Dr. Martin D. Weiss has been a leading name in the crypto space for years, but his latest presentation might be his most compelling yet. Our Weiss Crypto Investor review tells you everything you need to know about this cutting-edge crypto research service.

What Is Weiss Crypto Investor?

Weiss Crypto Investor is a flagship cryptocurrency investing newsletter created by Dr. Martin Weiss and the experts at Weiss Ratings. It features in-depth research and crypto recommendations using Weiss’ scientific rating system and timing methodology.

Members get new crypto recommendations monthly, plus a more comprehensive range of educational resources, market analysis, and more. The service also covers crypto-related ETFs, or equivalent, to give folks even more options for potentially capturing crypto market growth.

New members can also get valuable bonus research in the special reports offered.

Crypto investing can be very complicated, but expert research from Weiss Ratings could flatten the learning curve substantially. It gives you virtually everything you need to educate yourself about the crypto markets.

Is Weiss Crypto Investor Legit?

Weiss Crypto Investor is a legit newsletter service that offers genuine insights into the world of crypto. With Dr. Martin D. Weiss at the helm, you can be sure that you’re receiving quality analysis from someone who knows their way around the markets.

This research and editorial team has a knack for finding under-the-radar opportunities that many overlook, which is why it’s built such a loyal following during its run.

In short, the Weiss group is a leader in crypto research, and it shows in the quality of their analysis.

>> Save 62% when you join now! <<

Who Is Dr. Martin D. Weiss?

Dr. Weiss founded Weiss Ratings, one of the world’s leading independent rating agencies for traditional investment assets and the only financial rating agency that grades cryptocurrencies.

He began his ratings and research company in 1971 and has built a solid reputation for credibility and accuracy for over a half-century. Plus, his crypto ratings and forecasts have emerged as one of the most trusted analysis tools.

However, the guru is best known for his fierce independence.

Forbes once called Martin D. Weiss “Mr. Independence” in acknowledgment of his fearless approach to rating companies on the verge of failure that continued to receive top grades from Standard & Poor’s and Moody’s.

This helps explain why The New York Times declared that “Weiss was the first to see the dangers and say so unambiguously,” and why the U.S. Government Accountability Office (GAO) reported that Weiss’ insurance ratings outperformed their closest competitors by at least 3 to 1.

Weiss’ calls frequently challenge prevailing sentiments, but they’ve given his followers the chance to earn substantial returns over the years.

He came out of semi-retirement in 2017 to reassume his CEO position at Weiss Ratings and is still going strong today.

Dr. Weiss is a prominent investing expert with an excellent eye for opportunity and value. You can follow Weiss Crypto Investor with confidence knowing he and his leading crypto experts are at the helm.

Who Is Juan M. Villaverde?

Juan M. Villaverde is the editor of Weiss Crypto Investor and a highly esteemed figure in the cryptocurrency industry. His professional background as an econometrician and trader has been instrumental in his work with Bitcoin.

Applying his mathematical models to cryptocurrency, he made some fascinating discoveries that have significantly impacted the way we understand and interact with the crypto market.

One of his most notable findings was the identification of a persistent pattern in Bitcoin’s market fluctuations. He observed that these patterns were more regular and predictable than those found in many traditional equity or bond markets.

>> Sign up now to access the latest research and bonuses <<

He developed the first-ever timing model for cryptocurrencies, which was based on these identified cycles. This model has been a game-changer in the crypto industry, providing investors with a tool to better understand and navigate the volatile crypto market.

Villaverde’s expertise and insights have proven invaluable to his readers over the years. In 2018, he accurately predicted Bitcoin’s price bottom, giving his followers a chance to capitalize on one of the most significant growth opportunities in recent memory.

So, is Juan Villaverde legit? After a close look at his track record, I have to say yes. He has been in the crypto industry for a long time, and many of his predictions have proven correct over the years.

What is Weiss Ratings?

Weiss Ratings, founded by Dr. Martin D. Weiss, is one of the world’s top independent rating agencies that has performed at an excellent level over its 50-year run.

Weiss Ratings, founded by Dr. Martin D. Weiss, is one of the world’s top independent rating agencies that has performed at an excellent level over its 50-year run.

Its ratings cover 53,000 investments and companies. These include investment ratings on stocks, ETFs, and mutual funds; safety ratings on banks, credit unions, and insurance companies; plus over 500 ratings of crypto coins and tokens.

Weiss Ratings has become a particularly respected voice in the crypto market. To our knowledge, the firm is the world’s only rating agency that grades cryptocurrency.

Most importantly, Weiss Ratings is an independent research firm, so you can rest easy knowing you’re getting objective information from a reliable source.

Are Weiss Ratings Reliable?

The Weiss ratings system is a reliable model for gauging the potential of an investment. It uses a range of indicators to analyze and evaluate investments through an easy-to-understand grading system that folks have depended on since its inception.

The firm and its rating system are top-notch and could be a valuable addition to your investing arsenal, especially for cryptos.

You can do business with Weiss Ratings with confidence. This company has been around for over 50 years, and it’s maintained its reputation for fierce independence from its very first day in business.

>> Get started with Weiss Ratings’ crypto research now <<

Juan Villaverde’s Latest Presentation: Crypto’s Big THREE

Juan Villaverde predicts that 2025 will be a special year for crypto, potentially signaling the most profitable market we’ve ever seen from the sector.

Despite Bitcoin’s rampant success, he teases the popular coin is not the answer this time around.

Instead, the expert is looking to a new token rising up with the potential to meet Bitcoin’s growth, if not surpass it entirely.

It’s already generating a lot of interest from big-name investors, leading me to believe there’s a very short window left to get involved.

Why is now the ideal time to invest, and what moves can we make to cash in on this new opportunity before it’s too late?

Why 2025 Is So Promising for Crypto

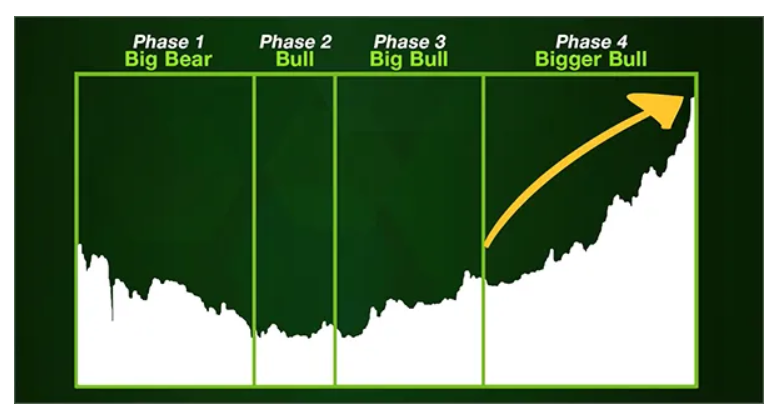

Bitcoin, and in turn the overall crypto market, travel through four-year cycles that repeat like clockwork.

Time and again, we’ve seen a year of bear trading give way to increasing levels of bull activity that culminates in huge growth in year four.

Villaverde says we’ve just entered the final stretch of this pattern, which in conjunction with the new administration’s pro-crypto stance, is creating the perfect atmosphere for game-changing profits.

The issue though is that Bitcoin’s gains get smaller each cycle as the coin goes mainstream. Its growth is nothing to laugh at, but the biggest opportunities there are in the past.

We’ve witnessed the same pattern with Ethereum, but returns are quieting down there too.

Fortunately, these crypto giants have a history of pulling up other coins with them that experience far more growth than their big brothers.

This is where Juan says the money’s at for 2025.

>> Uncover the altcoin set to outperform Bitcoin in 2025 <<

The New Coin in Town

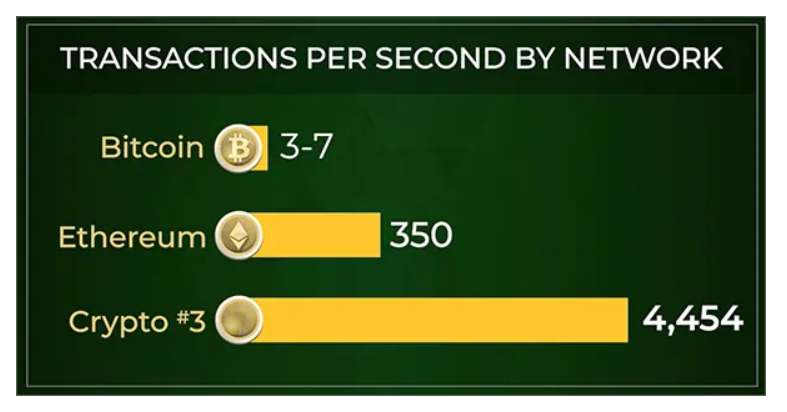

There’s one coin in particular that Villaverde really has his eye on.

What makes it really stand out are the applications companies can use it for, and having an actual purpose could lead to even more value.

This already gives it a distinct advantage over both Bitcoin and Ethereum, and we’re likely just scraping the surface of what it can do.

Google is already using it for cloud services, and companies like Visa and PayPal see it as an opportunity to make transactions faster and cheaper than ever before.

Even now, this new coin operates ten times faster than Ethereum, but an upgrade in the works that could blow that number out of the water.

There’s even an entire smartphone in the works and a gaming system that has more than one million users based on this very technology.

How to Play the Next Big Crypto

My first inclination is to wait for more big breakthroughs to take place with this up-and-coming coin, but Villaverde warns against such thinking.

It’s already gearing up for a big run, and its price and number of users are steadily ramping up to indicate that.

In fact, it’s moving at a similar pace to both Bitcoin and Ethereum when they were this size.

Plus, we’ve already entered into the biggest bull phase of the crypto cycle, leaving no time to wait – as long as you have the name of this mysterious coin.

That’s where Juan comes in. He’s done the research, and you can get instant access to this token simply by signing up for his Weiss Crypto Investor service.

Join me as I unpack everything else that’s part of this subscription.

>> Unlock the name of this promising new coin now! <<

Weiss Crypto Investor Review: What’s Included?

Here’s what you get when you join Weiss Crypto Investor under the latest deal.

Weiss Crypto Investor Newsletter

The Weiss Crypto Investor newsletter is the main entrée of this cryptocurrency service. It’s where you’ll find the latest research and investment recommendations from the Weiss Ratings Crypto team.

Each issue comes loaded with in-depth insights into the crypto world, new crypto recommendations, and much more. It’s also your go-to source for the latest cryptocurrency market news and analysis.

You’ll get a new issue of Weiss Crypto Investor every month, so you’ll always know what’s going on in the market.

The newsletter is like a gift that keeps on giving. It will continue to deliver new research and recommendations for an entire year after you sign up, so you’ll have plenty of new opportunities.

In addition, the Weiss Ratings team of crypto experts contributes tutorials and guides on earning high yields with stablecoins—digital assets designed to rarely fluctuate in value.

These high-yield, low-price-risk strategies can be an alternative way to benefit from crypto, especially when markets are moving sideways or down.

You are sure to get a lot of value out of the Weiss Crypto Investor newsletter. It keeps you busy with a steady stream of new recommendations and provides continual insights into the latest market-moving news.

>> Get a full year of Weiss Crypto Investor at 62% off! <<

Premium Access to Weiss Crypto Ratings

Alongside the Weiss Crypto Investor newsletter, this bundle comes with unlimited access to the Weiss Ratings system for cryptocurrencies.

The system contains roughly 500 unique digital currencies, all rated from “A” to “E.” Clicking on one of these coins reveals a detailed report chock full of research and the reasons why it received the particular grade.

In addition, you’re given a series of power tools to track your investments so you don’t miss a beat. Even if you’re not looking closely, the Weiss Ratings team can send upgrade or downgrade alerts through email or text.

Crypto Model Portfolio

Weiss Crypto Investor’s model portfolio showcases an up-to-date listing of all the platform’s current recommendations at a glance. These are the assets that passed the scientific crypto ratings system and Juan’s watchful eye.

Users can pop in any time they want to see how certain crypto assets are faring based on the date they first made the list.

I appreciate the transparency here, knowing I can log in at any time to gauge Villaverde’s track record. He doesn’t mince his losses, but in my experience, his wins are what really stand out.

Flash Alerts and Updates

Weiss Ratings wants to make sure you’re always aware of the latest happenings, so they send out alerts whenever something needs your attention.

If a new headline may impact the outlook for a recommended crypto, Weiss will notify you. That way, you’ll always know if you need to take action.

For example, if there’s a rating change for a covered crypto that you own, you can sign up for email alerts notifying you of the change.

Separately, the Weiss Crypto Daily alerts you to news events and what they might mean for crypto investments.

>> Get started now to see the next flash alert <<

Weiss Crypto Daily

Your Weiss Ratings Crypto Investor membership also includes a free subscription to Weiss’ crypto investing e-letter, Weiss Crypto Daily.

With a new issue every weekday, this e-letter is designed to keep you informed on the day-to-day happenings in the crypto market. It’s an excellent source for the latest crypto market news, trending cryptocurrencies, and more.

The Crypto Daily is another excellent addition to the Weiss Ratings Crypto Investor lineup. Between this weekday e-letter, ratings change alerts, and the primary monthly newsletter, you’ll have a constant flow of professional-grade research to aid your crypto endeavors.

>> Get Weiss Crypto Daily FREE when you join now <<

Juan’s Proprietary Crypto Timing Model

Juan is the first person I’m aware of to create a timing model for crypto, and he’s including it in this bundle at no extra charge.

Everything he’s learned about market cycles went into building this software that does an impressive job of predicting outcomes based on patterns.

It has accurately identified every bear and bull market since 2012 and led to repeated gains on top coins like Bitcoin and Ethereum over the years.

Villaverde’s using it now to locate big moves on other coins before they happen, like the one he’s tracking from the promo.

Members get unrestricted access to this tool, so you can put it to work for your own gains.

>> Access all these features and more at 62% OFF <<

Crypto’s Big THREE Bonuses

The latest Weiss Crypto deal also includes several new bonus reports that can help you discover new cryptos with tremendous growth potential.

Crypto’s New Big 3: The Coin to Match Bitcoin and Ethereum

This exclusive report captures all the details of the coin that Juan estimates will become a mainstay along with Bitcoin and Ethereum.

It was already one of the fastest-growing cryptos of 2024 and looks to keep that title as 2025 is in full swing.

Several companies are already putting it to use for its speed and cost, indicators of more growth.

You’ll get all the details inside, including this coin’s name and symbol.

Juan also provides all of his research so you can make an educated decision on whether now’s truly the time to invest.

Project Crypto: The One Coin To Own Under America’s First Crypto President

There’s another coin Juan’s very excited about, and it’s tied directly to the Trump administration.

As much as President Trump is for cryptocurrency, it’s the Vice President who’s even more vocal.

The two of them are building connections and making headway in making America a crypto nation, and the pair has one special coin that could see the biggest benefits of this shift.

Villaverde shares the name and symbol of that coin in this short guide alongside a thorough explanation of why it’s so important to Trump and his team.

He also gives instructions on how you can buy it right now and just how high it could go.

>> Get the full scoop on this new coin <<

The Ultimate Bitcoin Timing Guide

This guide sheds a ton of light on the different stages of the crypto market, from a big bear through the different bull cycles that folks should be very excited about.

While that’s important to understand on its own, Juan also reveals how to take advantage of these highs and lows.

He explains how the Crypto Timing Model comes into play, showing ideal times to get in and out of recommendations before it’s too late.

I found this especially helpful since we’re given the Timing Model to use as part of this bundle for a shot at unlocking even more gains.

The #1 Crypto For The AI World

Artificial intelligence is clearly making waves across several sectors, and it stands to reason that crypto has a role to play in its success as well.

In fact, cryptos are often the best place to find AI projects with the biggest potential for returns – if you know where to look.

Here, Juan reveals an AI coin that’s been called “The Nvidia of Crypto” that he thinks is ready to skyrocket in the coming months.

As with the other reports, Villaverde does an amazing job of explaining the reasoning behind his pick and even the performance targets he’s shooting for so you can decide whether to play.

>> Get access to all these bonus reports now! <<

Weiss Crypto Investor Refund Policy

Your subscription to Weiss Crypto Investor also comes with an excellent money-back guarantee.

If you try Weiss Crypto Investor for 12 months and you’re not satisfied, you can get a full refund of your subscription cost.

Simply contact Weiss’ customer service at any time before the end of your 12-month subscription and let them know you’re not satisfied with the service for any reason. They’ll rush you a full refund. Best of all, you still get to keep the bonus research reports and other extras.

That lets you test drive your Weiss Crypto Investor subscription, so you can experience a full year before you decide whether it’s right for you.

Weiss is offering a ton of upfront value with these packages. So, it makes sense to give it a try.

Either way, you’re covered if you’re not satisfied, and you have a full year of Weiss research at your disposal. It’s a win-win situation.

>> Try risk-free under 365-day money-back guarantee <<

Pros and Cons

Weiss Crypto Investor has many notable benefits and a few drawbacks. Here’s a breakdown of all the pros and cons:

Pros

- In-depth crypto insights from industry-leading experts

- Affordable; get started for as little as $49

- One-year money-back guarantee policy

- Includes a free subscription to the Weiss Crypto Daily with new issues every weekday

- Includes 12 monthly issues of Weiss Crypto Investor

- Unlimited access to Villaverde’s proprietary Crypto Timing Model

- Weiss Crypto Ratings on over 500 cryptocurrencies

- Bonus research that includes additional crypto picks

- Full access to the model portfolio and other Weiss resources

Cons

- No community chat or forum

>> Sign up now to access these perks and more! <<

How Much Does Weiss Crypto Investor Cost?

One year of Weiss Crypto Investor will normally set you back $129. As part of this incredible deal, you can scoop up your membership for just $49. That’s 62% off the cover price!

That means you can get new crypto picks for just over $4 each month. Not sure about you, but that feels like a very small amount to pay for the returns crypto can bring.

Is Weiss Crypto Investor Worth It?

With prices starting at $49, Weiss Crypto Investor is an excellent deal. It’s incredibly affordable compared to some other options out there, and you get a lot for your dollar.

It includes a hefty collection of bonus resources and extras that can help you capitalize on the next big altcoin breakout. Plus, expert analysis that will make you a better crypto trader.

Of course, a one-year Weiss Crypto Investor subscription is an exceptional value at that price in its own right, but the additional bonuses make these deals superb bargains.

You get a comprehensive crypto research solution that equips you with all the knowledge you need to succeed in crypto in return for the upfront cost.

At such a steep discount, Weiss Crypto Investor is an excellent value for the price, and it’s a great way to step up your crypto trades.

Tags:

Tags: