Besides going back to school for a degree in economics, reading is the most important thing you can do to better understand the stock market.

No industry is quite as demanding and volatile as the financial markets.

Furthermore, if you flip on the TV, there are so many talking heads and stock pickers that your head can start swimming with all the investing advice and financial theory.

The best resource is simply picking up a book and learning for yourself. This will help to demystify some of the terms you hear thrown around.

Plus, it will also deepen any knowledge that you already have on the subject.

On library shelves and in the digital halls of Amazon, there is a rich history of successful investors detailing fundamental knowledge and just some wild romps through famous moments on Wall Street.

Here are the best books on investing and the stock market.

Best Books on the Stock Market

The Intelligent Investor by Benjamin Graham

This is the grandfather of investing books from the man who invented “value investing.” In this classic book, Graham outlines his philosophy which counts Warren Buffett as one of his students— in a Socrates to Plato-like relationship.

The main gist of his belief system is that investors should invest like they are purchasing each business, and to examine the company’s business model, its competition, and the wider industry.

The six tenets are:

- Know the business you are investing in.

- Know who runs the business.

- Invest for profits over time, not for quick buy-and-sell transaction profits.

- Choose investments for their fundamental value, not their popularity.

- Always invest with a margin of safety.

- Have confidence in your own analysis and observations.

The last tenet or principle is maybe one of the more famous as Graham describes “Mr. Market,” who is the emotional, sentimental crazy trader who thinks that speculation is investing — they are not the same.

Graham does an excellent job of drawing a line between those two investing concepts.

This book will help increase your market common sense.

Many will find this book outdated and will probably not translate into many of our current market conditions, but it is an important foundational book for any investor, so we recommend this as one of the best books to learn about the stock market.

[maxbutton id=”1″]

Beating the Street by Peter Lynch

This is another respect your elder’s choice…But Lynch is on the Mount Rushmore of investing as the manager of the prestigious Magellan Fund at Fidelity.

Lynch is a proponent, like Graham, of researching your investment target thoroughly and putting your money into what you know best.

Every person has some sort of inside industry knowledge and this book does an excellent how of showing how that can lead to market insight.

Beating the Street also explains that stocks are not lottery tickets, but rather long-term investments…

But, the real value in this book is Lynch’s enthusiasm and his belief that everyday people can make excellent investors, so there so certainly a self-help aspect to this book that is great for beginner investors.

Many people also read Lynch’s One Up on Wall Street, which is just as good and where he gives this insightful adage: “Remember, things are never clear until it’s too late.”

>> Check Price On Beating The Street Here <<

A Random Walk Down Wall Street: The Time-Tested Strategy for Successful Investing by Burton Malkiel

This is clearly one of the best investing books.

If Lynch teaches you to research and put in a lot of hard work in understanding each investment, well, Malkiel flips that idea on its head.

The famous Princeton professor believes that the best way to beat the market is to build a differentiated portfolio that matches the market’s performance or Efficient Market Theory (EMT) or a random walk down Wall Street, as you would.

EMT is a hotly disputed idea but Malkiel demonstrates with some convincing anecdotes that over the long run, the markets are efficient, hence the idea: “Nobody knows more than the market.”

Malkiel recently updated his book and even gave some recent investing advice in an interview to MarketWatch saying: “I don’t think there ought to be a 60/40 portfolio.

I think there ought to be a broad diversification.

What I have recommended in the new edition of my book is, maybe for retired people, the bond allocation might be a lot less.

Not that you don’t need some safe assets or some income-producing assets, but there may be a better way to get them than through bonds.”

Regardless, The Random Walk Down Wall Street is still as important today as it was when it was first written.

>> Check Price On A Random Walk Down Wall Street <<

Best Stock Market Books for Beginners

Are you a boglehead? Well, you might be after you read this book from the famous founder of the Vanguard Group and creator of the first index mutual fund.

Not surprisingly, Bogle defends index mutual funds in this little book as the best way to get your fair share of the market.

In short, bogle surgically deconstructs the financial industry and numerous market products, especially the mutual fund.

Step by step, and through the relentless application of real-world performance numbers and statistics, Bogle shows investing for what is it is: a zero-sum game where people who don’t index, take money from each other while also paying the rest of the industry that is in place to chase mythical performance through mutual funds.

Here is a nice quote from the book:

“The grim irony of investing, then, is that we investors as a group not only don’t get what we pay for, we get precisely what we don’t pay for. So if we pay for nothing, we get everything.”

In this handy book, Bogle has a convincing argument—maybe a little repetitive—and an easy to read writing style.

This legend of the financial world proves succinctly that index investing should be a significant component of all financial plans. Some may argue that Bogle ignores aspects of investor behavior and FOMO.

This book is great for investing beginners because ETF investing is a great place for investors to get their feet wet and a relatively safe place to put some money.

But, beyond that, this book does not offer untold analysis or a more fluid investing theory.

>> Check Price On The Little Book of Common Sense Investing Now! <<

The Little Book That Still Beats the Market by Joel Greenblatt

First published in 2005 and updated in 2010, this book is great for understanding how the market functions and some successful ways to invest.

Greenblatt, the Founder and Managing Partner at Gotham Capital, offers readers a “magic formula” for stock market investing and provides some copious examples to prove and test this formula.

Essentially, this magic formula revolves around a company’s earnings yield and the return on assets.

Then, you recycle these stocks after a year. He’s reasoning is evident in quotes like the following. “Companies that achieve a high return on capital are likely to have a special advantage of some kind. That special advantage keeps competitors from destroying the ability to earn above-average profits.”

Greenblatt, unlike some other books on this list, does not get overly technical.

I would say you could understand this book if you passed 8th-grade math. He has written the book a light and easy manner. There are some dad jokes sprinkled throughout.

Like this one for example: “Choosing individual stocks without any idea of what you’re looking for is like running through a dynamite factory with a burning match.

You may live, but you’re still an idiot.”

Greenblatt even revisits Graham’s “Mr. Market” investor, stating: “If you just stick to buying good companies (ones that have a high return on capital) and to buying those companies only at bargain prices (at prices that give you a high earnings yield), you can end up systematically buying many of the good companies that crazy Mr. Market has decided to literally give away.”

But, overall, Greenblatt is great at removing anxiety and encouraging the reader to get involved.

This is a great book to get motivated about investing and start investing in a reliable market formula.

>> Check Price On The Little Book That Still Beats the Market Now! <<

Best Books to Learn How to Invest in the Stock Market

The Four Pillars of Investing by William Bernstein

Bernstein is another great voice for beginning investors to familiarize themselves with and to grab a quick strategy before putting your money up…but to also get some solid market history.

This book provides both and Bernstein accomplishes this without fluff and gives readers an honest look at the market. The book covers:

- How to mix different asset classes into an effective blend

- Why an investor should avoid picking stocks, as opposed to investing in the whole market

- What to know about trader behavior and how it affects a stock price

- Why brokers are often your most direct competitors

- Strategies for managing every type of asset

He also drops the occasional gem, like these two sage bits of wisdom:

“If you find yourself stimulated in any way by your portfolio performance, then you are probably doing something very wrong. A superior portfolio strategy should be intrinsically boring.”

And:

“If your portfolio risk exceeds your tolerance for loss, there is a high likelihood that you will abandon your plan when the going gets rough.”

>> Check Price On The Four Pillars of Investing Now! <<

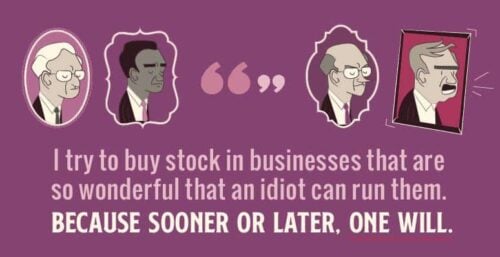

The Essays of Warren Buffett: Lessons for Corporate America by Warren Buffett

This list would not be complete without one from the “Oracle of Omaha” and Buffett’s letters to the shareholders of Berkshire Hathaway should be required reading.

These letters provide excellent insight into the shift of market sentiments and the passage of time over through the eyes of a Wall Street sage…But, the book has been organized by the editor Lawrence A. Cunnigham in a way for readers to gain specific knowledge from Buffett by subject rather than just read them chronologically.

Here is how he organized it:

I Corporate Governance

II Corporate Finance and Investing

III Alternatives to Common Stock

IV Common Stock

V Mergers and Acquisitions

VI Accounting and Valuation

VII Accounting Policy and Tax Matters

In truth, this book will likely give you more insight into the workings of corporate America (and one might argue that it is a must-read for any current CEO or wanna-be future CEO).

It also has sound investment advice on how to find good businesses and hold them for the long haul.

This book by Buffett offers a great way to learn about the stock market from a personal and sympathetic viewpoint devoid of bluster and ego. And, of course, Buffett has a masterful way of turning a phrase, here are some of my favorites:

When a person with money meets a person with experience, the one with experience ends up with the money and the one with money leaves with experience.

Buffett is a master of the market and any chance to study his philosophies and theories is not to be missed.

>> Check Price On The Essays of Warren Buffett Now! <<

Final Thoughts and a Little Advice

These books are just a starting point and every reader needs to find something that clicks with them. Buffett might not be for every reader, just like Lynch may be too droll for another.

Don’t get me wrong, your investing philosophy will benefit from reading all these books—some may cement your particular view of the market or maybe even totally blow your hair back.

The bottom line, reading to increase your knowledge and acumen is essential. Every investor should have a deep bench of theories and strategies to call to mind. Let’s be honest, most of us are not going back to school for this. So, pick up a book and go to a library even for some free education. I mean, who knows, the move might make you a ton of cash.

Tags:

Tags: