Crafting the perfect investment portfolio can be a daunting task without proper tools and while trying to juggle life at the same time. The team at Seeking Alpha seeks to solve that problem with their newest subscription service. In this Alpha Picks review, I investigate how it stacks up.

What is Alpha Picks?

Alpha Picks is a relatively new service by the minds at Seeking Alpha. It launched in mid-2022 to identify stocks with the highest probability of capital appreciation through data-driven methodology.

The platform is the result of hundreds of thousands of dollars spent on the best tools and talent in the trade. Each bit is carefully selected so Alpha Picks can build a portfolio with the best shot at crushing the S&P 500.

Steve Cress leads the team with more than 30 years of experience in equity research and quantitative strategies.

At its core, Alpha Picks consists of a working portfolio and two new stock recommendations each month. Stock picks only make the list after analyzing company fundamentals, valuation, momentum, growth, and profit potential. The powers that be constantly juggle these assets to achieve the best possible outcomes.

Members are encouraged to invest in some or all of this portfolio and follow the recommendations within. This strategy takes a lot of time and guesswork out of investing that not all of us enjoy doing.

I’ll look more into Alpha Picks’ features in a moment. First, a look at Seeking Alpha.

>> Optimize your portfolio now! <<

What is Seeking Alpha?

Seeking Alpha is the publisher behind Alpha Picks and a myriad of analysis, news, and market data. The company uses this content to empower people to make the best investment decisions possible.

Its team of experts are investors who write content for like-minded individuals. Their research covers a wide range of topics and opinions to showcase all sides of a story or recommendation.

For all Seeking Alpha does, it does it surprisingly well. I’m always impressed with how organized their page and information is, from trending topics to the latest numbers from top indexes, exchanges, and assets.

Many articles and analytics are free to read, but the most valuable content is understandably tucked away behind subscriptions. Alpha Picks is just one of those areas.

Is Seeking Alpha Legit?

Everything within the Seeking Alpha toolbox is totally legit, and the company remains a leading source for market analysis.

It features a combination of experts and technology to deliver reliable stock reports and ratings. Many of those experts, including ones on the Alpha Picks team, carry at least ten years of experience.

Perhaps best of all, the platform isn’t skewed by anyone or anything. It stands completely independent of outside interference to supply the most objective analysis possible.

>> Explore Seeking Alpha’s comprehensive market insights <<

What Comes with Alpha Picks?

Here’s what you get with an Alpha Picks subscription:

Two Stock Picks Every Month

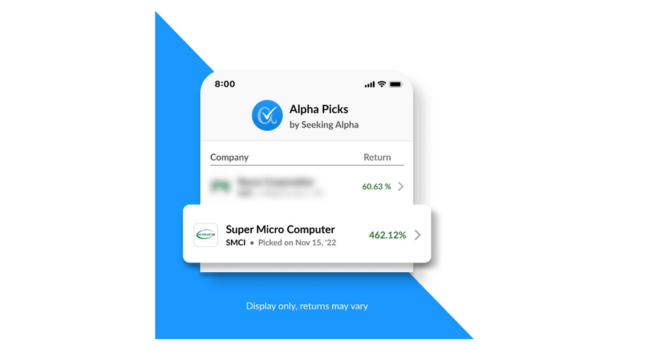

Members receive two data-driven stock picks from Seeking Alpha every month. Each stock pick is ripe with quantitative analysis so you know exactly what you’re getting into.

You’ll see the first stock added at the beginning of the month, with the subsequent one dropping right around the 15th.

Alpha Picks requires each new recommendation to have a “Strong Buy” quant rating for at least 75 consecutive days and be a U.S. common stock. It must have a share price greater than $10 and a 3-month average market capitalization greater than $500M.

Stock picks can’t be REITs and must not have been recommended in the past year.

>> Start receiving two top-rated stock picks every month <<

Ratings Alerts

If you’re like me, you don’t always remember to watch for new stock picks to appear. Fortunately, Alpha Picks sends out a message whenever a new recommendation gets added. From there, it’s easy to hop over to the platform and invest.

Subscribers also get a notification any time the Alpha Picks team closes out a security or makes changes to an existing stock pick. In most cases, a stock ends up on the chopping block when its rating falls to “Sell” or “Strong Sell”.

You may also see an alert if stock ratings fall to “Hold” and remain there for 180 days or if a merger announcement takes place.

>> Stay updated with real-time ratings alerts <<

Over 20 Alpha Picks Stock Recommendations

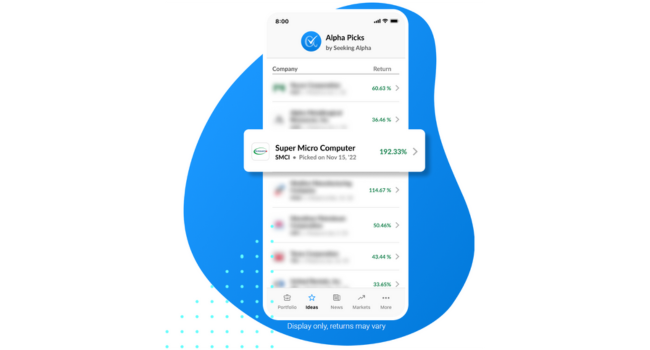

As soon as a new member joins, they’re immediately awarded access to all current Alpha Picks stocks. There are typically 20 in the portfolio at any given time.

Recommendations often cover multiple sectors to promote diversity and the highest likelihood of success. Since there’s no subjectivity or bias behind selections, stock picks come from the most fruitful industries at any given time.

You’re free to grab any or all of these as you choose to meet your investing strategy. Each pick comes with a detailed investment analysis and reasons why the Alpha Picks team declares it a winner.

>> View top stock picks now! <<

What Should I Expect from Alpha Picks?

Alpha Picks‘ primary goal is to significantly outperform the overall market and bring in big gains for its members. Some stock picks will win and others will lose, but the crew constantly rebalances the portfolio and swaps in new positions to stay ahead.

You’re settling into a long-term strategy here, so expect to be in for some time. Alpha Picks bases its performance on its entire portfolio, which they recommend investing in for your best chance at optimal results.

Stocks are usually diverse, but don’t be surprised if picks come from a single sector for a while. It likely means that particular industry is witnessing the biggest growth.

>> Optimize your portfolio for the long-term now! <<

What is Alpha Picks Performance Track Record?

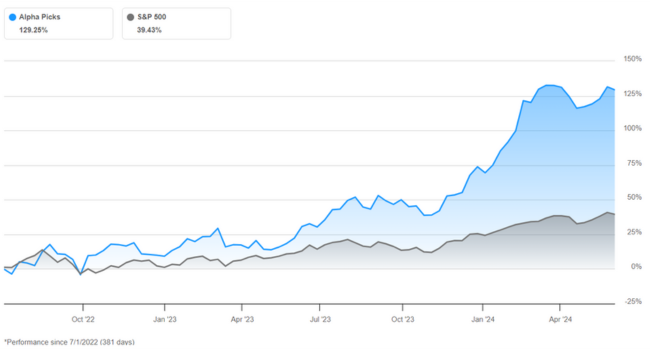

Alpha Picks’ performance track record is right in line with the platform’s goals. It’s soundly beaten the S&P 500 with nearly three times the gains since its inception in July 2022.

I know the experts at Seeking Alpha will do anything to ensure this trend continues. However, the market is unpredictable, and we can’t consider this current track record to be typical.

As always, never invest more than you can afford to lose. There’s no guarantee Alpha Picks will be able to keep these stellar results up forever.

That said, the accurate predictions the team has made so far clearly demonstrate their experience and skill.

Is Alpha Picks Right for Me?

Alpha Picks could be an excellent option for individuals looking to get ahead in the market. Rookies and veterans alike are privy to two stock picks per month along with the quantitative analysis backing each one.

Having that information here saves all the time and energy of having to track down leads yourself. Plus, this data is backed by Seeking Alpha’s top computational systems you simply don’t have access to otherwise.

You’re also alerted to any changes in the portfolio as it happens. That means no more hesitation about when to sell or how long to keep winners.

Seeking Alpha takes a long-term approach to its selections, so traders need not apply. If all goes according to plan, there won’t be frequent buying and selling here.

>> Explore Alpha Picks now! <<

How Much is Alpha Picks?

Joining the ranks of Alpha Picks normally comes with a $499 annual membership fee. As part of this special deal, you can snag your first year of the service for 10% off the cover price!

At the end of the day, you’re paying just $37.41 per month for access to all the content here. One victory could cover the cost of admission and then some.

There is no refund policy for Alpha Picks, likely due to its low barrier to entry. Next year’s renewal will come in at the current annual list price.

>> Sign up now and save 10% <<

Is Alpha Picks Worth It?

I spent a lot of time reviewing all that Alpha Picks has to offer, and I’m quite happy with what I see.

Time is a premium for me, and I’ll gladly pay for a service offering expert-level research and data I’m unable to get to on my own. Alpha Picks definitely delivers.

Two new picks per month are enough to keep a portfolio fresh without being overwhelming. Over 20 recommendations already in the pipeline greatly increase your options.

Perhaps my favorite feature is the analyst ratings with clear indicators of when to buy, hold, and sell. The last thing anyone needs is to lose money by getting in or out at the wrong time.

All that rolls up nicely into a package that’s 10% off right now. If Alpha Picks’ track record continues, it could pay for itself rather quickly.

Anyone looking to optimize their investments should give Alpha Picks a closer look. Act now before this special deal comes to a close.

>> That’s it for my review. Subscribe today for instant discount! <<

Tags:

Tags: