In the crossroads of financial hardship and housing stability, the interplay between bankruptcy and eviction commands attention.

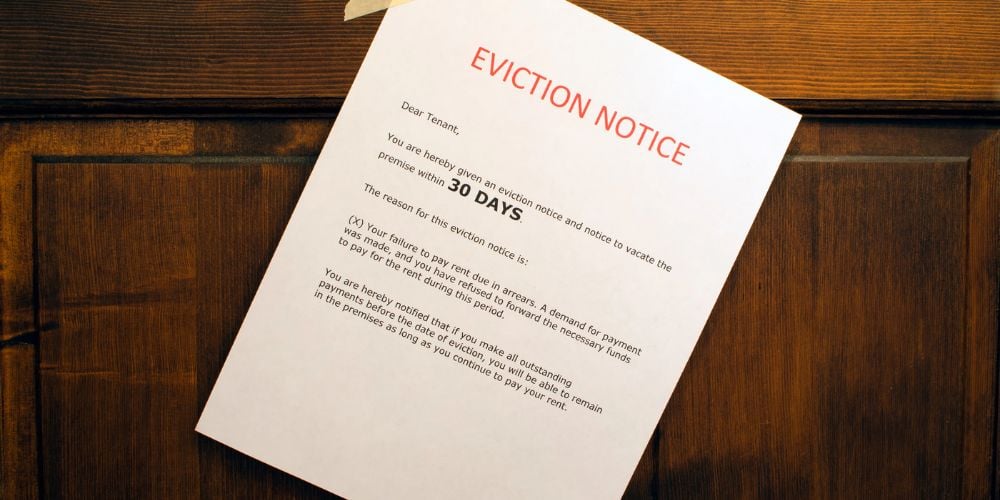

Individuals facing eviction may wonder if declaring bankruptcy could provide them with a fresh slate, clearing away their eviction history. So, can bankruptcy clear evictions?

This article aims to offer a comprehensive examination of whether bankruptcy can erase evictions and its broader implications.

Can Bankruptcy Clear Evictions?

Bankruptcy may help address debts from past evictions, such as unpaid rent or lease termination fees, which can be discharged in bankruptcy, giving you relief from those financial obligations.

However, bankruptcy does not automatically clear an eviction record or stop a current eviction process based on non-payment from proceeding.

If the eviction is related to money owed and appears as a debt, filing for bankruptcy could potentially discharge that debt, depending on whether you file for Chapter 7 or Chapter 13 bankruptcy. But any record of the eviction itself might remain on your credit report and rental history.

Additionally, the automatic stay provision in bankruptcy can temporarily halt eviction proceedings, but landlords can ask the court to lift the stay.

For a permanent solution to an eviction, especially one already ordered by a court, bankruptcy may not be sufficient on its own to remove the eviction from your record.

The Dynamics Between Bankruptcy and Evictions

Before we delve into the specifics, it’s important to understand the basic relationship between bankruptcy and evictions. Bankruptcy is a legal process allowing individuals or businesses to address their debt under federal court protection.

Eviction is a legal procedure whereby a landlord may remove a tenant from rental property due to violation of the lease or rental agreement.

Comprehensive Insights into Bankruptcy Laws

Bankruptcy laws are intricate and vary significantly between different chapters, with each holding different implications for eviction proceedings.

Chapter 7 Bankruptcy and Evictions

Chapter 7 bankruptcy focuses on discharging unsecured debts, like credit card balances or medical bills. When you file for Chapter 7 bankruptcy, an automatic stay is triggered, which temporarily pauses most creditors’ actions, including evictions.

However, this is not always a foolproof escape from eviction. If your landlord has already won a judgment for possession before you file, the eviction process may continue unaffected.

Chapter 13 Bankruptcy and Evictions

Chapter 13 bankruptcy is more about reorganization than liquidation. A filer proposes a plan to repay debts over time while keeping their assets. When it comes to eviction, Chapter 13 may offer more benefits than Chapter 7.

If you file before a judgment for possession, not only does an automatic stay come into effect, but you may also be able to pay back the owed rent through your repayment plan. This can potentially allow you to avoid eviction altogether.

The Influence of Bankruptcy on Eviction Avoidance

Bankruptcy can act as a legal buffer against eviction, but its effectiveness largely depends on timing. The automatic stay can give tenants breathing room to regroup financially or negotiate with the landlord.

Yet, there’s a clock ticking. If the landlord has already obtained a judgment, the stay’s power diminishes significantly.

When Bankruptcy Doesn’t Clear Evictions

It’s important to recognize that bankruptcy is not a universal remedy for evictions. For instance, if the eviction is due to endangering property or the use of illegal substances on the premises, a bankruptcy filing might not offer any protection.

Additionally, bankruptcy does not wipe out obligations incurred after filing, including future rent. Therefore, if you can’t keep up with ongoing payments after filing, you may still face eviction.

Credit Report Consequences of Bankruptcy and Evictions

The after-effects of bankruptcy and eviction do not end with the resolution of immediate financial issues. Both events can leave a lasting stain on your credit report. Bankruptcy can be listed for up to a decade, and an eviction can remain for seven years.

These records can dramatically reduce your credit score and, as a consequence, harm your chances of renting again, securing a mortgage, or obtaining other forms of credit.

Seeking Alternatives to Bankruptcy

Pursuing alternatives can often provide a more favorable outcome than filing for bankruptcy. Communication with the landlord can sometimes lead to an amended payment plan or even forgiveness of part of the past due amount.

Other options include seeking legal advice from tenant support organizations or consulting a lawyer for more personalized guidance.

Frequently Asked Questions

Does Bankruptcy Remove Evictions from Credit Report?

No, bankruptcy does not erase eviction records from credit reports. The eviction’s public record aspect may last up to seven years, regardless of a bankruptcy filing.

Can You Be Evicted While in Chapter 13 Bankruptcy?

It’s less likely you’ll face eviction if you’re complying with your Chapter 13 repayment plan. If you fall behind on the agreed-upon plan to cover rent arrears, you could be evicted.

How Long Do Evictions Stay on Your Record?

An eviction can linger on your record for seven years, complicating future renting opportunities.

Does Chapter 7 Bankruptcy Remove Evictions?

Chapter 7 bankruptcy doesn’t remove eviction records but can potentially pause an eviction in progress if the stay is placed before the landlord wins a judgment for possession.

In navigating the turbulent seas of financial distress and housing instability, knowing the bounds and potential of bankruptcy in relation to evictions is indispensable.

While bankruptcy can sometimes shield against eviction or delay the process, it’s not a panacea that can dissolve all traces of the ordeal.

Equipped with this knowledge and the advice of professionals when needed, those facing such challenges can chart a more informed course.

Conclusion

The decision to file for bankruptcy in the face of eviction is nuanced and should be approached with a clear understanding of the legal implications and consequences.

Bankruptcy may offer a reprieve from eviction in certain circumstances, but it is not a catch-all solution. Understanding the scope and limitations of bankruptcy’s reach on evictions, as well as its lasting effects on your financial wellbeing, is critical.

Tags:

Tags: