The Behind the Markets newsletter is generating quite a bit of buzz online with members, and I’m here to see if it lives up to the hype. Keep reading my Behind the Markets review for the full rundown of Dylan Jovine’s stock-picking service.

What Is Behind the Markets?

Behind the Markets is an online newsletter that provides subscribers with stock recommendations, trade alerts, and bonus reports. Dylan Jovine is the editor and lead stock picker.

This stock-picking service cues members into mid-cap companies with growth potential. It follows a conservative investing approach that seeks out long-term value.

Something that I like about Behind the Markets is it doesn’t anchor itself down to a single sector. Jovine scours the stock market to find investment opportunities for members—wherever they may be.

A lot of newsletters have a niche, which could be great when the sector is hot. However, portfolios could also take a big hit when an industry cools down.

So some folks might appreciate the variety on offer.

There’s a lot more to this service, and I’m going to dig into the details as we go.

But first, let’s take a closer look at Behind the Markets’ strategy.

Behind the Markets’ Investment Strategy

Jovine and his team look for stocks that could be trading at a significant discount to what the underlying business is worth.

The team’s business valuation approach is very comprehensive, but here are some key takeaways about Behind the Markets’ strategy. They search for companies that have:

- Market capitalizations ranging from $1 billion to $10 billion.

- High returns on equity, low debt, and a durable competitive advantage.

- The hallmarks of only suffering a temporary setback.

While all these points of analysis are valuable, the major draw is Dylan Jovine’s focus on companies that could be seeing a temporary setback. In other words, they might be undervalued at the moment, which may result in bigger returns in the future.

When Jovine spots a stock that fits this criteria, he shares his findings with Behind the Markets’ subscribers through the monthly newsletter.

>> Like Behind the Markets investment strategy? Sign up now at 80% off! <<

Who Is Dylan Jovine?

Dylan Jovine is an excellent stock picker, and he’s earned a great rep as a Wall Street vet who has a finger on the pulse of the market.

Jovine pens insightful investing analysis that’s influenced by his extensive background as a professional investor.

He is currently the lead researcher for the Behind the Markets service, but you might know Jovine from his previous work on Tycoon Report.

Some of his most popular research reports include:

-

Past the Blood-Brain-Barrier: The Small Company Revolutionizing Alzheimer’s Disease

-

World War 5G

-

Bullet-Proof: How to Create the Ideal Small-Cap Biotech Stock Portfolio

Jovine made his Wall Street debut in 1991 under the tutelage of NYC investment banking legend Peter Jaquith.

This was a big break for a blue-collar kid from Queens, and he ended up making the most of it.

In 2009, he forecasted the ’09 Financial Crisis and subsequent stock market crash.

The depressed market was a fertile trading ground, and Jovine used it to reap massive rewards in dirt-cheap stocks as the market recovered. This is just one example where his stock market predictions paid off big.

So what is Dylan saying about the stock market today? Let’s take a look at his latest prediction to find out.

Is Dylan Jovine Legit?

Yes, Dylan Jovine is legit. While doing my Behind the Markets review, I found out that he has a solid track record in the world of finance and pens quality analysis.

Jovine’s reputation is much more established than your average self-proclaimed online research guru.

You don’t need to worry about credibility with Behind the Markets. Dylan Jovine is as qualified as they come.

Let’s switch gears and check out Jovine’s latest prediction.

>> Get Dylan’s latest insights and research reports at 80% off today! <<

Dylan Jovine’s 2025 Presentation: “The Last Retirement Stock You’ll Ever Need”

Dylan Jovine believes there’s a $85 trillion mega-shift starting to take shape as America embraces artificial intelligence like never before.

It actually has nothing to do with the microchips or computer software we often hear about but rather a relatively unknown niche that’s absolutely essential for keeping the technology on track.

I start to drool at opportunities like these, since such innovations have a way of generating huge amounts of wealth for those involved.

Even more, Jovine teases a lifetime-lasting income opportunity on top of all the gains this sector could bring.

Just what has the guru so excited?

The Rise of Data Center Alley

Artificial intelligence requires just massive gobs of data to function, even in its current state.

All that information lives in data centers, processing hubs for not just AI but everything we consume on the internet.

Without these buildings, we’d have no texting, email, or websites, and AI could completely cease to exist.

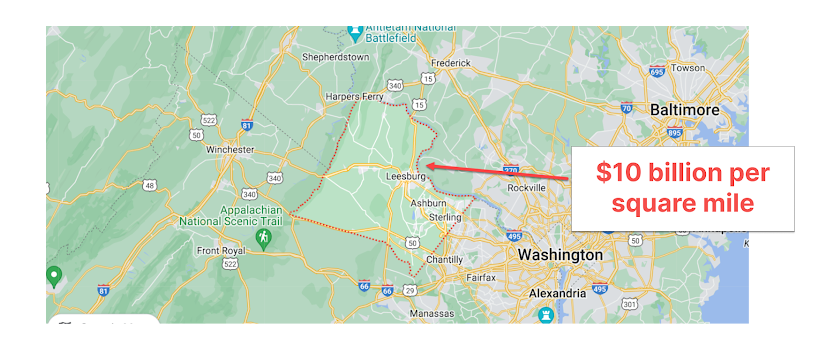

That demand gave rise to Data Center Alley, a 500-square-mile stretch of land near Washington, DC.

This area currently accounts for roughly 70% of global data traffic, and that number is expected to grow much higher in the coming years.

It comes as no surprise that those buildings require absurd amounts of energy to function, which is where Dylan feels the real money’s at.

We’ve managed to double our energy consumption every year since 2010 with no end in sight.

Although it’s exciting to be at the cutting edge, it’s not all sunshine and rainbows.

>> Get the full scoop on Dylan’s last retirement stock <<

America’s Energy Problem

Energy is the linchpin of innovation, and that leaves us facing a major power problem.

Presidential policies have made it very hard to drill on federal soil, leading to a search for alternative methods, which, to be honest, haven’t really worked out.

We tied our own hands with an aging power grid and, quite honestly, nowhere to turn.

Other countries are closing their doors to essential energy exports, or at least made them quite hard to acquire.

America’s energy boom some ten years back offered a ray of hope, utilizing never-before-seen technology that fused fracking and horizontal drilling to pull oil out of the soil.

Infrastructure became our next challenge, with bottlenecks and poor connection points slowing the distribution of energy to where it was needed most.

It’s here that, as the United States comes up to speed, Jovine anticipates the biggest opportunities for making money.

How to Cash in on the Energy Boom

The energy boom is coming whether we’re ready for it or not.

Jovine’s been at the forefront of the movement for some time, scouring the sector for ways to take advantage.

His research led him not to a driller but an oil transporter he predicts could climb 2,000% or higher in the coming months.

It serves as a “toll booth” for black gold, offering payments to shareholders on every drop passing through its system.

You can have immediate access to the name of this stock pick, along with how to play it, by signing up under Dylan’s brand-new deal.

The goodies don’t end there, though. Join me as I uncover everything that comes with a Behind the Markets subscription.

>> Sign up now to access Dylan’s top picks <<

Behind The Markets Review: What’s Included with a Membership?

Behind the Markets has a whole host of exceptional features.

Keep reading my Behind the Markets review for a breakdown of each one.

Behind the Markets Newsletter

The Behind the Markets newsletter seeks to discover growth opportunities that aren’t obvious winners on the stock market.

You’ll receive up to two Dylan Jovine stock recommendations every month, plus detailed analyses of the latest market moves.

The newsletter is jam-packed with valuable content, so you’ll be sure to get a lot of value out of this insightful monthly read.

Model Portfolio

All of Jovine’s current recommendations find their way into his model portfolio. Members get unlimited access to the list to view current standings.

From there, you can select securities to add to your own portfolio and follow Jovine’s strategy as much as you desire. He’ll add new recommendations each month and remove old picks as they peak.

Trade Alerts and Portfolio Updates

Dylan sends out regular portfolio updates whenever he makes a change so you’re always one step ahead of the game. These updates come via email so you don’t have to monitor the portfolio all day.

If stock market shakeups happen, Jovine’s quick to send out actionable alerts so you can buy an incredible opportunity or drop a tanking one.

Complementary Report: “SEARCH & DESTROY: 3 A.I. Software Stocks Revolutionizing Warfare”

This free report is your in-road to the big A.I. stock Jovine’s so excited about. It contains the company’s name, ticker, and even ideal buy and sell prices. You’ll get a chance to pick up shares before most others.

The report doesn’t end there. It’s actually over 100 pages of information, including two quiet A.I. stocks worth checking out.

Dylan’s second pick monitors systems on fighters to keep them airborne. Planes remain vital for military operations, making this stock a great option in his book.

The third stock comes from a small A.I. firm helping to keep our nation’s top secrets safe. Jovine’s banking on the government to use this company to protect our critical assets.

>> Get 12 months of Behind the Markets today—at 80% off!<<

Bonus Reports

Alongside Behind the Markets, Jovine is throwing in three additional reports to sweeten the pot further:

The Last Retirement Stock: AI Income For Life

This power-packed report features the big energy player Jovine is so fired up about.

Inside, he explains in detail how the company operates and why he thinks it will jump 20-fold as the demand for energy intensifies.

You’ll get the small stock’s name, ticker symbol, and the best ways to play it for maximum gains should its share price rise as intended.

Dylan goes on to cover its unusual income steam that shareholders can tap into whether its share price is moving or not.

I won’t say there’s anything groundbreaking about this guide, but by the time you set it down, you’ll know exactly how to move on the opportunity.

The AI Linchpin: 10X From Big Tech’s Secret Weapon

The AI Linchpin takes readers on a wild ride through the world of AI to a small company secretly at the center of it all.

It has a real monopoly, interacting with 70% of the world’s population every day.

In fact, the venture’s microchips power the cloud, smartphones, data centers, and, most recently, AI.

Several tech giants actually design their hardware around what this company can do.

I was shocked to hear the name, as I’ve never seen it make the headlines on any media outlet.

With the world’s current AI push, there’s a good chance it will only get more popular.

Jovine shares this chip designer’s name, ticker symbol, and full scoop right here in this special report.

The Atomic Moonshot: Scoring 1,000% Gains From The Nuclear Frenzy

Oil remains Jovine’s (and likely the world’s) focus for now, but that doesn’t mean folks aren’t looking for alternative energy sources.

The nuclear sector keeps popping up on my radar, and it seems that Dylan has the same outlook.

Even Sam Altman of OpenAI started his own nuclear startup, but that’s not the pick he’s highlighting today.

This small energy stock stands to profit from every nuclear power plant built across the nation as our oil reserves struggle to keep up.

As always, the guru does an excellent job of laying bare all the details of his opportunity without being over the top.

It’s definitely one of Jovine’s more speculative picks, so do keep that in mind before investing.

>> Join now to get these special reports <<

6-Month Money-Back Guarantee

Jovine stands behind his service and is willing to go the extra mile to prove it.

He’s offering an unprecedented six-month window for you to try out every aspect of his platform and see if it’s right for you.

That’s an entire six months of stock picks, updates, and bonus reports without having to commit.

If you’re not thrilled with even the most minute detail, simply reach out to the customer service rep for a complete refund of your purchase price.

You can even keep all the materials you’ve received up to that point, meaning Jovine’s carrying all the risk here.

This is an incredible offer, especially considering most services allow a maximum of 30 days to test the content out.

>> Sign up now under the six-month money-back guarantee <<

Pros and Cons

During our Behind the Markets Review, we found out it has a lot of excellent features, but it’s not perfect. Here are the pros and cons of the service.

Pros:

- One year of Behind the Markets newsletter

- New investment ideas each month

- Frequent alerts and updates

- 24/7 access to the model portfolio

- Three bonus reports

- Six-month money-back guarantee

- Heavily discounted price

Cons:

- No community chat or forum

- Doesn’t offer options trading

FAQs

Is Behind The Markets Suitable For Short-Term Investors?

Behind the Markets takes a conservative, long-term approach to generating income based on company valuations.

Since you’ll want to hold these securities for a while, short-term investors may not find what they need here.

That said, another of Behind the Markets’ services, Takeover Targets, focuses instead on short-term income through faster moves and capital gains.

These plays often come at the hand of merger targets and the fluctuations that space brings.

Is Behind The Markets A Scam?

No, Behind the Markets is definitely not a scam.

The company has an extensive history and remains transparent in all it does, providing a clear look into its dealings.

This includes its many recommendations, which Jovine lists in his model portfolio.

In addition, many people value the guru’s insights and track record of success.

As with any service, however, it is important to remember that there’s no guarantee of future results.

Does Behind the Markets update its stock picks frequently?

Behind the Markets frequently updates its stock picks.

Subscribers can expect 1-2 new stock recommendations each month and detailed reports explaining why each pick is worth considering.

The service also provides timely updates on existing recommendations, helping you know when to buy or sell.

It’s all about keeping you in the loop with the latest opportunities while making the process as easy as possible.

>> Save 80% when you join now! <<

Behind the Markets Performance/Track Record

In recent years, Behind the Markets has consistently delivered outstanding results for its subscribers.

The service’s ability to uncover high-growth opportunities, especially in emerging sectors like AI and biotech, has set it apart from other investment advisories.

Whether it’s spotting the next big AI software company or identifying promising biotech firms, the track record speaks for itself.

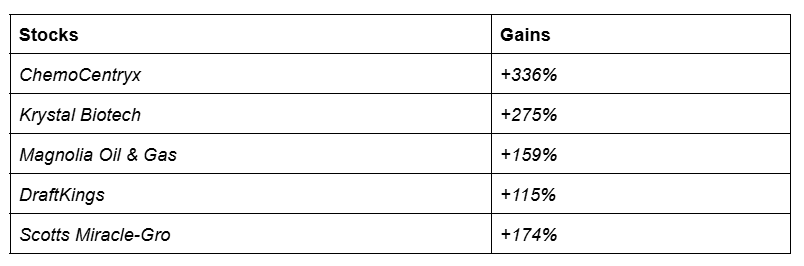

Notable wins include a 336% return from ChemoCentryx, a 275% gain from Krystal Biotech, and 159% from Magnolia Oil & Gas.

These aren’t just lucky picks; they are the result of thorough research and a keen eye for undervalued companies poised for growth.

Scotts Miracle-Gro saw a 174% increase, while DraftKings brought in a solid 115%, showcasing the diverse range of industries Behind the Markets covers.

By focusing on small companies with big potential, this service has helped subscribers navigate market fluctuations with confidence.

Each recommendation is backed by careful analysis, ensuring that subscribers have access to the best opportunities available.

Here’s a quick snapshot of some key stock performance:

Behind the Markets Reviews by Members

I give Behind the Markets’ research high marks. You don’t need to take my word for it, though. Here are reviews from reported Behind the Markets members:

While these are glowing reviews of the service, it’s important to remember that reported returns from testimonials may not be typical, but they could indicate what’s possible.

>> Sign up now to share these members’ amazing experiences <<

Is This Service Right For Me?

Behind the Markets comes with a slew of great tools for anyone and everyone.

Newbies will find tons of information to get started in various sectors thanks to the newsletter and special reports.

Based on a thorough review of Behind the Markets, beginners and folks with more experience can both benefit from all the stock picks located within.

This bundle is also one of the first places you’ll get access to A.I. stocks with oodles of potential.

Unlimited access to a model portfolio should keep everyone happy.

You’ve got a guru sharing his top recommendations and offering insights every step of the way.

You get to go about your business and are notified any time something needs attention. No more watching the markets 24/7.

How Much Does Behind the Markets Cost?

You can get started with Behind the Markets for as little as $19 for an entire year of service, a deal that will normally set you back $399.

At that rate, your average monthly cost comes to just over $1.50. It’s hard to beat a deal like that.

Just so you’re aware, that price point does bump up to $99 annually when it comes time to renew.

However, if you want to get the most bang for your buck, consider upgrading to a Premium Lifetime Subscription for $199.

Valued at nearly $2,000, this package grants you Behind the Markets for life.

The best option depends on your priorities and budget, but you can’t go wrong with either of Behind the Markets’ subscription options.

>> Claim your 80% discount here <<

Is Behind the Markets Worth It?

Behind the Markets is a rock-solid research service. Each feature included is worth more than you’ll pay for access to the entire package.

The current energy-focused offering appears particularly promising. We’ve all seen the way certain energy stocks have performed, and this research could lead you to the sector’s next rising star.

You’d be hard-pressed to find a better deal for $19, and, better yet, your purchase is covered with an airtight money-back guarantee. There’s virtually no way you’ll walk away unsatisfied.

The energy boom is just getting started, so now is the time to start thinking about making moves to position yourself in the sector. Dylan Jovine and Behind the Markets can help you pinpoint the right picks.

After a thorough Behind the Markets review, I can confidently say this deal is a straight steal. The steep discount is the icing on the cake, but it won’t last forever. Make your move now before it’s gone for good.

>> Join now for a one-time fee of $19! Limited Time Offer! <<

Tags:

Tags: