ChartMill is a popular stock screener that boasts an impressive array of analysis tools. But can this scanner really improve your investment strategy? We’re putting it under the microscope in our ChartMill review to find out.

What is ChartMill?

ChartMill.com is an all-in-one stock screening platform that brings a lot more to the table than your bargain bin scanners.

The service provides a range of tools to help you read the market, including scanners, charts, stock analyzers, and more.

It caters to a variety of trading strategies, such as day and swing trading.

In fact, during our research, this screener showed up quite often for swing traders because of its trend tracking capabilities.

One of ChartMill’s most unique features is its credit system which allows you to only pay for the service when you use it.

There are paid subscriptions, but this credit feature piqued our interest right out the gate.

Each tool has a credit value that must be paid to perform a scan, view a chart, or even save a watch list.

The site awards 6,000 free monthly credits, which may be enough for new traders to test the waters.

Also, this is not a trading platform, so you cannot buy or sell stocks directly with ChartMill.

We won’t count this as a point against the platform, as the ability to trade stocks can come with a hefty price tag or has very limited support.

Is ChartMill Free?

As mentioned, you can use ChartMill for free, but you are limited to 6,000 credits each month.

Also, some features do not come with the same functionalities you get with subscriptions.

The free version is a good place to start, but if you’re an active day trader, you might need to upgrade.

Is ChartMill Reliable?

ChartMill’s tools can offer a reliable read of the stock market, so it’s a solid tool to build a trading strategy around.

Its analyzer uses a sophisticated algorithm to rate the value of stocks.

These ratings allow you to effortlessly locate stocks with significant profit potential as well as ones to stay away from.

Setting Up a ChartMill Account

It takes no more than a minute to create an account and get started.

The technical analysis website starts users off with 6,000 free credits each month and allows you to effortlessly filter stocks based on your own technical screening criteria.

The free credits are great, but you can spend them pretty quickly if you aren’t careful.

>> Already sold on ChartMill? Click HERE to sign up today! <<

ChartMill Review: What’s Included?

This service has so many thing to offer and that’s why we prepared an overview of all the features in our ChartMill review.

- Stock Screener

- Watch Lists

- Stock Charts

- Alerts

- Analyzer

Stock Screener

The ChartMill stock screener allows traders to search multiple markets to find new trading ideas.

It gives access to technical indicators and fundamental screens, so you can dive as deep as you want to with your research.

These features are essential in locating stocks that are ripe for growth.

You can find shares listed on a variety of stock exchanges, including:

- NYSE

- NASDAQ

- American Stock Exchange

- Toronto Stock Exchange

- And more

Because these stocks show up on major exchanges, the shares could be easily accessible through your favorite brokerage.

One downside is that this screener does not track the forex market or other securities like crypto.

It does support ETFs, however.

How Do You Use ChartMill’s Stock Screener?

ChartMill’s technical analysis filters look at things like trading volume increase, market cap, volatility, and trending stock data.

Fundamental analysis filters track more qualitative data such as revenue growth, price, and operating margin.

Within the ChartMill stock screener, traders can even create custom filters based on any available stock property.

Also, ChartMill makes it easy to save screener configurations so you can access them quickly next time.

It’s important to note, however, that without a premium subscription, these screens can rapidly eat through your credits.

Watch Lists

The watch list ties all of ChartMill’s features together.

This tool allows traders to earmark their favorite stocks and revisit them at any time.

Watch lists can be customized with alerts or indicators, so traders are immediately alerted to significant changes in value, which is especially useful for day and swing trading.

Thanks to these alerts, investors can keep a close eye on volatile stocks without having to stare at the website all day.

ChartMill even provides daily watch lists on stocks that are seeing strong breakouts or huge drops.

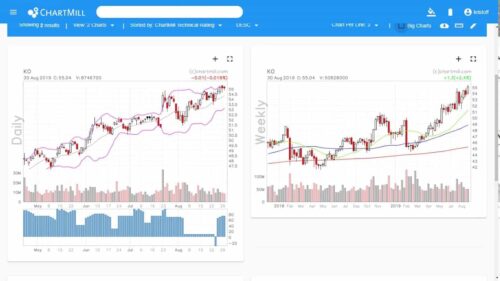

Stock Charts

When you want to track the performance of a stock over a specific time interval, ChartMill stock charts are the place to go.

You can see price action over the course of a day, week, or even the past month.

There are several chart options, including line, bar, and candlesticks, to monitor stock value.

Investors are not limited to just one chart per screen.

Whether you’re running basic or advanced charts, you can view multiple charts side by side for comparison.

There is a long list of technical indicators to choose from and no limit to the amount that can be added to a chart.

Here, as with the stock screener, traders can save chart settings for easy viewing in the future.

Viewing charts uses credits and can deplete a trader’s supply quickly.

Fortunately, the premium subscription allows for unlimited charting.

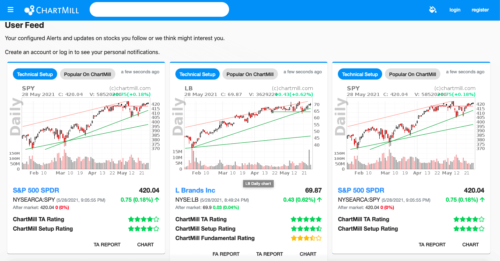

Alerts

You can place alerts right into watch lists or on charts you’ve created.

Alerts can be put in place for price, condition, or by setup.

When an alert is triggered, you can be notified through a pop-up, email notification, or even by audio alert.

This is a solid feature for stock trading on the go.

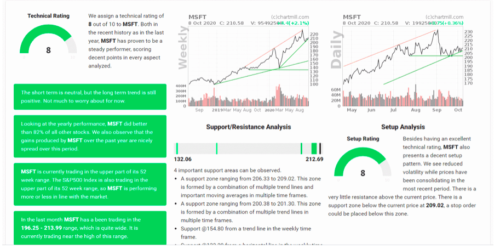

ChartMill Analyzer

One reason why ChartMill stands out as a great stock screener is because of its stock analyzer.

This is a beefy tool that traders can use to view a comprehensive amount of information on the stock of their choice.

The tool gives a detailed list of both fundamental and technical information through a series of reports and charts.

This information is updated every day by the team at ChartMill.

At the top of the site, ChartMill shows a list of stocks that could potentially see huge gains.

Each one can be selected to bring up a full report for that particular stock.

The ChartMill value indicator assigns each stock a technical rating value (out of 10), with a summary explaining why the rating was given.

For example, stocks that are higher risk will show lower numbers.

Traders will also find graphs that document support, resistance, and setup analysis.

Jumping over to a fundamental analysis reveals a fundamental score and an explanation summary of the rating.

The fundamental analysis then breaks down this score into components such as profitability and growth.

>> Like all that ChartMill has to offer? Click here to sign up for an account NOW! <<

Is ChartMill Legit?

ChartMill is a legit stock screener with a unique payment model that sets it apart from many competitors on the market.

While the payment model is a major draw here, the tools on offer provide fantastic market insights.

Some alternatives have more tools, but we appreciate ChartMill’s quality over quantity approach — what it does, it does exceedingly well.

The credit system also makes ChartMill a perfect pairing for some of your favorite research products, as you can selectively use tools to compensate for features that may be lacking on some of your go-to analysis software.

ChartMill Review: How Much Does It Cost?

As we touched on earlier, ChartMill has a really accessible business model.

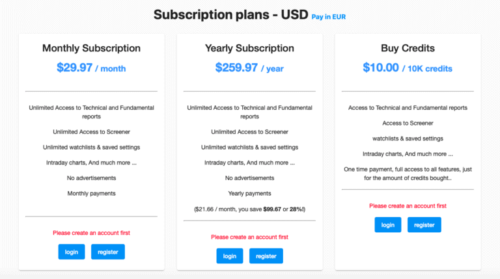

You have three options, monthly subscription, annual subscription, or credits.

Here’s how their costs break down:

Monthly – $29.97/month (~$360/year)

Annual – $259.97/year (~$21/month) 32% discount

Credits – $10.00/10K credits

The average trade report costs 500, so those credits add up fast, which is why you might want to upgrade from a free account.

ChartMill Cancellation Policy

ChartMill makes it easy to cancel at any time and terminate your recurring payments.

At the end of your billing cycle, the service will revert to the free model, where you will receive 6,000 credits to use each month.

The company does make it clear that there are no refunds for its services.

>> Ready to sign up for a ChartMill account? Just click HERE to sign up NOW! <<

ChartMill Review: Pros and Cons

Several features make ChartMill stand out as a top contender for the best stock screener on the market.

Let’s take a look at the list of all the pros and cons we prepared for you in our CharMill review.

Pros

- Several filter options for screeners and charts

- The platform’s sleek interface helps traders effortlessly track financial metrics, financial reports, custom metrics, chart patterns, technical criteria, historical data, and much more

- Affordable premium subscription

- Live trading room available to share trade ideas with other investors

- Search through over 6,000 different stocks

- 6,000 free credits each month

- Ability to save screens and charts

- Covers US and Euronext markets

- Several customizable settings

Cons

- Free monthly credits can run out quickly

- No ChartMill app for mobile

- Does not link to a trading account

- Quote data is delayed by 15 minutes

Is ChartMill Right for Me?

ChartMill offers a ton of powerful tools that could appeal to almost anyone trading stocks.

But there are some traders who could benefit more from using this platform.

Swing Traders

This platform has a wealth of valuable technical and fundamental analysis tools that can help with swing trading.

The ChartMill Trend Indicator will likely be your go-to for planning your entry and exit points.

Beginners or Traders on a Budget

ChartMill’s free credits and affordable subscriptions make this trading software ideal for someone who doesn’t want their screener to break the bank.

If you’re going to test out the service, it might be best to opt for a monthly subscription, as you’ll likely blow through credits testing its features.

Then you can pick a plan most suitable to you once you figure out how to integrate ChartMill into your trading system.

Day Traders

The service offers a lot to like for day traders, including charting, watch lists, screeners, and more.

That being said, there is a 15-minute delay on data, so it might not be for intraday trading at a breakneck pace.

There are some stock screeners with more current price quotes, but it typically comes at the cost of a substantial premium.

ChartMill Reviews by Members

ChartMill has garnered positive praise and high ratings by reported members.

Let’s see what subscribers have to say:

“Interesting explanation of setups and ease of use, most screeners don’t explain much whereas ChartMill I feel has the potential to be a great tool.”

— Mike, on Facebook

Another ChartMill stock screener review reads:

“Great site and I hope to add another payment method, not just Paypal, analyzer is a perfect tool.”

— Abdullah Almuhanna, on Trustpilot

ChartMill Review: Is It Worth It?

ChartMill is a great stock scanner, and its affordable pricing options make it hard to ignore.

The wide range of filters and customization options allow you to make the platform your own.

Better yet, ChartMill takes a lot of the guesswork out of hunting for that ideal stock by providing top-tier stock screening at a reasonable price.

Also, the ChartMill value indicator is an exceptional tool for finding breakout stocks.

If you are in the market for a solid stock screener, you can always start with the free plan and move forward from there.

But if you really want to give ChartMill a chance, you’ll probably want to sign up for a month so you’ll have unlimited access to run tests.

Tags:

Tags: