We’re all trying to get ahead of the market, but the sheer number of secrets and strategies out there is simply overwhelming.

Most methods don’t even work, resulting in losses and frustration that leave a bad taste in our mouths.

Not long ago, I came across Bigshort, a platform built for folks who want more than lagging indicators.

In this Bigshort Trading Tool review, I’ll explain what it offers, how it works, and why it might deserve a spot in your trading toolkit.

>> Join BigShort Today for a Special Deal <<

What is BigShort?

At its core, Bigshort is an AI-powered trading platform specifically geared for folks pursuing short-term gains.

Instead of giving you scattered bits of data, it pulls Smart Money activity, options flow, dark pool prints, and even short volume into one consolidated view.

The goal is simple: help see what institutions are doing in real time and react faster.

What makes it appealing is the mix of speed and clear insight so you don’t have to dig through multiple sources or guess what large players are up to.

Subscribers also get access to private alerts, a dynamic screener, and an active Discord community where ideas and strategies are shared daily.

If you’ve ever wanted to trade with more confidence and stop second-guessing lagging indicators, Bigshort is designed to give you that edge.

How Does It Work?

Bigshort works by streaming raw, tick-by-tick data directly from the exchanges and layering it onto one consolidated chart.

Instead of jumping between platforms for order flow, options data, and dark pool activity, you see everything visualized in real time.

The algorithms parse millions of data points per second and distinguish between retail trades and Smart Money moves, highlighting manipulation and intent.

This workflow means you can spot institutional footprints before they show up in price action.

For individuals who rely on quick decisions, that workflow is what makes Bigshort stand out.

Is BigShort Legit?

Yes, Bigshort is legitimate and has built credibility in the trading community.

It was developed by a quant trading firm and has won recognition such as the Benzinga Fintech Award for Best Order Flow Analytics.

The platform claims its SmartFlow helped grow $139,000 into $10 million, backed by forward and backtesting data.

In the FAQ, the co-founder mentions he made $2.4 million last year alone.

If that wasn’t enough, BigShort has a forward and back-tested 90% win rate on its squeeze indicator.

While no tool can guarantee profits, the proven track record and transparent development background make Bigshort a trusted name among serious traders.

BigShort vs Competing Trading Tools: Why Is It Special?

Compared to most trading tools on the market, Bigshort sets itself apart by the depth and speed of its data.

Many competitors rely on delayed or filtered feeds, while Bigshort streams raw exchange data and processes it in real time.

This matters because it allows users to see institutional footprints the moment they happen, not after the fact.

Spodin alerts let you input as many price points as you want, giving you the freedom to build out your own data sets that no one else can see.

Add in its award-winning recognition and active Discord community, and you have a platform that feels more like a professional trading desk than a retail tool.

BigShort Trading Tool Review: Most Notable Features

Here’s a brief breakdown of the features you can access with a BigShort subscription:

SmartFlow

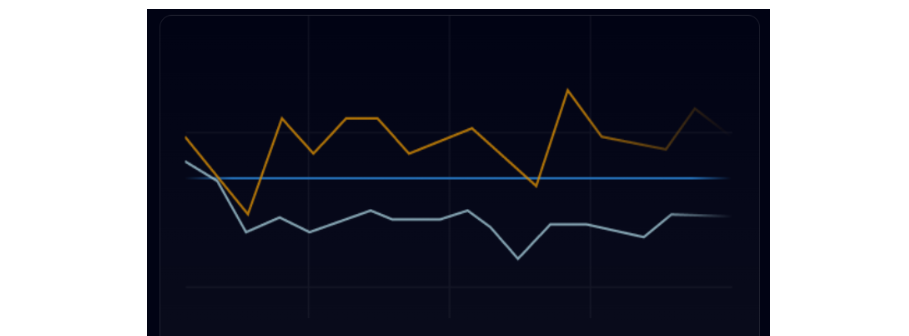

SmartFlow is BigShort’s proprietary algorithm designed to convey smart money positioning data in a clear and concise way.

It filters raw exchange data in real time and separates retail activity from Smart Money trades.

On the flip side, the platform’s MomoFlow tends to act as a reliable inverse indicator when you want to see what’s flowing in the opposite direction.

The developers highlight that this tool was central to turning $139,000 into $10 million, and while past performance doesn’t guarantee future results, it shows how powerful tracking institutional footprints can be when used consistently.

>> See real-time covert Smart Money activity in actionable form <<

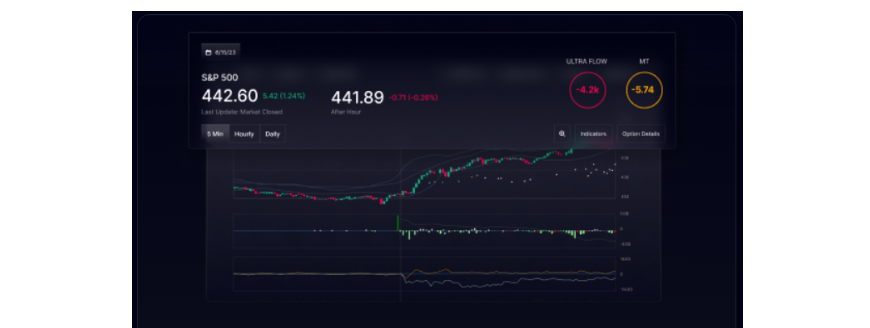

UltraFlow

UltraFlow utilizes machine learning to pull millions of market data points per second through its big data algorithm.

If SmartFlow helps you drill into a single ticker, UltraFlow helps you understand the bigger picture.

You can also look into market dynamics for a handful of other trusts, including the Invesco QQQ Trust and the DIA, an ETF based on the Dow Jones.

Like SmartFlow, the UltraFlow tool provides real-time market insights that are accurate to the second.

Perhaps one of UltraFlow’s best features, however, is its Similarity Search. Here, you can see the top five days with the most similar price action and precisely how those days played out.

This can be incredibly useful, as trading days tend to follow similar patterns that can lead to at least somewhat predictive profits.

>> Tap into AI-powered market insights now! <<

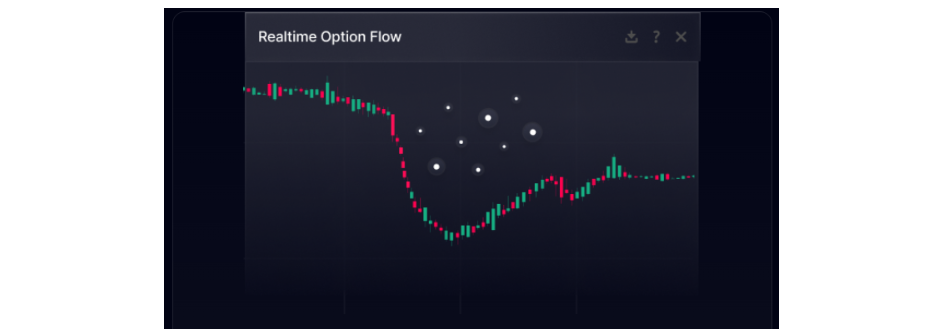

OptionFlow

With OptionFlow, Bigshort overlays option block trades, sweeps, and splits directly onto your chart.

Instead of scrolling through endless option chains or third-party tools, you can see this information as it happens in real time.

For active individuals, knowing when institutions are aggressively buying calls or hedging with puts provides an edge that can’t be replicated with lagging indicators.

OptionFlow essentially brings transparency to an area of the market that has traditionally been hard for us to follow.

There’s a sentiment indicator along with a few other data points at the top of the page that indicate overall market dynamics to help with initial assessments.

>> See options bocks, sweeps, and splits in real-time <<

GEX (Gamma Exposure)

GEX, or Gamma Exposure, shows the levels in the options market where market makers have the most exposure and are likely to hedge aggressively.

Instead of relying only on traditional technical levels, GEX gives you an additional layer of context that reflects how option positioning is shaping intraday moves.

For traders who want to better understand how derivatives flow influences stock prices, this tool adds a critical edge.

Dark Pool Prints

Dark pool trades are often where the biggest institutions move their positions quietly, away from public exchanges.

Bigshort exposes these hidden transactions and plots them directly on your charts, offering untold new real-time insights into moves potentially affecting stocks that we don’t typically get to see.

The charting here is laid out similar to the OptionFlow, with coverage on the number of trades taking place and where support and resistance come in.

By seeing where large blocks are executed, you can identify potential support and resistance levels that aren’t obvious from price action alone.

This feature is particularly useful for swing trading, where institutional buying or selling pressure might come into play.

Instead of being surprised by sudden reversals, you’re able to anticipate moves driven by hidden flows.

>> Get visual data to spot support and resistance levels now! <<

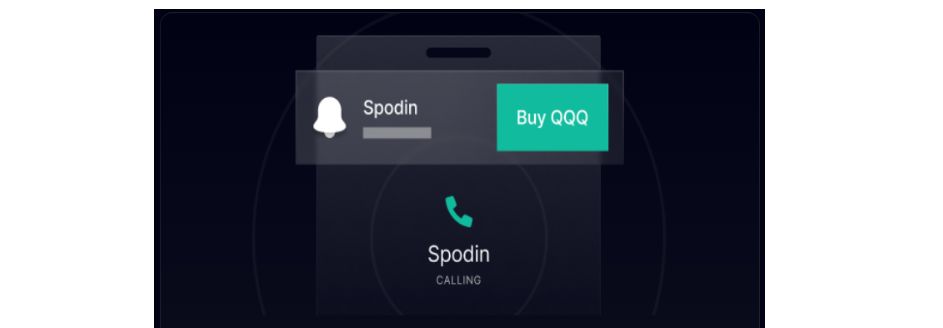

Unlimited Spodin Alerts

Spodin alerts are your built-in alarm system when using BigShort for watching stocks.

It’s possible to get these alerts via call or text, but the beauty of the Spodin system is that no one else ever sees or hears them.

Because it’s completely closed access, BigShort never sells your alerts to market makers that would give them your price targets and information they can use to trade against you.

>> Switch to smart trading with covert Spodin Alerts <<

Manipulation Indicator

The Manipulation indicator is one of the most popular tools on the platform because it attempts to show where market makers want the price to move.

Instead of reacting to what has already happened, you get a sense of intent in real time.

It doesn’t replace chart reading, but it adds a layer of context that can significantly improve your timing. Many users call this their go-to feature for daily setups.

There are two such charts available, one for the biggest positive manipulation moves and the other tallying up negative manipulation instead.

>> See price direction being guided in real-time <<

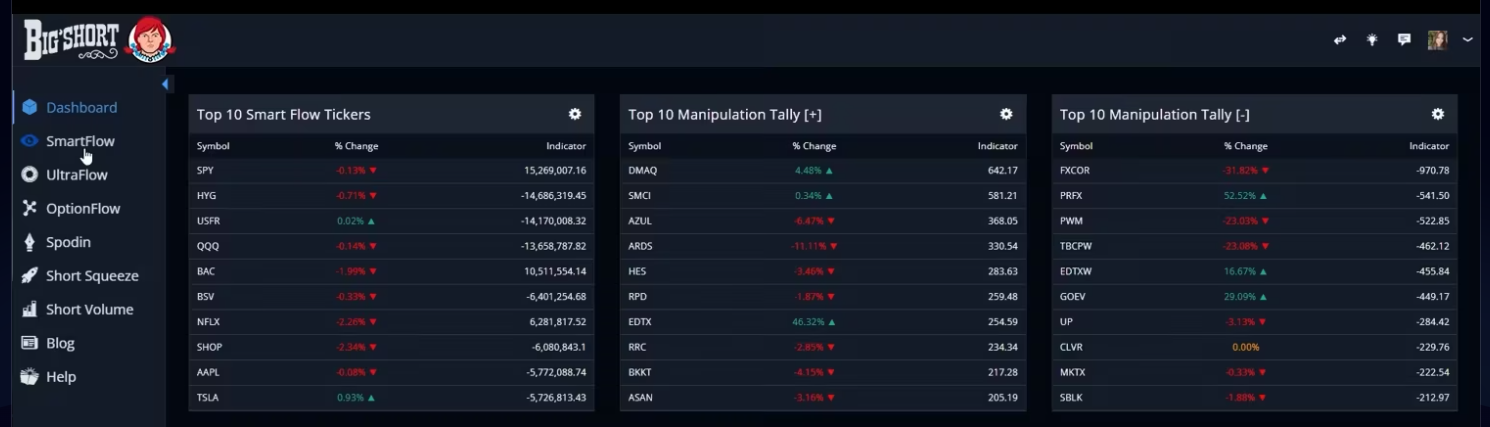

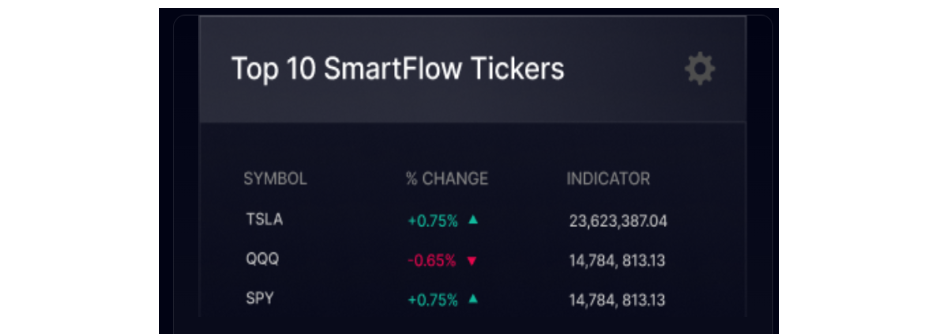

Top 10 SmartFlow & Manipulation Lists

For folks who don’t have time to scan hundreds of tickers, the platform’s dynamic Top 10 lists are invaluable.

By clicking into these lists, you can quickly identify the best opportunities without spending hours filtering data. It’s like having a constantly refreshing watchlist built from institutional footprints you can use to make your plays.

This feature saves time and ensures you’re always looking where the action is instead of chasing lagging setups.

>> Try the BSS indicator now! <<

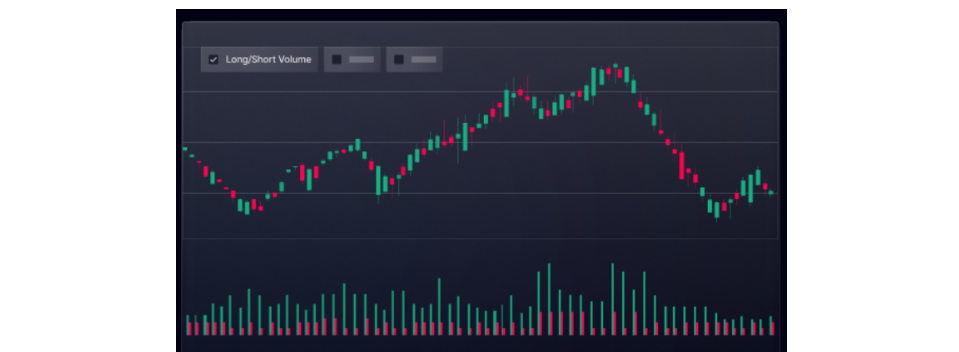

Short Volume Charts

Short volume is a powerful piece of data for reading the room, so to speak. Bigshort takes this information and turns it into clear visual charts that show when short positions are being opened or covered.

This matters because every short trade eventually becomes buying pressure when it has to be closed. By keeping an eye on short volume, folks can anticipate potential squeezes or reversals.

BigShort’s short volume charts are an excellent window into this space, providing one of the most straightforward ways to assess and move in this incredibly profitable niche.

>> Get visual clarity with real-time short data <<

Dynamically Updated Top 10 SmartFlow Lists

- Dynamically Updated Top 10 SmartFlow List

- Dynamically Updated Top 10 Positive Manipulation List

- Dynamically Updated Top 10 Negative Manipulation List

Your dashboard is the prime place to kick off your trading strategy for the day. Not only is it jam-packed with pertinent information, it loads right into a series of SmartFlow lists you never want to miss.

Next to the SmartFlow lists are two similar tallies indicating tickers experiencing the most manipulation on the day.

It’s a great way to see which securities are primed to move and those that will likely remain stagnant.

>> Find the best trade setups now! <<

Built-In Screener

Instead of juggling multiple screeners and filters, Bigshort has a built-in tool that highlights the highest-opportunity tickers in real time.

The screener uses the same proprietary algorithms behind SmartFlow and Manipulation to surface the most relevant names.

This means you’re not just getting random stocks that fit generic filters, you’re getting curated setups based on institutional activity.

Having the built-in screener helps keep your workflow efficient and focused.

Exclusive Members-Only Discord Chat

In addition to tons of data and technical analysis, BigShort taps into the power of Discord to create a platform for its subscribers to use.

It’s an active hub where individuals share setups, discuss market conditions, and get guidance from the team behind the platform.

Channels are organized by style, day trading, swing trading, market chat, and there’s even a section for exclusive recommendations.

For many members, this community is as valuable as the software itself.

I’ve witnessed and participated in plenty of discussions on profits and trading strategies in what I’d consider a safe space.

There are also sections with guides you can watch on how to effectively use the platform and its advanced charting capabilities.

The platform’s developers are quite active here, sharing their insights and listening to crowd suggestions.

BigShort Squeeze Indicator (Honey Badger Days) – Premium Only

The BigShort Squeeze Indicator is sometimes referred to by users as the “payday” signal.

It has been both backtested and forward-tested and is marketed with a 90% win rate.

While no signal can be perfect, this tool has a strong reputation among members for identifying explosive setups.

Short squeezers will want to take advantage of honey badger days, known as one of the best trading signals on the platform.

It looks for moments when short covering and Smart Money activity align to push prices sharply in one direction.

This signal pops up somewhere between 6 and 7 pm PST, indicating there’s a lot of shorting in the market. Members can use this data to capitalize on the bullish pressure this generates and the gains that typically ensue.

Volatility Skew – Premium Only

Volatility Skew is one of the premium features inside Bigshort that gives traders deeper insight into the options market.

It measures the difference in implied volatility between out-of-the-money calls and puts, which can reveal where market participants expect bigger moves.

When skew becomes unbalanced, it often signals that institutions are positioning for sharp price swings in one direction.

Having this information integrated into your charts helps refine entries and exits with greater accuracy.

It’s important to note that Volatility Skew is only available for premium members, making it an advanced tool for those who want to go beyond the standard package.

>> Join the BigShort community HERE <<

Does BigShort Offer a Satisfaction Guarantee?

BigShort does not offer any sort of satisfaction guarantee, which makes perfect sense considering the services provided here.

They’re offering instant benefits through each of their trading tools, allowing you to log in and start assessing stocks and ETFs the moment you join.

All the technical analysis here pulls data from available sources, giving moment by moment snapshots of the market.

There’s a wealth of information you can gather here, but it’s ultimately up to you how you use it.

It simply wouldn’t be fair for them to feature a guarantee or refund based on anything like that. Plus, bad seeds would surely come in and abuse the policy.

BigShort’s Future Growth Prospects

Bigshort’s future looks promising, especially as retail traders increasingly demand access to the same level of data that institutions have enjoyed for years.

The platform is already recognized as a 2023 Benzinga Fintech Award winner for Best Order Flow Analytics, which gives it industry credibility and momentum for wider adoption.

Its adaptive algorithms, such as SmartFlow and UltraFlow, are built to evolve with market conditions rather than degrade over time, making the technology more resilient than traditional charting tools.

On top of that, the team actively incorporates feedback from its private Discord community, ensuring the software keeps improving.

With more folks seeking real-time insights into Smart Money and dark pool activity, Bigshort is positioned to capture a growing niche of serious day and swing traders who want institutional-level clarity without building their own data infrastructure.

My Experience with BigShort

After spending a good amount of time testing out BigShort’s many features, I’m really impressed with how easy it is to get access to such complex data.

The site boots up to the dashboard, but I always spend a significant amount of time there gauging the securities on the top ten lists before heading anywhere else.

I really like how you can find a bunch of guides here on reading charts as well if you’re new or need a refresher.

Side panel tools quickly take you to SmartFlow, Dark Pool Prints, or wherever else you’re interested in visiting in a flash.

Everything loads smoothly and remains that way, even as the system updates by the second.

I find myself spending just as much time on the members-only Discord page. You’re free to assess all the channels with the provided invitation, and there’s a feed right on BigShort if you don’t want to stray from there.

If I don’t want to watch my screen all the time, I’ll use the Spodin to add some alerts that I can move on if they hit. Having these delivered to my phone via call or text means I get them from anywhere.

>> Get real-time insights for all NYSE and Nasdaq tickers <<<

Pros and Cons

After an extensive review of BigShort trading tools, here are my top pros and cons:

Pros

- Real-time institutional-grade data from NYSE and Nasdaq

- Proprietary signals that evolve with market behavior

- Unlimited private alerts

- Several charting options following smart money

- Indicators back and forward tested with excellent results

- Dashboard with dynamic lists

- Live Discord channel for community interaction

- Detailed shorting charts and data

Cons

- Comes at a higher price than basic platforms

- Has a bit of a steep learning curve

- Strict no-refund policy

Best Uses for BigShort Trading Tools

It’s evident that the platform is built with data-hungry individuals in mind. There’s a ton here, and anyone basing market decisions on in-depth analysis will appreciate what BigShort brings to the table.

Anyone hoping to hop on board emerging trends can utilize DarkFlows or Manipulation indicators to see which way the train’s rolling. BigShort gives these insights before you’ll ever see them on mainstream media when it’s likely too late anyway.

Cancellation and Refund Policy

Because BigShort relies on costly raw data feeds from the exchanges, billed per user, the company doesn’t provide refunds once a payment has been processed.

This applies to both the $37 two‑week trial and the regular monthly or annual subscriptions.

You can cancel future recurring payments anytime from your account dashboard, but you won’t get money back for past charges.

Additionally, accounts terminated for violating terms, such as attempting to resell data or misrepresenting trading activity, are not eligible for refunds.

>> Save 33% when you join now! <<

How Much Does BigShort Subscription Cost?

Bigshort follows a premium subscription model, but it offers a way to test-drive the platform before making a long-term commitment with a two-week trial for $37.

After the trial, the standard Non-Pro monthly plan costs $149 per month.

For those willing to commit longer, the annual plan is priced at $1,188, which works out to $99 per month. That’s roughly a 33% discount compared to paying monthly.

Even if you opt for the monthly plan, you’re only paying $5 per day for access to everything I covered earlier in this review. That’s no more than a cup of coffee, if you think about it.

While it’s not the cheapest option on the market, the value comes from having all major trading signals, SmartFlow, UltraFlow, OptionFlow, dark pool prints, I’m alerts, and the proprietary Squeeze indicator, consolidated in one platform.

On top of these, Bigshort also offers a Pro Monthly Plan at $395/mo that unlocks additional advanced features such as Volatility Skew and the BigShort Squeeze Indicator (Honey Badger Days).

These tools are designed for traders who want the highest level of detail, particularly around institutional positioning and volatility patterns.

Premium members also receive enhanced access to GEX and Volatility Skew content that’s not available to standard subscribers.

BigShort Trading Tool Review: Is It Worth It?

I’ve had full access to BigShort for a while now, and it’s been a pretty amazing journey so far.

The SmartFlow and Squeeze indicators provide insights you don’t normally get from retail platforms, and the addition of UltraFlow and Dark Pool data makes it possible to see where institutions may be moving money before it shows up in price action.

This can make a real difference if you’re active in day or swing trading.

From my own use, I found the learning curve noticeable at first, but once I got comfortable, the indicators helped me cut through noise and make decisions faster.

While the price point may seem steep, you’re honestly getting what you’re paying for in the vast feature set this service provides.

As this Bigshort Trading Tool review has shown, the platform can provide genuine value for anyone looking for an edge against market makers.If you already have the skills and want real-time insights that adapt to changing markets, Bigshort could be a strong addition to your trading setup.

Tags:

Tags: