Every once in a while, a financial story surfaces that makes you stop and pay attention.

That’s exactly what happened when I read Dr. David Eifrig’s warning about The Mar-a-Lago Accord, a potential “monetary reset” that could redefine America’s wealth landscape.

In this Retirement Millionaire review, I’ll unpack why Doc believes this shift could devalue the dollar, what it means for us, and how his approach might turn the chaos ahead into a rare opportunity.

>> Join Dr. David Eifrig’s Retirement Millionaire today <<

What Is Retirement Millionaire?

Retirement Millionaire is Dr. David Eifrig’s investment research service published by Stansberry Research, and it’s built for people who want to grow and protect their wealth without taking unnecessary risks.

His goal isn’t fast profits or speculative trades, it’s long-term financial security through practical, well-researched strategies.

Members get access to his ongoing market commentary, a model portfolio, and regular updates showing exactly how he’s positioning for major shifts like the so-called Mar-a-Lago Accord.

Along with timely investment ideas, Doc weaves in lessons on living well, cutting financial stress, and maintaining health during retirement.

I’ll get into its pool of features in a bit, but I first want to take a closer look at our guru.

Who Is Dr. David Eifrig?

On the road to becoming one of the most trusted names in financial research, Dr. David Eifrig spent years in two very different worlds.

That Wall Street experience gave him a rare understanding of how the financial system truly operates behind the scenes.

However, growing tired of the grind and hypocrisy there, Eifrig later went on to earn his medical degree from the University of North Carolina at Chapel Hill.

The guru even helped start a biotech firm before finding himself back in the financial spotlight.

Today, he blends that insider knowledge with the discipline of a scientist, helping everyday readers make smart, low-risk investment decisions through his flagship service, Retirement Millionaire.

Is Dr. David Eifrig Legit?

Without question. Dr. Eifrig’s record speaks for itself, both in credentials and results.

Beyond his investment work, he’s the Senior Partner at Stansberry Research and CEO of MarketWise, one of America’s largest independent financial publishing firms.

He’s also the author of several books, including Dr. David Eifrig’s Big Book of Retirement Secrets, and many of his words have stellar ratings on Amazon.

With over 40 years of combined experience in finance, medicine, and research, Doc’s reputation for accuracy and calm leadership has earned him a loyal following of tens of thousands of subscribers worldwide.

>> Discover Retirement Millionaire by Dr. Eifrig <<

What Is Stansberry Research?

Stansberry Research is one of the leading names in the retail research industry, and they’re the publisher behind Doc’s Retirement Millionaire.

Porter Stansberry founded the company in 1999, and it exploded in popularity over the next two-plus decades.

Today, Stansberry Research is one of the most prolific publishers in the investment research industry, but Retirement Millionaire remains one of its most popular research newsletters.

What Is “The Mar-a-Lago Accord” Presentation?

Every so often, an event takes shape in the background of global finance that changes everything, yet barely makes a ripple in the headlines.

That’s exactly what Dr. David Eifrig says is happening right now with what he calls “The Mar-a-Lago Accord.”

According to him, we’re looking at a deliberate “monetary reset” that could permanently alter how wealth is measured in America.

History shows that when currencies are revalued, the winners are those who moved early. Doc believes this time is no different and that the next few years could create a whole new class of millionaires.

This may be your best opportunity to make that list.

Understanding the Coming Monetary Reset

At the core of Eifrig’s message is a concern that most Americans are completely unprepared for what’s unfolding.

He points out that the U.S. dollar has already begun to weaken sharply, echoing what happened before the Plaza Accord of 1985, when the dollar lost nearly 40% of its value in less than two years.

Doc connects those dots to what’s happening now, describing a plan quietly circulating among policymakers, one designed to weaken the dollar and rebalance global trade.

If this plays out as he expects, the impact will flow beyond Wall Street to the savings, retirements, and spending power of everyday Americans.

For most, it will feel like wealth is vanishing overnight. For a few, it could be the opportunity of a lifetime.

The Mar-a Lago Move

In Doc’s view, the new policy framework led by President Trump, which he calls The Mar-a-Lago Accord, will effectively “reprice” certain assets while devaluing others.

The numbers he shares are startling: a potential 40% drop in the value of dollar-denominated wealth, alongside an enormous transfer of capital into tangible assets like gold, silver, and energy resources.

It’s the kind of situation that could leave unprepared folks completely caught off guard.

For all this talk of gloom and doom, there is light at the end of the tunnel.

During his talks at the club, it sounds like President Trump is working hard to revalue a currency that’s been around since the beginning of time – gold.

Turning a Crisis into Opportunity

Here’s the rub – you can get into gold in all sorts of ways, but not every opportunity will capture the momentum Doc sees here.

For those of us outside the Wall Street inner circle, that’s where Retirement Millionaire becomes invaluable.

Signing up now gives you the chance to see exactly how Doc is navigating the shift, step by step, and which areas he believes are set to thrive as the reset unfolds.

The next section explains what comes with Retirement Millionaire and how you can use its various tools to react.

>> Unlock Dr. Eifrig’s “Mar-a-Lago Accord” insights <<

What Comes With Retirement Millionaire?

Here’s everything you get as a Retirement Millionaire member:

One Full Year of Retirement Millionaire

A full year of Retirement Millionaire gives you 12 monthly issues delivered directly to your inbox on the second Wednesday of each month, right after the markets close.

Each issue focuses on one clear theme, often tied to the biggest financial story shaping the economy, and explains what it means for your money.

He always includes at least one new recommendation, complete with his reasoning, price guidance, and what to watch going forward. It’s designed so readers can follow along without having to monitor markets all day.

Access to the Retirement Millionaire Model Portfolio

Members also get exclusive access to Doc’s live Model Portfolio, which currently holds more than thirty-five open recommendations.

At a glance, you’ve got a list of active plays you can add to your own strategy or pass them by and wait for updates.

I appreciate that Doc stays transparent about his selections here. No one’s a perfect picker, but seeing his track record on the screen instills confidence.

Special Updates

Markets can move fast, and Dr. Eifrig doesn’t leave members waiting for the next issue to react.

These updates often include actionable steps, whether it’s adjusting a position, locking in a gain, or staying patient during short-term volatility.

It’s the kind of communication most traditional advisors simply don’t provide.

During uncertain markets, like what we’ve seen heading into 2025, those steady, well-timed notes have become one of the most appreciated features of Retirement Millionaire.

A Library of Special Reports

From day one, subscribers unlock Dr. Eifrig’s complete research library, a collection of premium reports, back issues, and private presentations covering dozens of topics.

In effect, these are step-by-step guides on how to implement ideas in real portfolios that you can sift through at your leisure.

The library gives readers an immediate edge by helping them understand not just what to invest in, but why and how it fits into the broader economic picture.

>> Try Retirement Millionaire risk-free for 30 days <<

Retirement Millionaire Bonuses

Subscribing to Retirement Millionaire through Dr. David Eifrig’s “Mar-a-Lago Accord” offer unlocks a suite of premium research bonuses as well:

Special Report #1: The No. 1 “Mar-a-Lago Accord” Gold Stock

This report is the centerpiece of Dr. Eifrig’s research into the coming financial reset.

Inside, he identifies one company uniquely positioned to profit from that move, not a miner or ETF, but a firm whose business model lets nearly every uptick in gold prices translate directly into balance sheet gains.

Eifrig points out that this same stock previously delivered returns exceeding 900% during a past gold surge, and he believes history could repeat itself as demand for tangible assets spikes.

Special Report #2: How to Play Silver’s “Mar-a-Lago Mania”

While gold takes center stage in Eifrig’s thesis, silver plays a critical supporting role.

We’re seeing a heavily skewed gold-to-silver ratio, meaning silver is undervalued relative to gold by historical standards.

He lays out how a simple move back toward normal levels could deliver triple-digit gains, and pinpoints one lesser-known stock he believes could triple in value within two years.

The report also includes a unique method for buying physical silver at near-wholesale prices, without taking on leverage or storage headaches.

Special Report #3: The “America First” Nuclear Renaissance

In this bonus report, Dr. Eifrig turns his focus to energy, and specifically, uranium.

At the same time, uranium supply remains dangerously low, with production covering only about 80% of global demand.

Eifrig connects these dots to show how the U.S. government’s renewed support for domestic uranium mining could spark a multi-year rally similar to the early 2000s, when uranium prices jumped over 1,000%.

You’ll uncover one company positioned to benefit directly from that supply-demand imbalance, with a risk profile far lower than typical small-cap miners.

Dr. David Eifrig’s Big Book of Retirement Secrets

This 672-page guide is the culmination of Dr. Eifrig’s decades of experience on Wall Street, in medicine, and in financial publishing.

Unlike dense finance textbooks, it’s written in Doc’s accessible, conversational tone, helping readers apply simple principles that protect wealth and enhance quality of life. Topics range from generating income in retirement to avoiding hidden fees and improving your long-term health.

It’s been called a “treasure trove of wisdom,” and that description fits, because it’s practical, tested, and refreshingly straightforward.

Health & Wealth Bulletin

The final bonus is Dr. Eifrig’s Health & Wealth Bulletin, a weekday email advisory that brings together his two lifelong passions: medicine and financial wellness.

Topics range from overlooked medical tips and home remedies to daily habits that protect both body and bank account.

Past issues have covered practical advice such as how to boost immunity naturally, reduce unnecessary medical costs, and avoid lifestyle traps that drain energy and money.

For many subscribers, this bulletin becomes a trusted part of their morning routine, reminding them that true wealth isn’t just about money, but about maintaining the health and freedom to enjoy it.

>> Subscribe to Retirement Millionaire <<

Pros and Cons

After exploring all that Retirement Millionaire has to offer, here are my top pros and cons:

Pros

- Backed by Dr. David Eifrig’s expertise

- Track record of triple-digit gains

- Clear, actionable monthly recommendations

- Multiple bonus reports

- Includes model portfolio access

- Valuable health and finance insights

- Excellent value for new members

- Trusted Stansberry Research publication

Cons

- Requires long-term investment patience

- Not for quick-profit seekers

Refund Policy

Dr. David Eifrig and the Retirement Millionaire team back the service with a 100% money-back guarantee for the first 30 days.

That means you can explore every issue, report, and portfolio recommendation completely risk-free.

You’ll even get to keep the materials you’ve collected so far as a thank you for trying things out.

This flexible policy reflects Eifrig’s long-standing commitment to transparency and trust, giving readers every reason to try the service without hesitation.

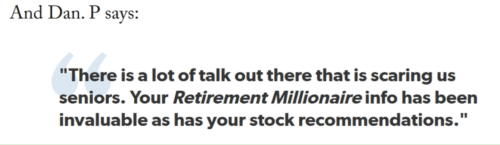

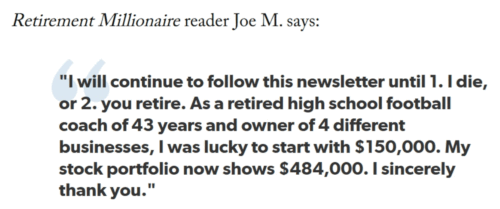

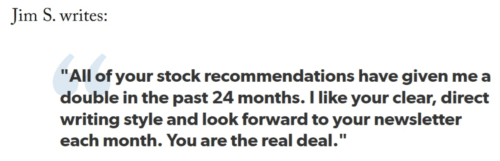

Retirement Millionaire Reviews by Members

I’ve given my two cents, but don’t just take my word for it. Here are some actual reviews from Retirement Millionaire customers:

As you can see, many members appreciate that Eifrig’s approach balances safety and opportunity.

While no investment outcome is guaranteed, readers trust in Eifrig’s integrity, his medical and financial expertise, and his steady hand guiding them toward lasting wealth.

>> Get David’s latest picks for 2025 when you sign up now <<

Retirement Millionaire Track Record and Past Performance

Over the years, Retirement Millionaire has built one of the most consistent performance histories in Stansberry Research’s lineup.

Dr. David Eifrig has guided his readers through some of the most volatile markets of the past two decades, from the 2008 financial crisis and the COVID-19 crash of 2020 to the inflation shock of 2022, often helping them avoid major losses by raising cash or shifting focus well before broader market declines.

According to the latest data from the presentation, Retirement Millionaire’s open positions currently hold an average gain of 126%, meaning members have had the opportunity to more than double their money across all active recommendations.

Some standout wins include 264% on CBRE Group, 204% on 3M, 200% on Cisco Systems, and 155% on AGIC Income Fund, all achieved without taking on excessive risk.

This steady track record is a reflection of Eifrig’s disciplined approach, focusing on reliable companies, defensive assets, and income-generating strategies rather than speculation.

How Much Does Retirement Millionaire Cost?

The Retirement Millionaire membership is currently available through a limited-time 84% discount, making it one of the best-value research services offered by Stansberry Research.

Normally priced at $499 per year, the full one-year subscription is now just $79 when ordered through the special Mar-a-Lago Accord invitation. In the end, you’re paying just under $7 a month.

This price includes everything, 12 monthly issues of Retirement Millionaire, full access to the model portfolio, the complete archive of back issues and research reports, as well as five valuable bonuses at no extra cost.

After the initial term, the membership renews annually at $199, a price still significantly lower than most competing advisories that charge upwards of $1,000 a year for comparable content.

Is Retirement Millionaire Worth It?

After carefully going through the research, past results, and reader feedback, it’s clear that Retirement Millionaire offers real value far beyond its modest price tag.

What stands out most in this Retirement Millionaire review is how practical Dr. David Eifrig’s approach feels.

With a 30-day refund policy and full transparency on every pick, the trust factor is strong—and that’s rare in this space.

Plus, Dr. Eifrig combines decades of Wall Street insight with a doctor’s analytical mindset to create research that’s thoughtful, evidence-based, and focused on real results.

Given the current global uncertainty and his “monetary reset” forecast, joining now gives readers both guidance and peace of mind.

For anyone serious about long-term financial security, Retirement Millionaire is more than worth it, it’s a service that helps you make sense of the market and act with confidence.

Join today for your shot at getting in ahead of a potentially game-changing run for gold.

>> That’s it for my review. Claim your discount BEFORE IT’S GONE! <<

Tags:

Tags: