Crypto Payments Demystified: A Behind-the-Scenes with CryptoProcessing

With a range of benefits on offer, such as lower transaction fees, faster settlements, and access to a global customer base, businesses worldwide are increasingly exploring ways to integrate crypto payments into their operations.

Crypto processing, a critical component in this ecosystem, enables merchants to handle cryptocurrency transactions seamlessly, converting digital currencies into fiat money or securely transferring them to digital wallets.

This article delves into the intricacies of crypto processing, using CryptoProcessing as a case study to illustrate the customer flow and benefits of integrating cryptocurrency payment solutions.

Get ready for a behind-the-scenes look into crypto payment gateways.

What is Crypto Processing?

Crypto processing is the method of handling payments made with cryptocurrencies, similar to how traditional payment processors handle credit card or bank transfer transactions.

It involves converting digital currencies like Bitcoin into fiat money (such as USD or EUR) or transferring them securely to a digital wallet.

For example, imagine you buy a product online using Bitcoin. The merchant uses a crypto processing service, which takes your Bitcoin payment and either converts it into dollars and deposits it into the merchant’s bank account, or securely transfers the Bitcoin to the merchant’s digital wallet, depending on their preference.

This way, the merchant can accept cryptocurrency payments without needing to manage the complexities of digital currencies themselves.

Why Do Businesses Choose to Integrate Crypto Payments in 2024?

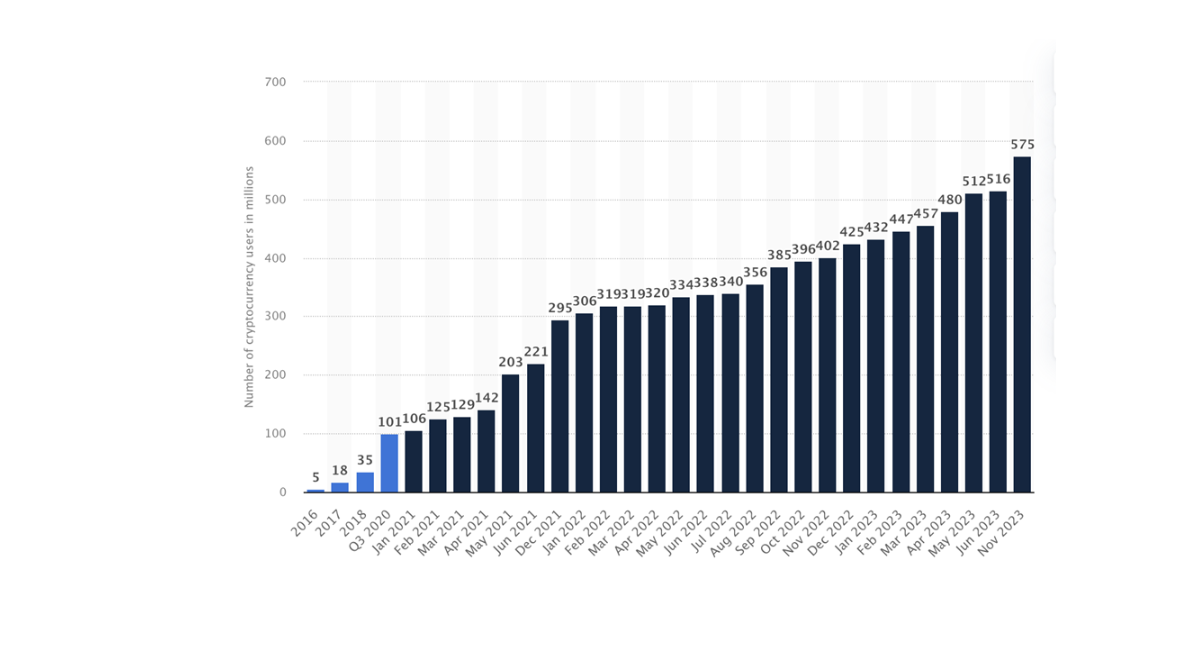

Merchants almost all over the world add crypto payment options to their businesses to keep up with the market trends and meet customer demand. As of November 2023, there are over 580 million crypto users worldwide, with the number growing each day.

Number of identity-verified cryptoasset users (2006-2013)

Moreover, more than 15 thousands companies accept bitcoin as payment, with such giants as Microsoft. Paypal, Tesla, Twitch, Shopify – have already embraced crypto. Thus, the adoption of digital payments might not be a question of “if” anymore, but “when”.

Global Reach – New Customers

Accepting crypto payments enables businesses to tap into an international market. Cryptocurrencies are not bound by national borders, allowing businesses to attract customers from almost anywhere in the world without the complications of currency exchange. This wider reach can significantly expand a business’s customer base and increase sales opportunities.

Lower Transaction Fees

Crypto payments typically involve lower transaction fees compared to traditional payment methods such as credit cards and bank transfers. Traditional financial institutions often charge high fees for processing payments, especially for international transactions. By using cryptocurrencies, businesses can reduce these transaction fees to around or <1%, improving their profit margins.

Faster Settlements

Cryptocurrency transactions can be processed and settled much faster than traditional payment methods. Traditional banking systems can take days to clear and settle payments, particularly for international transactions. In contrast, crypto payments can be completed within minutes, enhancing cash flow and operational efficiency for businesses.

Branding and PR Opportunities

Accepting cryptocurrency can enhance a company’s brand image and public relations efforts. It positions the business as innovative and forward-thinking, appealing to tech-savvy customers and those who value financial independence. This modern approach and earlier adoption can differentiate a business from its competitors before it becomes a mainstream, and attract positive media attention, further boosting its reputation.

Crypto Processing Challenges (and How To Overcome Them)

Price Volatility

One of the main limitations of crypto payments is price volatility. Cryptocurrency values can fluctuate significantly within short periods, which can impact the final amount received by businesses.

Trusted crypto processors help alleviate this issue by offering exchange rate freeze options and instant conversions into fiat currency. These services ensure that businesses receive the exact amount they expect, regardless of market fluctuations, providing more stability and predictability in their financial operations.

Regulatory Compliance

Navigating the regulatory landscape for cryptocurrencies can be complex and daunting for businesses. Compliance with laws and regulations varies by country and can change frequently.

Partnering with a legal, licensed crypto processor ensures that businesses adhere to the latest regulatory requirements. These processors stay updated on compliance issues, helping businesses avoid legal pitfalls and focus on their core operations with confidence.

How Do Crypto Payments Work?

Let’s break down that process using the customer flow observed through an integration with CryptoProcessing, one of the leading crypto payments gateways with over 10 years of experience and over 800+ merchants accounts serviced across different industries.

The CryptoProcessing Customer Flow

Payment Initiation

The customer visits the merchant’s website and decides to make a purchase. They select the desired product or service and proceed to the checkout page. At checkout, the customer chooses the cryptocurrency payment option, initiating the payment process.

Upon selecting cryptocurrency as the payment method, the merchant’s website generates a payment request. This request includes the transaction details, such as the amount to be paid, the cryptocurrency to be used, and other relevant information needed to process the payment.

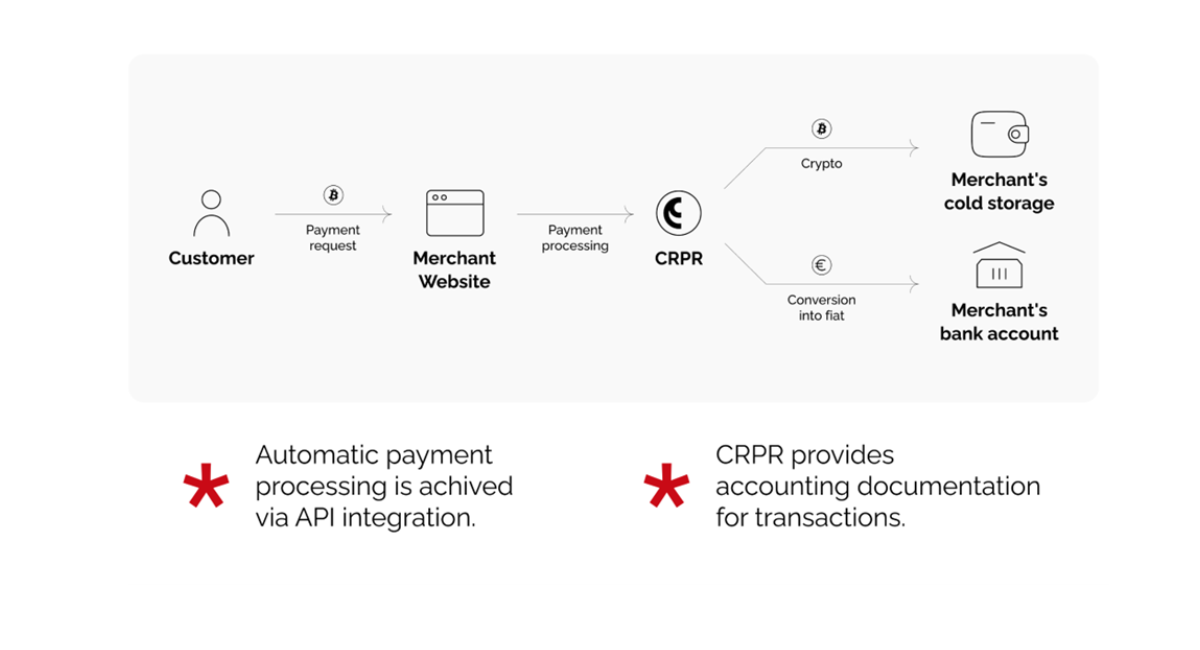

Payment Processing via API

The merchant’s website communicates with CryptoProcessing through an API integration. The process is automated, ensuring a seamless and quick transition from the merchant’s website to the payment processor.

CryptoProcessing receives the payment request and processes the payment. The platform verifies the transaction details to ensure accuracy and security. Depending on the merchant’s preference, the transaction can proceed in one of two ways.

Option 1: Merchant Holds Cryptocurrency

If the merchant opts to hold cryptocurrency on their books, CryptoProcessing transfers the cryptocurrency directly to the merchant’s cold storage wallet. Cold storage is a secure method of storing cryptocurrency offline to prevent unauthorised access. The funds remain securely stored until the merchant decides to use or convert them.

Option 2: Instant Conversion to Fiat

If the customer requires an instant conversion to fiat currency, CryptoProcessing facilitates this process. The cryptocurrency is converted to the equivalent fiat amount at the current exchange rate. Moreover, the platform freezes the exchange rate during the payment processing to avoid any price fluctuations. The converted fiat currency is then transferred to the merchant’s bank account, ensuring the merchant receives the payment in their preferred currency without holding any cryptocurrency.

Payment Methods

CryptoProcessing supports multiple payment options to fit any business model, ensuring that the merchants’ payments needs are fully met.

Payment Channels: Business transactions can get a bit intricate. In scenarios where transactions span anywhere from minutes to days, payment channels come into play. Think of it as keeping a tab at a bar; numerous transactions occur over time but only get recorded on the blockchain when the tab (or channel) is settled.

Payment Links: A user-friendly option, payment links eliminate the need for website integration. Businesses can share these links, possibly via email. Upon accessing, users are led to a payment platform, often with a timer indicating the payment window.

Invoices: Typically used in a B2B context, invoices serve as efficient tools for businesses to bill partners or clients. Nonetheless, individuals can also auto-generate these for tasks like freelancing. Distinct from payment links, invoices lack a time-sensitive component, instead, they have a legal due date.

About CryptoProcessing

CryptoProcessing is one of the leading cryptocurrency payment processors with over 10 years of experience in the industry. Having serviced more than 800 merchant accounts, the gateway provides robust and reliable crypto payment solutions.

The company has received numerous awards, including:

- Forbes’ Best Crypto Payment Gateway for High-Volume Transactions

- EGR B2B Awards’ Cryptocurrency Services Supplier of 2023

- AIBC Summit’s Crypto Payment Solution of the Year

- EiGE Awards’ Best Payment Provider in 2023

CryptoProcessing allows merchants across various industries to accept crypto in a legal, cost-efficient, and secure way. The service offers a variety of payment methods, ensuring flexibility and convenience for both merchants and customers. The integration process is straightforward, allowing businesses to easily implement crypto payments into their existing systems.

CryptoProcessing doesn’t have any set-up/monthly fees or hidden costs, while the transaction fees are around 1% or less, allowing businesses to reduce payment processing expenses.

Features extend beyond seamless top-ups, payments, and withdrawals – the platform caters to both options of payment processing, whether via auto fiat conversion or cold storage crypto transfer. In addition to payment processing, CryptoProcessing offers a secure digital wallet for managing cryptocurrency assets and an over-the-counter trading desk for large-volume transactions.

Conclusion

Crypto processing is a truly transformative solution for businesses aiming to capitalise on the advantages of accepting cryptocurrency payments. With benefits like lower transaction fees, faster settlements, and the ability to reach a wider customer base, integrating crypto payments can significantly enhance a business’s operations and profitability.

As highlighted today, CryptoProcessing exemplifies how a seamless and secure crypto processing system can function, providing both merchants and customers with a reliable and efficient payment experience.

Author

Victoria Shashkina, Content Writer at CoinsPaid, started her career in the tech sector, where she explored innovative technologies like AI and IoT. She later discovered the world of blockchain and web3, which engaged her as a writer. Combining this newfound interest with her long-standing interest for finance, Victoria found cryptocurrency to be a perfect fit for her knowledge and skills, and she’s been covering all things crypto since.

Tags:

Tags: