Finding a reliable trading automation tool that actually simplifies technical analysis isn’t easy.

Most platforms either overwhelm you with features or fall short when you need precision.

That’s where TrendSpider stands out. It combines smart AI tools with advanced charting, backtesting, and scanning, all designed to help you act faster and trade smarter.

This power-packed toolset looks legit, but can it really transform how you make decisions in this uncertain investment environment?

Here’s my honest TrendSpider review for 2025.

What Is TrendSpider?

TrendSpider is an automated trading platform championed by Dan Ushman and Ruslan Lagutin, who founded the platform in 2016.

It is an advanced trading automation and analysis platform built to help traders make faster, smarter decisions using data, not guesswork.

It acts like an always-on market analyst, one that never sleeps.

The software brings together everything serious users need under one roof: AI-driven charting, strategy backtesting, real-time market scanning, smart alerts, and automated trendline detection.

What makes it stand out is how it streamlines technical analysis. Instead of manually drawing support and resistance or scanning hundreds of charts, TrendSpider automates it all, saving hours of screen time.

It’s designed for anyone who wants to trade more efficiently, reduce human error, find opportunities before the crowd spots them, and stay ahead of the market.

Is TrendSpider Legit?

Yes, TrendSpider is a fully legitimate and well-established trading automation platform.

Founded in 2016 and headquartered in Illinois, it’s led by CEO Dan Ushman and a team of experienced developers and market analysts.

The company holds an A+ BBB rating, operates transparently, and serves thousands of active users worldwide.

What gives it credibility is its proven record, consistent updates, excellent customer support, and real user feedback across sites like Trustpilot, where it averages above 4.7 stars.

Unlike many charting tools that rely on marketing hype, TrendSpider focuses on practical innovation, features like algorithmic detection and automation, no-code backtesting, and real-time market scanning that traders actually use.

It’s trusted by both retail and professional users, and its clear privacy, billing, and refund policies further reinforce that TrendSpider is a reliable, secure, and authentic platform.

How to Use TrendSpider

TrendSpider is used to analyze forex, stocks, and crypto.

What makes the platform so easy-to-use thanks to AI-assisted tools and automation..

TrendSpider uses pre-defined logic and AI-assisted tools (like Automated Trendlines and Raindrop Charts)

You’re able to use automated and cloud-based tools with their charts, reducing grunt work, minimizing biases and human errors while improving the consistency of your chart analysis.

You can access TrendSpider charts and utilize their analysis software from anywhere with TrendSpider Mobile.

The app allows you to check your charts from remote locations if you’re constantly on the go.

Automated technical analysis is powered by algorithmic detecetion (e.g. automated trendlines, patterns).

You won’t be drawing trendlines tediously on your own as their smart charts do all the work for you, helping you eliminate the guesswork from your trading.

The platform provides objective automated analysis so you can boost the quality of your trade decisions.

The backtesting tool is particularly helpful as you can test technical analysis events, seeing how they’d perform in past scenarios to determine their current potential.

You can also use moving averages to boost your trading.

These technical indicators represent the average price over a particular time period.

You can use it for bullish and bearish bias, confirmation for other technical patterns, and support/resistance.

In case you need added guidance to use TrendSpider, they regularly make blog posts detailing every aspect of chart and technical analysis as well as ongoing market trends, platform updates, education, and much more.

Can You Trade from TrendSpider?

While TrendSpider isn’t a brokerage platform itself, trading execution happens via an integration with SignalStack.

Currently, the platform supports a long list of integrations with brokers like TradeStation and Interactive Brokers. If your broker of choice isn’t on the list, you can request a connection.

For anyone serious about automation, this hybrid model is appealing, you get the analytical power of TrendSpider combined with the execution reliability of your broker.

It’s not “push-button trading,” but it comes close, offering a safer and smarter bridge between strategy and action.

>> Already sold on TrendSpider? Click HERE to sign up for an account today! <<

TrendSpider Review: What’s Included?

Here are the top features I uncovered during my TrendSpider review:

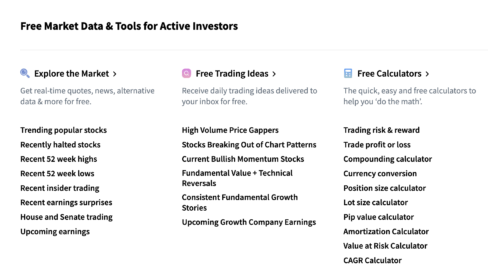

TrendSpider Review: Real-Time Data

TrendSpider provides real-time market data across major asset classes including stocks, ETFs, crypto, forex, and futures.

Data comes from trusted institutional-grade feeds, either in real-time or with a slight delay depending on the asset. You can switch seamlessly between live intraday data and extended historical data for backtesting or long-term research.

The platform’s multi-timeframe data engine updates charts instantly, meaning if you’re tracking a stock on the 15-minute and daily chart simultaneously, both adjust in real time.

For crypto and equities, TrendSpider delivers streaming data directly into your dashboard. Futures data is also available but may require exchange add-ons.

This depth of access makes TrendSpider ideal for traders who rely on precision timing and fast data flow. It ensures that when you act on a signal, it’s based on live market information, not delayed or outdated feeds like many cheaper tools offer.

TrendSpider Review: Charts & Analysis

The charting experience is where TrendSpider really shines. You can create fully customizable layouts, layer multiple indicators, and toggle between standard or Raindrop Charts, a proprietary visualization that combines price and volume in a single candle.

The platform allows for multi-timeframe analysis, letting you overlay data from different time horizons on a single chart. This means you can see how short-term signals line up with long-term trends without switching windows.

More importantly, the system automatically identifies trendlines, Fibonacci levels, and candlestick patterns using algorithmic analysis. This eliminates the human bias that often comes with manual drawing. You can easily adjust or refine the AI’s analysis, but most users find its accuracy surprisingly high.

For traders who depend on technical precision, TrendSpider’s visual clarity and data responsiveness make it one of the most intuitive and powerful charting systems available today.

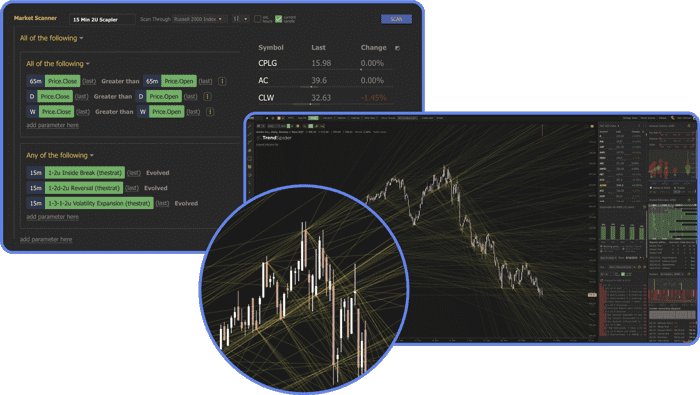

TrendSpider Review: Market Scanning

TrendSpider makes discovering new trade opportunities effortless.

Its Market Scanner lets you search thousands of symbols using your own technical conditions. You can combine multiple indicators, like RSI, MACD, and moving averages, and the platform instantly finds all assets that fit your criteria.

The scanner works across multiple timeframes, which means you can, for example, look for stocks forming a bullish pattern on the daily chart while also breaking resistance on the hourly chart.

You can save custom scans or use hundreds of pre-built templates, covering everything from trend breakouts to oversold setups.

Perhaps best of all, you can set up automations so your scans run continuously in the background, updating as the market moves.

Whenever a symbol matches your criteria, it automatically populates in your watchlist.

TrendSpider Review: Strategy Development

With TrendSpider’s Strategy Tester, building and validating a trading system requires zero coding. You simply select your indicators, define your entry and exit conditions, and the platform runs a full historical backtest instantly.

The backtester shows your win rate, profit factor, drawdown, average trade performance, and total returns. It even plots your trades visually on the chart, helping you see how your logic performed during different market phases.

You can optimize strategies by adjusting parameters like lookback periods, thresholds, and exit rules, all from an intuitive visual interface. Once you’ve found a strategy that fits your edge, you can save it, monitor it in real time, or convert it into an alert for live trading.

This feature is ideal for anyone who wants to move beyond theory and actually verify whether their setups hold up over years of price data, before risking real money.

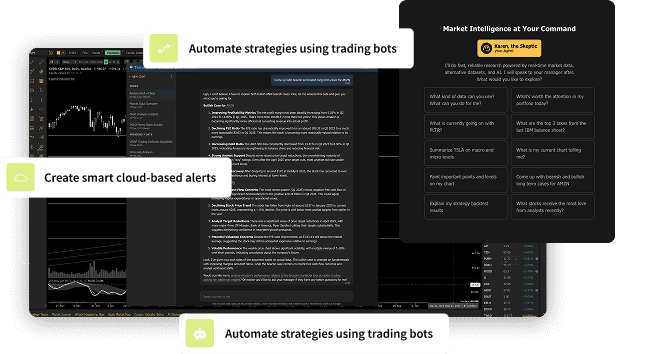

TrendSpider Review: Trading Bots

The Trading Bot feature in TrendSpider lets you automate your trading strategies without any coding.

You start by building and backtesting a system — for example, a simple moving average crossover (5-period crossing above 15-period for buy, below for sell) with defined stop-loss and take-profit levels.

Once tested, you can instantly convert it into a live bot by selecting “Launch as Trading Bot.”

From there, configure its timeframe, notifications, and broker integration using SignalStack.

Through webhook connections, the bot sends real-time buy or sell orders directly to supported brokers like TradeStation, or Interactive Brokers.

Each bot runs continuously in the background via SignalStack webhooks and external broker integration, automatically scanning markets, executing trades, and managing positions.

You can even use bots for non-trading actions, such as posting updates to Discord, Twitter, or Google Sheets, making TrendSpider’s bots one of the most flexible, no-code trading automation tools available today.

TrendSpider Review: AI Strategies

The AI Coding Assistant is one of TrendSpider’s most innovative tools. It allows you to describe your strategy idea in a simple manner, and the platform automatically converts it into working code.

For example, you can type: “Create an indicator that highlights when RSI crosses above 50 and price breaks the 20-day moving average.” The AI will write the code, apply it to your chart, and even visualize historical triggers.

This is powered by an AI-powered scripting assistant fine-tuned for market logic, making it accessible for non-coders who want advanced custom indicators.

It’s a huge leap forward for traders who previously relied on developers to implement new ideas. With AI integration, TrendSpider has turned complex scripting into a simple conversation, bridging the gap between creativity and execution in trading.

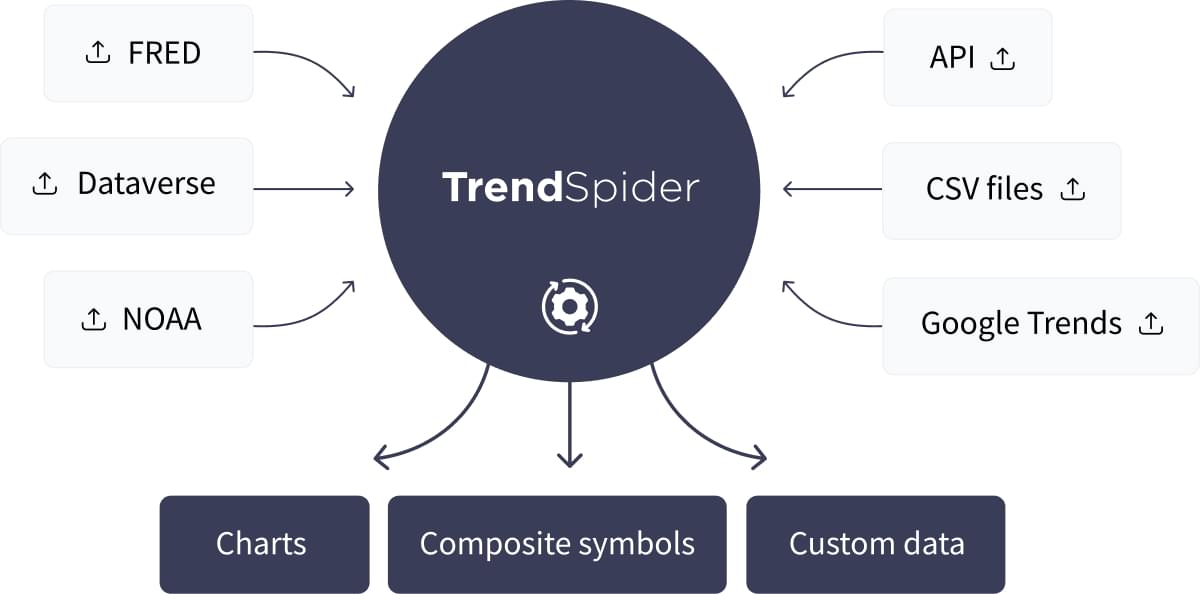

TrendSpider Review: System Tools

TrendSpider’s system tools bring together everything that makes the platform feel like a real trading assistant.

You can organize multi-chart workspaces, sync watchlists, and customize layouts to suit specific strategies or markets.

Whether you’re tracking large-cap stocks, crypto, or forex, switching between setups takes just a click.

The highlight here is TrendSpider Sidekick, an intelligent companion that acts as your personal market assistant. Sidekick continuously monitors charts, alerts, and watchlists, providing real-time updates and proactive alerts about price changes, technical signals, and important market movements.

Alongside Sidekick, TrendSpider’s Sector Heatmaps, Seasonality Analyzer, and Custom JS Scripting extend the analytical edge even further.

You can track how a stock performs during certain months, visualize sector performance, or even code your own JavaScript-based tools for specific use cases.

TrendSpider Review: Access From Multiple Devices

TrendSpider works seamlessly across web, desktop, and mobile devices. The web and desktop versions are identical in functionality, delivering a full suite of tools including multi-chart layouts, strategy testing, and automation controls.

The mobile app, available on iOS and Android, allows you to monitor alerts, track your watchlists, and review charts on the go. While it’s more lightweight compared to the desktop version, it’s constantly improving and supports key features like drawing tools and indicator overlays.

All data, alerts, and layouts sync automatically between devices. You can start building a strategy on your desktop and check results on your phone later.

For folks who move between screens frequently, this cross-device harmony ensures that you’re always connected to your analysis, wherever you are.

TrendSpider Review: Support

TrendSpider’s customer support is consistently rated among the best in the trading software space. Every subscriber gets access to live chat, email, and comprehensive onboarding assistance.

All users can schedule 1-on-1 training sessions with a platform specialist who walks them through setup, alerts, and strategy tools, with higher tiers getting more access.

The Knowledge Base and Help Center are also exceptional, featuring hundreds of tutorials, video guides, and case studies for both beginners and pros.

The company’s support team is known for being responsive and personal, real humans who understand trading and can solve issues fast.

In a world where most platforms hide behind automated chatbots, TrendSpider’s accessible, knowledgeable support adds major value to the subscription.

TrendSpider Review: Asset Insights

The asset insights feature is accompanied by a newsfeed so users can view the live streams of their partner, Benzinga, on the chart.

Meanwhile, this feature presents corporate earnings data (past and present) on your chart as well as dividends data such as declaration dates, ex-dividend dates, and payout dates.

TrendSpider provides stock splits where users can review data sets related to split actions on a chart, including effective dates and announcements.

You can even view analyst recommendations and actions data via the Analyst Ratings Data feature.

Add in their insider trading component that features corporate insider information on their shares, plus a seasonality visualization to display how seasonal assets are within seconds, and you get a robust asset insights feature.

TrendSpider Review: Alerts

The alerts that TrendSpider uses are plentiful, instantaneous, and cover a lot of ground.

Alerts will expire anywhere from 14 to 90 days, depending on which TrendSpider plan you use.

You can right-click on indicators to create instant price alerts on them.

You can also create alerts on manual drawings or create alerts on an automated trendline while using any timeframe.

The automatic Fibonacci alerts create alerts around different levels of automated Fibonacci retracements.

Through sensitivity control, you can control what is framed as a sensitivity buffer zone.

You can control such a zone around an alert to get special notifications on apEliteach.

Using triggers for dynamic price alerts, users can monitor specific events like breaks, bounces, and touches in your alerts.

Multi timeframe alerts let you create alerts that use data from multiple timeframes in a single alert.

You can also create complex alerts using all sorts of indicator combinations.

>> Like all that TrendSpider has to offer? Click HERE to sign up NOW! <<

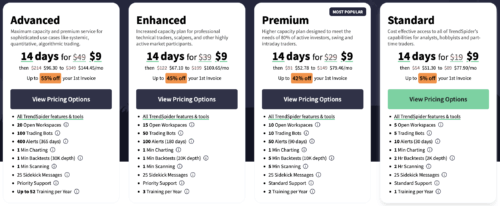

How Much Does TrendSpider Cost?

TrendSpider offers four core individual plans, Standard, Premium, Enhanced, and Advanced. Each plan gives you access to all features, with the differences lying in capacity limits, support, and priority perks.

The Standard plan is the entry level and gives you the essentials: 5 open workspaces, 5 trading bots at once, and up to 10 alerts (which expire after 30 days).

You also get 1-minute charting, 2-hour backtests at 2K depth, and 2-hour scanning cycles. For support, you get standard service and one training session per year.

The pricing originally is ~$54/month (billed annually) or ~$82/month (billed monthly), with promotional discounts available on first invoices.

Next up is Premium, which is considered their “sweet spot” for many active users. It expands limits to 10 workspaces, 10 bots, and 50 alerts (active for 90 days). Backtesting depth is increased (up to 10K) and scanning cycles are faster (5-minute).

You also get two training sessions per year. The monthly cost is often quoted ~ $117.82 after discount (with a listed MSRP around $149).

Enhanced is aimed at power users and intraday-style traders. It includes 15 workspaces, 50 bots concurrently, and 100 alerts (valid for 180 days).

Backtesting and scanning run down to 1-minute granularity with deeper depth (~20K), and you gain priority support plus three training sessions yearly. Many promotions slash the first invoice by up to ~45%.

The top tier, Advanced, is for professionals, algorithmic traders, and quant strategies. You get 20–45 workspaces (depending on plan option), up to 100 bots, 400 alerts (365 days validity), and full 1-minute charting, scanning, and backtesting at 30K depth.

You also receive priority support and as many as 52 training sessions per year. The advertised pricing can go up to ~$276/month after discount (from a higher MSRP).

Each plan comes with a 14-day trial (for a nominal fee) so you can test features before fully committing, and most first invoices carry a significant discount (often 30–45%).

On top of base subscription, TrendSpider offers optional add-ons & market data fees. For instance, real-time futures data costs ~$7.50/month for non-professional users. Also, some “Pro” data feeds (like NASDAQ for professionals) require extra charges.

How Do I Cancel TrendSpider?

TrendSpider’s policy does not include prorated refunds but ensures users retain full access through their billing period

But you can stop future charges on your account when you’re ready to move on.

You can cancel the automatic renewal of your TrendSpider account through their hassle-free online system.

You can also contact customer support via email, live chat, or phone to let them know you’re canceling your subscription.

By deactivating your account, you also deactivate future renewals of your TrendSpider account.

When you cancel during your free trial, you can still use TrendSpider until the free trial period ends.

At the end of your trial, your subscription will not start, your account shuts down, and you won’t be charged.

Should you cancel during your paid subscription period, you’ll continue to have access to TrendSpider until the end of your pre-payment period, preventing future renewals.

If you don’t cancel your TrendSpider membership before the automatic renewal kicks in, you will be charged your membership fee for that renewal period.

>> Ready to sign up for a TrendSpider account? Just click HERE! <<

TrendSpider Review: Pros and Cons

TrendSpider has many features that set it apart from other investment platforms, but it’s not perfect.

Take a look at all the pros and cons of our TrendSpider review.

Pros

Technical Analysis Tools – You’d be hard-pressed to find tools as well-rounded and precise as TrendSpider’s technical analysis tools are. Plus, there are tons of them.

Alerts – Their alerts are ample and personalized for your needs. You can receive them via SMS, text, or any way you please.

Training – Every training session that TrendSpider offers is free.

Trendline Spotting – When you review TrendSpider, you immediately notice their ability to spot trendlines as well as their price interpretations.

They also provide a highly accurate identification of trendlines.

Machine Learning – The algorithm is what drives the seamlessness of the platform.

Customer Support – Email, chat, phone, and priority service.

Cons

Single Browser – Despite being customizable, TrendSpider can only be used in one browser at a time as a security safeguard that prevents simultaneous sessions.

Complex – With so many features and functions, TrendSpider can be difficult to navigate.

TrendSpider Review: Is the Service Right for Me?

If you’re an active day trader or someone with a wealth of experience with trades, TrendSpider is perfect for you.

Whether you need a trendline, analysis, or dynamic price alerts, the hard work is essentially done for you so you can focus more on the facts and figures to improve your trading expertise.

Day trading and trading opportunities will become easier with the many tools and data that TrendSpider provides.

TrendSpider Reviews by Traders

“I think this is the most innovative technology for traders since live streaming.”

– Scott Smith, Professional Trader and Owner of LiveTradePro.com

“I believe TrendSpider Raindrop Charts are the biggest advance in visual charting since Steve Nison brought candlesticks back from Japan.”

– Steve Burns, Professional Trader & Founder of New Trader University (NewTraderU)

“I have to say thanks for this system. As a result, I’m getting into trades lower and selling higher.”

– Chris, Professional Trader

Is TrendSpider Worth It?

As our TrendSpider review shows, this automated platform is a viable option for anyone looking to simplify the way you view trading.

Whether you’re a day trader, do trading with a day job, or are a professional trader who does it as a full-time career, TrendSpider is highly informative and will also help you optimize your investment in stock and crypto.

In short, TrendSpider is well worth the price if you want to spend less time crunching charts and more time improving your automated trading skills.

Tags:

Tags: