Veteran investor Eric Fry claims we’re on the cusp of a massive tech shift that could leave many in financially dire straits. Does Fry’s prediction hold any water? I investigate in this Eric Fry’s tech melt-up review.

Who is Eric Fry?

Eric Fry is a market expert with decades of experience anticipating market shifts and finding big winners.

Early on, he served as a specialist in international equities, earning him the ability to identify opportunities on a global scale1.

Fry segued over to the Wall Street-based publishing operations of James Grant after that, helping to produce research products for professional money managers2.

In 2016, the guru beat out 650 of the biggest names in finance to win the Portfolios with Purpose competition, one of Wall Street’s most prestigious3.

Now, Eric uses all the knowledge and insights he’s collected over the years to help the masses have a chance to protect and grow their nest eggs through his Fry’s Investment Report.

>> Get Eric Fry’s latest research now! <<

Is Eric Fry Legit?

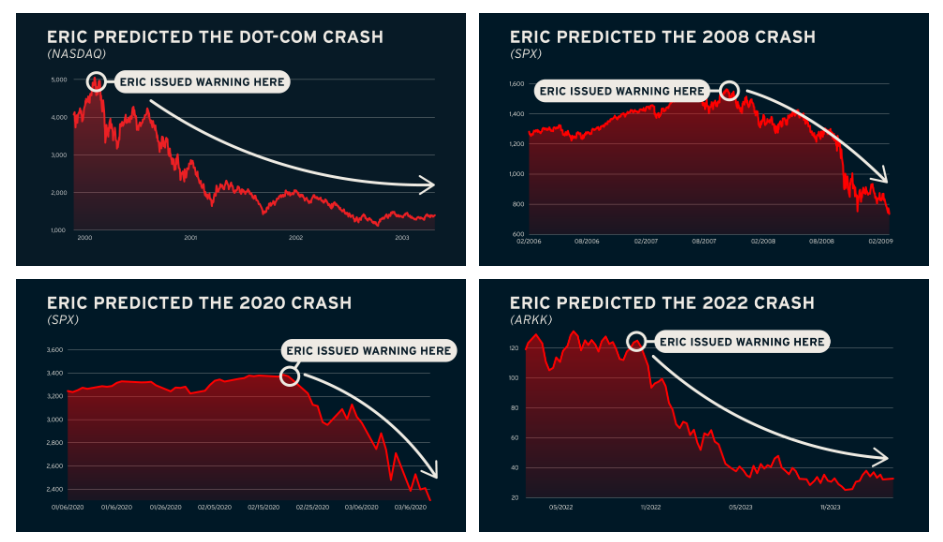

Over the last 30 years, Eric Fry has accurately predicted several major market events.

He called the dot-com blowout, 2008’s bankruptcies, and saw the 2020 tech crash with enough time to warn his readers before they happened4.

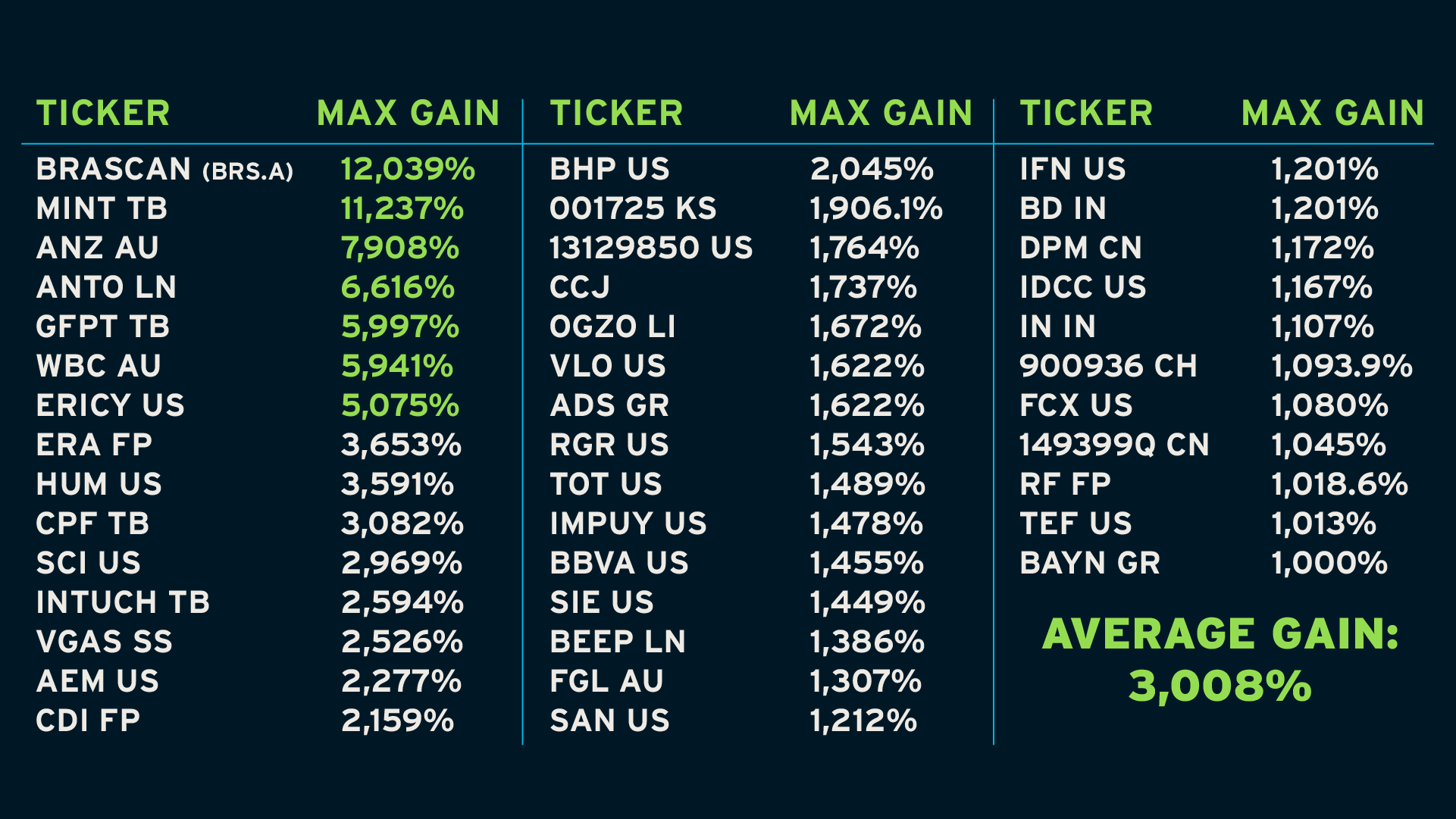

Forty-one of his recommendations have led to gains as high as 1,000% , including Humana (HUM) and Service Corporation International (SCI) that reached nearly 3,000% growth at their peak.

I’d be leery about a guru with one or two big picks, but 41 picks with gains like this high are hard to argue against.

In addition, Fry has appeared in numerous publications like the New York Times, Business Insider, The Wall Street Journal, and USA Today5.

What is The Tech Melt Up?

Eric Fry believes there’s a rare event around the corner that’s on a collision course with the market’s biggest stocks.

If he’s right, folks caught unaware could watch their investments get obliterated in a flash as these securities come crashing back down to earth.

Amid the chaos, Fry believes a small corner of the market will flourish and rise to new heights.

Join me as I dig into what this tech melt-up is and how we can actually play it for our personal benefit.

Eric Fry’s Tech Panic Prediction for 2024

Fry’s been doing this a long time, and he claims tech stocks have become way too saturated.

The biggest names in investing seem to sense this as well, which is leading to a massive wave of selling.

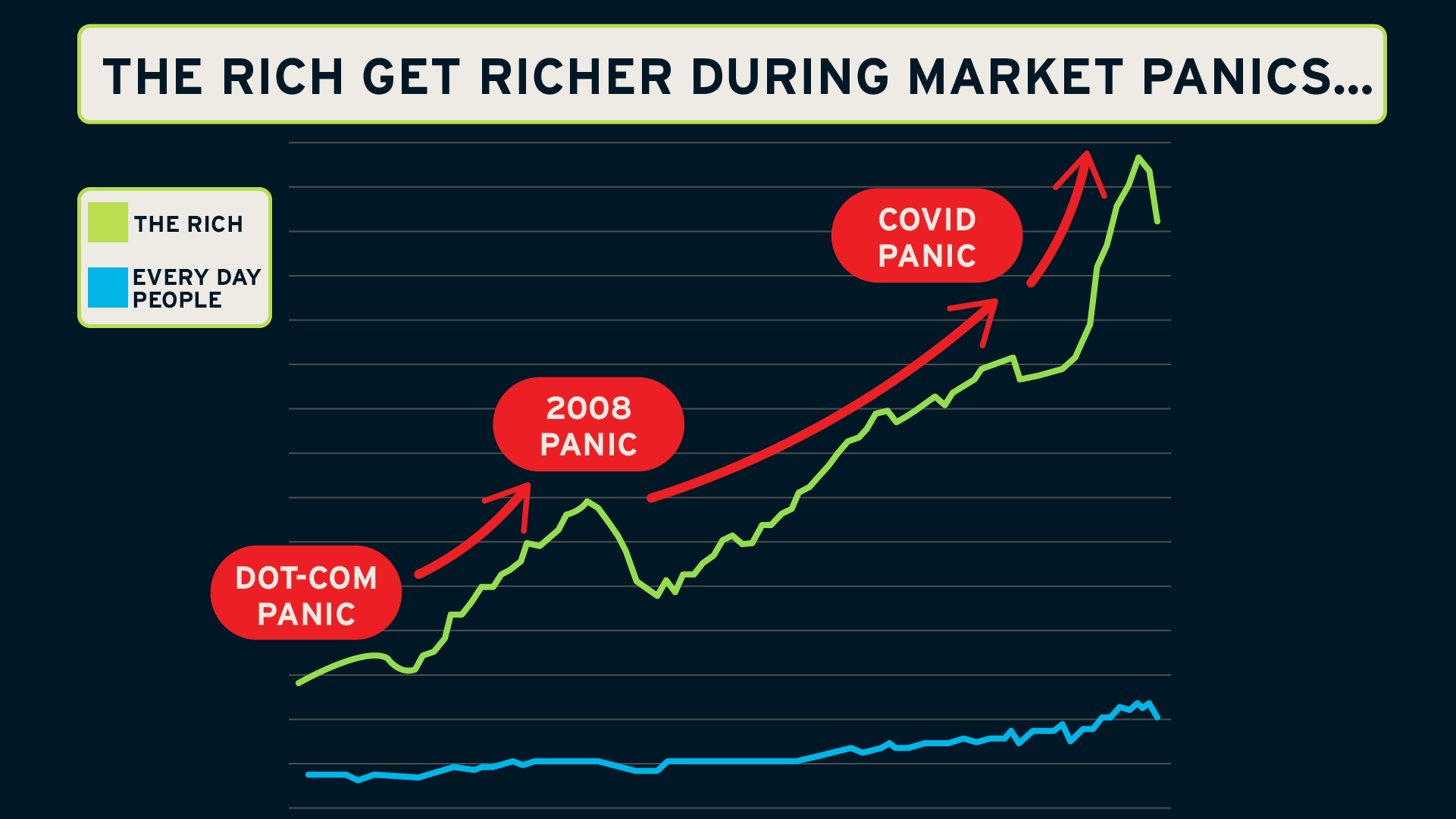

No less than 31 billionaires are shifting their investments as we speak.

While they move their wealth to greener pastures, the rest of us get left cleaning up the crap.

I’ve seen the effect of massive sell-offs before, and it’s never pretty for anyone who waits too long to act.

If all that money’s moving as Fry predicts, we all need to take this advice to heart.

>> Access Eric Fry’s prediction now! <<

Lessons from the Last Tech Panic

It’s hard to fathom the fall of the Magnificent Seven or other tech greats when they’re doing so well, but this isn’t the first time we’ve walked this path.

I clearly remember the dot-com bubble burst around the turn of the century and the ramifications it had on so many people. The loss of savings and security was devastating.

Our current tech bubble is following that same trend almost to a “T”. It’s almost scary how closely the current pattern fits, thanks to the Mag Seven propping up the S&P.

Just like in 2000, it wouldn’t a big push to send the tech industry crumbling again.

What’s worse, it took the market some 15 years to climb back out of the hole. We owe it to ourselves to prepare for the possibility.

>> Get insights to navigate the tech melt-up – Sign up now! <<

Eric Fry’s Top Melt Up Stocks

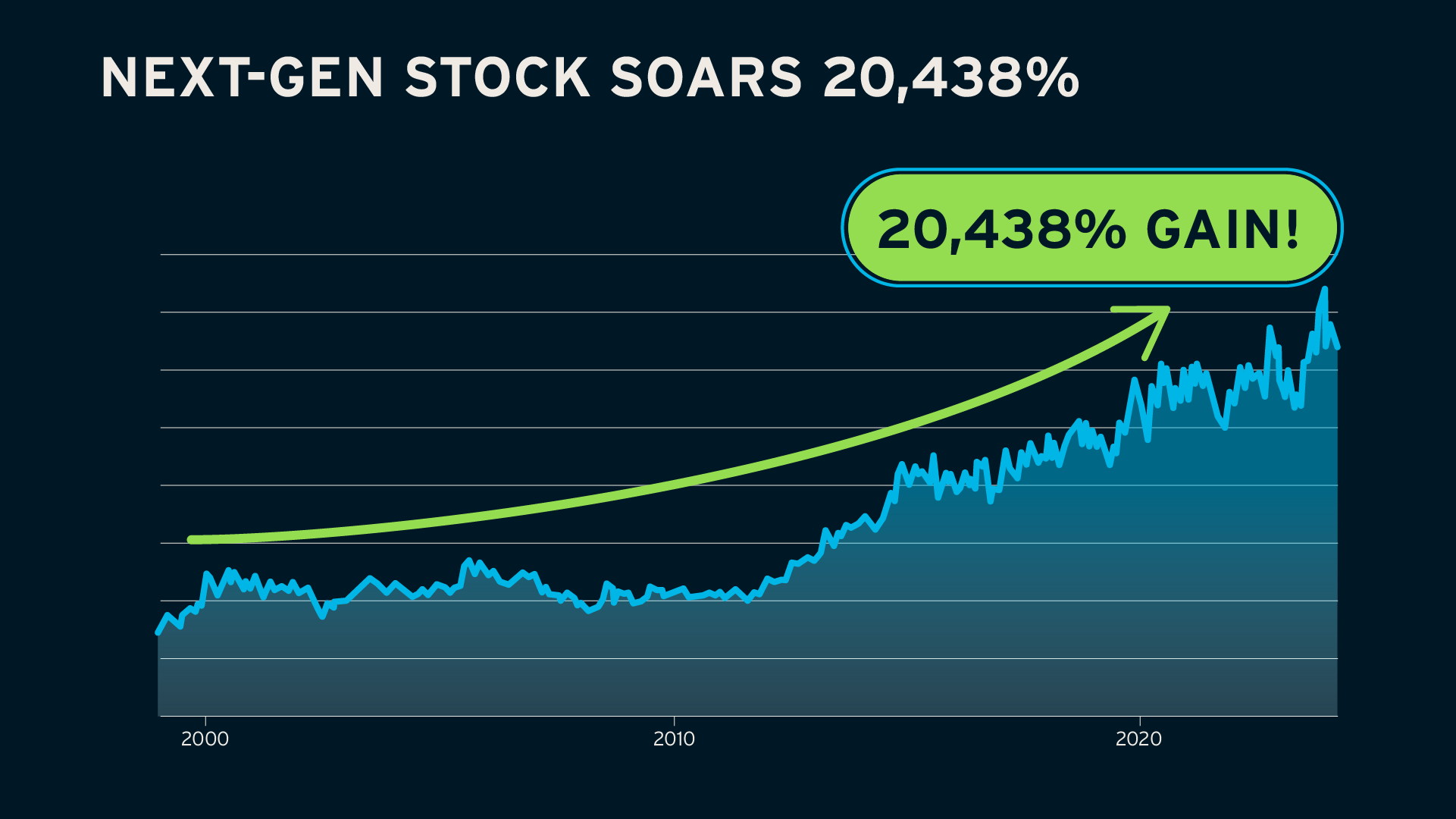

Eric says the smart money is heading toward a slew of next-gen stocks set to emerge and dominate the market.

This small sector saw huge success during the dot-com bubble burst, and the pattern looks to be happening again.

In even better news, it’s converging with AI to become a major disruptor for potentially years to come.

The last time Fry saw a moment like this, his stock recommendations each climbed 1,000% or more over the coming years.

He’s identified some promising opportunities that could follow the same trajectory this time around. Right now could be the final chance to get in on these picks before they start to take off.

I’m super encouraged by the possibility of these stocks, even if the tech panic doesn’t come to pass.

You’ll need to get your hands on a subscription to Fry’s Investment Report to uncover all the details.

>> Get Fry’s top stock picks now! <<

How to Access Eric Fry’s Stock Picks

You get instant access to Eric Fry’s tech melt-up research when you sign up for Fry’s Investment Report. Here’s a breakdown of everything you get under the current deal.

12 Months of Fry’s Investment Report

Membership comes with 12 issues of Fry’s Investment Report monthly newsletter.

Inside, Fry explores the tech world for advancements and all the ways we can profit from them.

Each new release includes a new stock recommendation you can immediately take advantage of, along with Eric’s current take on the market.

Most of his plays focus on long-term shifts that could lead to massive growth over time.

I appreciate that he doesn’t focus on a particular sector but casts a wide net for the most applicable money-making opportunities ripe for the picking.

>> Get full access to Fry’s investment Report now! <<

The #1 Next-Gen Stock

Eric Fry shares his absolute favorite next-gen stock in this featured report.

This top pick is essentially like a bank, providing financing to rising stars in exchange for royalties from the products they produce6.

It’s already landed the largest royalty portfolio the sector has ever seen, and its investments could continue to grow by the day7.

In effect, it’s a way to profit from the biggest innovators right now, all from one single source.

Morgan Stanley, BlackRock, and Vanguard already own tens of millions of shares, showing that big money’s headed here8.

You’ll get all name, ticker, and all pertinent details of how to invest after a quick read-through.

The 1,000% Next-Gen Portfolio

In his years as an investor, Eric Fry has come to understand the elements of a stock set to reach incredible heights.

The guru and his team have scoured this mysterious next-gen sector for companies fitting the bill, and they’ve compiled a list of the top three that could reach 1,000% gains or more.

Keep in mind that these recommendations come from the same guy with 41 other recommendations that went up as much as 1,000% under his belt.

I love how Fry clearly articulates his reaching for each one so you know precisely what you’re getting into.

Even if only one goes 20X, it could be a huge win for your financial future.

>> Join now for expert insights and save 60%! <<

The 10 Stocks Insiders Are Dumping Right Now

Corporate insiders are selling stocks at the fastest rate in a decade9, clear indicator of dark times approaching.

And Eric Fry was able to discover ten stocks with crazy amounts of insider selling going on.

This report unveils these companies and explains why CEOs and founders are dumping shares at record rates.

It goes without saying that if executives don’t have confidence in their own organization, you should not own shares of these stocks either.

In my experience, holding these stocks could quickly prove catastrophic for your portfolio.

Full Access to Fry’s Investment Report Research Archives

All Fry’s Investment Report subscribers get unrestricted access to the platform’s entire research archive.

This includes the model portfolio, weekly financial research, and current special reports.

You’re able to go back and peruse previous entries as well and there’s information on just about every topic here that you can think of.

There’s even a section for past newsletter issues with previous recommendations you can read through for additional tips and suggestions.

Despite the large amount of information, it’s quite easy to search through and find topics most applicable to you through various functions.

The new content is great, but I find myself spending an awful lot of time here.

>> Sign up to access all these features and more <<

Money-Back Guarantee

Eric Fry gives new members 90 days to test everything out before making any commitment.

You’re able to put three issues of the newsletter to the test, pick through the model portfolio, and read the special reports to your heart’s content.

If there’s anything you don’t like about the platform, reach out during those first three months for a complete refund of your entire membership fee.

As a thank you for trying Fry’s Investment Report out, you’ll get to keep all the materials you’ve received up to that point as well as any profits you’ve earned during that time.

>> Sign up under Fry’s money-back guarantee <<

Is Eric Fry’s Tech Melt-Up Prediction Legit?

Eric Fry’s Tech Melt-Up deal is indeed a legit service with tons of potential.

The guru accurately predicted the last great tech crash, and the last 25 years have clearly not dulled his senses.

He’s picking up on all the same signs that led to 2000’s dot-com burst, which is a very valid cause for concern.

Even if his concerns don’t come to pass, it makes sense to reconsider our devotion to the Magnificent Seven with other rising stars starting to shine brighter.

How Much is the Tech Melt-Up Deal?

This Fry’s Investment Report bundle would normally set you back $499. As part of this Tech Melt-Up deal, you can have it all for just $199. That’s 60% off the cover price!

You’re only paying $16 per month for a stock recommendation that could grow 1,000% or more. A single big win could make up for your membership fee and then some.

>> Save 60% when you join NOW <<

Is Eric Fry’s Tech Melt-Up Bundle Worth It?

I pay close attention to the tech sector, and Fry’s Tech Melt-Up bundle is a legitimate cause for concern.

Both his warnings and opportunities for navigating potential pitfalls seem on point, especially considering where smart money is going.

You’re only paying $199 for 12 months of research plus all of Eric’s recommendations and insights for coming out of possible disaster with your finances in check.

Having that peace of mind alone is enough for me to pursue the service further. The fact that you could increase your wealth through it all is simply a bonus.

If you’re interested in pursuing tech sector opportunities, Fry’s Investment Report should be at the top of your list.

>> That’s it for my review. Claim your 60% discount NOW<<

- https://investorplace.com/author/ericfry/

- https://investorplace.com/author/ericfry/

- https://marketwise.atlassian.net/wiki/spaces/ILD/pages/232685764/Fry+Claims

- https://marketwise.atlassian.net/wiki/spaces/ILD/pages/232685764/Fry+Claims

- https://marketwise.atlassian.net/wiki/spaces/ILD/pages/71103086673/Eric+Fry+s+Media+Appearances

- Royalty Pharma – See 2024 EFIR Tech Melt

- https://www.royaltypharma.com/ #1 buyer of biopharmacy royalties. 60% global market share.

- https://finance.yahoo.com/quote/RPRX/holders/

- https://www.marketwatch.com/story/corporate-insiders-are-dumping-stock-at-the-fastest-rate-in-more-than-a-decade-4cc5ed3a

Tags:

Tags: