With so many platforms out there designed to improve your trading game, it can be all but impossible to find the right one for you. In this BigShort trading tool review, I unpack what the service has to offer so you don’t have to.

What is BigShort?

BigShort is a trading service showcasing a host of real-time charts and indicators designed to provide in-depth market analysis.

It prides itself on taking a comprehensive approach to crunching numbers while presenting its findings in a very clear and concise format.

Members get to choose from multiple data sets based on information coming from smart money and the big players with the most impact on market dynamics.

All this information, interpreted correctly, should lead to smarter trading decisions.

While perhaps not for the faint of heart, BigShort’s dynamics can make a powerful companion to anyone wanting to get more out of their investments.

Is BigShort Legit?

The brains behind the platform boast using their own indicators to turn $139,000 into $10 million in real-world profits. They even back it up with verifiable evidence through broker statements right on the website.

In the FAQ, the co-founder mentions he made $2.4 million last year alone.

If that wasn’t enough, BigShort has a forward and back-tested 90% win rate on its squeeze indicator.

BigShort vs Competing Trading Tools: Why Is It Special?

Right off the cuff, BigShort showcases some unique features like a Manipulation Indicator and Dark Flows to set itself apart. These create an access point into where smart money is flowing, something other platforms rarely convey.

Its visualization tools really stand out as well, overlaying complex data into a single candlestick chart for quick reading.

Spodin alerts let you input as many price points as you want, as many other platforms do. This feature is notable because you’re the only one that ever sees this data, not the market makers out to bid against you.

Unlimited access to a private Discord page is just the icing on the cake, as members have a space to discuss ideas and trading strategies that other services don’t provide.

BigShort Trading Tool Review: Most Notable Features

Here’s a brief breakdown of the features you can access with a BigShort subscription:

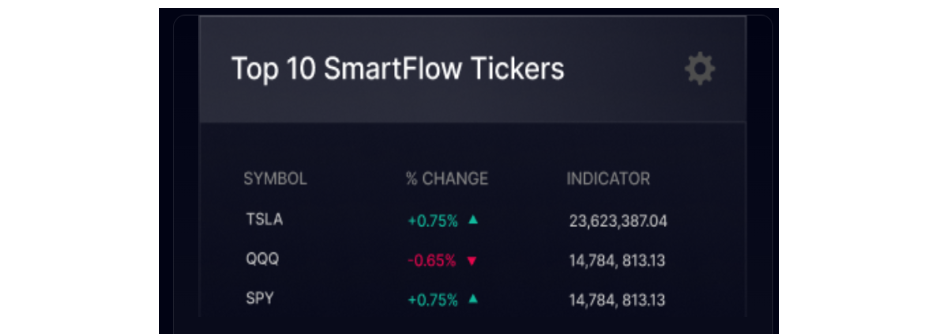

SmartFlow

SmartFlow is BigShort’s proprietary algorithm designed to convey smart money positioning data in a clear and concise way.

You’re able to see real-time insights, allowing you to take immediate action on the market data presented on the screen.

The most interesting piece of this tool is that it allows you to focus on what institutional traders are doing. After all, these individuals are the market makers who have the most impact on how trends play out.

On the flip side, the platform’s MomoFlow tends to act as a reliable inverse indicator when you want to see what’s flowing in the opposite direction.

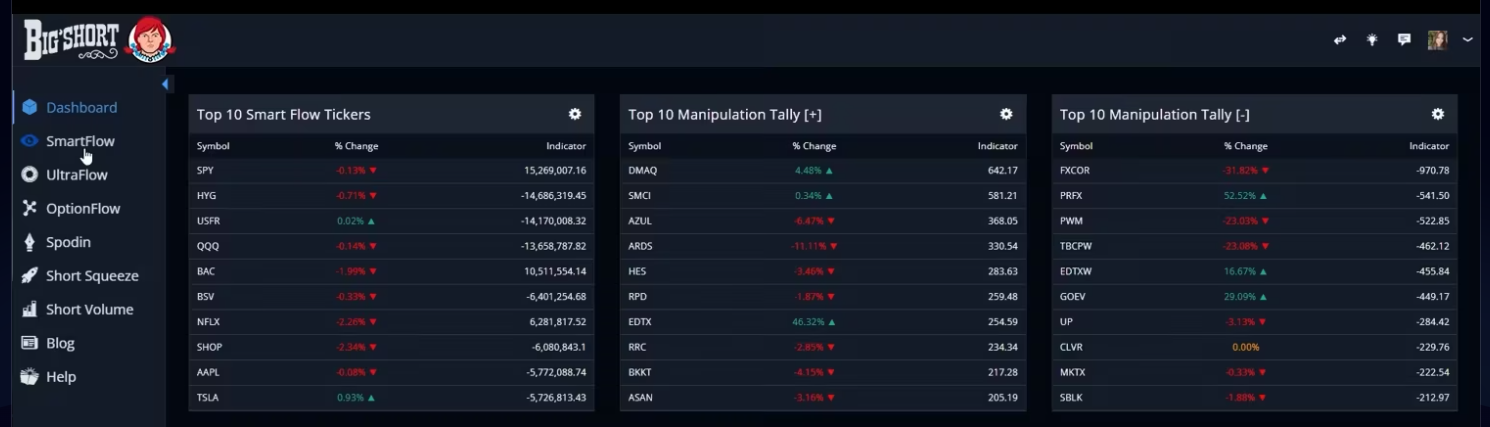

There’s even a list of the top ten SmartFlow smart money tickers on the dashboard that update regularly as the day goes on.

>> See real-time covert Smart Money activity in actionable form <<

UltraFlow

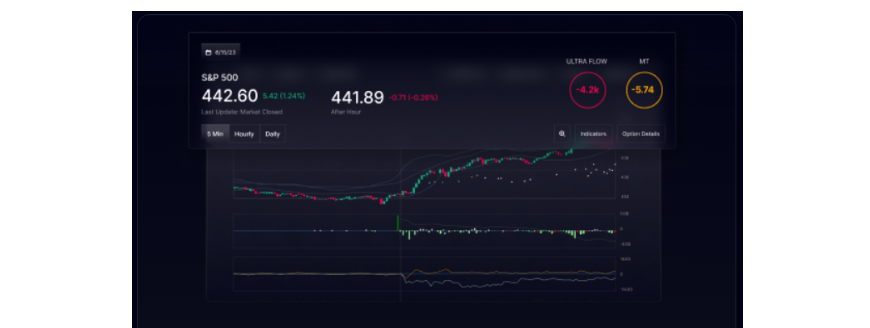

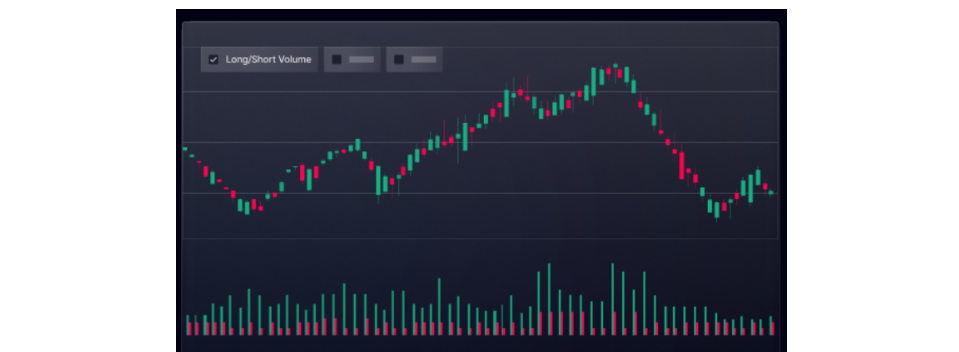

UltraFlow utilizes machine learning to pull millions of market data points through its big data algorithm each second.

I find it best to think of UltraFlow as a SmartFlow for all stocks folded into the S&P 500, where you can visualize these data points in one chart.

You can also look into market dynamics for a handful of other trusts, including the Invesco QQQ Trust and the DIA, an ETF based on the Dow Jones.

Like SmartFlow, the UltraFlow tool provides real-time market insights that are accurate to the second.

Perhaps one of UltraFlow’s best features, however, is its Similarity Search. Here, you can see the top five days with the most similar price action and precisely how those days played out.

This can be incredibly useful, as trading days tend to follow similar patterns that can lead to at least somewhat predictive profits.

>> Tap into AI-powered market insights now! <<

Net OptionFlow

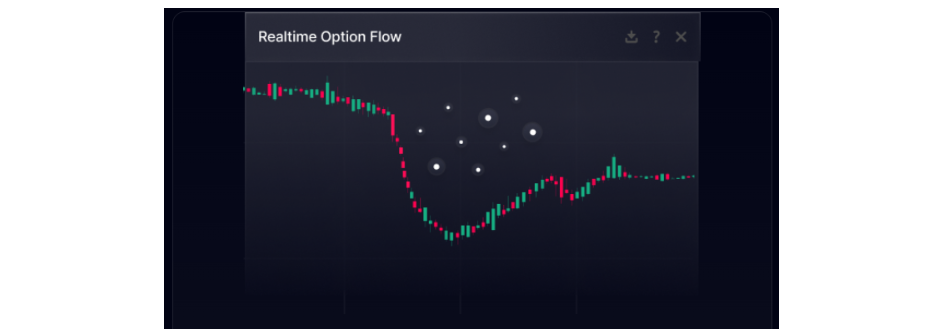

Net OptionFlow provides real-time insights into what’s happening in the world of options.

At a glance, you can see the stock symbol, strike value, spot, and whether you’re dealing with a call or a put.

The chart also shows if the option is a block, split, or sweep and what the sentiment for each is: bear, bull, or neutral.

There’s a sentiment indicator along with a few other data points at the top of the page that indicates overall market dynamics to help with initial assessments.

I’m a fan of the button that lets you toggle options near expiry that you may want to take immediate action on.

>> See options bocks, sweeps, and splits in real-time <<

Dark Pool Prints

Dark pool prints convey data from the behind-closed-door deals institutions make on private exchanges.

BigShort makes these covert transactions visible, offering untold new real-time insights into moves potentially affecting stocks that we don’t typically get to see.

The charting here is laid out similar to the OptionFlow, with a coverage on the number of trades taking place and where support and resistance comes in.

In effect, it’s a powerful window into potentially emerging trends sparked by institutional day traders that help fill in some of the unexplainable gaps in sentiment we see when investing on our own.

>> Get visual data to spot support and resistance levels now! <<

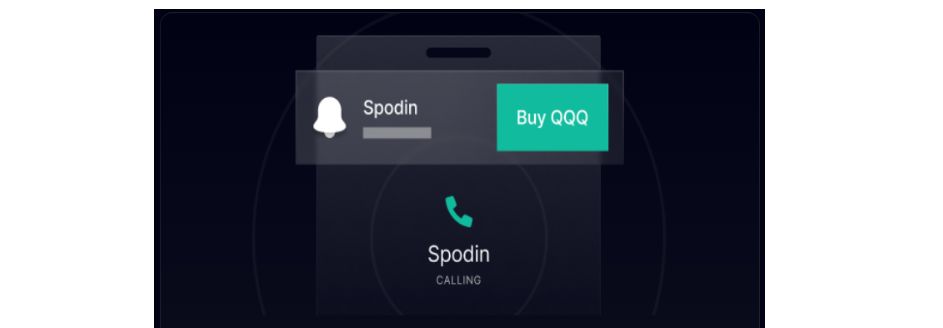

Unlimited Spodin Alerts

Spodin alerts are your built-in alarm system when using BigShort for watching stocks. You’re free to set any flags you desire, and the platform will alert you when that stock reaches your specified price.

It’s possible to get these alerts via call or text, but the beauty of the Spodin system is that no one else ever sees or hears them.

Because it’s completely closed access, BigShort never sells your alerts to market makers that would give them your price targets and information they can use to trade against you.

>> Switch to smart trading with covert Spodin Alerts <<

Manipulation

The BigShort dashboard has a series of top ten lists, with perhaps the most notable covering market manipulation.

When Manipulation is high, Smart Money is taking a firm stance to either buy stock or offload the inventory they already have.

This in turn can reveal forthcoming trends that lead to stock rises or falls based on large volume shifts you can keep an eye out for.

There are two such charts available, one for the biggest positive manipulation moves and the other tallying up negative manipulation instead.

>> See price direction being guided in real-time <<

BigShort Squeeze Indicator (Honey Badger Days)

Bigshort’s squeeze indicator captures those shorts that can make series profits for anyone prepared.

It has a forward and back-tested win rate of over 90% to date, leading to outsized returns a significant amount of the time.

Short squeezers will want to take advantage of honey badger days, known as one of the best trading signals on the platform.

This signal pops up somewhere between 6 and 7 pm PST, indicating there’s a lot of shorting in the market. Members can use this data to capitalize on the bullish pressure this generates and the gains that typically ensue.

>> Try the BSS indicator now! <<

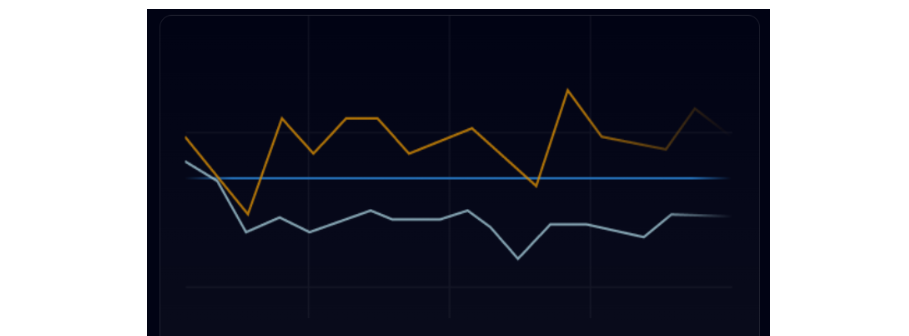

Short Volume Charts

Opening a short position creates an obligation to close it out by either buying shares or selling the derivative.

This often-overlooked short data is the perfect place to glean actionable insights on tickers required to move in some way, shape, or form.

The tool can help zero in on the best entry and exit points for short trading strategies and ultimately provide you with significant gains.

BigShort’s short volume charts are an excellent window into this space, providing one of the most straightforward ways to assess and move in this incredibly profitable niche.

>> Get visual clarity with real-time short data <<

Dynamically Updated Top 10 SmartFlow Lists

- Dynamically Updated Top 10 SmartFlow List

- Dynamically Updated Top 10 Positive Manipulation List

- Dynamically Updated Top 10 Negative Manipulation List

Your dashboard is the prime place to kick off your trading strategy for the day. Not only is it jam-packed with pertinent information, it loads right into a series of SmartFlow lists you never want to miss.

These lists convey the top ten stocks or ETFs at any given time that you can use to locate the best trade setups. Conversely, there’s a list revealing some of the weakest opportunities as well.

Next to the SmartFlow lists are two similar tallies indicating tickers experiencing the most manipulation on the day.

It’s a great way to see which securities are primed to move and those that will likely remain stagnant.

>> Find the best trade setups now! <<

Exclusive Members-Only Discord Chat

In addition to tons of data and technical analysis, BigShort taps into the power of Discord to create a platform for its subscribers to use.

Within Discord, it’s possible to connect with hundreds of like-minded individuals to bounce ideas off of in various text-based channels.

I’ve witnessed and participated in plenty of discussions on profits and trading strategies in what I’d consider a safe space.

There are also sections with guides you can watch on how to effectively use the platform and its advanced charting capabilities.

The platform’s developers are quite active here, sharing their insights and listening to crowd suggestions.

>> Join the BigShort community HERE <<

Does BigShort Offer a Satisfaction Guarantee?

BigShort does not offer any sort of satisfaction guarantee, which makes perfect sense considering the services provided here.

They’re offering instant benefits through each of their trading tools, allowing you to log in and start assessing stocks and ETFs the moment you join.

All the technical analysis here pulls data from available sources, giving moment by moment snapshots of the market.

There’s a wealth of information you can gather here, but it’s ultimately up to you how you use it.

It simply wouldn’t be fair for them to feature a guarantee or refund based on anything like that. Plus, bad seeds would surely come in and abuse the policy.

My Experience with BigShort

After spending a good amount of time testing out BigShort’s many features, I’m really impressed with how easy it is to get access to such complex data.

The site boots up to the dashboard, but I always spend a significant amount of time there gauging the securities on the top ten lists before heading anywhere else.

I really like how you can find a bunch of guides here on reading charts as well if you’re new or need a refresher.

Side panel tools quickly take you to SmartFlow, Dark Pool Prints, or wherever else you’re interested in visiting in a flash.

Everything loads smoothly and remains that way, even as the system updates by the second.

I find myself spending just as much time on the members-only Discord page. You’re free to assess all the channels with the provided invitation, and there’s a feed right on BigShort if you don’t want to stray from there.

If I don’t want to watch my screen all the time, I’ll use the Spodin to add some alerts that I can move on if they hit. Having these delivered to my phone via call or text means I get them from anywhere.

There’s honestly not much I don’t like about the platform, which is something I can’t say about every service I’ve tried over the years.

>> Get real-time insights for all NYSE and Nasdaq tickers <<<

Pros and Cons

After an extensive review of BigShort trading tools, here are my top pros and cons:

Pros

- Real-time data from NYSE and Nasdaq

- Several charting options following smart money

- Indicators back and forward tested with excellent results

- Dashboard with dynamic lists

- Live Discord channel for community interaction

- Detailed shorting charts and data

Cons

- Comes at a higher price than basic platforms

- Has a bit of a steep learning curve

Best Uses for BigShort Trading Tools

It’s evident that the platform is built with data-hungry individuals in mind. There’s a ton here, and anyone basing market decisions on in-depth analysis will appreciate what BigShort brings to the table.

There’s quite a bit for folks interested in day trading as well. Real-time insights provide the data needed to make those crucial split-second decisions.

Anyone hoping to hop on board emerging trends can utilize DarkFlows or Manipulation indicators to see which way the train’s rolling. BigShort gives these insights before you’ll ever see them on mainstream media when it’s likely too late anyway.

>> Save 33% when you join now! <<

How Much is a BigShort Subscription?

When signing up for BigShort, you’ll have to decide out of the gate if you’re in for a month or a year.

A monthly membership will run you $149, set to automatically renew at the start of each billing cycle. Annual members pay $1188, saving them about 33% in the process.

Even if you opt for the monthly plan, you’re only paying $5 per day for access to everything I covered earlier in this review. That’s no more than a cup of coffee, if you think about it.

If you join right now, BigShort will hand you your first two weeks for just $37 to try things out. It’s a great way to test the waters and see if a longer-term membership is in the cards for you.

BigShort Review: Is It Worth It?

I’ve had full access to BigShort for a while now, and it’s been a pretty amazing journey so far.

The simple interface is a breath of fresh air after the many cumbersome platforms I’ve used in the past. In my experience, having a lot of data is only beneficial if you can quickly and clearly process it.

BigShort’s charts do an excellent job of taking all those data points and presenting them in an actionable format. This saves a lot of time and energy so I can get into making trades faster.

I won’t reiterate all the neat tools BigShort has in its repertoire, but I really appreciate the behind-the-scenes data that sheds light on ticker movements.

All this ties up nicely with the included Discord page for chatting with other members. The advice there may not be sanctioned by BigShort, but I’ve heard some good tidbits that turned out in my favor.

If you’ve been on the lookout for a platform designed to up your trading game, BigShort is well worth a closer look.

Sign up today to take advantage of introductory offers to maximize your profit potential.

Tags:

Tags: