Artificial intelligence and biotech have a lot of investment potential right now. Dylan Jovine believes combining the two could lead to unfathomable gains. Join me in this Behind the Markets End of Disease review as we uncover the truth behind his claims.

Who is Dylan Jovine?

Dylan Jovine grew up on welfare and food stamps in Queens, New York. His desire to leave that life behind created a passion for investing and making money.

The guru started his Wall Street career in 1991, where he managed accounts. He found his true calling in researching stocks and became very good at picking them right before they were taken over.

Over the next 15 years, Jovine launched a brokerage and an investment research firm. Both had great success before being sold for profit.

Jovine founded Behind the Markets in 2018. It’s the culmination of his 30+ years of investment success.

>> Get Dylan’s latest research when you join now! <<

What is Behind the Markets?

Behind the Markets is Dylan Jovine’s newest research service. He uses it as a means to bring regular Joe’s quality investment research that typically only the top dogs have.

In the last five years, the platform has become home to a variety of products, reports, and portfolios catered to specific investing goals.

Jovine further shares his insights through a subscription email newsletter and courses for folks investing on their own.

Best of all, he doesn’t get stuck in any particular market sector. Dylan’s current favorite may be biotech, but he goes where the money is.

Dylan Jovine’s “End of Disease” Presentation

We’ve had some major breakthroughs in medicine over the last 100 years, but we’re nowhere near where we need to be. It currently takes some 12 years and $2.6 billion to approve just a single drug for use.

Dylan Jovine believes that’s all about to change, and he’s got the proof to back up his claim. New treatments for diseases have been created in record time. We’re talking days or months, not years.

This breakthrough could also do wonders for folks looking to generate some wealth. Join me as we investigate what’s leading the charge.

>> Ready to seize the AI in healthcare boom? Start NOW! <<

What is the AI Medicine Breakthrough

You’ve probably already figured out that AI is the brains behind these breakthrough treatments. It could help us bridge the gap between diseases and cures by an immense margin.

Today, scientists test new drugs one beaker at a time. It can take months to create even a single data point on the journey to approval.

AI functions like a billion scientists all working together at the same time who never take breaks. Moreover, it already knows every protein and chemical that could play a role in a cure.

Thanks to AI, we’re seeing potential groundbreaking treatments in as little as 30 days. According to Jovine, 420 AI-designed treatments have already been approved by the FDA. That’s incredible when you think about how new AI is!

Companies helping to lead this charge are in line to see huge profits from government contracts to get more breakthrough drugs off the ground. I’m drooling at the potential profits that could mean for us.

However, not every biotech firm is going to be a winner. Dylan looks for three factors before making any investment move.

>> Sign up now to access Dylan’s top AI stock picks <<

“3 Key Ingredients for Biotech Profits”

Jovine says investing in biotech isn’t like other industries. He’s been doing it for a while and has developed a secret method for determining the best stocks.

That secret boils down to three key ingredients he feels are necessary for having success with biotech investments. He moves on if a company doesn’t have every single one.

Without further ado, let’s check them out now.

#1 Revolutionary Science

Marginal improvements in biotech aren’t going to cut it anymore. After all, the entire drug discovery process is on the verge of changing forever.

Companies need to present themselves with revolutionary scientific breakthroughs that will set current patterns and processes entirely on edge.

Now that biotech can invent new drugs in mere weeks, these firms need to show what sets them apart from the rest.

#2 Strong Patent Portfolio

Some biotech firms have lofty dreams but can’t actually execute on them. Having a strong patent portfolio shows they actually have the means to back up their new science.

It means that the company’s idea is secure – no one’s going to come in and steal it. Without ownership of a design or concept, it’s likely a matter of time before they have to shut their doors.

Patents also serve as a “toll bridge” for intellectual property. The firm keeps benefitting every time someone else wants to use that particular design.

#3 Strategic Partnerships

Most biotech firms are started and run by scientists and academics with little knowledge of how to make their little companies shine.

They need a strategic partner to come along beside them and help them go global. This is someone with the money and the means to get the word out there quickly in an industry where time is now a major factor.

>> Discover Dylan’s top stock picks – Sign up now & save <<

The AI Company Revolutionizing Medicine

Jovine’s found a small AI company that ticks each of his boxes in a big way. It already has a patent for the most powerful AI supercomputers and a partnership with Google and Amazon.

This tech could step in and radically change how we treat diseases, and those changes are coming fast. That said, it’s still relatively unknown apart from scientists and inventors.

There’s so much room for this company to grow; it’s not even funny. If even a small part of the $1.5 trillion market heads its way, the growth could be off the charts.

Dylan calls it his number-one investment opportunity in the biotech space, and it’s set to take off as we speak. He’s not even recommending any of the big pharma companies over this one.

The only way to get the full scoop on Jovine’s small-cap company is through a Behind the Markets membership. Let’s check out everything a subscription includes.

What’s Included?

Here’s what you get when you join:

One Year of Behind the Markets

Signing up nets you a full year of Jovine’s Behind the Markets service.

That includes immediate access to his model portfolio and all his currently recommended stocks. I appreciate that, at a glance, you can see what to buy, what price to buy it at, and when’s the best time to sell.

Dylan typically recommends at least one new stock per month to keep his portfolio fresh. Biotech stocks will surely come up, but Jovine focuses on all areas of the market for some nice diversity.

Any time news breaks about one of the stocks on Dylan’s list, he’ll send out an email by the end of the day at the latest. You’ll hear straight from the expert how to adjust your investment accordingly.

All this info and more is stored on the Behind the Markets members-only website. It’s available 24/7, and Jovine updates his thoughts and positions frequently.

>> Get instant access when you JOIN NOW! <<

End of Disease Bonus Reports

You’ll also get these reports:

The End of Disease: The AI Company Revolutionizing Medicine

This special report has everything you need to know about the incredible company Jovine believes is at the forefront of the AI revolution.

You’ll get the company’s name, ticker, and all of Dylan’s research behind why he feels it’s a smash hit. He goes over how it meets each of his keys and why the world’s leading scientist is embracing AI tech.

Similar biotech firms dealing with just one disease have seen nearly 37,000% growth in very short windows of time. It’s hard to imagine what this one could do.

Bullet-Proof: How to Create the Ideal Small-cap Biotech Stock Portfolio

Big names like Facebook, Amazon, and Netflix still dominate the news and many a portfolio. Meanwhile, biotech stocks rarely make the radar.

In this report, Jovine reveals how to build out a solid small-cap biotech stock portfolio with enormous upside potential. These companies pale in share price with the tech giants, granting even more opportunity to grow.

After finishing the report, you’ll have a much better idea which biotech stocks to pick up and which to avoid.

Medical Money

Jovine has identified a hidden mechanism to investing in biotech stocks that most people overlook.

In short, many of these companies allow you to generate both profits and income from a single investment. The trick is knowing what to look for.

Medical Money outlines the step-by-step process for finding these biotech companies and how to set yourself up for the biggest upsides. That extra income could help immensely even if these stocks wobble a bit as they carve out a niche.

>> Sign up now to get Dylan’s top biotech picks! <<

Tidal Wave Profits

Tidal Wave Profits takes you behind the scenes for an in-depth look at how biotech companies are already changing the treatment process for the better. Jovine includes examples of how combatting prostate cancer will look different with the next generation of medicines.

The report showcases precisely how these new treatments are forever changing science for the better. You’ll hear about how old practices are becoming obsolete and the best ways we can profit from these changes.

Pot Stocks

Cannabis stocks are becoming more popular thanks to their medical implications and an increase in legalization across the country. There’s likely some room for profits here if you know where to look.

In Pot Stocks, Jovine likens cannabis to the tobacco industry and what we all can glean from its rise. By the time you set it down, you should have a much better idea about which marijuana segments are slated to succeed and the reasons behind it.

6 Questions to Ask Before Buying Any Stock

With thousands of stocks to choose from, it’s obvious some are better than others. What is it though that sets them all apart?

This special report provides a clear list of six questions you’ll want to ask any time you go to pick up a new security. You can use these tools to filter down stocks with the biggest upside and give yourself a higher chance at success.

>> Join now to get these bonus reports <<

Money-Back Guarantee

Jovine wants to remove any barrier between you and his research service. Therefore, he’s rolled out a 30-day 100% money-back guarantee for you to try everything out.

You’ll get to see the stocks in his portfolio and peruse the bonus reports included in this deal. If there’s anything at all you don’t like, reach out for a full refund of the membership price.

Even if you cancel your subscription, the bonus reports are yours to keep as a thank you for checking out the service.

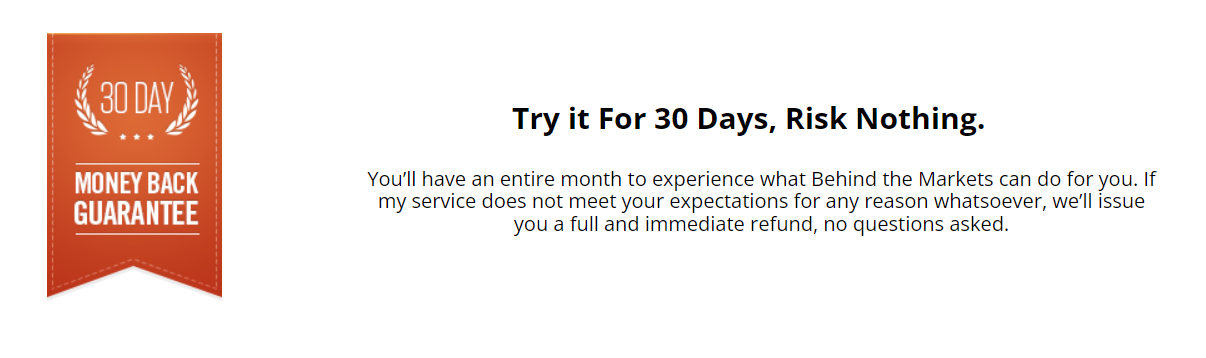

How Much is the End of Disease Deal?

Behind the Markets normally retails for $199 for a year of the research service. As part of this special promotion, you can join for just $49. That’s 75% off the cover price.

That means Dylan’s insights could be yours for less than $0.10 per day.

On top of that, Jovine throws in several bonuses for free. Adding up all the additional material, this End of Disease deal carries a $1,700 valuation.

>> Claim your 75% discount HERE <<

Is BTM End of Disease Worth It?

After a thorough review, I can honestly say that Behind the Markets’ End of Disease bundle is a top-tier service.

Jovine’s zeroed in on some incredible opportunities in biotech, and he’s here to share them with us. What AI can do in the space is no joke and getting in at the ground level could be incredible.

Six unique bonus reports surrounding biotech and similar companies only add to the bundle’s draw.

You’ve also got a year of Behind the Markets and all the recommendations Jovine makes through his flagship service. He’s been at it for over 30 years, and his track record more than speaks for itself.

It’s fairly easy to justify $49 for this service, especially considering the profit potential of Dylan’s #1 biotech stock. The 30-day money-back guarantee is just icing on the cake.

If you’re looking for a breakthrough investment opportunity in AI or biotech, look no further than this End of Disease bundle. Sign up now before this tech really takes off.

Tags:

Tags: