive ongoing market commentary, technology breakdowns, and explainers that clarify how different innovation trends work. Lango often dives into the science, engineering, or economics behind emerging industries, which helps investors understand both the “why” and the “how” behind each recommendation.

Is Innovation Investor focused on U.S. stocks only, or does it include global opportunities?

While the portfolio is primarily focused on U.S. equities, Lango does occasionally highlight global companies involved in major innovation cycles such as semiconductors, AI hardware, or biotech. However, international exposure is usually captured indirectly through U.S.-listed ADRs or companies with global revenue footprints.

What makes Luke Lango’s research style different from other growth-focused analysts?

Lango blends traditional financial analysis with an engineering-driven approach rooted in understanding how breakthrough technologies scale. He often focuses on adoption curves, cost declines, and innovation diffusion models rather than purely valuation metrics. This gives his research a forward-looking, thematic structure that distinguishes him from analysts who rely primarily on traditional technical or fundamental signals.

Does Innovation Investor offer guidance during major market downturns?

Yes. Lango often publishes special updates during high-volatility periods, outlining which positions remain strong, which may need trimming, and where new opportunities might emerge. Because innovation stocks can swing widely during corrections, this real-time guidance helps subscribers avoid panic decisions and evaluate positions using data rather than fear.

Tags:

Tags: