Energy innovations tend to reshape markets, and Whitney Tilson argues that nuclear fusion could be next in line.

He highlights Amazon and Jeff Bezos as early movers, hinting at a shift that may carry more weight than most expect.

There could be a lot of wealth up for grabs if this new tech comes to pass, but I had to uncover the truth for myself.

In this Commodity Supercycles review, I walk through his “Bezos Breakthrough” and assess whether the direction Stansberry Research suggests is worth considering.

What Is Commodity Supercycles?

Commodity Supercycles is a research service and monthly newsletter published by Stansberry Research and led by stock market veteran Whitney Tilson.

It focuses on spotting long-term shifts in energy and natural resources before they hit the mainstream.

That’s awesome in itself, but you’ll need to think beyond just stock picks to see the full picture.

This is a structured research service designed to keep you plugged into long-term trends like nuclear fusion, the AI energy boom, and the broader commodity cycle.

Each month, Tilson shares fresh insights and new ideas he and his team are tracking, while also maintaining an active model portfolio that shows exactly where he’s placing his focus.

You don’t need to be a commodities expert to follow along, which is what really caught my eye.

I’ll get into the specifics in a moment, but I first want to study our guru under a microscope.

Who is Whitney Tilson?

Whitney Tilson is the lead guru for Commodity Supercycles and one of the most respected analysts on Stansberry’s roster.

He has built a reputation over the last three decades as one of the more thoughtful voices in finance, and he’s certainly earned my attention over what he’s achieved.

He studied at Harvard, earning both his undergraduate degree and his MBA from Harvard Business School before launching his Wall Street career.

Tilson went on to co‑found Teach for America and later started his own hedge fund firm, Kase Capital Management, which at its peak managed more than $200 million.

Additionally, his adventurous spirit, seen in his passion for mountaineering and obstacle course racing, adds another fascinating dimension to his life.

Today, Tilson focuses his energy on bringing these kinds of big‑picture opportunities to each of us as the editor of Commodity Supercycles.

Is Whitney Tilson Legit?

I have no doubts about Tilson’s legitimacy in the financial research world.

Over nearly twenty years, he developed a knack for spotting major market inflection points, earning invitations to share his insights on CNBC, Bloomberg, and Fox Business.

You can see his work in the Wall Street Journal, Barron’s, and the Financial Times, and he’s the author of several books on investing, including The Art of Value Investing.

He even appeared on CBS’s 60 Minutes to expose a corporate scandal that later sent a major company’s stock tumbling.

Furthermore, Tilson warned of the dot‑com bubble before it burst, shorted financials ahead of the 2008 crisis, and flagged risks that played out during the 2022 market downturn.

>> Get Whitney Tilson’s latest recommendations <<

What is Stansberry Research?

Commodity Supercycles is published by Stansberry Research, one of the leading names in the investment research industry.

Stansberry has several popular services under its banner, but Commodity Supercycles is one of its main offerings for commodity plays.

Based in Baltimore, the U.S.-based research firm has been bringing professional-grade investment insights to the public for decades.

Stansberry’s services have thousands of subscribers, making it one of the most credible and trustworthy research firms around.

You can rest assured that Commodity Supercycles is the real deal.

Is Stansberry Research Legit?

Stansberry Research is one of America’s most established financial research publishers. With dozens of publications under its banner, Stansberry is an absolute powerhouse in the financial publishing space.

Thousands of subscribers in dozens of countries across the world regularly read Stansberry content, so the firm’s research is extremely influential and even consequential, at times.

My experiences with Stansberry have always been positive. A quick online search will reveal some criticism about some of their more aggressive marketing practices, but their tactics have become more user-friendly as of late.

However, I have noticed that most negative reviews complain about service issues, NOT research quality. Their research is widely read and respected, so you can trust the research coming from a Stansberry publication.

>> Access the team’s latest research <<

What Is Whitney Tilson’s “Bezos Breakthrough” Presentation About?

Whitney Tilson believes a meaningful shift in the energy landscape is starting to unfold, even though there’s little to no writing on the wall.

He points to early signs coming from Amazon and Jeff Bezos that suggest nuclear fusion may be entering a phase where it deserves closer attention.

It sounds like science fiction to me, but we could be at the doorstep of a development that could influence markets long before it reaches full maturity.

He says the encouraging part is that progress often becomes visible in small steps, and those early steps can create opportunities for anyone who understands what to look for.

I probably don’t need to tell you that early adopters are the ones who typically make the most when these technologies really take off.

The Pursuit of Energy

For decades, the assumption has been that large energy transitions move slowly.

Tilson challenges that belief by explaining how rising demand from sources like AI, higher costs, and aging systems have pushed the search for alternatives forward.

In his view, many of the traditional fixes only cover symptoms rather than addressing the underlying constraints.

Without a new solution, we could face some serious issues in the very near future.

This is where fusion becomes important. He explains that recent breakthroughs in research labs, along with growing private investment, have accelerated development more than most people realize.

Whitney’s points definitely made a lot of sense to me, but energy is a big landscape. I needed to know where to look to get involved.

How Amazon and Jeff Bezos Fit Into the Story

Enter Amazon. With so many data centers, logistics networks, and cloud infrastructure, there aren’t many corporations that depend so heavily on reliable energy.

Just like when Amazon set up its own product-moving service because UPS and FedEx couldn’t deliver (pun intended), Tilson says that Jeff Bezos has been investing in fusion for years.

Code-named by Tilson “Amazon Helios”, the quest for sustainable energy is set to surpass even the impact of the internet some 20 years ago.

This seems really big, and it’s traveling at the speed of light. Big money seems to have already caught wind of this new energy direction, meaning there’s less time than ever to lock in your own gains before it’s too late.

How to Win Big From “Amazon Helios”

Should fusion continue to advance, even modest progress could shape energy costs, industrial output, and long-term investment trends.

What really surprised me though is that Whitney’s not saying to buy Amazon stock at all.

On the contrary, there are companies moving behind the scenes to make fusion a reality that are set up for the biggest gains once it takes center stage.

Tilson has all the info you need on these rare opportunities, and that research is yours by signing up for Commodity Supercycles today.

Next, I want to dive into what comes with a membership and how it all plays into the big picture.

>> Sign up now to access the #1 gold stock <<

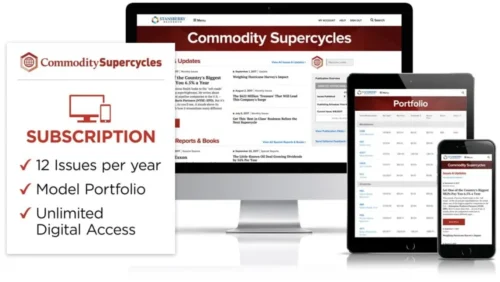

What Comes With the Commodity Supercycles Membership?

Here’s a closer look at what membership actually provides.

1 Year of Commodity Supercycles Newsletter

A full year of access to Commodity Supercycles acts as a guided tour through some of the biggest financial stories unfolding today.

Every month, Tilson releases a new issue packed with research on disruptive trends in energy and natural resources.

He doesn’t just toss out a stock name and move on; instead, he explains why he’s recommending it, what forces are driving the opportunity, and how long he expects it to play out.

The writing strikes a balance between professional insight and plain‑spoken clarity, so you don’t need a Wall Street background to understand the message.

What makes this especially valuable is that you get to follow Tilson’s evolving thought process as conditions shift.

1 FREE Year of Access to the Commodity Supercycles Model Portfolio

Whitney’s model portfolio gives you a complete picture of where his recommendations stand at any given time.

Inside, you’ll see every stock that has been added, whether it’s still in buy range, and the price targets Tilson has mapped out.

For newcomers, this takes away a lot of the guesswork. Instead of asking yourself if you’re too late to buy or whether you should be taking potential profits, you can look directly at the guidance Tilson provides to his readers.

Tilson updates it regularly, adjusting positions as the market changes or as catalysts play out. If a stock runs up and no longer offers a good entry, he’ll flag it right here.

1 FREE Year of Access to Stansberry’s Investment Advisory

The Investment Advisory is where Tilson and his colleagues take a step back and look at the big picture, beyond fusion, beyond energy, and analyze the most powerful economic forces driving markets today.

The beauty of getting access for free is that you can follow along with a seasoned team that has weathered bear markets, booms, and everything in between.

Every month, a new issue arrives with fresh opportunities across industries and a clear explanation of why they matter now.

For someone who doesn’t want to be boxed into a single sector, this adds balance and breadth to what you get with Commodity Supercycles.

Updates & Urgent Alerts

Tilson sends updates between monthly issues whenever market conditions change or when a recommended position requires attention.

These alerts help ensure you aren’t left wondering about the status of an investment or whether a new development affects the original thesis.

I love this kind of communication because commodity-driven markets can move quickly, especially when energy policy, supply disruptions, or new technologies influence prices.

It’s really nice to always feel in the know without having to spend my life in front of a computer.

Instant Access to Research Archive

Your membership includes complete access to Stansberry’s password-protected research archive.

This library contains hundreds of back issues and past special reports, covering a wide range of historical recommendations and research themes.

Trust me when I say that the archive is more than a snapshot of past ideas. It shows how Tilson and other analysts approach long-term trends and evaluate opportunities across cycles.

I found it useful for understanding how certain ideas developed over time and how different sectors responded to shifts in policy, technology, or global events.

Plus, you can return here time and again should you need to for reference.

On-Demand Support

If you ever have questions about your subscription, Stansberry’s customer service team is available by phone or email on weekdays.

Their support is handled by trained representatives who can walk you through accessing your reports, navigating the website, or resolving account concerns.

This matters more than people realize, because many research services leave you on your own once you subscribe.

Here, the ability to reach someone directly makes the experience smoother, especially if you’re new to the platform. Support hours run Monday through Friday from 9 a.m. to 5 p.m. Eastern Time.

The Stansberry Digest – Free Daily Market Insights

Every market day, I also get an inside look at what analysts across Stansberry Research are focusing on through my copy of The Stansberry Digest.

These notes cover breaking developments in the markets, emerging risks that most people miss, and fresh opportunities that can appear in unexpected corners of the economy.

Instead of chasing after scattered news or trying to interpret market chatter, it’s right in my inbox every single day.

This not only helps you stay informed in real time but also sharpens your perspective by showing you how professional analysts connect the dots between global events and market shifts.

>> Get Stansberry Digest free when you JOIN NOW<<

Special Bonus – Whitney Tilson’s Daily

Every weekday the markets are open, Tilson writes to members with his thoughts on what’s moving and why.

I consider these notes his unfiltered observations, often shaped by conversations he’s having with industry insiders and the vast network he’s built over decades on Wall Street.

He frequently highlights specific stocks he’s watching, shares lessons he’s learned from past calls, and points readers toward articles or resources that can help them see the bigger picture.

It’s all designed to keep you ahead of emerging themes so that you’re at the forefront of investing instead of playing catch-up – and it works.

>> Join now to see Commodity Supercycles’ latest picks <<

Bonus Reports Included

These reports are your window into some of the most exciting opportunities Whitney is tracking right now.

Bonus Report 1: The Nuclear Fusion Trailblazer

In this report, Tilson shines a spotlight on a major oil and gas company that is quietly positioning itself as a leader in the race to make nuclear fusion a commercial reality.

On the surface, it may look surprising that a traditional energy giant would be investing in something that could disrupt its own industry.

But Tilson argues this is precisely why the opportunity is so compelling. This firm has invested in multiple fusion startups and is prepared to benefit no matter how quickly the technology scales.

You get the full scoop here, including the venture’s name and ticker symbol, so you can jump right in.

Bonus Report 2: New Nuclear: Top Stocks for the Future of Energy

While fusion may be the holy grail, advanced fission technology and new nuclear infrastructure are already moving forward at a rapid pace.

Here, Whitney introduces readers to several companies that are building the backbone of tomorrow’s power grid.

Tilson describes why the best opportunities often come before the mainstream narrative catches on, and he explains how positioning in these stocks today could lead to some of the biggest gains of his career.

Microsoft, Amazon, and Alphabet are all investing billions in nuclear solutions to power their AI growth, making it apparent that a lot of money is flowing there that we can be a part of.

Bonus Report 3: The AI Speculation: How to Double Your Money or More in the Next Few Years

This report zeroes in on a well‑established but relatively unknown company trading at less than $10 per share, and it produces a component that has suddenly become essential for a wide range of AI applications.

What makes this especially intriguing is that the company already has a strong balance sheet and recently secured a $258 million contract with the Department of Defense.

Tilson notes that when small, profitable firms are at the right place at the right time in a new technological wave, the upside can be explosive.

While he’s clear that this idea carries more risk than the others, I think this could be one of those rare asymmetric bets that could dramatically boost overall returns.

>> Get the top stock when you join now <<

30-Day Money-Back Guarantee

One of the most reassuring aspects of subscribing to Commodity Supercycles is that every new membership comes with a 30-day, 100% money-back guarantee.

That means you have a full month to explore everything inside the service, the monthly issues, the model portfolio, the bonus reports, and the daily insights, before deciding if it’s right for you.

If at any point within those 30 days you feel the research isn’t a fit, you can contact Stansberry’s member services team and receive a prompt refund of your subscription cost.

There are no hoops to jump through, and you even get to keep all of the special reports as a thank-you for giving the service a try.

This no-risk policy shows confidence in the value of the research while giving you the peace of mind to test it out without financial pressure.

Commodity Supercycles Track Record

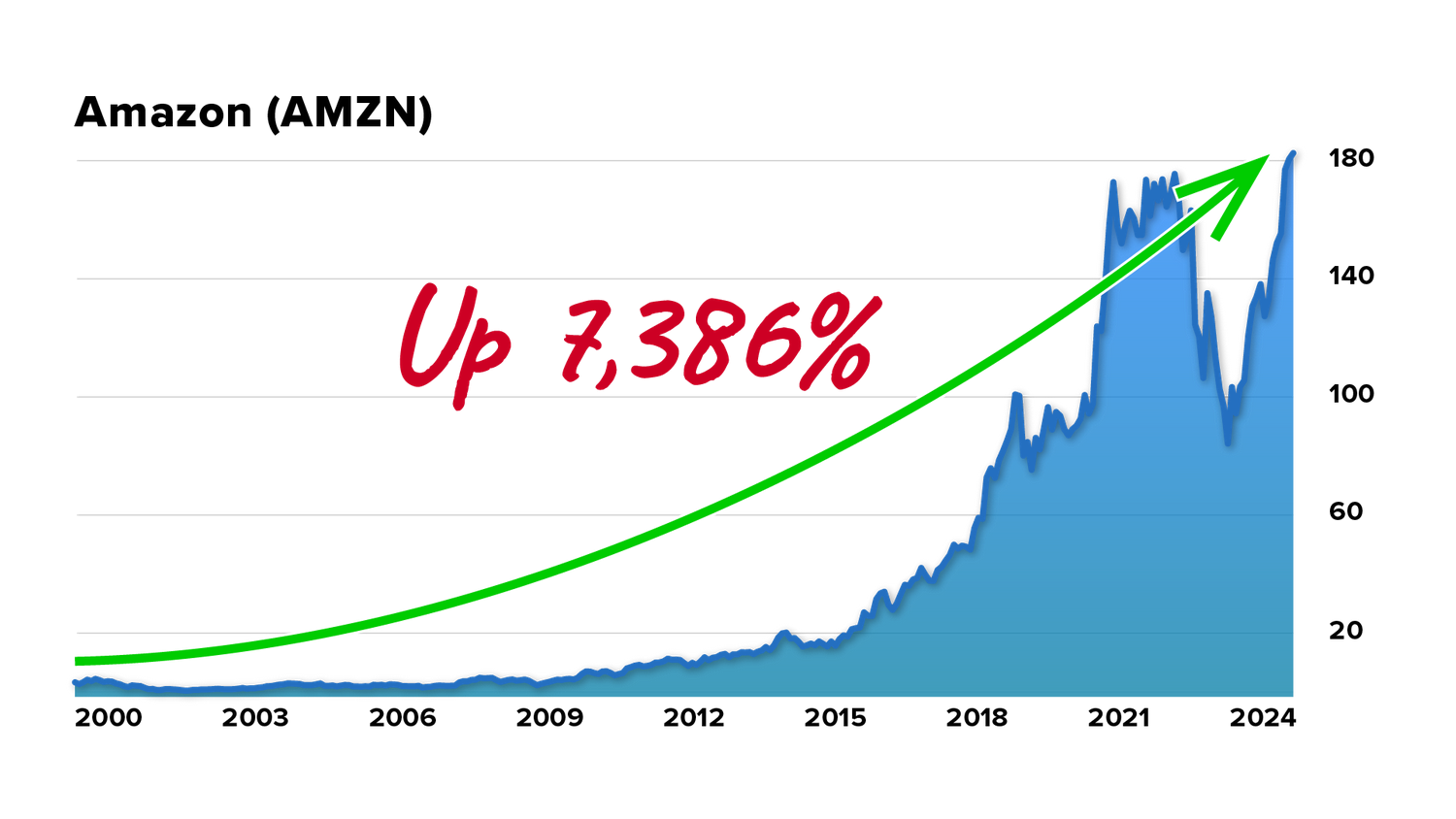

Tilson may be excited about the growth potential for “Helios” right now, but across his career, he has already come up with 19 800%+ winners in the past.

Several of the service’s open recommendations are already showing strong performance, with gains as high as 100% or more.

While not every pick will be a winner, Tilson himself is quick to stress that risk is part of the process.

However, the data I’ve found suggests his research has consistently uncovered companies tied to powerful megatrends.

Pros & Cons of Commodity Supercycles Review

Commodity Supercycles is a great service, but nobody’s perfect. Here are the pros and cons.

| Category | Details |

|---|---|

| Pros |

|

| Cons |

|

> Get started now for instant access to these benefits and more <<

How Much Does It Cost?

The regular retail price for a one-year subscription to Commodity Supercycles is listed at $499.

However, Tilson and Stansberry are currently promoting a heavily discounted entry point of just $79 for the first year, which represents an 84% savings.

That initial payment doesn’t only cover twelve months of access to the monthly issues, it also unlocks the model portfolio, the daily commentary, and all three bonus reports.

On top of that, subscribers are granted a complimentary year of Stansberry’s Investment Advisory, which usually sells for $499 on its own.

From where I’m sitting, the two major research services, daily insights, and multiple bonus reports make this a slam dunk for the price point.

After the first year, renewals are billed at $199 annually, still well below the standard retail price.

Is Commodity Supercycles Worth It in 2026?

After going through the research and everything included in the membership, Commodity Supercycles is absolutely worth considering if you want a clearer view of where long-term energy and resource trends may be headed.

Tilson’s approach is structured enough that you never feel lost, and his ability to break down complex ideas like the “Bezos Breakthrough” makes the material easier to digest.

That’s great news, considering the year of service and slew of bonus materials you’re getting as part of this bundle.

It starts you off strong and keeps on giving with regular updates and new stock picks backed by research that you can invest in.

Plus, you can get all this for just $79 for the first year, along with a 30-day refund policy to remove most of that risk.

If you’re all about following major shifts early like I am, this service offers a thoughtful way to stay ahead of them.

Don’t wait until Amazon Helios is all over the news, or you’ll be too late. Get in now to give yourself the best shot at profiting from this breakthrough tech.

>> That’s it for my review. Join now to save 84%! <<

Commodity Supercycles FAQ

What is the main investment thesis behind Commodity Supercycles?

Commodity Supercycles is built around the idea that long-term supply shortages and rising global demand can trigger multi-year price cycles in key commodities, creating outsized investment opportunities when positioned early.

Is Commodity Supercycles focused on short-term trading or long-term investing?

The service emphasizes long-term investing rather than short-term trades, with recommendations typically tied to multi-year macro trends instead of daily or weekly market movements.

The newsletter is led by Whitney Tilson, a well-known investor and financial writer associated with Stansberry Research, along with supporting analysts.

Does Commodity Supercycles recommend individual stocks or ETFs?

Most recommendations focus on individual companies positioned to benefit from commodity trends, though ETFs may occasionally be referenced for broader market exposure.

How risky are the investments recommended in Commodity Supercycles?

The investments can carry above-average risk due to commodity price volatility, emerging technologies, and geopolitical factors that affect global supply chains.

Is Commodity Supercycles suitable for conservative investors?

It may not be ideal for conservative investors, as commodity-driven investments often experience larger price swings than traditional blue-chip stocks or bonds.

No. While energy plays a major role, Commodity Supercycles also explores metals, materials, and other resources tied to long-term industrial and technological demand.

How often are new recommendations released?

New recommendations are released periodically rather than on a fixed schedule, usually when the team identifies a strong opportunity tied to macro trends.

Does Commodity Supercycles include sell alerts?

Yes, the service provides guidance on when to exit positions, including updates when the original investment thesis changes.

How detailed are the research reports?

Reports tend to be in-depth, covering the macro thesis, company fundamentals, competitive advantages, and long-term growth catalysts.

Is Commodity Supercycles beginner-friendly?

While explanations are included, some familiarity with investing and market cycles helps readers get the most value from the analysis.

Does Commodity Supercycles provide portfolio allocation advice?

The service may suggest position sizing concepts but does not usually provide personalized portfolio allocation recommendations.

Instead of focusing on short-term commodity price moves, it concentrates on structural shifts that can last years or even decades.

Like most investment publications, any performance examples are illustrative and not guarantees of future results.

Does Commodity Supercycles focus on U.S. markets only?

No. Many opportunities discussed have global exposure, reflecting how international supply chains influence commodity pricing.

Is nuclear energy a recurring theme in Commodity Supercycles?

Yes, emerging energy technologies, including nuclear-related developments, are often discussed as potential long-term catalysts.

Can Commodity Supercycles help hedge against inflation?

Commodity-linked investments can act as an inflation hedge in some market conditions, though results are not guaranteed.

Does the service provide real-time alerts?

Alerts are typically delivered via email, but they are not designed for real-time or intraday trading decisions.

Is Commodity Supercycles updated for 2026 market conditions?

The newsletter evolves with current macroeconomic and geopolitical trends, adjusting its outlook as conditions change.

Are international investors allowed to subscribe?

Yes, international investors can subscribe, though not all recommended securities may be available in every country.

Does Commodity Supercycles explain why each recommendation matters now?

Yes, each recommendation is tied to a specific timing rationale based on supply, demand, or technological inflection points.

How transparent is the reasoning behind each pick?

The research typically walks readers through the logic step-by-step, helping them understand the “why” behind each idea.

Is Commodity Supercycles affiliated with Stansberry Research?

Yes, Commodity Supercycles is published under the Stansberry Research umbrella.

Environmental and regulatory risks are often discussed when they materially impact supply constraints or future demand.

Are updates frequent during major market events?

During periods of significant market volatility, updates tend to be more frequent to address changing conditions.

Does Commodity Supercycles recommend physical commodities?

The focus is on investable securities rather than direct ownership of physical commodities.

Is there a refund policy for Commodity Supercycles?

Subscribers typically receive a satisfaction guarantee, allowing refunds within a specified trial period.

Does Commodity Supercycles include model portfolios?

The service generally provides individual ideas rather than a fully managed or model portfolio.

The service is designed for investors who prefer periodic updates rather than constant monitoring.

Are geopolitical risks heavily factored into recommendations?

Yes, geopolitical considerations are a core part of commodity cycle analysis and often influence recommendations.

Does Commodity Supercycles compare its picks to competitors?

Comparisons may be made indirectly when discussing industry positioning, but direct head-to-head comparisons are limited.

Is Commodity Supercycles better suited for taxable or retirement accounts?

This depends on individual strategy, but long-term holding periods may be more tax-efficient in certain account types.

Can Commodity Supercycles replace a diversified portfolio?

No. It is designed as a thematic supplement, not a complete investment strategy on its own.

Yes, most reports include discussion of what could go wrong and what would invalidate the thesis.

Are recommendations easy to execute with a standard brokerage account?

Most picks are publicly traded securities accessible through major brokerage platforms.

Does Commodity Supercycles focus on emerging markets?

Emerging markets are frequently discussed due to their role in global resource production and consumption.

Is Commodity Supercycles appropriate during economic downturns?

Some commodity trends can perform well during inflationary downturns, but performance varies by cycle.

Macro drivers such as supply constraints, capital investment cycles, and demand growth are central to the analysis.

Is Commodity Supercycles updated when recommendations underperform?

Underperforming positions are typically addressed through updates explaining next steps or revised expectations.

How does Commodity Supercycles handle volatile markets?

Rather than reacting to daily volatility, the service focuses on maintaining conviction in long-term trends.

Does Commodity Supercycles provide educational value?

Yes, many readers find the macro explanations helpful for understanding broader commodity markets.

It may be less suitable for purely passive investors due to the thematic and cyclical nature of the strategy.

Does Commodity Supercycles offer lifetime access?

Access terms depend on the subscription plan chosen at sign-up.

How does Commodity Supercycles identify the start of a supercycle?

The analysis looks for underinvestment, tightening supply, and rising demand that can persist over multiple years.

Does the service rely on technical analysis?

The emphasis is primarily on fundamentals and macro trends rather than chart-based technical analysis.

Who benefits most from Commodity Supercycles?

Investors comfortable with volatility and interested in macro-driven, long-term themes tend to benefit most.

Tags:

Tags: