Dan Ferris’ 2025 predictions warn that we could soon see an event that slows the growth of the US markets for years to come. But is he really on to something, or is his projection premature?

I’m going to do a deep dive into his latest presentation and his namesake newsletter, The Ferris Report, to find out about Dan Ferris predictions and warnings for upcoming years.

What Are Dan Ferris Predictions for 2024?

Dan Ferris predicts that US markets could slip into a cataclysmic “Dead-Zone.”

A “Dead-Zone” is an extended period where securities more or less could trade sideways or suffer a gradual decline for years or even decades.

And some markets that have drifted into one have never fully recovered — even after 30+ years.

Also, a “Dead-Zone” impacts more than stocks. The effects could ripple into a large swath of investment classes.

This is also much different from typical bear markets or crashes.

Here’s what Dan has to say on the matter:

“Most Americans are totally unprepared for a multi-year bear market, let alone a market “Dead-Zone” that could last a decade… or two… or three or longer.

But that’s exactly what we could be entering right now.”

This might sound a little ambiguous at first, but his presentation digs into some historical analysis to illustrate his point.

You might be familiar with one of his top examples (more on this later).

Also, The Ferris Report team has developed a new research newsletter with investment ideas that they believe could help folks come out better on the other side of a “Dead-Zone.”

I’m going to put Dan’s prediction, his credentials, and his new newsletter under the microscope, so stay tuned.

Get the scoop on Dan’s LATEST prediction for 75% OFF

“Dead-Zones” Are (Unfortunately) Nothing New

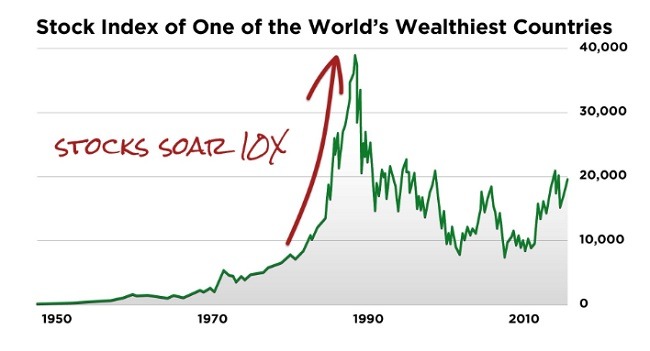

As mentioned, Dan Ferris points out that “Dead-Zones” have persisted on and off the stock market for decades.

He touches on a few examples in his presentation but emphasizes an important event that occurred back in the late 80s and early 90s.

An economic bubble popped in one of the world’s wealthiest countries, and a wavering market stretched across decades.

Here’s the relevant chart:

The market didn’t completely flat-line, but it definitely took a hit.

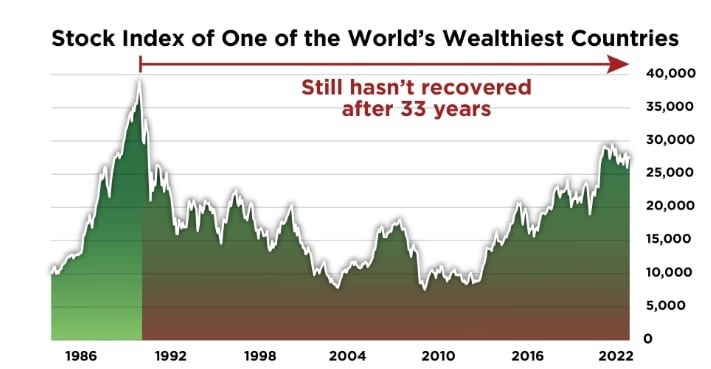

When you zoom out of this graph further, the picture grows even grimmer:

Thirty-three years after its market crash, its economy hasn’t even fully recovered.

What you’re seeing right now is Japan’s stock index from 1986 to 2022.

Dan projects that a similar event might hit the US sooner than many think.

This wouldn’t be the first time, either.

“Dead-Zones” have plagued US markets for decades since the 20s.

Though, to be fair, not to the same extent as Japan. The “Dead-Zone” following the Great Depression took 25 years to recover from.

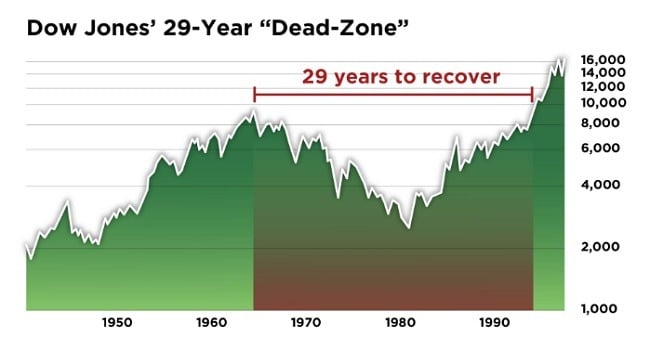

And a similar event in the US occurred between 1965 and 1990.

During this period, the market took about 30 years to break even when adjusting for inflation.

In the presentation, Dan says that we could be on the bad end of one of the biggest bubbles in history, and there’s no telling how long the “Dead-Zone” might last.

But what is the catalyst for this downturn?

Let’s see what Dan has to say.

The “Everything Bubble” Bust

You may already be familiar with the “Everything Bubble.”

The term was not coined by Dan.

It’s actually been talked about by experts for quite some time.

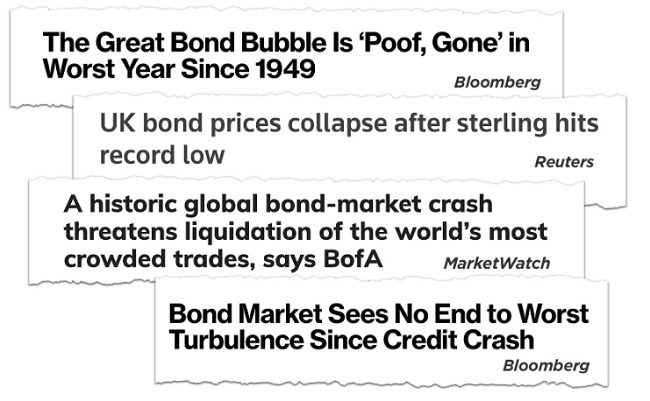

This one is a bit different from something like the Dot-Com bubble. “The Everything Bubble” comprises more than tech investments. It includes multiple markets, bonds, housing, etc.

Because it has bloated the value of many asset classes, it could take a large swath of portfolios with it when it pops.

If you’re wondering what’s inflating this bubble, Dan’s answer is… inflation.

He says the Fed has been feeding it with fresh stacks of greenbacks and refusing to raise interest rates adequately, until now. And this has culminated in the immense inflationary cycle we’re seeing today.

No one likes rising interest rates, but they play a vital role in maintaining the health of the markets.

But instead of using them strategically over time, the Fed is throwing the kitchen sink.

Basically, the only thing left in the tank is to use interest rate increases to pinprick or pop the inflationary bubble that’s been building for years.

And Dan and the team predict that this could spell trouble for the stock market.

Remember my Japan example earlier?

Guess what they did to pop their bubble… poked it with a sharp incline in interest rates.

So if the “Everything Bubble” explodes and is tied to a slew of asset classes, how could someone protect their portfolio?

Buying the dip, maybe?

Dan Ferris’ Warning: Beware Buying the Dip

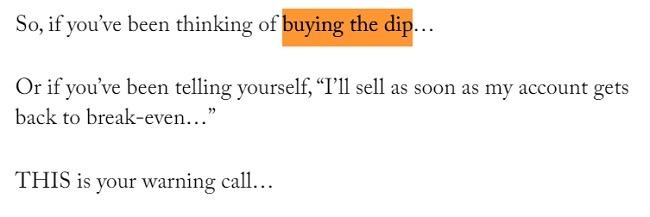

Dan Ferris is warning that buying the dip could spell trouble for portfolios down the road.

Despite the commonly held belief that a bear market is an excellent opportunity to buy the dip, he says that this might not be ideal during a “Dead-Zone.”

That’s because he believes growth could slow to a crawl, and it could take decades for a proper rebound.

Also, in the case of Japan, timing buying the dip wasn’t easy: folks would have needed to wait years for the market to find the floor.

If they bought right at the peak or shortly after the pop, they could have been holding for decades.

Fortunately, The Ferris Report team has a plan to navigate a “Dead-Zone” in the US.

And the full details are in their latest research service.

Before I dive into the package, let’s look at Dan’s credentials.

Who Is Dan Ferris?

Dan Ferris is a talented analyst with a lengthy background in investment research.

As a value investor, his goal is to find opportunities that could provide safe, cheap, and profitable stocks.

You might know him from his appearances on Money with Melissa Francis and The Willis Report on Fox Business News, as well as The Street with Paul Bagnell on Business News Network.

He joined Stansberry Research back in 2000 and has been dishing out valuable insights ever since.

During this time, Dan has displayed his predictive prowess.

Some of his past forecasts include:

- The collapse of Lehman Brothers in ‘08

- 80% Bitcoin fallout of ‘18

- The peak of the Nasdaq in ‘21

There’s no such thing as a stock market crystal ball that can foresee the future. But Dan’s uncanny ability to spot trends before the broader market catches on has earned him the respect of many.

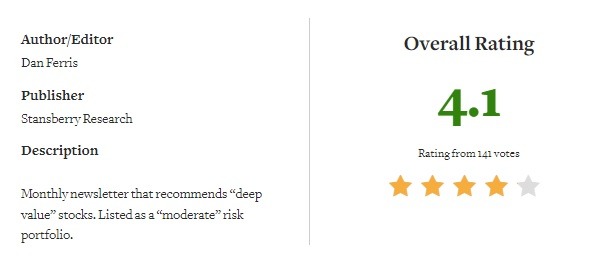

His other Stansberry Research newsletter, Extreme Value, has cultivated a strong following over the years. It’s also well-rated on Stock Gumshoe, locking in a 4.1/5 rating.

Here’s a quick look:

Keep in mind that this is a third-party site, so I can’t verify the veracity of these ratings.

Still, given that he started Extreme Value in 2002, it’s a good sign that Dan’s analysis appears to have had a positive reception over the years.

His latest venture, The Ferris Report, doesn’t have a rating yet, which makes sense because the service is brand-new.

Join Ferris Report Today for 75% OFF

What Is The Ferris Report?

The Ferris Report is an investment newsletter led by Dan Ferris and published by Stansberry Research.

Some features include a monthly stock recommendation, bonus reports, as well as market forecasts from Dan and the team.

For the newsletter, the team pinpoints mid to long-term investments that provide the opportunity to profit from micro and macro market trends.

Recommendations revolve around stocks and ETFs.

Stock picks lean into large and liquid companies with at least a $1 billion market cap.

The team also casts a wide net to make the most out of what Dan believes could be the biggest mega bubble in stock market history.

One month, a trade idea could be in semiconductors; the next, it could be a basket of stocks in a foreign country.

What Comes with the Service?

As mentioned, the service provides much more than a newsletter and a monthly stock pick.

Read on to find out everything on offer.

Annual Subscription to The Ferris Report

Each issue presents members with one carefully vetted recommendation: a stock or an ETF.

There’s no deliberate rotation between the two.

I prefer this approach over the team deliberately sidelining an investment idea because they need to drop a stock to meet an arbitrary quota.

The recommendation also comes with supporting research, market commentary, and more.

Once the team makes a rec, it’s logged into the model portfolio, which members are free to check out whenever they want.

And the model portfolio could eventually house up to 25 recommendations.

The general tilt of the trade ideas puts the safety rating of the investments into the moderate range. This could change over time, however.

Special Alerts and Updates

The team sends out alerts to keep members in the loop about open positions and market events that could affect them.

They’re sent via email, so they’re a breeze to follow.

You can simply skim your inbox here and there, and see if anything needs your attention.

Archives of Special Reports

Members also receive ongoing access to Dan’s special report archives throughout their subscription.

This means that every current and future report is available throughout the entire year.

If you’re looking for deep dives into investment opportunities, the archives are a serious bonus.

The Stansberry Digest

Around 6pm each market day, members receive a complimentary newsletter, Stansberry Digest.

Dan Ferris is a contributor, but other analysts hop into the fold.

So it’s a good place to hear from varied perspectives.

These frequent insights could also hold you over until the monthly newsletter drops.

Something to keep in mind is that the daily newsletter does not send out recommendations.

Access these features and more HERE

New Member Bonuses

Dan sweetened the deal with five special reports that deliver additional recommendations and market warnings.

Let’s take a look.

Avoid at All Costs: These Stocks Will Never Trade This High Again in Your Lifetime

Typically, bonus reports offer additional trade ideas or trading education.

This one is a little different, though.

Dan Ferris is predicting that 11 stocks might not make it out of the big bubble.

They go as far as calling them “dangerous companies.”

Also, the report shares some insights into sectors and investment classes that could fall by the wayside, as well.

It’s a must-read for members looking for the opportunity to protect portfolios.

The Best of the Best: The ONLY Stocks That Can Safely 8X Your Money During America’s “Dead-Zone”

This report is essentially the polar opposite of Dan’s 11 companies to stay away from.

He and the team identify what they believe are the only stocks that could “safely” provide 8X potential — even in a devastating bear market.

According to them, these stocks have persevered through the recent market turmoil and have been up.

Despite their growth, they say there’s still much more upside potential.

Trade Your Dollars for Potential 1,000% Gains Thanks to Gold and Silver

Given current market conditions, it’s no surprise that the team is recommending precious metals as a potential hedge against inflation.

This goes beyond buying just bullion, though. The report reveals another way to help profit from precious metals.

Unlike the recommendations’ moderate risk profile, this is a more speculative play.

They say that even a small position could have tremendous upside if their thesis plays out as they expect it could.

The Recession Haven That Could 7X Your Money in 10 Years

Dan Ferris has dialed in on a sector that he is especially bullish on to make it through America’s “Dead-Zone.”

He claims that this could be one of the most financially stable havens to invest in on the stock market.

The draw is that while other companies might flounder during the inflationary cycle, the government could grow heavily dependent on this sector.

As the name of the report suggests, the team anticipates that these stocks could see strong growth throughout the decade.

The World’s Two Most Valuable Assets in a Time of Crisis

Dan and the team are tight-lipped about these opportunities, but they anticipate that they could be the most important assets to hold during a downturn.

The first asset has been up 1,700% over the long term and has not had a down year for decades.

The second has provided the opportunity for about 12% to 14% income for around 30 years.

It’s no wonder these assets made Dan’s shortlist, given how many downturns they’ve survived.

30-Day 100% Money-Back Guarantee

New memberships to The Ferris Report come with a 30-day money-back guarantee.

So you have about a month to take the service for a spin. If Dan Ferris’ insights don’t live up to your expectations, you can opt for a full money-back refund on the subscription cost.

Even better, you still get to keep all the special reports, recommendations, and other bonuses.

It’s a solid guarantee that shows the Stansberry Research team stands by its services.

Join under Dan’s guarantee TODAY

How Much Does The Ferris Report Cost?

The Ferris Report usually costs $199 for an annual subscription. However, the team is providing new members with a 75% discount.

This means you can sign up today for just $49.

Given all the bonuses, it’s an incredible deal.

There’s also no trade-off for opting for the discount. You’ll receive the monthly newsletter, bonus reports, and a 30-day refund period.

It’s important to note, however, that this is an introductory deal. The newsletter renews at its original rate of $199 per year.

While I’d prefer the deal to carry over, $49 for the first year is a great entry price.

Final Verdict

Only time will tell if Dan Ferris’ predictions come to fruition. There are no guarantees events will unfold as he anticipates they could.

That said, he does build a strong case.

Regarding his thesis, something I appreciate is that he taps into historical analysis to draw parallels between previous events and now.

He’s a big believer in studying historical market patterns, which is precisely how Dan predicted past black swan events.

Also, if the bubble does burst, he and the team have assembled a well-rounded blueprint for a chance to make the most of this opportunity.

The newsletter has a lot going for it, as well.

The Ferris Report’s recommendations follow a moderate risk level, focus on liquid companies, and tackle a broad range of industries. So this service could help set a strong foundation for a starter portfolio.

Plus, some of the special reports tap into opportunities outside the stock market.

The 75% discount on the first year and 30-day money-back guarantee provide even more value.

Thirty days likely won’t be enough time to see a position to its conclusion. However, it does offer a fair window to gauge the quality of insights.

All in all, the package is solid. And if you’re looking for careful and competent analysis, I recommend giving The Ferris Report a close consideration.

Tags:

Tags: