Cryptocurrency and the blockchain it relies on can be a confusing area for many people. Still, there’s no denying the impressive gains made possible by investing the right coins, if you know where to look. This Forbes Crypto Advisor review closely examines how one such crypto research service stacks up.

What is Forbes Crypto Advisor?

As the name implies, Forbes Crypto Advisor looks exclusively at blockchain and the digital assets attached to it. Steven Ehrlich is the head author and advisor of this service published by Forbes Media.

Members are met with monthly reports on the latest happenings in the crypto world and trending coins that may make excellent investment options. All this research shares the spotlight with four portfolios currently tracking the best opportunities.

It’s a pretty cut-and-dry approach to the digital currency sector, but that’s one of the things I appreciate most about it. Newcomers and veterans to crypto alike can tune in and get their fill without the content feeling too heavy.

Another feather in Forbes Crypto Advisor‘s cap is an equal consideration of coins themselves and the industries that support them. The service calls attention to ways to get involved in blockchain technology even if you’re not ready to add digital currency to your wallet.

We’ll take a detailed look at the platform’s top features in just a moment. First, let’s investigate the minds that make it all possible.

>> Sign up for Forbes Crypto Advisor now! <<

Who is Steve Forbes?

Steve Forbes is the current editor-in-chief of the Forbes business magazine. Although his name is on the cover, Steve graduated with a degree in American history from Princeton in 1973 and has worked for the company ever since.

He took over Forbes Media after the death of his father in 1990 and transformed the publisher from a family-owned business to the publishing powerhouse it is today. Under his leadership now boasts several research services like Forbes Crypto Advisor that span the globe.

Who is Steven Ehrlich?

Steven Ehrlich is an expert in the realm of blockchain and digital currency. He currently serves as the director of research for digital assets within the Forbes umbrella.

His journey started with a B.S. in Business Administration from the Tepper School of Business at Carnegie Mellon University and an M.A. in International Affairs from Columbia University’s School of International and Public Affairs. From there, Ehrlich moved into a number of strategic roles to help equip him for this position.

Some of these notable postings include time as Vice President/Lead Strategy Analyst at Citi FinTech, Lead Associate within the Emerging Technologies practice at Spitzberg Partners, and five years as a Senior Intelligence Analyst at Booz Allen Hamilton.

Is Steven Ehrlich Legit?

If Ehrlich doesn’t know his stuff, I don’t know who does. He’s been a leader in emerging tech and an industry advisor on blockchain practically since the industry began.

One of his more recent roles was with Kraken, an American cryptocurrency exchange. Before that, Steve was Chief Operating Officer at the Wall Street Blockchain Alliance.

His accolades further back up his expert status. Ehrlich is a Certified Information Privacy Professional and a Certified Information Privacy Technologist at the International Association of Privacy Professionals (IAPP).

>> Access Ehrlich’s latest research insights <<

What Comes with Forbes Crypto Advisor?

Here’s what you get when you join Forbes’ crypto service.

12 Monthly Issues of Forbes CryptoAsset & Blockchain Advisor

A new Forbes Crypto Advisor sign-up comes with a year’s worth of the Forbes CryptoAsset & Blockchain Advisor newsletter. Steve Ehrlich is the voice behind each one.

Each new issue hits the internet with an overarching theme, which he then covers in detail throughout the post. You’ll get to read about where the Forbes team’s attention lies and their thoughts on the current state of the market.

In all the articles I’ve seen, Ehrlich shares some of his favorite altcoin opportunities and why he feels they’re winners.

There’s tons of data in each new release for anyone wanting to go deeper. I find it an excellent blend of text and charts.

Near the end of each monthly issue, Ehrlich interviews an expert in a crypto or related field. The insights you can pull from this section alone are worth the price of admission.

Forbes CryptoAsset & Blockchain Advisor also captures a snapshot of the platform’s current portfolios. It’s a snapshot, of course, but it provides an opportunity at a glance to suss out some opportunities.

>> Get your first issue now! <<

Crypto Accelerator Portfolio

The Crypto Accelerator Portfolio focuses primarily on newer tokens and those lower down on the market cap table.

These are potentially worthy challengers to the Crypto Asset Core Portfolio or look to be at the forefront of new use cases for crypto.

Expect the assets on this list to shuffle around more frequently than others as coins rise or fall in popularity. Chances are, distributions will be fairly level across the board.

Since many of these tokens are new, you should consider this portfolio higher risk/higher reward.

>> Unlock new token opportunities <<

Crypto Asset Stock Portfolio

In this portfolio, you’ll find stocks and securities that stand to benefit from gains in the crypto space. It’s a way to invest in crypto without actually investing in crypto.

Selections here span a slew of categories despite all learning on digital currency and blockchain. There’s definitely a heavy shift toward certain industries, though.

At present, most of them have a heavy Bitcoin focus. Ehrlich and the Forbes team anticipate diversifying to proxies for other coins as they become more prevalent.

Crypto Asset Core Portfolio

This right here is the bread and butter of Forbes’ crypto recommendations. It’s where you’ll find the most popular coins and a few established rising stars.

Obviously, the coins you hear the most about carry the vast majority of the weight here. Still, it shows which altcoins Ehrlich believes stand out from the ever-expanding crowd.

Plan to plug some or all of these picks into the alternative asset section of your overall portfolio if you’re looking to get into crypto investments. Note that these are all mid to long-term plays and aren’t meant to be quickly traded.

>> Uncover top coin picks and blockchain tech stocks now! <<

Blockchain Equity Portfolio

The Blockchain Equity Portfolio points members toward stocks likely to benefit from blockchain technology.

Few of these companies, if any, have an active role in blockchain technology or crypto. That means these areas won’t be the primary driver for a company’s revenue or stock valuation.

Still, they stand to benefit from improvements to blockchain technology either in the present or at some point in the future. Some of these assets may already appear in your portfolio under different categories.

Special Research Articles

Alongside monthly newsletters, Forbes CryptoAsset & Blockchain Advisor features a number of special research articles. There’s no telling exactly when these will land, but Ehrlich sends them out rather frequently.

Consider these your go-to places for important activities or events involving crypto and the technology it touches. You’ll also get opportunities to catch up on new coin offerings and anything else that matters in the sector.

Each article is surprisingly in-depth for shorter-form content but remains remarkably easy to read.

>> Access exclusive features and research articles when you subscribe now <<

Pros and Cons of Forbes Crypto Advisor

Here are the most notable pros and cons of Forbes Crypto Advisor.

Pros

- 12 issues of Forbes CryptoAsset & Blockchain Advisor newsletter

- Expert recommendations from Steve Ehrlich himself

- Four unique portfolios offering investment opportunities

- Bonus research articles throughout the month

- Sprinkles stock recommendations in with crypto picks

- Solid price for the content

Cons

- Never deviates far from the crypto sector

- Focuses primarily on mid to long-term gains

How Much Is Forbes Crypto Advisor?

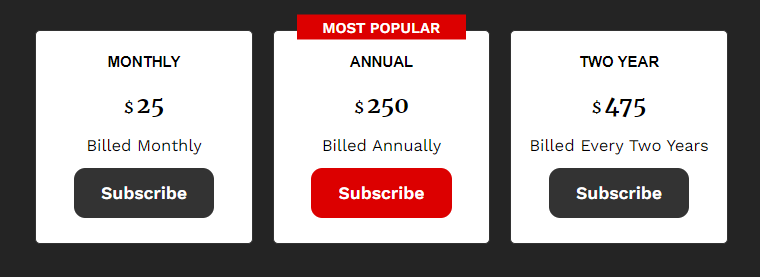

You’ve got three options for becoming a Forbes CryptoAsset & Blockchain Advisor member.

First, you can pick up a monthly subscription for $25 a pop. It’s a fair price for the research and portfolios provided, as any crypto investment opportunity could earn that back quickly.

Consider an annual membership if you’re sold on the platform and looking to save a little cash. At $250, you’re getting $50 off the normal monthly rate over the year.

A two-year subscription drops the price just a bit lower to $475. It’s not an earth-shattering discount, but a deal is a deal if you plan to use Forbes CryptoAsset & Blockchain Advisor for a long time.

>> Try Forbes Crypto Advisor for a month for just $25 <<

Is Forbes Crypto Advisor Worth It?

I’ve been able to check out everything Forbes Crypto Advisor has to offer, and I’m delighted with the service. Steve Ehrlich sheds a lot of light on an often confusing sector of the market with witty quips and powerful insights.

Plus, you have unlimited access to four different portfolios each serving a unique purpose. There are recommendations for stock followers and top coins to pursue for folks wanting to get more out of the crypto space.

Some of these portfolios are more volatile than others, playing perfectly into the various investment strategies people may have. I’m all about mixing and matching selections for what I hope is the biggest bang for my buck.

Speaking of bucks, all this content comes in at no more than $25 per month. I feel like that’s such a low barrier for entry, especially considering the type of returns tokens can bring in in short order.

If you’ve been waiting to get more out of digital currencies and blockchain but haven’t known where to look, Forbes Crypto Advisor is an excellent next step. Secure your spot today and see just what the service can do for you.

>> That’s it for my review. Subscribe now for monthly crypto insights! <<

Tags:

Tags: