Trading is never easy, and convoluted methodologies, tips, and tricks seem to just muddy up the space even more.

That’s why veteran floor trader Andrew Keene stepped in with a system that cuts through the noise and zeroes in on the most powerful options setups caught by his 13 custom scanners.

Is his strategy a beacon of hope in a dark space or just another platform to toss aside?

In this AlphaShark 10/10 SPECIAL review, I’ll share how this approach stacks up and whether it truly delivers an edge worth paying attention to.

>> Join Andrew Keene’s 10/10 SPECIAL Today <<

What Is AlphaShark 10 / 10 SPECIAL?

AlphaShark 10/10 SPECIAL is a premium-level service under the AlphaShark Trading brand, built around the concept of giving members access to only the highest-rated trade setups spotted through Andrew Keene’s 13 custom scanners.

Instead of bombarding you with constant alerts, it filters thousands of daily institutional options trades and surfaces only those that meet a perfect “10 out of 10” confidence score, the trades that historically showed the strongest follow-through.

The 10/10 SPECIAL pulls from AlphaShark’s broader ecosystem of tools, real-time trade alerts, access to proprietary scanners, weekly updates, and occasional live-trading insights to bring you what you need.

You’ll get these actionable trades wrapped up in a nice bow and delivered weekly while removing complexity and chaos.

It promises focus, structure, and clarity, three things most of us struggle to find.

>> Unlock AlphaShark’s 10/10 Trade Alerts Now <<

Who Is Andrew Keene?

Andrew Keene is the founder and CEO of AlphaShark Trading, a Chicago-based firm known for bringing institutional-style options strategies to regular folks like you and me.

Before starting AlphaShark, he spent years on the floor of the Chicago Board Options Exchange (CBOE), where he traded the largest options on stocks for firms such as Botta Capital and KATL Group.

A graduate of the University of Illinois Urbana–Champaign, Keene went on to build a reputation as one of the few retail educators who still trades with his own capital in real time.

He’s also authored several books, including Keene on the Market and The AlphaShark Trading System, both focused on decoding unusual options activity.

Over the years, his insights have been featured on CNBC, Bloomberg TV, Fox Business, and Business Insider, cementing his standing as one of the most visible educators in modern options trading.

Is Andrew Keene Legit?

There’s no question that Andrew Keene is the real deal.

His background as a former CBOE floor trader gives him firsthand experience of how professional traders use order flow to spot market-moving opportunities, something few educators can claim.

Keene has traded millions of contracts over his career and has taught more than 50,000 students through live classrooms, online sessions, and seminars across the U.S.

His track record includes accurately identifying large institutional trades before major price moves, a skill he’s translated into the scanner technology behind AlphaShark.

Beyond trading, he’s contributed to publications like Yahoo Finance and Seeking Alpha, and his frequent media appearances make his research easy to verify.

>> Start Trading Live with Andrew Keene <<

How Does the “10 / 10” System Work?

The “10 / 10” system is built around the idea of filtering thousands of daily trades so you receive only the very best ones.

With AlphaShark Trading monitoring more than 500 unusual options trades every day across major exchanges, the goal is to isolate those setups that score a perfect “10 out of 10”.

The framework works like this: the firm’s 13 custom scanners scan for heavy institutional flow, elevated volume at the ask/bid, meaningful open interest, and strong technical or volatility setups.

When a trade passes all of those internal filters, it earns the “10/10” tag and is sent to members.

In the end, you get to focus on only what the system considers highest-probability opportunities.

Next, let’s unpack what you do get as a member.

>> Get Access to AlphaShark’s 13 Scanners <<

What You Get With AlphaShark 10 / 10 SPECIAL

When you sign up for the AlphaShark 10/10 SPECIAL, you’re getting more than a handful of trades.

Below, I break down the main features so you know exactly what you’ll receive and why each matters.

Real-Time Trade Alerts

With the 10/10 SPECIAL, you receive alerts the moment the setup passes the internal filters and hits “go”.

These alerts arrive in near real time and include the ticker, option strike, expiration, rationale for the trade, and suggested stop-loss and target levels.

Once the service flags a “10 out of 10” event, you can act immediately, or at least study the logic.

I appreciate the clarity behind each send, so you can quickly step into a trade whether you’re new or have been doing it for years.

Because the alerts derive from an active flow-tracking system, they’re not hypothetical signals posted days later; they’re designed to align with live market moves.

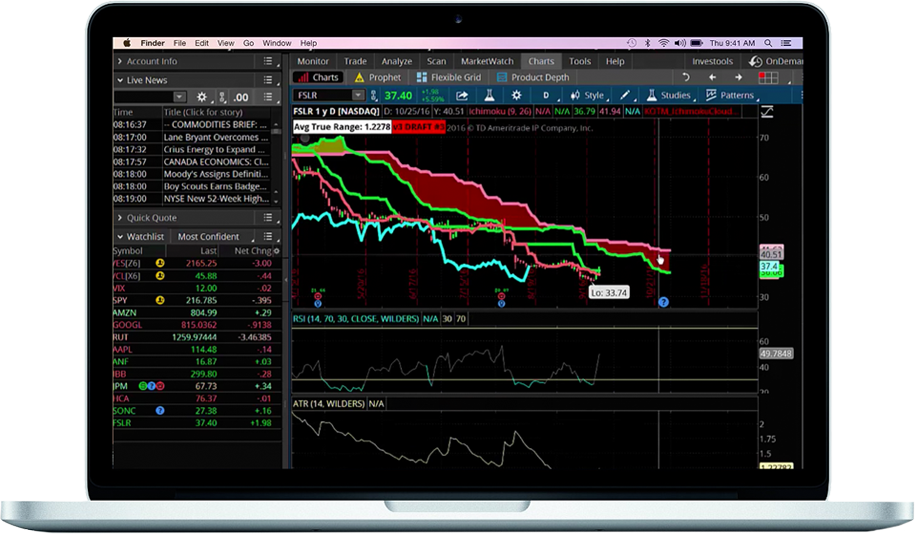

Access to All 13 Scanners

A core piece of what makes the 10/10 SPECIAL different is the access (directly or indirectly) to the full suite of 13 proprietary scanners maintained by AlphaShark.

These scanners comb the options markets, ETF flows, dark-pool activity, institutional size orders, open interest shifts, and more. When a setup triggers across these multiple streams, you know it’s meeting a higher standard.

The value here is that you’re tapping into what is usually institutional-grade data and filtering logic, rather than just casual newsletter picks.

For anyone who wants to understand why a trade is selected, having this scanner backdrop provides context and confidence.

Weekly Activity (1-5 Trades)

Instead of flooding your inbox with dozens of picks each week, the 10/10 SPECIAL focuses on selectivity.

You’ll likely see only 1 to 5 trades per week, meaning each signal has passed through rigorous filters.

That weekly cadence allows you to digest setups without being overwhelmed, allocate capital thoughtfully, and avoid “spray and pray”.

Keene and his crew won’t throw trades at you to fill a certain quota, either. That freedom allows them to deliver only the best of the best in each scenario.

This pacing appeals especially if you have limited screen time, want to preserve discipline, and prefer quality over quantity. The expectation is fewer but stronger alerts.

Optional Live Access

Depending on when you enroll, the 10/10 SPECIAL may include access to live-trading room sessions where you observe the team, including Andrew Keene, working through live order-flow, executing trades in real time, and discussing their rationale.

This component bridges the gap between simply receiving alerts and learning how professionals act in the moment.

Since you get to see the decision-making process and not just the end result, these sessions are a fantastic way to learn from the pros.

If you’re eager to understand “how” the setups are found, this live access is a distinct bonus.

Email and Push Notification Alerts

To ensure you don’t miss opportunities, alerts from the 10/10 SPECIAL come via both email and push notifications so you’re notified no matter your device.

Whether you’re at your desk or mobile, you’ll be able to see the alert when it happens.

That matters because many of the high-probability setups move quickly; lagging alerts can quickly reduce your edge.

By receiving timely notifications and having the trade detail at your fingertips, you can act (or review) without delay.

>> Trade Smarter with AlphaShark Trading <<

Refund Policy

AlphaShark maintains a very clear and strict refund policy, which is consistent across all its trading programs, including the 10/10 SPECIAL.

According to the official terms listed on AlphaShark.com and confirmed in the transcript, all sales of digital products are final.

However, subscribers can cancel their memberships at any time by emailing support@alphashark.com at least five business days before their next billing date.

The cancellation will take effect after the current cycle ends, ensuring you still receive access for the remaining period.

This policy reflects AlphaShark’s commitment to transparency, making it essential for potential members to review all details carefully before joining.

How Much Does AlphaShark 10 / 10 SPECIAL Cost?

The AlphaShark 10/10 SPECIAL is offered through two straightforward pricing tiers designed for different levels of commitment.

The monthly plan costs $199 per month, providing full access to Andrew Keene’s live alerts, weekly “10 out of 10” trade opportunities, and all 13 custom scanners. It’s ideal for those who want to test the system for a short period before committing long-term.

For those planning to stay longer, the yearly plan is priced at $1,999 per year, which effectively saves two full months of subscription fees compared to the monthly rate.

Both plans deliver the same features, real-time trade alerts, scanner access, and push/email notifications, without limitations. The difference lies in overall savings and convenience.

>> Join the AlphaShark 10/10 SPECIAL Now <<

Pros and Cons

After swimming into the AlphaShark tank, here are the top pros and cons I observed:

Pros

- Led by a verified former CBOE floor trader

- Focus on quality over quantity (1–5 signals per week)

- Access to 13 proprietary institutional scanners

- Real-time email and push alerts

- Teaches practical order-flow interpretation

Cons

- Non-refundable digital sales policy

- Requires timely execution to mirror signals

AlphaShark’s Track Record

AlphaShark Trading has built a long-standing reputation for transparency and real-time trading.

Andrew Keene and his team actively trade with their own capital, a point highlighted throughout the 10/10 SPECIAL page, and every alert originates from the same data they personally act on.

Several recent options trades, such as Energy Transfer, Douglas Emmett, and Fiserv, brought in more than 50% profits each in short timeframes, revealing the effectiveness of the service.

These impressive results are no guarantee of future gains, but knowing each recommendation is a 10/10 is encouraging.

>> Tap Into AlphaShark’s Institutional Flow Alerts <<

Is AlphaShark 10 / 10 SPECIAL Worth It?

After reviewing everything in this AlphaShark 10/10 SPECIAL review, it’s clear the service stands out for folks who value precision and accountability.

Unlike generic alert groups that flood inboxes with random picks, AlphaShark focuses on selective, data-backed setups tracked through Andrew Keene’s 13 custom scanners.

Each alert you receive has already been vetted by an active trader with real capital on the line, not a marketing team chasing sign-ups.

The limited number of alerts each week creates a focused environment where you can plan out and execute each play while cutting out extra noise..

While it’s not a fit for anyone expecting overnight wins, disciplined individuals who appreciate structured, high-quality signals will find strong value here.

For those serious about mastering options flow, the 10/10 SPECIAL delivers one of the most authentic, experience-driven systems available.

Tags:

Tags: