If you’re like me, you’re constantly stressed about your funds for retirement with so much uncertainty on the horizon.

Tim Plaehn believes there’s sanity in what he calls “AI royalty checks” that can offer consistent income.

These royalty checks sound great, but are Tim’s claims really as good as he says?

In this Dividend Hunter review, I investigate the ins and outs of his service so you don’t have to.

>> Get Tim’s “AI Royalties” At a Special Deal Today! <<

What Is Dividend Hunter?

I doubt you’ll be surprised to discover that the Dividend Hunter is a service that looks for the best dividend plays on the market right now.

Overview of the Service

There are plenty of dividend-paying stocks out there, but they don’t all live up to expectations.

The crew behind Dividend Hunter susses out stocks in the best shape to increase in income and capital appreciation.

They’re less volatile and designed to pay monthly or quarterly dividends regardless of market conditions.

Recommendations come via a monthly newsletter, portfolios, and weekly alerts alongside a series of goodies to invest in style.

With a clear emphasis on real, bankable income, this service appeals to anyone seeking reliable monthly cash flow for the present or the future.

How the Strategy Works

Plaehn’s Dividend Hunter investment strategy forgoes rough and tumble day trading or timing the market for a much more regimented plan.

Since the guru focuses on dividends, many of the trades he recommends are long-term buy-and-hold stocks you can collect on indefinitely.

While not a perfect science, it’s, in my opinion, a much more laid-back approach to growing wealth.

He shares exactly which dividend stocks to own, and how long to carry them for. In my experience, you’ll have up to 30 in your portfolio at any given time.

That said, you can’t expect massive gains overnight with this approach. Dividend Hunter’s strategy is set to net you small daily gains that can add up to around $3,000 per month.

Are Dividends Actually Worth It?

Dividend investing comes with a whole host of advantages that speak to me, including the opportunity for passive income, tax benefits, and the potential to reduce portfolio risk.

With the right stocks, it’s even possible to build a steady income stream to live off of. I won’t lie, this can take a significant investment to pull off.

While there are many pros, there are also some cons to consider.

Most dividends are paid out quarterly or semi-annually, which could leave some long stretches between payments.

Also, companies can cut payouts at a moment’s notice.

Sometimes a business can fall on hard times. In other cases, a yield might be so high that it’s not sustainable in the first place.

This is why many income-focused strategies, including Tim’s, pay very close attention to a company’s history and the sustainability of business practices.

Who Dividend Hunter Is Designed For

The Dividend Hunter has a very specialized investing approach that’s an excellent fit for anyone interested in income investing.

That said, I believe there are some people who could get more out of the service than others.

High-Yield Dividend Hunters

Planning an income portfolio requires a very different approach than a traditional growth-focused portfolio.

If you’re serious about building income, you might want to consider a service specifically designed for that goal.

And the service fits the bill perfectly with high-yield dividend stocks for a purpose-built strategy.

Retirement Planners

This deal includes several resources that can help you plan out your retirement with greater certainty.

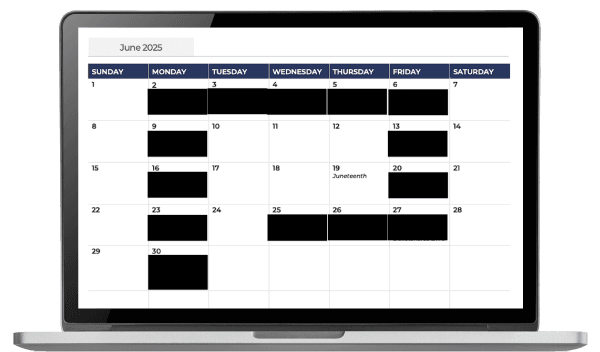

You can see all your upcoming dividends with the Monthly Paycheck Calendar, so you’ll always know what to expect.

Business Fundamentals

Tim doesn’t chase the latest “here today, gone tomorrow” fad stocks.

While most gurus are fixated on price action and short-term gains, he prioritizes stocks with strong business fundamentals and dividend growth to ensure each pick has the best possible chance of long-term success.

Monthly Income Chasers

Dividends are great, but most companies only make quarterly payouts.

That might work for some, but if you want consistent retirement income, you might be better off with more regular payments.

The service prioritizes stocks with monthly payouts, so you have as much income flexibility as possible during your golden years.

Who Is Tim Plaehn?

Tim Plaehn is an excellent stock picker who pens some solid research.

He brings a unique blend of discipline and real-world pragmatism with a no-hype approach, favoring dividend workhorses over flashy growth stocks.

Investors Alley made him lead research analyst for a reason. His unique blend of mathematical analysis and income investing expertise puts him a cut above many of his peers.

He studied mathematics when he was in the US Air Force, and his education proved fruitful during his time as a financial advisor.

After serving in the military, Tim launched his finance career, which includes a stint as a financial advisor.

Given his strong analytical background, I feel the need to emphasize his deep understanding of market trends and his ability to pick stocks effectively in my Tim Plaehn review. His expertise in combining mathematical analysis with income investing really sets him apart in the financial world.

Is Tim Plaehn Legit?

Tim Plaehn is legit.

Instead of following the hype and chasing hot stocks, he targets reliable dividend stocks that have the potential to generate predictable income.

If you’ve checked out the Investors Alley website, you’ve probably seen the wall of reviews left by subscribers to his research services.

I snagged a small screengrab, but this is a fraction of the positive press Plaehn has received:

I did some digging for reviews of Tim Plaehn on Stock Gumshoe, but there were only reviews of The Dividend Hunter.

That said, what I found appears to be largely positive, which could put some folks’ minds at ease. I’ll cover this in more detail later.

If you’re looking for a grounded expert who values consistency over hype, Tim is one of the most reliable names in income investing.

Tim Plaehn Track Record

Let’s take a look at some of Tim’s previous calls.

In 2015, he recommended selling Oaktree Capital Group when it had just hit one of its highest price points ever at $54.14.

Over the next 11 months, it sold off for nearly 25% and never recovered to the $50 mark. It was eventually bought out and taken private at $49 per share.

In another example, he accurately called a top in shares of Ventas, Inc. twice in two years, and he was right in both cases.

Another of Tim’s more recent calls, CyrusOne Inc., saw an opportunity for solid gains in the first 10 months following his recommendation.

This is in addition to paying an excellent dividend yield.

This chart shows how CyrusOne shares performed following his alert:

Even though the service primarily focuses on dividend payouts, these dividend stocks have the potential to increase in value as well.

These are just a few examples of his accurate calls. You shouldn’t expect results like these with every trade, but they provide a useful example of this service’s ultimate potential.

Tim Plaehn Net Worth

Tim Plaehn has come a long way in the last 20 years, when he struggled to make ends meet.

He learned from the challenges of securing a nest egg that passive income provided a reliable means to support himself day by day.

Despite my best efforts, I wasn’t able to track down what Plaehn’s net worth might be. It seems he keeps that information close to his chest, and I can’t say I blame him for it.

He does spell out in his presentation that he’s not worth millions, but he is able to invest roughly $250,000 at a time to keep his monthly income palatable. That says something right there.

I’m sure the fact that he has more than 100,000 readers doesn’t hurt his overall wealth either.

What Is Investors Alley?

Investors Alley is a great publisher that has many solid services under its umbrella.

It’s based in the US, and it has a strong track record for customer satisfaction.

Investors Alley has several prominent gurus under its banner, with Tim fitting right into the mix.

And each of the firm’s services targets a different angle. The Dividend Hunter service is one of its leading options for dividend income strategies.

>> Discover Tim’s LATEST recommendation <<

What is “The AI Royalties” Pitch All About?

A Surprising Twist on the AI Boom

If you’ve been watching the rise of AI stocks with a mix of excitement and hesitation, you’re not alone.

Big names like Nvidia and Microsoft have already soared—but what if you missed the first wave?

That’s exactly what “The AI Royalties” pitch tackles. Instead of chasing high-flying tech giants, this presentation hints at a different way to profit by tapping into the companies that are being paid every time AI tools are used.

It’s not about building AI. It’s about getting paid like a landlord, every time someone uses it. That’s a different angle most people haven’t considered—and I’d argue that it just might be the smarter play.

The Problem With Chasing AI Giants

The hype around AI is real, but so is the volatility. Plus, stocks like Nvidia are trading at sky-high valuations.

Most of the big-name AI plays have already had their moment. And while it’s tempting to jump in, the reality is that we’re at this point probably too late to that party.

The average person can’t afford to gamble on tech names priced above $700 a share, which is why Tim’s strategy caught my eye.

It introduced the idea that there are “AI landlords”—smaller, lesser-known companies quietly collecting royalties every time AI is used.

Instead of betting on who wins the AI race, you’re collecting a cut no matter who comes out on top.

The Royalties Model That Could Change Everything

Here’s the part that really sold me: this isn’t theoretical.

According to Plaehn, there are companies already receiving payments through licensing deals, infrastructure contracts, or data access agreements tied directly to AI usage.

That means they earn income whether it’s OpenAI, Google, or Amazon pushing the envelope. These firms don’t rely on advertising or app downloads.

They’re quietly embedded into the digital backbone of AI—and they get paid repeatedly, month after month.

If you’ve ever wanted to be on the right side of a major tech shift without the crazy swings, this model makes a lot of sense.

How to Make AI Royalties Equal Profit

The beauty of it all is that any of us can now invest in companies that benefit from AI demand without the noise and risk of chasing viral tech stocks.

It’s a royalty model, and it’s been quietly rewarding insiders while most people are distracted by headlines. Now, the door’s open for regular traders to step in.

If you want to learn how to identify these “AI royalty” plays and ride the trend while avoiding the traps, the full strategy is revealed when you join the service.

You’re handed a straightforward way to take advantage of the AI revolution, without needing to be a tech expert.

And now, let’s dive into what’s actually included when you sign up. You might be surprised by just how comprehensive this service really is.

>> Tap into the High-Yield Daily Dividends TODAY <<

Dividend Hunter Review: What Comes with the Service?

There’s a ton here to take advantage of, so let’s break down each feature:

Annual Subscription to The Dividend Hunter Newsletter

This is Tim’s flagship newsletter and is the centerpiece of this deal.

Each month, you’ll get a new issue of The Dividend Hunter with updates on the latest market action, one trade idea, and much more.

The stock picks also come with extensive supporting research and the team’s buy case.

This includes the company’s background and why it could make for a strong addition to an income-investing portfolio.

All in all, the team’s writing is clear and to the point.

Something I also like about this newsletter is that Tim also occasionally sprinkles in general tips about income investing that could apply outside his recommendations.

It could be a great place for someone with little experience to start building up their knowledge base.

Weekly “Stock of the Week” Alerts

A month is a long time in the market, so the service doesn’t leave you hanging between issues.

Every Tuesday, Tim sends out a new alert showcasing the best buys in The Dividend Hunter portfolio, with supporting research explaining each call.

The weekly reports are a regular chance to add to my other positions if something particularly enticing catches my eye, and they’re really easy to understand.

Each alert includes the ticker, the rationale behind the pick, expected yield, ideal entry point, and risk notes. It’s an excellent way to stay in tune with Tim’s thinking without having to sift through endless news or data yourself.

Weekly Mailbag Video

Tim Plaehn takes your questions to heart. Every week, he’ll record a video called the Weekly Mailbag that answers the more pertinent questions he’s received from the last seven days. Only members get the chance to pose questions and watch Tim share his thoughts.

His responses could come from any number of topics. Plaehn may answer a question about your portfolio, the stock market, or opportunities in a specific sector.

The content varies significantly from week to week, so I make sure to tune in every chance I get.

Live U.S.-Based Customer Service

When you subscribe to The Dividend Hunter AI Royalties, you get access to a real, responsive customer support team based in the U.S.

This might sound minor, but if you’ve dealt with offshored support before, you know how frustrating it can be.

Here, you can actually speak to a human Monday through Friday, 9:30 a.m. to 4:30 p.m. Eastern Time.

Whether it’s questions about billing, access, or navigating the platform, help is just a phone call away.

The representatives are polite, knowledgeable, and empowered to resolve issues efficiently.

For a financial product with ongoing alerts and sensitive data, having dependable support is essential.

Dividend Hunter Model Portfolio Review

Portfolio Structure

Many of Tim’s picks end up in his “Start Out Portfolio” so you know which ones to buy first.

As soon as you’ve taken the time to read some of the educational material, this is the first stop I’d make to set yourself off on the right foot.

There are a handful of others mixed in here, too, so you’ll have plenty of opportunities to pursue right out of the gate.

They’re all updated regularly with entry prices, yield data, and performance history.

Portfolio Risk Level

The very nature of Tim’s platform means these portfolios offer relatively low-risk ways to build stable income.

There are obviously no guarantees here, but this is a safer route than a lot of services I’ve seen that go after more speculative plays that are just as likely to crumble as they are to grow.

I’d say this conservative approach is more my style, but I realize it’s not for everyone.

If you resonate with this risk level like I do, I think you’ll find Plaehn’s portfolios some of the best out there.

Ongoing Updates on Positions

Tim doesn’t leave you hanging once you’ve bought a stock.

Through weekly videos, email updates, and model portfolio adjustments, he continually shares updates on performance, risks, and any recommended buy/sell moves.

These updates are particularly valuable during market turbulence. If one of the stocks takes a hit, Tim explains why, what he’s watching, and whether it’s a hold, trim, or sell.

That level of clarity keeps you confident and removes the second-guessing that can derail many income strategies.

The Dividend Hunter AI Royalties Bonuses

You’ll also get the following bonus materials if you sign up right now:

Special Report 1: “The Ultimate Guide to Collecting AI Royalty Checks”

This flagship guide serves as your foundation, containing the full list of seven AI-connected income stocks that Tim has hand-selected for their yield potential and infrastructure relevance.

He explores each company in detail, covering financial metrics, dividend safety, payout frequency, and connection to America’s AI growth.

You’ll learn why these businesses are positioned to benefit as data centers demand more energy and how they generate recurring income through long-term contracts.

Tim also provides actionable buy guidance, expected annual income ranges, and a timeline for potential compounding gains.

This isn’t a surface-level summary. It’s a full-fledged income blueprint, and it makes the strategy feel tangible and real.

Special Report 2: The Monthly Dividend Paycheck Calendar

Tim Plaehn‘s Monthly Dividend Paycheck Calculator hashes out key dates for all the dividend stocks in the service’s model portfolio, including their dividend payment dates, ex-dividends, and more.

It also lists how much each dividend will pay out, so you can find out exactly how much you’re getting months in advance.

The calendar looks something like this:

As you can see, it lays out each important date in a straightforward format that’s easy to follow. You can quickly identify which stocks are paying when, how much they’re paying, and more.

Special Report 3: The “Start Out Portfolio” Blueprint

The “Start Out Portfolio” Blueprint is designed to strip away the noise and give you a simple, powerful starting point to invest: five carefully chosen income-generating positions, designed to work together from day one.

What I appreciated most about this blueprint is how it focuses on balance and immediate results.

You’re not just building a portfolio—you’re setting up a cash-flow machine with monthly payouts where each position plays a unique role.

The best part? There’s no guesswork. The report gives you the full allocation strategy and step-by-step instructions on how to put it all in place.

It’s perfect for someone starting from scratch, or anyone who wants a no-fuss way to kickstart reliable dividend income without trying to juggle a dozen tickers.

12-Month Money-Back Satisfaction Promise

Under the latest deal, new members signing up are covered by the team’s 365-day money-back guarantee.

This means you have the entire first year to review the service. If it doesn’t live up to your expectations, you can opt for a full refund of the subscription cost.

Most investment newsletters I’ve seen only offer one month for refunds, so this is definitely a step-up.

A big plus is that it provides ample time to see how a position performs.

One month is usually enough to gauge whether a stock picker provides great analysis, but it’s rarely a long enough window to actually see how a position performs.

So I’m giving The Dividend Hunter extra points here.

>> Sign up Under Tim’s Guarantee <<

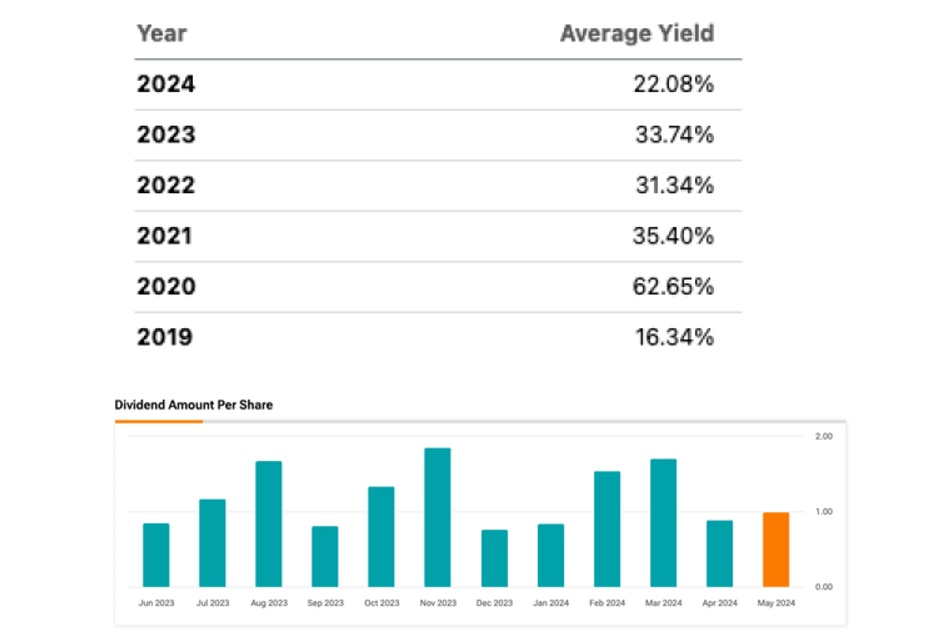

Dividend Hunter Performance Review

Tim Plaehn has built an income-focused portfolio that has weathered market ups and downs.

While the AI Royalties pitch is new, it’s rooted in the same principles that have kept his core Dividend Hunter service running strong for years.

Plaehn demonstrates just how his strategy works through some of his breakthrough plays over the last few years.

In late 2020, as the world still battled against the COVID-19 virus, Tim recommended Ralph Lauren and Tanger Outlet to his subscribers.

Not only did these stocks significantly grow during the drought, they kicked in dividends to add to the overall pot.

Historically, he’s been able to map out payouts down to the day so you know exactly what you’re receiving, and when.

Some of his biggest returns were 8.35% on AAL, 6.71% on TUP, and 7.99% on UNG all within the course of a few weeks.

In one month, with a $250,000 portfolio, the guru calculated that anyone following the system could have collected $2,970.73. That adds up to over $35,000 for the year.

With those returns, it’s possible to double your account in just six years. Even if it takes a little longer, those numbers are nothing to laugh at.

>> Tap into the High-Yield Daily Dividends TODAY <<

Pros and Cons of Dividend Hunter

The service has many pros, but there are some cons to consider:

| Category | Details |

|---|---|

| Key Strengths |

• Features innovative income-generating investment opportunities • Led by one of the world’s foremost dividend investors • Ironclad 365-day money-back guarantee • Monthly and weekly stock picks and updates • Jam-packed model portfolio • Comes with three bonus reports featuring additional stock picks • Positive reviews from members • Excellent value for the price |

| Potential Drawbacks |

• No community chats or forums • Focuses only on dividend/income plays |

The Dividend Hunter Reviews by Real Members

Tim Plaehn has an impressive track record and the credentials to back it up, but what do his readers think of him?

These Dividend Hunter reviews by real members will shed some light on what you can expect with the service.

As you can see from these testimonials, Tim Plaehn is legit. These satisfied customers clearly had a positive experience with the service.

However, you should know that I pulled these reviews from the latest presentation. They came directly from Tim, so take them with a grain of salt.

>> Sign up now to join these satisfied members <<

Dividend Hunter vs Other Income Services

I get that Dividend Hunter may not be for everyone. Here are some other income services I’ve checked out that you can look into instead:

Dividend Hunter vs Motley Fool Income

As far as I am concerned, Dividend Hunter and Motley Fool Income tick a lot of the same boxes. It’s the approach that sets them apart. Dividend Hunter seeks to maximize the money you bring in from dividends, whereas Motley Fool Income takes a more balanced stance between income and returns.

You can’t go wrong either way if income’s your goal; it’s all about the long-term focus you’re setting yourself up for.

Dividend Hunter vs Oxford Income Letter

The Oxford Income Letter catches my eye because it looks beyond just stocks for income opportunities. I’ve seen REITs, bonds, and even some alternative investment vehicles pop up that bring a nice amount of diversification.

Both services are surprisingly easy to use and focus more on the long-term, so don’t think you’ll make a lot of money quickly here.

Dividend Hunter vs Contrarian Income Report

Contrarian Income Report’s name is a bit of a giveaway for its scope, and it doesn’t disappoint. I often find more off-the-beaten-path income plays there that aren’t quite as safe but tend to yield higher rewards.

Setups can be a bit more complex, but if you’re willing to put in the time, the end result might be worth it.

>> Sound Like a Match? Sign Up TODAY! <<

How Much Does The Dividend Hunter AI Royalties Cost?

Under the latest deal, members can sign up for an annual subscription to The Dividend Hunter for just $49.

Given that the team values each individual report at $99, this is an excellent deal.

At that rate, your overall cost comes out to slightly more than $4 for every month of your The Dividend Hunter subscription. This is a solid discount and offers loads of value at a very affordable upfront price.

It’s also worth noting that the discount only applies to your first year of service. If you renew your subscription, you’ll pay $99 for the second year.

However, The Dividend Hunter team will give you a heads-up so you can back out before the bill comes through if you decide to.

Is Dividend Hunter Worth It? (Final Verdict)

After a thorough review, my answer is unequivocally “yes”.

If you’re looking for consistent, income-generating investments tied to the massive AI infrastructure buildout, The Dividend Hunter AI Royalties delivers exceptional value at just $49 for an entire year of service.

You’re not just getting a newsletter—you’re getting a full plan for monthly cash flow with minimal risk.

Tim Plaehn presents a distinctive approach to dividend investing that has the potential to establish a consistent passive income stream for your portfolio.

The added advantage of a 365-day money-back guarantee makes it an opportunity that’s difficult to overlook.

Moreover, the newsletter ensures you stay up-to-date with the latest research throughout the entire year.

The package also includes a wealth of supplementary valuables for new members, including several bonus reports. These resources greatly amplify this deal’s value.

Click here to lock in your membership before these opportunities slip away and start working toward your first AI Royalty Check.

>> Sign up today for JUST $79! <<

Dividend Hunter Frequently Asked Questions (FAQ)

Is Dividend Hunter legitimate?

Yes, Dividend Hunter is a legitimate income-focused investment newsletter published by Investor’s Alley and led by analyst Tim Plaehn. It’s been around for years and has a large subscriber base, focusing on generating reliable monthly income by investing in high-yield securities. While no income strategy is risk-free, Dividend Hunter itself is legitimate and widely used.

What does Dividend Hunter actually invest in?

Dividend Hunter focuses heavily on high-yield stocks that tend to be more mainstream and “safe”. The goal is to build a portfolio with strong cash flow, often emphasizing dividends over price appreciation. These assets typically offer yields far higher than traditional stocks.

What is the typical yield of the Dividend Hunter portfolio?

The Dividend Hunter model portfolio often targets yields in the 8% to 12% range, depending on market conditions. However, high yields generally come with higher risk, and yields can fluctuate. The service provides ongoing guidance on managing income positions, navigating cuts, and reinvesting dividends.

Who is Dividend Hunter best suited for?

Dividend Hunter is ideal for investors who prioritize income over growth. This includes retirees, near-retirees, and anyone looking to build a monthly or quarterly cash-flow portfolio. It’s less suited for folks seeking aggressive capital gains. If your goal is predictable income, it can be a good fit.

How much does Dividend Hunter cost?

Dividend Hunter is priced much lower than most income newsletters. Depending on promotions, it typically costs under $100 per year and sometimes even less. The subscription includes portfolio updates, buy/sell alerts, and guidance on managing high-yield positions.

What are the risks of using Dividend Hunter?

The biggest risk is tied to the strategy itself: high-yield investments can be volatile, experience dividend cuts, or face pressure during rate hikes or downturns. While the strategy focuses on income, price fluctuations are common. Still, Dividend Hunter provides guidance to help manage these risks.

Has Dividend Hunter performed well over time?

Past performance varies depending on the market cycle. Dividend Hunter has maintained substantial yield levels, and many picks offer consistent income. However, like all high-yield portfolios, some picks experience dividend cuts or price declines. Overall, performance is tied to income stability rather than aggressive returns.

Is Dividend Hunter good for beginners?

Yes, beginners can use Dividend Hunter because the service provides clear instructions, model portfolios, and simple action steps. However, it’s important for newer investors to understand the basics of high-yield investing, including risks, volatility, and how dividends work. The guidance is beginner-friendly, but the strategy itself requires awareness of potential downsides.

Does Dividend Hunter guarantee monthly income?

Dividend Hunter cannot guarantee income, but the strategy is designed to produce frequent dividend payments across a diversified basket of high-yield assets. Monthly income is possible depending on your allocation, but payments depend on the underlying holdings and market conditions.

Is Dividend Hunter worth it?

Dividend Hunter can be worth it if your primary goal is generating high-yield income and you’re comfortable with the risks associated with high-dividend assets. The low subscription cost makes it accessible, and many investors appreciate the guidance and cash-flow focus. However, it’s not for investors seeking growth or low-volatility portfolios.

![Is Tim Plaehn Legit? [Tim's recommendations vs. Big name blue chips]](https://www.thestockdork.com/wp-content/uploads/2023/06/dh6.png)

Tags:

Tags: