Leverage ETFs look like a win-win from the outside. After all, there is the safety of ETFs and the benefit of doubling or even tripling the returns—what can go wrong?

Well, can leveraged ETFs go to zero? We explain their risks and benefits below.

About Leveraged ETFs

Leveraged exchange-traded funds (ETFs) are derivative instruments designed to amplify the gains from their underlying index.

Traditional funds track their constituent securities in a one: one ratio, growing or declining in the same percentage.

Leveraged ETFs are different.

They are designed to give double or even triple the returns the underlying asset can offer.

If you are new to trading, this might sound too good to be true—and well, it is.

Investors should know that leveraged ETFs also magnify the losses corresponding to drops in the tracked index.

Over time, such artificially amplified losses can outweigh the gains due to volatility decay (we will explain this in the next section).

For this reason, these instruments should be traded very carefully and used mostly for short-term or intraday positions.

Another class of such assets is inverse leveraged ETFs.

These try to invert the results of their underlying index and multiply and then magnify the inverted returns.

Hence their output would be -2x or -3x of the underlying basket of securities.

Unlike traditional shorts, they are beneficial because they do not require collateral or margin money.

Most popular indexes, including the S&P 500, Dow Jones Industrial Average, and the Nasdaq 100, have leveraged ETFs designed for them.

Can You Hold Them For the Long Term?

Leveraged ETFs are not a good instrument for long-term investment because of a phenomenon called volatility decay.

Due to how they are designed, these assets tend to lose value the longer you hold them.

This is true even if the underlying index is performing well at an aggregate level and is trending upwards.

A higher loss occurs because the falls get equally amplified by the ETF.

It is hard for the security’s price to recover once a big drop happens.

To illustrate the point, let us take an example.

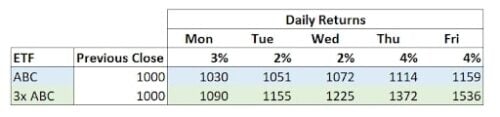

Consider a hypothetical ETF ABC currently trading at 1000 and its corresponding triple-leveraged ETF 3x ABC.

A triple-leveraged fund can outshine the market many times over in a perfectly bullish market, where the returns are consistently growing every day.

Let’s track the movements of ABC and 3x ABC for a week when there is daily growth.

As you can see, 3x ABC gave more than 50% returns in just five days.

This is more than three times the 16% overall returns of ABC.

So 3x ABC is the better fund, right?

After all, it can help traders generate outsized returns while also giving the benefit of diversification.

Well, let’s hold on a second.

This constant growth scenario is not how markets work.

Most broad indexes will have volatility with regular ups and downs but might end up growing positively over the long term.

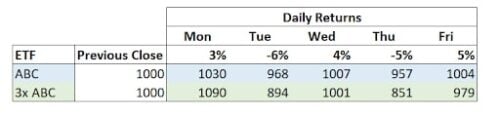

Let’s try to plot the movements of ABC in a more realistic market with both gains and losses.

The above picture shows that the regular ETF ends up, after a series of growth and de-growth movements, at 0.4% above the previous closing.

However, 3x ABC ended up in the red by about 2%.

For ABC, the small gains on three days were able to counterbalance the large drops on Tuesday and Thursday.

But for 3x ABC, those drops created a bigger hole (due to the amplification).

This fall could not be recovered by the relatively smaller gains on the remaining days.

This creates a “constant leverage trap,” which causes the overall returns to deteriorate over time.

This phenomenon causes them to track lower than their underlying indexes when viewed over a longer period.

Are They Good for Beginners?

No. Leveraged funds are risky to trade and not suited for beginners.

They are created from futures, equity swaps, and other equity derivatives.

This makes their returns very uncertain.

Moreover, as discussed above, they are designed to amplify returns on a single day.

Their objective is not to grow over a longer period, which is usually what beginner investors are looking for.

Hence, new traders need to be very careful about these instruments’ entry and exit points.

Again, fund managers need to rebalance the derivative instruments used in creating leveraged ETFs daily.

This daily re-jig means their fund fees are much higher than regular ETFs.

Do Triple Leveraged ETFs Decay?

Yes, the longer a trader holds them, the more they lag against their underlying index, as explained earlier.

Volatility drag causes their returns to decay over time.

Usually, market indexes that grow over the long term outperform their corresponding triple-leveraged ETFs.

For example, the Russel 2000 index has offered a 66% return since 2008.

In comparison, Direxion’s TNA fund, a triple leveraged ETF for the same index, has only given a 32% growth during the same period.

For an investor, it would have been better just to hold the index ETF itself.

Can Leveraged ETFs Go to Zero?

Yes, leveraged ETFs can tend towards zero over time because their returns keep decaying.

The higher the leverage, the more the lag.

A triple-leveraged ETF goes down faster than a double one.

When eventually the fund starts nearing zero, one option for fund managers is to do a reverse split.

They increase the fund’s price while reducing the total number of units available.

However, it might happen that the leveraged fund again starts heading towards zero with time.

Eventually, if there is no further demand for a reverse stock split, the ETF will have to be delisted.

Why Can They Go to Zero?

To explain this, let us take the case of a triple-leveraged fund tracking the S&P 500

Let’s assume that on a particular day, the benchmark index falls by 33.3% (in reality, this is impossible, but humor the idea for a second).

Think about what will happen to the triple-leveraged ETF that tracks it perfectly.

It will fall by 100% and go to (almost) zero.

After that, any percentage growth will not bring it back (since the base is so small now).

This example is simplistic since the S&P 500 has circuit breakers to prevent a huge fall like this.

A leveraged ETF based on the index can never go to zero in this way.

But we are trying to illustrate that these funds can go toward a zero value, especially if the underlying basket of securities is not as mature.

Over time, and with enough market drops, the decay in such funds will eventually cause them to end up there.

Can They Go Negative?

No, a leveraged ETFs price cannot go negative, but it can tend toward zero.

These instruments are a type of market security. They have a team who manages them.

The fund managers would not allow the asset to become negative.

But as the example above explains, large drops in the underlying index over time can cause them to trend toward zero.

Can Inverse Leveraged ETFs go to Zero?

Yes, an inverse leveraged ETF can also go to zero.

These instruments offer returns opposite to a certain index, amplified by a double or triple amount.

Thus, if the fund rises significantly daily, it will not just fall but magnify the effect.

In the process, they might tend towards zero, just like leveraged ETFs.

What Happens When a Leveraged ETF Liquidates?

If there is little demand for an ETF, eventually, it will get liquidated.

When this happens, investors have two options:

- Sell their holdings to a market marker

- Wait for the fund to offer a final closure

In the second case, the ETF will close all operations, clear off all debts and then send a settlement to its remaining shareholders.

This amount is usually sent by check and is decided based on the fund’s net asset value (NAV) before liquidation.

Can You Owe Money in Leveraged Trading?

No, leveraged trading only means higher exposure against your collateral.

No real money is borrowed; hence it’s impossible to end with debt from it.

If a trader cannot pay the margin money, the broker can liquidate the deposited collateral and recover any losses.

Lastly, the broker can always liquidate part of the position for a bad trade that is not covered by the investor’s deposit.

This will bring down the required collateral, and the investor can continue to use leverage on the remaining holdings.

Are ETFs Better Than Stocks?

An exchange-traded fund might be better than buying stocks in two scenarios.

The first case is when shares in a certain industry have returns that are very near the mean value of the sector.

In such cases, similar returns can be gained by investing in an ETF rather than a single stock.

Hence the benefit of holding only one share does not outweigh the risk of non-diversification.

Taking an ETF would significantly reduce the risk and still offer similar returns.

The second scenario is when it is difficult to analyze the fundamentals of a stock to identify value drivers.

Investors may not understand them simply by looking at financial statements.

For example, in industries such as biotechnology or semiconductors, the drivers of success require technical understanding.

For biotech firms that produce drugs, a lot depends on FDA approval.

If it comes through, the stock may shoot through the roof, but if it doesn’t, the share will fall like nine pins.

In such cases, it is better to take an ETF that exposes you to the sector rather than a single firm.

Evaluating individual stocks is unlikely to yield clear information about the strength of the opportunity.

Are They a Good Investment?

Yes, ETFs can be a good investment for traders looking for low-risk and low-cost trading instruments.

These funds are created out of a basket of goods and offer diversification.

Investing across multiple securities or sectors lowers the inherent risk of trading in individual shares.

ETFs also pass through dividends. Hence traders do not miss out on this additional benefit.

Moreover, these funds are very cost-effective.

They have very low expense ratios and commissions compared to mutual funds.

Another benefit is that these funds are tax-friendly.

Due to how ETF units are created, there are very few taxable events inherent to them.

This brings down the tax burden on their income compared to mutual funds and other similar pooled investment instruments.

However, there are some unique problems that investors should also be aware of.

ETFs are not actively managed.

So if the underlying index is falling, the fund will too.

Again, folks need to know that leveraged and inverse ETFs are not the same as regular ones.

These high-risk instruments are created out of derivatives that aim to amplify or invert returns.

Due to how they are created, combined with daily rebalancing, most leveraged ETFs tend to be more expensive and risky.

Final Thoughts

In theory, leverage ETFs look like excellent products. They offer the benefits of diversification while also amplifying returns.

However, in practice, they perform poorly when the market is volatile.

Over longer time horizons, these instruments can even tend to zero. Hence, they are not meant for long-term investing.

Beginner investors should stay away from using leveraged ETFs.

However, normal ETFs are a perfectly safe way to invest. They offer lower risk and good returns at a very low cost.

They are tax efficient as well.

Those looking to invest in leveraged ETFs should try them out only for short-term trading.

Tags:

Tags: