Whether you’re up close and personal with crypto or watching from afar, it often feels like the biggest gains happen right under our noses.

If you’re tired of missing out like I was, veteran investor Juan Villaverde claims to have the answer.

Backed by Weiss Ratings, this research service uses the guru’s proven Crypto Timing Model to spot high-potential coins before they potentially take off.

In this Weiss Crypto Investor review, I’ll share what you actually get, why Villaverde’s strategy stands out, and whether it’s still the right time to follow his crypto roadmap in 2025.

>> Join Weiss Crypto Investor Today! <<

What Is Weiss Crypto Investor?

Weiss Crypto Investor is a monthly research advisory from Weiss Ratings, created to help everyday people identify the biggest opportunities in the fast-moving crypto world.

Unlike most newsletters, the service revolves around Juan’s proprietary Crypto Timing Model that has accurately called every major bull and bear market for over a decade.

Each month, subscribers receive an easy-to-follow issue highlighting new insights from Juan’s research, including which coins are gaining momentum and which to avoid.

The goal is simple: help members buy early, sell smart, and stay ahead of Wall Street’s moves in crypto.

What makes Weiss Crypto Investor appealing is that it’s not just focused on Bitcoin or Ethereum; it digs deeper into smaller, high-quality coins tied to real-world innovation.

On top of that, members also get timely alerts, educational guidance, and access to exclusive Weiss Ratings research that can help them navigate volatility with confidence.

Is Weiss Crypto Investor Legit?

Weiss Crypto Investor is a legit newsletter service that offers genuine insights into the world of crypto. With Dr. Martin D. Weiss at the helm, you can be sure that you’re receiving quality analysis from someone who knows their way around the markets.

This research and editorial team has a knack for finding under-the-radar opportunities that many overlook, which is why it’s built such a loyal following during its run.

In short, the Weiss group is a leader in crypto research, and it shows in the quality of their analysis.

>> Save 62% when you join now! <<

Who Is Dr. Martin D. Weiss?

Dr. Weiss founded Weiss Ratings, one of the world’s leading independent rating agencies for traditional investment assets and the only financial rating agency that we know of that grades cryptocurrencies.

However, the guru is best known for his fierce independence.

Forbes once called Martin D. Weiss “Mr. Independence” in acknowledgment of his fearless approach to rating companies on the verge of failure that continued to receive top grades from Standard & Poor’s and Moody’s.

This helps explain why The New York Times declared that “Weiss was the first to see the dangers and say so unambiguously,” and why the U.S. Government Accountability Office (GAO) reported that Weiss’ insurance ratings outperformed their closest competitors by at least 3 to 1.

Weiss’s calls frequently challenge prevailing sentiments, but they’ve given his followers the chance to earn substantial returns over the years.

He came out of semi-retirement in 2017 to reassume his CEO position at Weiss Ratings and is still going strong today.

Dr. Weiss is a prominent investing expert with an excellent eye for opportunity and value. You can follow Weiss Crypto Investor with confidence knowing he and his leading crypto experts are at the helm.

Who is Juan Villaverde?

Juan Villaverde is a trained econometrician and mathematician who’s been studying blockchain markets since the early days of Bitcoin.

Over the years, he’s worked closely with Weiss Ratings, leading their crypto research division and co-developing the firm’s renowned Weiss Crypto Ratings Index, one of the first independent rating systems for digital assets.

His foresight into cryptocurrencies feels almost otherworldly, allowing him to call every bull and bear market since 2012.

Villaverde’s career blends academic precision with real-market experience, giving him a unique edge in an industry known for noise and speculation.

Is Juan Villaverde Legit?

Villaverde’s track record speaks for itself, making Bitcoin’s top and bottom calls that turned out to be almost perfectly timed.

His research at Weiss Ratings helped identify altcoins like Cardano before their massive 2,900%+ surge, and his model captured multiple triple-digit wins on Ethereum, Bitcoin, and other major assets.

Unlike self-proclaimed “crypto gurus,” Juan operates within Weiss Ratings’ long-standing reputation for independence and data integrity, a company that’s been analyzing markets for over 50 years.

He’s recognized not just for his market calls, but for publishing clear, evidence-based analysis.

With his academic background, decade-long forecasting record, and Weiss Ratings’ credibility behind him, there’s no doubt that Juan Villaverde is one of the most legitimate voices in the crypto research space today.

>> Sign up now to access the latest research and bonuses <<

What is Weiss Ratings?

Weiss Ratings, founded by Dr. Martin D. Weiss, is one of the world’s top independent rating agencies that has performed at an excellent level over its 50-year run.

Weiss Ratings has become a particularly respected voice in the crypto market. To our knowledge, the firm is the world’s only rating agency that grades cryptocurrency.

Most importantly, Weiss Ratings is an independent research firm, so you can rest easy knowing you’re getting objective information from a reliable source.

Are Weiss Ratings Reliable?

The Weiss ratings system is a reliable model for gauging the potential of an investment. It uses a range of indicators to analyze and evaluate investments through an easy-to-understand grading system that folks have depended on since its inception.

The firm and its rating system are top-notch and could be a valuable addition to your investing arsenal, especially for cryptos.

You can do business with Weiss Ratings with confidence. This company has been around for over 50 years, and it’s maintained its reputation for fierce independence from its very first day in business.

>> Get started with Weiss Ratings’ crypto research now <<

What Is Juan Villaverde’s “Ethereum Shift” Presentation About?

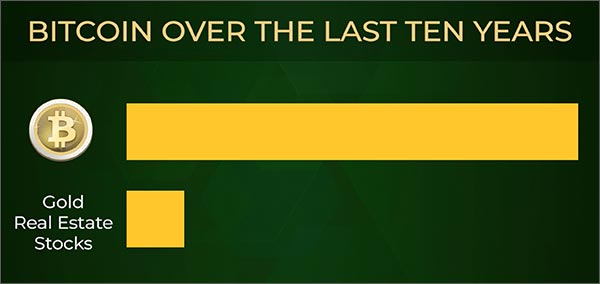

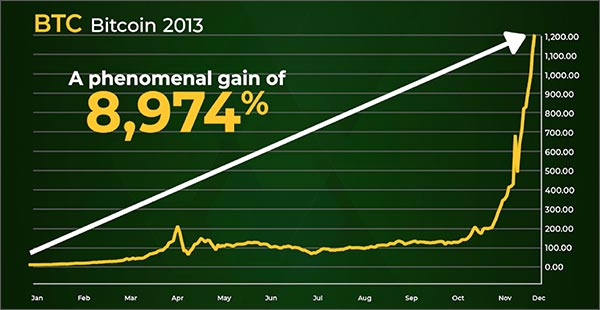

Few would argue that the crypto world has presented the best investment opportunities this past decade, and Bitcoin stands atop that list.

However, Juan believes there’s a new revolution unfolding in the crypto world right now, and it’s not about Bitcoin this time.

If he’s right, the smart money on Wall Street is moving billions out of Bitcoin and into Ethereum.

Interestingly, most people haven’t noticed it yet.

Juan’s message is simple: those who recognize this rotation early could stand to benefit the most. And he’s convinced this shift could redefine the next five years of crypto growth.

Why Ethereum — and Not Bitcoin — Holds the Edge Now

Villaverde makes a convincing case for why Ethereum is stealing Bitcoin’s spotlight. Bitcoin may have been the pioneer, but it’s starting to show its age.

Juan explains that the biggest difference isn’t just technological, it’s strategic.

Ethereum’s transition to proof-of-stake makes it more energy efficient, faster, and capable of generating real yield for those who hold and stake their tokens.

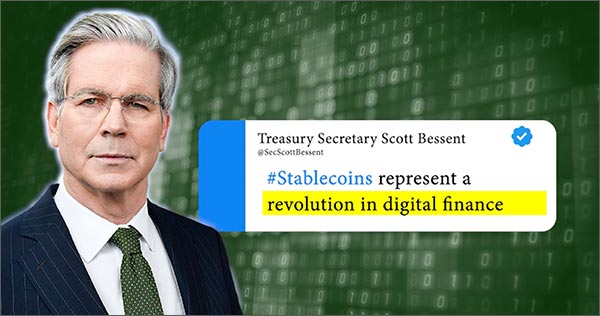

That’s why major financial players, and even the U.S. government, are embracing Ethereum-backed networks.

He even points out that President Trump himself holds over a million dollars’ worth of Ethereum, and the government now controls millions more through seized assets.

All this signals growing institutional confidence, the kind of momentum that typically precedes explosive rallies.

The Hidden Winners Behind the Shift

But here’s where it gets even more interesting. Villaverde doesn’t believe the biggest profits will come from Ethereum itself.

Instead, he’s identified a cluster of smaller, lesser-known cryptocurrencies that are closely tied to Ethereum’s ecosystem, tokens that help it scale faster, process more transactions, or connect to traditional financial systems.

From what I gathered, Villaverde’s research points to a handful of projects quietly gaining traction with institutional investors. These are the cryptos he believes could “blow past Bitcoin” in performance as this rotation plays out.

How To Take Advantage of This Shift

The real takeaway from Villaverde’s “Ethereum Shift” presentation is that there’s still time to act, but not much. The institutional money has already started moving, and when others catch on, the potential gains could disappear.

His strategy centers around using his Crypto Timing Model, the same system that’s successfully pinpointed every bull and bear run since 2012, to help members identify ideal buy and sell points.

If you’ve been waiting for a smart, data-backed way to re-enter crypto without chasing hype, this is that window.

To see how this strategy works, and to get the details on which coins Villaverde believes are set to lead Ethereum’s next rally, you’ll need to become a member of Weiss Crypto Investor.

Next, let’s look at what the service has to offer.

>> Unlock the name of this promising new coin now! <<

Weiss Crypto Investor Review: What’s Included?

Here’s what you get when you join Weiss Crypto Investor under the latest deal.

One Full Year of Juan Villaverde’s Weiss Crypto Investor

The Weiss Crypto Investor newsletter is the main entrée of this cryptocurrency service. It’s where you’ll find the latest research and investment recommendations from the Weiss Ratings Crypto team.

You’ll get a new issue of Weiss Crypto Investor every month, so you’ll always know what’s going on in the market.

The newsletter is like a gift that keeps on giving. It will continue to deliver new research and recommendations for an entire year after you sign up, so you’ll have plenty of new opportunities.

In addition, the Weiss Ratings team of crypto experts contributes tutorials and guides on earning high yields with stablecoins—digital assets designed to rarely fluctuate in value.

These high-yield, low-price-risk strategies can be an alternative way to benefit from crypto, especially when markets are moving sideways or down.

You are sure to get a lot of value out of the Weiss Crypto Investor newsletter. It keeps you busy with a steady stream of new recommendations and provides continual insights into the latest market-moving news.

>> Get a full year of Weiss Crypto Investor at 62% off! <<

Premium Access to Weiss Crypto Ratings

Your subscription also unlocks full access to the Weiss Crypto Ratings system, the same data tool used by major financial institutions and independent analysts.

This database covers over 160 digital assets and is updated regularly as conditions change.

Each rating comes with a detailed explanation of the factors that influenced the score, helping you learn how to evaluate projects like a pro.

With this access, you can research coins beyond the ones featured in the newsletter, giving you more control over your portfolio decisions.

This resource alone is worth the price of admission; it’s the difference between investing blindly and making informed, confident decisions backed by fifty years of Weiss’s data-driven credibility.

ASAP Alerts and Updates

Crypto moves fast, and that’s why members receive Villaverde’s ASAP Alerts.

Whether it’s a sudden regulatory announcement, a network upgrade, or a major institutional shift, you’ll never be caught off guard.

Each message gives you clear, direct instructions: what’s happening, why it matters, and what to do next.

This level of responsiveness ensures you stay one step ahead of the crowd. I’ve found that these timely communications help eliminate the uncertainty that often leads to bad decisions in crypto.

>> Get started now to see the next flash alert <<

Weiss Crypto Daily

Your Weiss Ratings Crypto Investor membership also includes a free subscription to Weiss’ crypto investing e-letter, Weiss Crypto Daily.

The Crypto Daily is another excellent addition to the Weiss Ratings Crypto Investor lineup. Between this weekday e-letter, ratings change alerts, and the primary monthly newsletter, you’ll have a constant flow of professional-grade research to aid your crypto endeavors.

>> Get Weiss Crypto Daily FREE when you join now <<

Juan’s Proprietary Crypto Timing Model

Juan is the first person I’m aware of to create a timing model for crypto, and he’s including it in this bundle at no extra charge.

Built on quantitative algorithms and market-cycle analysis, his Crypto Timing Model identifies shifts in momentum long before most folks notice them.

It looks at dozens of on-chain indicators, including network activity, trading volumes, and relative valuations, to pinpoint ideal buy and sell points.

Villaverde’s using it now to locate big moves on other coins before they potentially happen, like the one he’s tracking from the promo.

>> Access all these features and more at 62% OFF <<

Weiss Crypto Investor Bonuses

Signing up now also nets you the following bonus materials at no extra cost:

BONUS Report #1: The Best Way to Play Ethereum’s Rise

In this report, Villaverde spotlights what he calls the most efficient way to capture Ethereum’s upside — without buying Ethereum directly.

This crypto asset benefits every time Ethereum usage spikes, which means we could see amplified returns when network activity surges.

Villaverde walks readers through why he believes this token could eventually outperform Ethereum on a percentage basis, citing its growing adoption among developers and major DeFi protocols.

If you missed Ethereum’s early gains, this report outlines a data-backed way to ride the next leg of its growth story from the ground floor.

BONUS Report #2: Crypto’s New Big Three – The Coin to Match Bitcoin and Ethereum

Here, Villaverde introduces what he calls “Crypto’s New Big Three”, with the centerpiece being a digital asset he believes could soon join Bitcoin and Ethereum in the top tier of the crypto hierarchy.

In the report, Villaverde explains how it bridges the gap between decentralized networks and mainstream financial systems, creating a bridge that few competitors can match.

This coin could benefit massively from enterprise adoption as corporations look for stable, regulatory-compliant blockchains.

He also breaks down the ideal entry range and long-term potential, helping readers understand both the opportunity and the risks.

BONUS Report #3: Trump’s New Favorite Coin – The Best Way to Play Washington’s Crypto Push

This bonus report explores how the political landscape is quietly fueling a new wave of crypto adoption, and how one specific digital asset could stand to benefit the most.

He reveals a token closely linked to this shift, one that appears to be positioned to thrive as regulatory acceptance broadens and government agencies begin embracing blockchain integration.

What makes this report compelling is its focus on timing. Villaverde explains that political catalysts often precede market moves, and he lays out why this coin could become a “policy favorite” as the U.S. pushes for digital innovation.

BONUS Report #4: Your Guide to Ethereum and Higher Crypto Yields

This final report is all about income, something most people don’t associate with crypto. Villaverde shows how folks can earn up to 20% annual yields simply by holding and staking certain digital assets.

It’s written in plain English, making it approachable even for those new to staking.

Villaverde also highlights a handful of smaller coins offering even higher yields with manageable risk profiles. His guidance goes beyond the “what” and explains the “how”, from duration and payout frequency to compounding strategies.

>> Get access to all these bonus reports now! <<

Refund Policy

Your subscription to Weiss Crypto Investor also comes with an excellent money-back guarantee.

Simply contact Weiss’ customer service at any time before the end of your 12-month subscription and let them know you’re not satisfied with the service for any reason. They’ll rush you a full refund. Best of all, you still get to keep the bonus research reports and other extras.

That lets you test drive your Weiss Crypto Investor subscription, so you can experience a full year before you decide whether it’s right for you.

Weiss is offering a ton of upfront value with these packages. So, it makes sense to give it a try.

Either way, you’re covered if you’re not satisfied, and you have a full year of Weiss research at your disposal. It’s a win-win situation.

>> Try risk-free under a 365-day money-back guarantee <<

Pros and Cons

Weiss Crypto Investor has many notable benefits and a few drawbacks. Here’s a breakdown of all the pros and cons:

Pros

- In-depth crypto insights from industry-leading experts

- Affordable; get started for as little as $49

- One-year money-back guarantee policy

- Includes a free subscription to the Weiss Crypto Daily with new issues every weekday

- Includes 12 monthly issues of Weiss Crypto Investor

- Unlimited access to Villaverde’s proprietary Crypto Timing Model

- Weiss Crypto Ratings on over 500 cryptocurrencies

- 4 Detailed Bonus reports that include additional crypto picks

- Full access to the model portfolio and other Weiss resources

Cons

- No community chat or forum

- Requires basic wallet knowledge

>> Sign up now to access these perks and more! <<

Weiss Crypto Investor Track Record / Past Performance

One of the strongest selling points in this Weiss Crypto Investor review is Juan Villaverde’s documented performance history.

He’s closed out wins to the tune of 153%, 335%, and 478% since 2022, just on the rises and falls of Bitcoin.

That doesn’t even include the four-digit gains he’s witnessed in 2-3 year timeframes on lesser coins, giving him an average return of 288% (including losses) since 2018.

This track record was achieved without leverage and without reinvesting gains, making it more convincing to everyday users.

It’s important to note, however, that no system is perfect. While his historical track record is strong, past success does not guarantee future results, especially in a volatile, regulatory-sensitive space like crypto.

That caveat aside, Villaverde’s performance remains among the most statistically documented in crypto research services, which makes Weiss Crypto Investor appealing to those seeking disciplined, data-driven analysis backed by real results.

How Much Does Weiss Crypto Investor Cost?

Weiss Crypto Investor is currently available at a significant discount, making it one of the best-value research advisories in the crypto space today.

A full year of membership normally retails for $129, but right now, new members can join for just $49.

That’s a 62% savings off the regular retail rate.

This limited-time offer gives you twelve months of uninterrupted access to Juan Villaverde’s monthly issues, all ASAP Alerts, weekly updates, model portfolio recommendations, and the complete set of Weiss Crypto Ratings.

There’s also a Premium Edition, priced at $99, which includes both digital and printed versions of each monthly issue for those who prefer having a physical copy to mark up and reference.

Is Weiss Crypto Investor Worth It?

After spending time going through everything included in this service, I can confidently say that Weiss Crypto Investor offers far more than a typical newsletter.

Add to that Weiss Ratings’ decades-long reputation for independent, data-driven analysis, and it’s easy to see why this service appeals to both new and seasoned crypto followers.

The inclusion of four detailed bonus reports and access to Weiss’s full crypto ratings database adds even more depth, tools that would cost far more if purchased separately.

Considering all of this, along with a 365-day refund policy, it’s hard to find another crypto research service that offers this level of value for under fifty dollars.

If you’re looking for a proven, disciplined way to navigate the next phase of the crypto market, especially the opportunities building around Ethereum and its ecosystem, Weiss Crypto Investor is absolutely worth the investment.

Hop aboard now to position yourself early in what could be one of the most important digital asset shifts of the decade.

Tags:

Tags: