We’re lost without the seemingly endless supply of energy that powers our cars, devices, and homes.

It’s a steady industry for sure, but veteran investor Larry Benedict believes we’re about to see a change of epic proportions that could flip the industry on its head.

He believes this shift could rival the early days of the Internet, and his strategy focuses on one simple way to profit from it.

In this One Ticker Trader review, I analyze the guru’s approach and share my thoughts on whether it’s worth a closer look.

>> Get Access to Energy Stocks TODAY<<

Larry Benedict Review: What Is One Ticker Trader?

One Ticker Trader is Larry Benedict’s flagship research service published by The Opportunistic Trader, built around a simple but powerful idea that you don’t need dozens of trades to build wealth, just one well-timed move.

The service is designed to help members capture fast, strategic profits by focusing on a single ticker connected to whatever’s trending at that time..

Inside, subscribers get clear trade recommendations, step-by-step options guidance, and regular updates straight from Benedict and his team.

It delivers a direct, research-backed way to profit from some of the most powerful market forces shaping the U.S. economy today, all while learning from a seasoned pro who’s been consistently winning for over two decades.

Before I dive deeper, however, I want to look at the guru behind it all.

Who Is Larry Benedict?

Larry Benedict is the CEO of Opportunistic Trader and the mind behind One Ticker Trader.

His area of expertise is options trading, and many of his premium services lean into this strategy.

He began his career as a trader at the Chicago Board Options Exchange in 1984, where he quickly earned a reputation for his disciplined approach and uncanny ability to read market signals.

It wasn’t long before Larry was managing a hedge fund clocking in at upwards of $900 million.

Over two decades, Benedict maintained an unbroken streak of profitable years, a feat so rare that legendary author Jack Schwager featured him in Hedge Fund Market Wizards, alongside icons like Paul Tudor Jones and Ray Dalio.

Today, Larry brings that same professional-grade research and precision trading to everyday readers through The Opportunistic Trader and his One Ticker Trader advisory, combining experience, intuition, and decades of proven success into one focused service.

>> Sign up to Larry’s One Ticker Trader TODAY<<

Is Larry Benedict Legit?

Larry Benedict is as legit as they come.

He’s a genuine Wall Street professional with more than 35 years of trading experience, multiple media appearances, and a career built on consistent performance, not luck.

His unique investment strategies led him to a perfect run from 1990 to 2010, where he didn’t have a single losing year.

These successes resulted in more than $274 million in profits for his clients and put his hedge fund in the top 1% worldwide.

Before stepping away from the hedge fund world, Larry had more than $1 billion under his control.

Benedict’s credibility also stems from his transparency.

He’s known for publicly explaining his trades, discussing his risk management process, and focusing on strategies that perform in both bull and bear markets.

What Is Opportunistic Trader?

Opportunistic Trader is a market research publisher led by Larry Benedict. Unlike many publishers, this one has a very strict focus: options.

Many of his publisher’s newsletters follow the One Ticker Strategy. Each one has its own twist on the formula.

One Ticker Trader is the publisher’s entry-level offering. It’s also the most economical.

So if you’re on the fence about signing up for one of the premium newsletters, One Ticker Trader might be the way to go.

>> Tap into the team’s strategy HERE<<

What is Larry Benedict’s Strategy?

Larry Benedict uses a range of options strategies, but he’s probably best known for his One Ticker Strategy.

It’s a simple approach that targets on one stock at a time. Combined with options, it offers the opportunity to make money off a stock regardless of the direction it moves.

In essence, Larry becomes an expert on one stock or investment theme at a time. He then recommends options contracts based on where he believes the stock could move next.

Once he believes the trade has run its course, he moves over to the next stock or theme.

Unlike buy-and-hold strategies, this approach provides the opportunity to profit in down markets without waiting for a reversal.

In the latest presentation for One Ticker Trader, the newsletter taps into an iteration of Larry Benedict’s strategy called #1 Retirement Play in U.S. Energy.

What Is Larry Benedict’s “The #1 Retirement Play in U.S. Energy”?

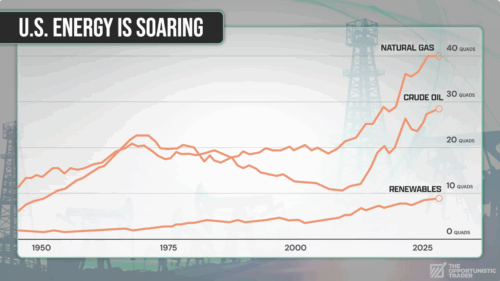

Larry Benedict senses a powerful shift in America’s energy landscape that’s happening quietly, one that most folks haven’t even noticed yet.

Across Pennsylvania, West Virginia, and Ohio, shuttered coal facilities are transforming into modern natural gas and data power hubs.

Every new server farm, from Google’s to Amazon’s, needs massive amounts of power, and natural gas is quickly becoming the only reliable source capable of meeting that load.

Benedict believes this is the beginning of what he calls a hidden bull market in U.S. energy, and it’s creating opportunities that could define the next decade of American wealth.

The Fuel Behind the New Industrial Revolution

Larry Benedict explains that we’re entering an era not unlike the first Industrial Revolution, only this time, it’s powered by artificial intelligence.

Every time someone prompts ChatGPT or runs an AI model, energy is consumed.

Multiply that across billions of queries, and you start to see why AI has an insatiable hunger for energy.

Data centers already use about 200 terawatt-hours per year, and that number could triple within five years, exceeding the energy use of California itself.

While most folks chase tech stocks and crypto, the real winners will likely be the companies fueling this digital explosion.

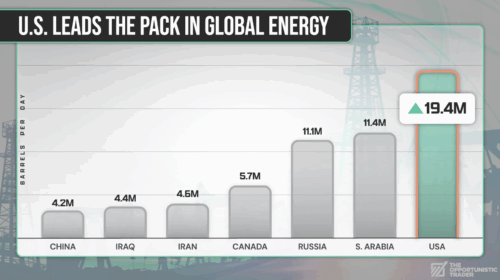

According to him, there’s only one fuel source that can deliver the consistent, scalable power these AI systems demand: U.S. natural gas.

Why Natural Gas Could Redefine Retirement Investing

Natural gas is undoubtedly a massive industry, and knowing where to invest is a battle in itself.

Larry’s answer lies deep within the legendary Marcellus Shale basin that continues to astound miners with its seemingly endless supply of fuel.

This basin alone holds over 260 trillion cubic feet of recoverable gas, and projects like the $10 billion Homer City conversion are proof that AI companies are already building around it.

Google has pledged $25 billion to power its AI infrastructure with American energy, and Blackstone recently committed $85 billion in similar projects.

And what we’re witnessing now is very likely the start of something much bigger as more companies look to join the initiative.

Benedict’s current play focuses on one company positioned at the center of this transformation, a fully integrated natural gas supplier tied directly to America’s growing AI power grid.

How to Profit From the Coming Energy Supercycle

Here’s the kicker, though – investing in energy directly isn’t enough.

The best energy stocks returned around 50% during the last boom through standard buying and selling, which, while impressive, isn’t much to write home about.

However, Larry’s alternative strategy delivered up to seven times higher gains in a fraction of the time.

His secret lies in using carefully selected options trades to leverage natural gas movements without exposing individuals to the boom-and-bust risks that plague most energy plays.

Benedict is neatly folding his lucrative energy opportunity from the Marcellus Basin into a power-packed options play that you can take advantage of, if you choose to become a One Ticker Payouts member.

One Ticker Trader Review: What Comes With The Deal?

Once you join One Ticker Trader, you get all of the following resources at your fingertips:

12 Months of One Ticker Trader

Every month, Larry Benedict delivers a brand-new issue of One Ticker Trader packed with his latest market insights, trade setups, and commentary on what’s driving the next major moves.

Each issue focuses on one high-conviction play, the “one ticker” he believes could deliver the strongest near-term gains.

What makes these reports stand out is their clarity. Larry explains the “why” behind every trade, breaking down his logic in simple language so even readers new to options or energy investing can follow along confidently.

He covers key catalysts, technical levels, and risk thresholds, ensuring members always know when to enter and when to step aside.

Over the course of a year, these monthly issues build into a powerful framework for identifying repeatable opportunities in volatile markets.

Access to One Ticker Trader Model Portfolio

Alongside the monthly reports, subscribers gain full access to Larry’s live model portfolio, a running record of every open and closed position. This transparency lets you track his performance day by day, exactly as it unfolds.

Each position includes trade dates, entry prices, and exit guidance, so members can follow along or mirror the moves in their own accounts.

It shows at a glance where Larry is looking, and, since it’s updated often, you can follow along as he moves into or away from positions based on what’s happening in the broader market.

You’re in a sense getting Larry’s reasoning behind each adjustment.

Free Access to Password-Protected Members-Only Website

Every One Ticker Trader member receives access to a secure, password-protected online portal, the central hub for all updates, trade alerts, and bonus research.

The site is designed for convenience. You can log in anytime to re-read previous issues, review archived trades, or revisit Larry’s latest commentary.

It also hosts educational resources explaining his approach to options trading, energy market analysis, and macroeconomic signals.

I especially like how user-friendly the portal is, no confusing dashboards or endless menus.

Whether you’re on a desktop or phone, everything is clearly organized so you can act fast when new opportunities drop. It’s essentially a professional-grade research platform built for everyday readers.

The One Ticker Retirement Plan

The One Ticker Retirement Plan is the cornerstone of Larry’s strategy, a simplified framework that helps you grow your portfolio using a single, well-researched trade idea at a time.

The plan is rooted in Benedict’s belief that too much diversification leads to “diluted” results.

By focusing capital on one high-probability setup, members can capture outsized returns without spreading themselves thin.

Inside the plan, Larry outlines how to identify trades with asymmetrical risk, setups where the potential reward is several times greater than the downside.

He also explains position sizing, timing entry points, and managing volatility, exactly as he did when running his hedge fund.

Access to Weekly “Ask Larry Anything”

One of the standout features of One Ticker Trader is the weekly “Ask Larry Anything” sessions, a direct line between members and Benedict himself.

Each week, Larry answers subscriber questions about market trends, trade management, and macro shifts in energy or technology.

The tone is conversational, not technical.

He often uses real examples from recent trades to explain how he interprets market signals or why he changes course on a position.

These sessions give members rare behind-the-scenes insight into the decision-making process of a professional hedge fund manager.

For anyone serious about understanding how the market really works, these weekly touchpoints are worth the price of the entire subscription on their own.

Trade Alerts and Updates

Markets move fast, and Larry Benedict knows timing is everything. That’s why One Ticker Trader members receive timely trade alerts whenever new opportunities arise or when it’s time to adjust an existing position.

These alerts arrive straight to your inbox and include precise instructions, what to buy, what price range to aim for, and when to consider taking profits or cutting losses.

Everything is written clearly, with no guesswork or jargon, so even readers new to options trading can follow along easily.

This constant communication ensures you’re never left wondering what to do next, a level of hand-holding rarely seen in professional-level advisories.

Larry Benedict’s One Ticker Trader Bonus Reports

Joining One Ticker Trader also unlocks access to several exclusive bonus reports that expand on Larry Benedict’s core research:

The #1 Retirement Play in U.S. Energy

This cornerstone report is where Larry reveals the single energy company at the center of his One Ticker Retirement Plan.

In it, he explains why this firm stands to benefit most from the surging global demand for liquefied natural gas (LNG) and the rebuilding of America’s energy infrastructure.

What makes the insight valuable isn’t just the ticker itself but the context Larry provides, including project maps, production capacity, and how the company’s export contracts are tied directly to AI-driven data expansion.

By the time you finish reading, you should have a clear understanding of the simple options play you can make on a regular brokerage account.

Drill Baby Drill: How to Leverage Your Wealth in U.S. Energy

In Drill Baby Drill, Larry dives deeper into how average Americans can use the energy sector’s new growth cycle to amplify their returns, even without heavy capital.

He shows how to structure trades with limited downside while maintaining exposure to rising oil and gas demand.

The report walks through the mechanics of leverage in plain language, demystifying how professionals use options and layered entries to turn modest positions into meaningful results.

You’re looking at a disciplined framework based on data from real-world energy production and export trends. Larry also highlights regions seeing the fastest development, from Gulf Coast terminals to Appalachian conversion projects.

The Gold Multiplier

The Gold Multiplier is Benedict’s answer to the growing volatility in global currencies and inflation pressures.

Here, he identifies a select set of gold-related assets that historically outperform in late-cycle markets like today’s, especially when interest rates begin to plateau.

Larry explains how central banks are quietly increasing their gold reserves while the public focuses on tech, creating a hidden momentum shift that few people see coming.

The report breaks down his timing strategy for identifying when gold’s short-term pullbacks transform into breakout setups and how to apply his “multiplier” method using options for leveraged exposure.

He also shares why certain mining and royalty firms could benefit even more than physical bullion itself.

Larry’s Guide to Options

For newer members, Larry’s Guide to Options is the essential foundation. It’s a practical, no-jargon manual where Benedict explains how he uses options to control risk, increase potential returns, and simplify complex trades.

He covers the basics, calls, puts, strike prices, and expiration, but what makes it valuable is how he ties each concept to real trade examples from his hedge fund days and current One Ticker Trader recommendations.

The guide shows you how to size positions intelligently, avoid common retail mistakes, and build the confidence to execute trades with precision.

Even if you’ve never placed an options trade before, this resource makes the process clear and approachable.

Refund Policy

Larry Benedict backs One Ticker Trader with a straightforward satisfaction guarantee designed to make joining as risk-free as possible.

New members can try the service for a full 30 days, explore the trade alerts, access all reports, and review the research without any commitment.

If during that time you decide it’s not the right fit, you can contact the Opportunistic Trader support team for a full refund, no questions asked.

This refund window gives readers the confidence to experience Benedict’s strategy firsthand, see how his alerts perform, and evaluate the overall quality of the research before staying on long term.

It’s a fair, transparent policy that reflects the credibility and confidence behind his work.

Pros and Cons

Here’s a quick breakdown of what stood out after reviewing One Ticker Trader:

Pros

- Hedge fund manager with a 20-year winning streak

- Easy to follow “one ticker” strategy

- Timely opportunities tied to real economic trends

- Affordable entry cost ($19 Only) compared to other premium advisories

- Clear, detailed trade guidance

- Backed by a transparent model portfolio

- Includes multiple high-value research reports

- Refund policy provides peace of mind

Cons

- No Chat/Community Forum

- Requires basic understanding of options (though training is included)

One Ticker Trader Track Record

When I dug into the numbers behind One Ticker Trader, what stood out most was how clear the performance reporting is.

At the time of writing, One Ticker Trader captures an 87% win rate so far on this year.

Some of energy’s plays during that stretch came in at 157% and 143% in record time.

Even during some of the slower periods for the energy market, Benedict’s strategy offered opportunities for 12%, 38%, and 128% gains in a week’s time.

Of course, past results are no guarantee of future performance. But in my own review, the transparency and consistency of the track record are real indicators that Larry Benedict isn’t just throwing out hope-filled picks.

He’s sticking to a disciplined one-ticker method and showing members the actual outcomes so they can judge for themselves.

How Much Does One Ticker Trader Cost?

At the time of this review, One Ticker Trader is available through a special promotional offer that makes it one of the most affordable research advisories on the market.

A full 12-month subscription costs just $19, a steep discount (96% off) from the regular price of $499.

This limited-time pricing includes access to all monthly trade alerts, weekly updates, model portfolio access, and the complete set of bonus reports, including The #1 Retirement Play in U.S. Energy and Drill Baby Drill.

You’re essentially getting a year of professional-grade hedge fund research for less than the cost of a single consultation.

Is Larry Benedict’s One-Ticker Trader Worth It?

After going through this One Ticker Trader review in depth, I can confidently say that the service delivers solid value for its price point.

What makes it stand out is how Larry Benedict translates his 35 years of institutional trading experience into a strategy that everyday readers can actually follow.

You’re not just getting stock tips, you’re learning a method that emphasizes timing, precision, and disciplined risk management. The focus on one ticker at a time keeps the process simple yet highly strategic.

Plus, you’re handed a number of bonus materials to help start you on the right foot, and teaching materials to ensure you don’t stumble along the way.

The research, education, and transparency you get for under $20 per year make One Ticker Trader a smart choice for anyone looking to profit from America’s energy-driven market shift without getting lost in the noise of speculative trading.

Sign up today to stay ahead of America’s big energy move before all the power dissipates from this impressive deal.

>> That’s it for my review. Sign up to One Ticker Trader for 96% off <<

Tags:

Tags: