If you’re like me, you’re always on the hunt for clear market data for forming trades without having to rely on emotion.

That led me to Edgeful, a platform promising to do just that.

It boasts a ton of interesting features, but does it really hold up when put to the test?

In this Edgeful review, I took a detailed look at the platform, its tools, and the methodology behind it all to see if its data-driven workflow is worth your attention.

>> Try André Arslanian’s Edgeful Today <<

Quick Verdict: My Take on Edgeful

Quick Verdict: My Take on Edgeful

Edgeful strikes me as a fast, data-driven platform built for folks who want clear probabilities instead of emotional decision-making.

It isn’t a magic fix for inconsistency, but it offers one of the strongest structured workflows for anyone who wants to trade with real statistical guidance.

Best For

- People who rely on rules, probabilities, and structured setups

- Futures and short-term traders who want daily bias and real-time stats

- Anyone wanting automation options without restrictive trading limitations

Not Ideal For

- Total beginners who’ve never traded systematically

- Folks expecting signals or guaranteed results

Would I Personally Use Edgeful?

I’ve been playing with the software for a bit now, and I’d definitely give it a go. The blend of statistical reports, real-time tools, and clear workflow makes Edgeful appealing if you value disciplined, data-backed trading instead of guessing.

>> Start Using Edgeful’s Personal Quant Now <<

What Is Edgeful?

Edgeful is a browser-based analytics platform created to suss out clarity instead of noise. It positions itself as a personal quant that organizes market data into clean probabilities you can actually use during a live session.

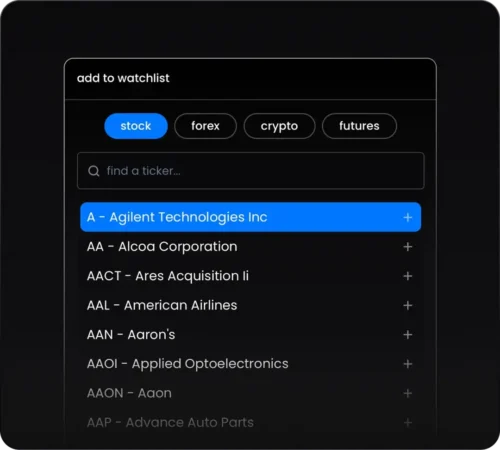

The platform covers stocks, futures, forex, and crypto, and everything centers around identifying how price historically behaves in situations we see every day.

That includes how markets respond to gap fills, opening range breakouts, and prior day range breaks, along with dozens of other patterns pulled straight from intraday movement.

Its product line includes a full statistical engine, real-time market dashboards, TradingView and NinjaTrader indicators, and an automation layer that ties all those probabilities into actual trade execution.

Data isn’t everything, but Edgeful works hard to replace the guesswork we sometimes have to make with structure in a format that’s easy to decipher.

Is Edgeful Legit?

Edgeful has earned credibility by grounding its platform in real statistical work and by being transparent about how it develops its models.

Independent feedback highlights Edgeful’s clarity and reliability rather than making unrealistic claims, which is another good sign.

The mix of quantitative depth and genuine transparency makes Edgeful a platform you can take seriously.

>> Unlock Edgeful’s Trading Edge Here <<

How Does Edgeful Work?

It Starts With a Data-Driven View of the Market

Edgeful works by turning raw intraday data into clean probabilities that are actually worthwhile for us to use.

I’ve counted over 100 customizable reports covering a wide range of search topics that you can dial in to your specific needs, an immense help to platforms that give a generic set you still have to filter through.

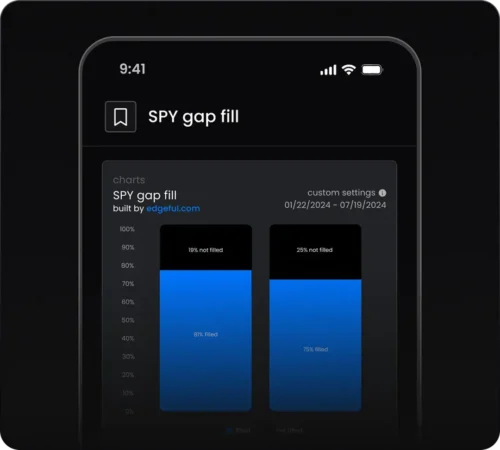

Instead of relying on intuition, you see how often patterns like gap fills, opening range breakouts, and prior day range breaks have played out across recent market conditions.

The platform pulls from credible exchange-level sources and organizes those tendencies into reports that help you understand the likelihood of continuation or reversal before entering a trade.

Your Daily Workflow Revolves Around Clear Market Bias

Once you know the historical tendencies, Edgeful helps you build a daily bias quickly.

I can select my instruments, open the reports tied to my playbook, and get a structured read on whether the session favors strength, weakness, or uncertainty.

This is real, grounded information with calculated probabilities based on live data. You’re seeing what’s circulating in the moment, not in the past.

Live Market Tools Keep You Focused in Real Time

As the session develops, Edgeful tracks the market and highlights when your preferred setups begin forming.

Because I’ve customized it, Edgeful shares when my favorite tickers are moving or when something meets my criteria.

I’ll be honest, there have been a number of times where I never would have found these opportunities on my own.

Having these relevant developments in front of you as they happen lets you react with more confidence and less noise.

The Platform Helps You Build a Consistent Strategy Over Time

Over time, the platform starts shaping a strategy around your strengths. You learn which setups fit your style, when you tend to time entries well, and where you take unnecessary risks.

My favorite part is that Edgeful can automate most (if not all) of this through its algorithms.

Once a stock meets your criteria, the platform kicks into high gear so you don’t miss a beat.

Even better, you can link up your brokerage account to make the entire trading process seamless.

>> Explore Edgeful’s Full Platform Access <<

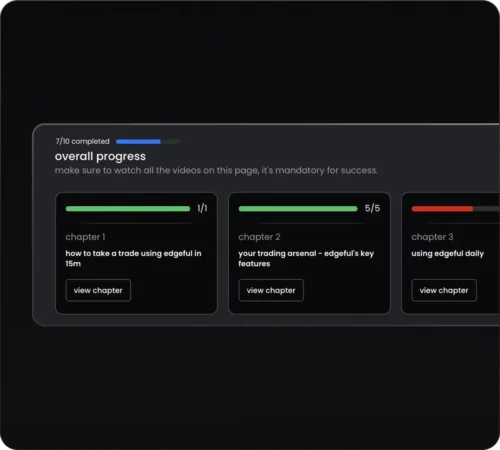

How to Get Started with Edgeful

I was hesitant when I logged into Edgeful for the first time, fearing I’d get lost in a sea of tools. I couldn’t have been more wrong.

You’ll want to start investigating which of the platform’s reports and instruments resonate with your style, and you’ll see firsthand how the probability engine works.

It takes only a session or two to understand how those tendencies shape your daily bias.

I set up a watchlist, and Edgeful helped me build out a simple routine. You won’t need much time to load top reports into your playbook, review the tendencies for the upcoming session, and note areas where probability leans higher.

You then move into the live session with a clearer sense of what to expect, rather than reacting blindly to every candle.

It’s kind of a lather, rinse, repeat setup from there. As you grow more comfortable, you can explore the features that refine your workflow, like real-time alerts, chart integrations, and the tools that help you track how your preferred setups behave over time.

>> Get Started With Edgeful Core Plan <<

Edgeful Review: All the Core Features Explained

Here are the features that most caught my eye in my Edgeful review:

Statistical Reports & Playbooks

Edgeful’s statistical reports are the backbone of the platform, giving you a data-backed read on how markets behave around patterns like gap fills, opening range breakouts, prior day range breaks, and dozens more.

You can also turn any report into a saved playbook item, making your daily workflow clearer and far more consistent.

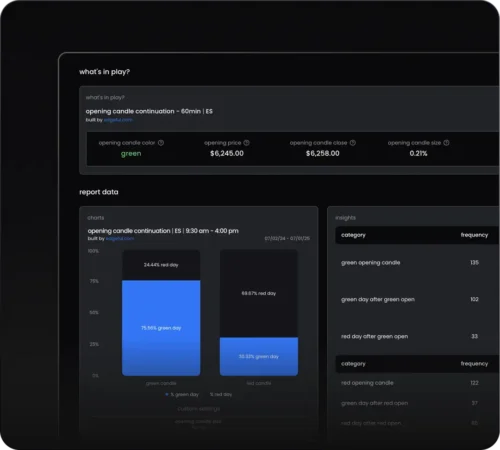

A Dedicated “What’s In Play” Tab

The “What’s In Play” tab gives you a real-time view of which setups are actively forming based on the reports in your playbook.

It tracks key levels, current market behavior, and probability shifts as the session unfolds.

I use it to quickly identify when familiar patterns begin to trigger, so I’m not having to hunt across multiple charts.

This feature makes Edgeful shift from a static research service into a live, session-ready workflow.

Real-Time Screener

The screener helps you track directional bias and active conditions across many instruments at once.

This makes it easy to see which assets offer clearer opportunities and which ones look uncertain.

If you monitor several markets at the same time, you’ll likely enjoy using the screener to simplify your focus and avoid the noise that comes from juggling too many charts.

TradingView & NinjaTrader Indicator Library

Edgeful comes with a full indicator library for TradingView and NinjaTrader, giving you chart overlays that match the same definitions the statistical engine uses.

The benefit here is accuracy and consistency, since your charts reflect the same criteria used in your reports.

It keeps your charting clean and ensures every level has real data behind it.

Custom Built Reports

Edgeful’s team regularly builds custom reports for members who want deeper insight into specific setups or market conditions.

This level of customization is perfect if you have clear ideas but no way to test them on your own.

>> Automate Your Strategy With Edgeful Algos <<

Option to Build Your Own Playbook

The playbook feature helps you create a structured routine by organizing your preferred reports into a personalized checklist.

The playbook feature helps you create a structured routine by organizing your preferred reports into a personalized checklist.

You decide which setups matter most, how they fit your trading style, and how they guide your daily bias.

Over time, this becomes your anchor for consistency.

Customization is truly key here, making Edgeful a vibrant tool instead of a rigid set of data.

Mentorship Call & Live Sessions

Edgeful hosts mentorship calls and platform walk-throughs that help traders better understand the logic behind the reports and how to use them in real sessions.

I appreciate how direct and practical these calls are, and I often walk away with answers to questions that need more context than a written explanation can provide.

Multiple Data Providers

Using multiple providers also adds redundancy, reducing the risk of gaps or inconsistencies that can distort probability analysis.

This matters for anyone relying on precise behavior around key intraday levels, since clean data is essential for any statistical model to remain useful.

Free Newsletter & Risk Calculator

Edgeful offers a weekly Stay Sharp newsletter that highlights market tendencies, educational breakdowns, and strategy insights drawn from the platform’s statistical engine.

Both tools are designed to deepen your understanding of probability and risk without overwhelming you, and they reinforce disciplined decision-making.

Edgeful Algos (Automated Strategies & Broker Connections)

Edgeful Algos are one of my absolute favorite features, letting you automate rule-based strategies using the same logic that powers the statistical reports.

I didn’t use them right away, but it was a no-brainer once I trusted how the process works. It saves so much time and repetition that can cause fatigue.

Edgeful AI & 2025 Platform Upgrades

The platform continues expanding with AI-driven tools designed to speed up research and surface deeper tendencies in the data.

Newer updates focus on faster report loading, improved screening logic, and a more responsive interface for real-time tracking.

The AI direction aims to let traders query historical behavior in natural language and create custom analytics on the fly.

It’s a forward-looking layer designed to make Edgeful’s data easier to explore and more intuitive to act on.

Educational Layer: Stay Sharp Blog & 5-Day Futures Course

Edgeful’s education section gives users a structured way to understand the concepts behind its statistical tools.

The 5-Day Futures Course introduces contract mechanics, leverage, volatility behavior, and the core intraday patterns the platform tracks, making it easier to connect the reports to real trading decisions.

An Active Discord Community

Edgeful’s Discord community is large and active, with traders sharing insights, playbook setups, and interpretations of the day’s probabilities.

The team also answers questions directly from time to time, ensuring users don’t get stuck.

I like how the environment here feels focused and cooperative, helping me stay accountable and grounded in the statistical approach Edgeful encourages.

>> Join André Arslanian’s Edgeful Community <<

Pros and Cons

Check out the top pros and cons I came up with during my review:

Pros

- Strong, data-driven trading framework

- Clear probabilities for intraday patterns

- Real-time bias and setup tracking

- Clean chart integrations on major platforms

- Helpful mentorship and active community

- Consistent, exchange-level data sources

Cons

- No refunds on subscriptions

- Learning curve for new users

- Best for active, short-term styles

Refund & Cancellation Policy

Refund & Cancellation Policy

Edgeful keeps its refund terms straightforward, and you’ll want to be aware of them before subscribing.

All payments are final, which means the platform does not offer refunds on monthly or annual plans once a charge has been processed.

Subscriptions renew automatically, and it’s your responsibility to cancel before the next billing cycle.

When you cancel, your access remains active until the period you’ve already paid for ends.

This policy is common for platforms built around instant, digital access, although it does require users to be certain about their plan before committing.

>> Claim Your Edgeful Membership <<

Edgeful vs Popular Alternatives

Edgeful vs TradingView

TradingView is one of the most widely used charting platforms, and it excels at technical analysis, community scripts, and multi-asset charting.

I like TradingView, but it doesn’t offer statistical reports that break down how often specific intraday patterns play out or build a probability framework around setups like gap fills, ORB, or prior day range interactions.

That’s where Edgeful stands apart. Its reports, screener, and What’s In Play feature give traders a data-backed understanding of market tendencies before they place a trade.

In my mind, Edgeful ends up complementing TradingView rather than replacing it.

It’s a pairing that works well when you want both high-level structure and customizable charting.

Edgeful vs TrendSpider

TrendSpider focuses heavily on automated charting, pattern recognition, smart trendlines, and multi-timeframe scanning.

It’s a strong tool for spotting technical setups quickly, but it doesn’t dive into statistical behavior the same way Edgeful does.

Edgeful is built on probability, how often something has happened, where it tends to happen, and what is likely to occur next based on historical tendencies.

That makes it better suited if you want quant-style clarity rather than visual automation. If your workflow revolves around structured data, session tendencies, and bias-building, Edgeful feels more impactful.

TrendSpider fits users who prefer automated chart marking and traditional technical analysis.

Both platforms solve different problems, but Edgeful is the clearer choice for folks like me wanting numbers instead of pattern-matching.

Edgeful vs Bookmap

Bookmap is built for traders who want to see real-time order flow, heatmaps, and liquidity movement.

It’s unmatched when it comes to visualizing market microstructure, but it doesn’t provide a broader statistical context, like how often a gap fills or whether a prior day range break usually continues.

Edgeful focuses on those bigger-picture intraday behaviors, helping traders understand the probabilities behind common setups before zooming into execution.

I could see people who use Bookmap relying on Edgeful for their overall session bias and use Bookmap to refine entries on a more granular level.

Edgeful is better for framing the day and building a structured plan, while Bookmap shines when you need to interpret depth-of-market activity in real time.

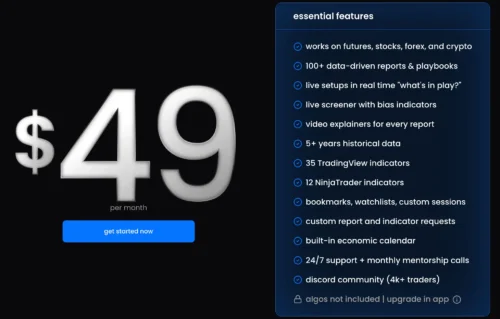

How Much Does Edgeful Cost?

How Much Does Edgeful Cost?

Edgeful’s base package will cost you $49 per month and includes full access to all statistical reports, What’s In Play, the screener, mentorship calls, indicators, and the Discord community.

If you want to jump in with both feet, the annual plan has a built-in discount ($39/month, billed annually), lowering the effective monthly cost.

Adding Algos to your plan requires a $250 per month upgrade, and you still need the base plan to use it.

It’s a bit costly, but it adds the automated trading engine that executes rule-based strategies through supported brokers.

Feel free to start with the basic plan to see how the analytical experience works and move into Algos once you’re ready to automate the trading process.

>> Activate Your Edgeful Trial Today <<

Who Is Edgeful Best For?

Edgeful is best suited for folks who want a structured, probability-driven workflow and rely on repeatable intraday setups.

It fits especially well for futures traders who benefit from clear session bias, real-time tracking, and consistent preparation.

The platform also appeals to individuals who enjoy working with data and want to refine or automate rule-based strategies over time.

It’s less ideal for folks looking for long-term gains or hands-off signals, but for disciplined traders who value clarity and routine, Edgeful offers a focused environment that strengthens decision-making.

Is Edgeful Worth It?

Edgeful is worth considering if you’ve reached a point where you want more structure and reliability in your trading decisions.

The platform’s strength comes from how naturally it fits into a disciplined routine. You aren’t chasing signals or guessing where the market might go.

Instead, you’re working with probabilities that make each session feel more intentional.

Traders who rely on setups like gap fills, ORB, or prior day range breaks tend to see the most benefit because Edgeful helps them understand how those patterns behave across real market conditions.

The automations add value once your rules are defined, but the statistical engine alone is enough for most users to improve consistency.

At this stage in the Edgeful review, it’s clear the platform delivers meaningful structure for traders who want clarity over chaos.

Edgeful FAQs

Does Edgeful work for all markets?

Yes. Edgeful supports futures, stocks, forex, and crypto, giving traders one consistent probability framework across multiple asset classes without changing tools or workflows.

Do I need TradingView or NinjaTrader to use Edgeful?

No. Edgeful runs entirely in your browser, while TradingView and NinjaTrader integrations are optional for chart overlays and automated execution through supported connections.

Can Edgeful guarantee profitable results?

No platform can guarantee profits. Edgeful provides statistical context and structured workflows, but trading outcomes still depend on discipline, risk management, and following a consistent process.

Is there a refund if I cancel?

No. Edgeful has a strict no-refund policy. You retain access until your billing period ends, so cancellations must be made before renewal.

Tags:

Tags: