George Gilder is back with an urgent new message regarding an emerging opportunity in tech stocks. In my Gilder’s Technology Report review, I’ll break down his latest presentation and accompanying bundle deal so you can decide if it’s worth your time.

What is Gilder’s Technology Report?

Gilder’s Technology Report is a research service from world-renowned investor and tech expert George Gilder.

It specifically targets the tech sector, one of the fastest-growing fields in the market.

Each issue contains detailed research, analysis, and up-and-coming recommendations based on emerging technology trends.

Gilder’s Technology Report primarily focuses on tech but also looks at other high-growth sectors like fin-tech, blockchain technology, healthcare, insurance, and real estate.

As a member of the service, you’ll get a new issue of the newsletter every month, featuring a new stock pick, expert research, in-depth analysis, and more.

With a veteran guru leading the way, Gilder’s Technology Report is also one of the most respected research services around.

I’ll break down this service in detail later in the review, but, for now, let’s take a close look at the man himself, George Gilder.

>> Save 70% when you join now! <<

How Does It Work?

Gilder’s Technology Report follows a simple but structured approach to uncovering high-potential tech investments.

Every month, subscribers receive a detailed report highlighting a specific stock, complete with in-depth analysis, market trends, and the reasoning behind the pick.

The goal is to give readers access to emerging opportunities before they hit the mainstream.

Beyond the monthly reports, members get timely updates and alerts when market conditions change.

If a stock needs immediate attention—whether it’s time to buy, hold, or exit—subscribers are notified promptly.

This way, investors don’t have to second-guess their decisions or constantly monitor the markets.

Gilder’s team also curates model portfolios, allowing members to track ongoing recommendations.

These portfolios are updated based on new developments, ensuring that the investment strategy stays relevant.

Whether you’re new to tech investing or already familiar with the space, the research aims to simplify the process and highlight stocks with strong growth potential.

Is Gilder’s Technology Report Legit?

George Gilder has built a reputation as one of the sharpest minds in tech investing.

With decades of experience and a track record of spotting game-changing innovations early, he’s been a trusted source for investors looking to stay ahead of market trends.

His insights have earned praise from industry leaders, including Bill Gates and former Google CEO Eric Schmidt.

Beyond his background, the report itself is backed by solid research.

Gilder and his team don’t just throw out random stock picks—they dig into the science, patents, and market positioning of companies before making a recommendation.

The goal is to identify opportunities that have real potential, not just hype.

Another good sign? The report offers a 30-day money-back guarantee, giving new subscribers a chance to explore the research without a long-term commitment.

While no service can guarantee profits, Gilder’s Technology Report provides well-researched insights from a seasoned expert, making it a worthwhile option for those interested in the tech sector.

>> Join now to get Gilder’s latest stock picks <<

Who is George Gilder?

George Gilder is a long-time stock investor and expert at spotting tech trends.

Gilder also holds the distinction of introducing one of the first silicon microchips to President Ronald Reagan back in 1986, when the first home computers hit the market.

He has also been featured by a slew of reputable publications, including The Wall Street Journal, The American Spectator, Forbes, Wired, Fox News, and many more.

Basically, he’s one of the best in the industry at predicting major trend shifts and other catalysts well before they occur.

You may recognize George from his previous publication, The George Gilder Report, which is no longer active.

Today, The Gilder Technology Report is George’s main focus, although it retains many of the elements which made The George Gilder Report such a well-regarded publication.

>> Get the details on his latest prediction HERE <<

Is George Gilder Legit?

George Gilder is the real deal, undoubtedly. He’s worked with finance heavyweights like Eric Schmidt and Bill Gates. Even more impressively, two U.S. presidents have sought his counsel.

Gilder made his bones in the market during the early days of the tech boom, so he’s been through some of the wildest events in stock market history, including the DotCom Boom, ’09 Financial Crisis, and many others.

In addition, Gilder is also well regarded for his research observations and predictions. He’s written more than 20 published works, including his bestseller Life After Google, which was even named as Financial Times’ book of the month.

A degree of skepticism always comes in handy when evaluating these types of services, but George Gilder passed all my tests. This guy is the real deal, so you don’t have to worry about credibility with Gilder’s Technology Report.

The $11.5 Trillion “Miracle Sheet”

George Gilder is known for finding huge technological breakthroughs before most people even know about them. He currently has his eyes set on a relatively unknown material he believes has a lot of promise.

This “miracle sheet” has so many applications across so many industries that it could very well change the world. Think bigger than the impact of Google, Apple, or even Amazon.

One company has discovered a new way to process this material for use, making it potentially the most valuable business on the planet. Its disruptive power could equate to upwards of $11.5 trillion across all those combined markets.

Just what is this incredible new material, and how can it bring about a new generation of millionaires?

>> Join now for more details on the Miracle Sheet <<

Graphene’s Trillion-Dollar Takeover

Our mystery metal is called graphene, made from the very same graphite we use in pencils. Graphite has to undergo a specific process that takes hours before we’re given the much more useful material.

Because of this slow process, estimates for graphene come in at $450,000 per pound. Not cheap stuff.

As I mentioned earlier, the uses for graphene look nearly limitless. In more obvious scenarios, it’s strong enough to serve as bulletproof technology at a fraction of the weight and thickness of Kevlar.

The applications get a bit more shocking from there. In the medical field, graphene has the potential to rebuild damaged tissue. One particular lab test showed a rat with a severed spine make a full recovery in just weeks thanks to a graphene injection.

Those same particles have the ability to target cancer cells at a molecular level. A metal processed from graphite could cleanse patients of this horrible disease without all the adverse side effects from the treatments we have today.

Just like with cancer cells, graphene also has the capability to draw out harmful chemicals in water. Imagine oil spills cleaned up in record time or previously polluted waterways made crystal clear again.

The list goes on. All this is great news, but why is graphene garnering attention now if it’s so difficult to produce?

Breakout In Progress

George Gilder caught wind of a company’s secret production plant up in Ontario that’s just about ready to start mass-producing graphene. Here’s what blows my mind – it’s figured out a way to make the miracle material out of garbage.

You read that right. Graphene out of food waste, old parts, and most of the other items we just discard.

That’s because this company isn’t some ragtag group. It staffs one of the top chemists in the world and a team with a combined 132 patents to figure out a way to make graphene more readily available.

The result is a process that speeds up graphene production by 350,000%. What once took hours now takes seconds.

Do the math, and we’re on the cusp of finally being able to see graphene have a massive breakout. This news is great for all the markets graphene touches, but it’s even better for us.

We’re standing at the same place with graphene where industry giants like Apple, Netflix, and Amazon once stood. It may feel like forever ago, but these companies were once nothing more than a patent and a dream.

Don’t worry if you missed those other guys; George Gilder is optimistic that graphene will put them all to shame. All you have to do is make sure you get in on the action now.

>> Join now to get the jump on the graphene boom! <<

How to Get in On the Action

Graphene’s not going to wait for you to come around. Electric vehicle companies are already drooling over the stuff as a more viable battery material. The head of production at that secret Ontario facility claims Ford is already getting its hands on as much graphene as it can for its EV endeavors.

We’re looking at such a great opportunity here because no other organization has a process that comes close to the Ontario plant George Gilder found. It’s literally writing the story of graphene as we speak.

There’s no telling how quickly the miracle metal could flood the market or how quickly this company’s stock could climb as a result. Positioning yourself correctly now could make all the difference if graphene makes an indelible mark in even one of the industries I talked about earlier.

Most people won’t have any idea this company even exists until it’s way too late. George has the inside scoop, but he’s only sharing his research with members of his Gilder’s Technology Report.

You can get instant access to the graphene manufacturer’s name and all the details on its breakout movement if you sign up now. Let’s take a look at everything you’ll receive for joining.

>> Get started now for INSTANT ACCESS <<

Gilder’s Technology Report Review: What’s Included?

If you sign up under the current limited-time deal, you’ll get a subscription to the Gilder’s Technology Report and several bonus resources.

One-Year Subscription to Gilder’s Technology Report

A Gilder’s Technology Report membership comes with a year’s worth of the guru’s flagship newsletter.

Graphene is the big name on campus right now, but it likely won’t be long before it’s too late to invest. That’s why George sends out monthly issues of the Gilder Technology Report for you to peruse.

Each new issue comes with a complete write-up of where Gilder is currently focusing his attention, straight from his own hand. He explains current trends and any influence the market has on his recommended portfolios.

You’ll also get information on exciting new sectors and which tech stocks are starting to make waves. Keep in mind these are quiet opportunities set to explode that most people have no clue about.

Model Portfolio

I alluded to it already, but Gilder’s Technology Report includes multiple portfolios you can sink your teeth into the moment you sign up. They’re all made available to you with tech stocks you can invest in as a set or pick and choose from as you see fit.

One portfolio in particular has delivered an average 100% gain over the last few months that you can add to yours.

Gilder does a great job of updating these as the market shifts so you’re not stuck holding onto a lost cause. New recommendations revealed in Gilder’s Technology Report are quickly added to the list.

>> Access Gilder’s latest stock picks when you JOIN NOW <<

Updates and Alerts

Gilder isn’t going at this alone. He’s got a sharp team of individuals constantly researching future picks that can lead to huge gains. They’re also monitoring current portfolios to ensure positions are growing as anticipated.

Big moves sometimes need attention outside of the once-monthly newsletter, so be on the lookout for timely updates and alerts delivered to your inbox. Expect both buy and sell notifications, including special situations George says you should jump on immediately.

Graphene Breakthrough Bonus Reports

You’ll also get several bonus reports as part of the Gilder’s graphene bundle deal.

Your Way In: Graphene’s Trillion-Dollar Takeover

This exclusive report is your ticket to getting in at the ground floor of graphene’s takeover. It’s the only place I’ve seen where research on this potentially massive breakthrough tech even exists.

Inside, George Gilder shares all the ins and outs of the Ontario-based company set to release the miracle metal into the world. His research identifies the biggest window for gains as well.

You’ll learn when and where to buy and the exact time it will be best to sell. Without this document, there’s simply no way for us to glean this information.

The Trillion-Dollar Ripple Watchlist

Graphene is perfectly positioned to create a ripple effect throughout the tech world and beyond with its many capabilities. Investing in the metal itself looks like a no-brainer, but a number of other companies are set to win big as well.

The Trillion-Dollar Ripple Watchlist from George Gilder himself outlines a handful of these lateral opportunities. Gilder reveals the names of these companies and why each one could skyrocket from graphene’s influence.

Just like with graphene, these are opportunities you won’t hear about anywhere else. In the report, Gilder teases past predictions like these have delivered potential gains in the four-digit range.

>> Join now to access Gilder’s Trillion-Dollar Wathclist! <<

Gilder’s Technology Report Quick Start Guide:

I’ll be honest – bundles like this with tons of content can be overwhelming for me to process. It’s hard to decipher where to look first and which opportunities are best to invest in.

That’s where the Gilder’s Technology Report Quick Start Guide comes in. It’s a quick and easy read that shows you how to hit the ground running with this service. You can get plugged in and on the path to making money in mere minutes.

The report also explains how to maximize your value from all the materials you’ll receive here. Time is money, and the quick start guide is a huge help on both fronts.

VIP Access

As part of this special deal, you’re handed VIP access to Gilder’s Technology Report team in the form of a direct number. VIP members can pose questions about the platform and can expect a prompt response.

VIP perks extend to private teleconferences where Gilder and the team walk members through every new opportunity they come across. You get to hear in real-time about exclusive opportunities as they become available.

If that wasn’t enough, you’ll receive at least one email per week with potentially earth-shattering special situations to move on immediately. Simply put, this is a level of service you rarely find elsewhere.

>> Join now to start enjoying these perks <<

100% Money-Back Guarantee

George Gilder offers a 30-day money-back guarantee for new subscribers, so you can test drive the service with confidence.

You have an entire month to explore the service and the included research reports. If you’re not satisfied, simply call customer service to make your request, and you’ll get a full cash refund within a few days.

Best of all, you get to keep all the bonus materials and content you received as a thank-you for trying the service out.

A thirty-day guarantee is pretty standard in the research newsletter industry these days, but it still provides tremendous reassurance for prospective subscribers.

George’s money-back guarantee doesn’t exactly break the mold, but it should give you the confidence you need to give his service a shot.

>> Take advantage of Gilder’s 100% moneyback guarantee <<

Pros and Cons

Here are the pros and cons of Gilder’s breakout new service.

Pros

- One year of Gilder’s Technology Report

- Two unique bonus reports

- Frequent alerts and updates

- Multiple model portfolios

- Quick start guide to navigate the service

- Exclusive VIP access

- 30-day money-back guarantee

- Heavily discounted price

Cons

- No community chat or forum

- Focuses primarily on upcoming tech stocks

Gilder’s Technology Report Reviews by Real Members

I don’t have any independently verified Gilder’s Technology Report reviews to share with you, but George Gilder’s track record is very reassuring.

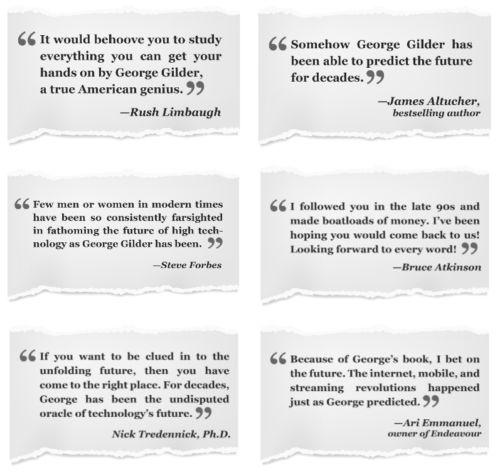

He’s been the driving force behind several notable stock market publications, and his work has drawn high praise from many of his colleagues and followers.

You can see some examples of what people are saying about George and his work with the Technology Report in the graphic above.

Full disclosure, I pulled these reviews directly from George’s “Miracle Sheet” presentation. Although they’re entirely authentic, they were specifically chosen to be in the presentation, so take them with a grain of salt.

Regardless, the feedback should give you some insights into George Gilder’s trustworthiness and credibility. The results mentioned in the reviews may not be typical, but they still demonstrate what’s possible with George’s research .

>> Get started now to join these satisfied customers! <<

How Much Does This Deal Cost?

Gilder’s Technology Report typically retails for $249 per year, but you can take advantage of a limited-time discount under his latest bundle deal.

You can get instant access to everything covered in my review for just $77, equaling a discount of nearly 70% off the stick price.

There’s also a two-year subscription available for $139, which breaks down to about $69.

Although that’s not a huge cost savings, it does allow you to lock in the discount for an additional year.

According to the fine print, your subscription will be renewed at “the prevailing renewal rate,” so the price could go up at the end of your first year.

However, the two-year deal allows you to lock in the discounted rate for an additional year, so it’s probably a better option, especially if you want the most bang for your buck.

>> Get started now for as little as $77 <<

Is Gilder’s Technology Report Worth It?

After a thorough Gilder’s Technology Report review, I can confidently say this service is the real deal.

Gilder’s bull case for the graphene industry is extremely compelling. This technology has a lot of potential, and now could be an excellent time to start building positions.

Aside from the special resources, the core service itself is very high quality as well. Gilder’s monthly reports are very insightful, and his analysis alone has led me to observe opportunities I might’ve otherwise missed.

I first ran into George’s work when he was with The Gilder Report, and I knew he was a talented guru as soon as I read his analysis. You’re in good hands with him leading the service.

One thing I really liked about this research bundle is it sets you up with all the ingredients required for success. The quick-start guide, the watchlist, and the feature report give you everything you need to take full advantage of the graphene opportunity, and you also get regular updates for your entire subscription term.

I don’t see anything to dislike about Gilder’s Technology Report. It’s a great option for stock market research, and, with many competitors recently raising their prices, it could be the best deal available in the current market.

Tags:

Tags: