Prop trading firms offer a unique way to trade without spending your own capital, but many have restrictive models that make it hard to succeed.

FTUK claims to do things differently, leaning into more fluid rules and instant funding to shorten the path to real payouts.

That promise sounds compelling, but does it actually hold up in real use?

In this FTUK review, I take a closer look at whether FTUK delivers on its claims and if it’s truly worth a closer look.

>> Start Trading With FTUK Today <<

Quick Verdict: My Take on FTUK

FTUK comes across as a flexible, trader-first prop firm built for speed, scalability, and fewer artificial restrictions.

The mix of instant funding, challenge-based programs, and permissive trading rules makes it one of the smoother ways to access funded capital without jumping through unnecessary hoops.

It isn’t risk-free, and rule discipline still matters, but FTUK offers a more accommodating environment than most traditional prop firms.

Best For

- Traders who want flexibility (news trading, no forced stop losses, no lot caps)

- Those who prefer faster access to payouts and instant funding options

- Anyone focused on scaling funded capital over time

Not Ideal For

- Complete beginners without a tested approach

- Traders expecting guaranteed payouts or loose risk enforcement

Would I Personally Use FTUK?

I would give FTUK a try for several reasons. The instant funding option, flexible rule set, and clear scaling path make FTUK appealing for disciplined traders who value freedom and consistency over rigid evaluations.

>> Join FTUK And Get Funded Fast <<

What Is FTUK?

FTUK is a proprietary trading firm that gives users access to funded accounts without requiring large amounts of personal capital.

These include instant funding options, structured evaluation challenges, and dedicated futures programs, all built around the same core idea of scaling capital through consistent performance.

It’s the first prop firm I’ve seen to offer a challenge specific to futures, adding a layer of diversity others don’t have.

Features like instant access to funded accounts, fewer trading restrictions, and a defined scaling plan are meant to reduce friction and speed up the process of earning payouts. For many, the appeal comes down to choice.

FTUK doesn’t force a single model but instead lets you pick the route that best fits how you already trade.

>> Unlock Instant Funding With FTUK <<

Who Owns and Runs FTUK?

I wasn’t able to locate any information on FTUK’s leadership team from its own website, which always leaves me scratching my head.

From what I can gather, FTUK has roots in Houston and first launched its evaluation program at the tail end of 2021.

Nicholas Quinn is a top executive and often appears as the face of the company. He carries 17 years of market experience that I can only assume the rest of the team would convey as well.

Is FTUK Legit?

Is FTUK Legit?

FTUK earns its credibility through execution, and it shares a few stats that caught my eye.

The firm operates with clearly published terms, consistent rule enforcement, and transparent pricing across all programs.

More importantly, it supports multiple professional-grade trading platforms and offers both forex and futures programs, which require real operational depth and ongoing infrastructure costs.

That alone filters out many fly-by-night prop firms.

FTUK also demonstrates legitimacy through its structured scaling model and defined payout process.

Over 30,000 traders from 130 countries trust the process here, with payouts surpassing $12 million.

This sets FTUK apart in my book, but what can it really do?

>> Trade Smarter With FTUK Now <<

FTUK Programs Explained

FTUK doesn’t force everyone into the same funding path, which is a big part of its appeal.

Here are the available programs you can jump into when you sign up:

Instant Funding (Forex)

After signing up, you’re given a funded account right away, with predefined risk limits that protect the account while still allowing freedom in execution.

There are no profit targets to hit before earning, which shifts the focus entirely to consistency and drawdown management.

You’ll only want to step in here if you have a trusted approach, since evaluations serve just as much to test your own strategy.

The instant funding route is often seen as the fastest way to start building a payout history and working toward larger capital through FTUK’s scaling structure.

One-Step Challenge (Forex)

Instead of multiple phases, there’s a single profit objective paired with clear daily and trailing drawdown rules.

This reduces complexity and keeps expectations easy to understand from the start. For me, it serves as a balance between cost, setup, and speed.

You still need to demonstrate discipline, but the path to a funded account is shorter and more direct than classic two-phase challenges.

The one-step challenge offers a practical middle ground between instant funding and longer evaluations without unnecessary layers.

Two-Step Challenge (Forex)

The two-step challenge follows a more conventional progression, designed for anyone who prefers a measured, methodical path.

Phase one focuses on profitability, while phase two emphasizes consistency and risk control.

With a slightly lighter climb, there’s a bit less resistance to pass each test while developing a strategy along the way.

It’s often attractive if you don’t mind taking longer to qualify, knowing that you’re laying a solid foundation as you go.

The two-step model also helps develop habits that translate well once funded, which is why many see it as a solid foundation for long-term scaling within FTUK.

>> Get Funded Capital Through FTUK <<

Futures Programs (SIM / Instant SIM Funding)

FTUK’s futures program may speak to you if you specialize in futures markets and want a prop firm that understands your needs.

These accounts operate in a simulated environment, with rules tailored to futures trading realities.

SIM funding allows you to prove consistency before unlocking larger opportunities, while instant SIM funding accelerates that process for those with confidence in their execution.

There are no challenges or phases to jump through, and you can actually remove daily drawdown limits to make risk less rigid.

I’ve never seen an option like this in a prop firm before, so get excited if futures is your jam.

Quick “Which Program Fits You?”

- Instant Funding: Experienced, fast-paced styles

- One-Step: Simple evaluation with lower upfront cost

- Two-Step: Structured, methodical progression

- Futures SIM: Futures-focused, rule-driven execution

How Does FTUK Work?

FTUK is designed to be straightforward from the moment you land on the platform.

They open the door to numerous programs, so it’s easy to build an account based on how you like to trade.

Each step is intentional, giving you control while still keeping risk parameters clear and consistent.

Select Your Account Type

FTUK separates these clearly, so you’re not guessing which rules apply once you’re live.

Select Your Program

Next, you choose how you want to get funded. FTUK offers instant funding and evaluation-based options, letting you decide whether speed or a lower entry cost matters more.

This flexibility is one of the main reasons I gravitate toward the firm.

Choose Your Trading Capital

Account size comes next, with multiple capital tiers available. Larger accounts offer more earning potential, while smaller ones allow you to start with a lower upfront commitment.

Risk limits scale logically with the account size, keeping expectations realistic.

Tailor Your Account Features

Depending on the program, FTUK allows you to customize certain account parameters, such as leverage or specific add-ons.

These options are meant to align the account more closely with your trading style without complicating the setup.

Pick Your Platform

Finally, you select your preferred trading platform. FTUK supports several well-known platforms such as MatchTrader and Tradelocker, which reduces the learning curve and lets you trade in an environment you’re already comfortable with.

Once that’s done, you’re ready to start trading under FTUK’s framework.

>> Scale Faster With FTUK Programs <<

FTUK Review: All The Core Features Explained

These features help FTUK rise above other drop trading firms out there:

Built and Designed to Scale Fast

The FTUK team sets up their platform with long-term growth in mind rather than short-term challenges.

It does so through a defined scaling framework that rewards consistency instead of one-off performance.

As accounts remain profitable and you respect the rules, you can grow the capital you have to work with over time.

This appeals if you want more than a single payout and are focused on building something repeatable rather than constantly restarting evaluations.

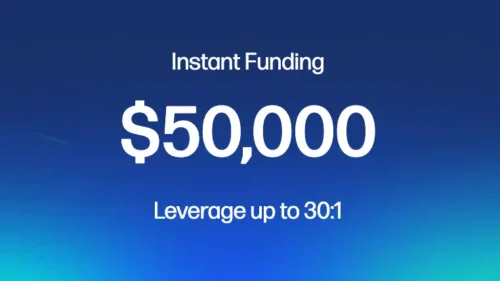

Instant Funding Program

The instant funding program allows you to skip evaluations entirely and start trading a funded account immediately.

Instead of profit targets, the focus shifts to managing drawdown and staying consistent.

It cuts through the crap so to speak, allowing you to bet your strategy against the system.

There’s no safety net here, but it’s the quickest route to payouts if you trust what you’re doing.

>> Try FTUK’s Instant Funding Option <<

No Max Lot Sizes

FTUK does not impose fixed maximum lot sizes, which gives plenty of flexibility in position sizing.

Because of this, FTUK controls risk through drawdown limits instead.

This setup works well if you scale positions dynamically or adjust size based on market conditions while still ensuring overall account protection intact.

On-Demand Payouts

Once you meet payout conditions, it’s possible to request withdrawals without unnecessary delays.

This structure improves cash flow and gives more control over when you access profits, which is a common frustration with older prop firm models.

No News Restrictions

FTUK allows trading during major news events, which is surprisingly something I see few prop trading firms do.

This means you can play off volatility or hold through reports or releases that can drive up share prices.

While risk management still applies, the absence of news restrictions removes a major limitation found at many prop firms and gives you more freedom in execution.

No Stop Losses

Stop losses are not mandatory at FTUK. Instead, the firm enforces risk through overall drawdown rules.

This gives you flexibility in how to manage trades, especially if you use manual exits, hedging, or alternative risk techniques.

Responsibility still lies with the trader to control risk effectively.

Fast Average Payout Time

FTUK promotes fast payout processing once it approves a withdrawal request.While exact timing can vary, the firm appears to pay out faster then industry average based on my experience.

Faster payouts build trust and reduce the feeling that you’ll never see profits through red tape, which is a common concern in this space.

Up to 80% Profit Split

It’s not the highest profit split I’ve seen, but it’s still a meaningful share of the pot for the work you put in.

As accounts grow, the payout structure becomes more attractive for consistent performers.

>> Access Flexible Funding With FTUK <<

Multiple Platforms Supported

This reduces friction during onboarding and avoids forcing users to adapt to unfamiliar software.

Futures trading happens on the prop firm’s proprietary FTUK XT platform, built to meld seamlessly with the overarching structure.

Platform choice is especially valuable if you rely on specific tools, interfaces, or execution styles.

Globally Trusted Brand

The website, support, and platforms are designed for traders across regions, which adds credibility.

A broad footprint also suggests operational stability, as the firm supports participants in multiple markets.

Vibrant Discord Community

While not a substitute for official support, this environment helps users feel connected and informed, especially during the early stages of their accounts.

>> Choose FTUK For Faster Payouts <<

Pros and Cons

I’ve spent some time with FTUK, and these are the pros and cons I came up with:

Pros

- Multiple funding paths available

- Instant funding option

- Flexible trading rules

- Fast payouts

- Strong scaling potential

- Forux and futures supported

Cons

- No refunds once purchased

- Rules still require discipline

Refund & Cancellation Policy

Refund & Cancellation Policy

FTUK’s refund and cancellation policy is clearly defined and consistent across all of its programs.

Once you purchase an account and gain access, the fee becomes non-refundable.

This applies whether you choose instant funding, a one-step challenge, or a two-step evaluation.

The firm explains this policy by pointing to immediate access to trading platforms, simulated capital, and backend infrastructure, all of which incur real costs from the moment an account goes live.

It is possible to earn a refund with both the one- and two-step evaluations, adding an incentive should you pass them.

>> Build Funded Accounts With FTUK <<

FTUK vs Popular Alternatives

When people compare FTUK with other prop firms, the differences usually come down to flexibility, speed to funding, and rule strictness.

Here’s how FTUK stacks up against three of the most commonly considered alternatives.

FTUK vs FTMO

FTMO is widely respected for its structure and consistency, but it remains firmly rooted in a challenge-only model with strict risk parameters.

You have to pass a two-step evaluation and follow tight rules around drawdowns and execution.

FTUK takes a more flexible approach by offering instant funding alongside challenges, fewer restrictions on trade management, and faster access to payouts.

FTMO suits traders who thrive under rigid frameworks, while FTUK appeals more to those who want freedom and speed without unnecessary constraints.

FTUK vs FundedNext

FundedNext offers a variety of challenge models and competitive pricing, making it attractive to budget-conscious traders.

However, its structure still leans heavily on evaluations and predefined trading conditions.

FTUK differentiates itself through instant funding options, broader platform support, and looser rules around news trading and stop losses.

Traders choosing FTUK are often prioritizing flexibility and customization over the lowest possible entry fee.

FTUK vs The5ers

The5ers is known for its conservative risk approach and long-term growth focus. Its programs reward patience and low drawdown trading, but progression can feel slow.

FTUK offers a more accelerated path with higher profit splits earlier and a clearer emphasis on scaling capital quickly.

Anyone valuing strict risk control may prefer The5ers, while those looking for faster momentum often lean toward FTUK.

Overall, FTUK stands out by giving more choice in how to get funded and trade rather than forcing everyone into the same mold.

>> Trade With Freedom Using FTUK <<

How Much Does FTUK Cost?

FTUK’s pricing is built around flexibility, which means the cost varies significantly based on the path you choose and the account size you take.

You’re paying a one-time fee for access to either an instant funded account or a challenge program, with prices broadly ranging from roughly $119 up to around $1,499.

For example, a $50,000 Instant Funding account costs about $749 at standard pricing, while higher-tier accounts scale up toward the upper end of the range.

Instant funding plans tend to be more expensive because they give you immediate access to a funded account without any evaluation.

Challenge-based programs, one-step or two-step, are generally cheaper, as they require you to meet profit targets before unlocking payouts.

You can also apply promotional codes at checkout to reduce fees and sometimes unlock add-ons like weekly payouts or extended risk limits.

Who Is FTUK Best For?

FTUK is best suited for disciplined traders who already have a defined approach and want more control over how they trade.

It appeals strongly to those who value flexible rules, whether that means trading news, managing positions without forced stop losses, or scaling size dynamically.

There are some excellent instant funded options here if you’re looking for quick access to profits, something not all firms allow.

It also works well for those thinking long-term, since the scaling structure rewards consistency rather than one-off performance.

On the other hand, FTUK may not be ideal for complete beginners who are still experimenting or for anyone expecting guaranteed outcomes.

The firm assumes you understand risk and are comfortable operating within defined drawdown limits.

>> Join FTUK And Scale Your Trading <<

Is FTUK Worth It?

FTUK is certainly worth it for what it offers, but you’ll need to keep expectations in line.

If you’re looking for the cheapest entry point or a casual environment to experiment, FTUK may feel like more of a commitment than you need. Where it shines is in flexibility, speed, and long-term potential.

Instant funding, fewer trading restrictions, on-demand payouts, and a clear scaling structure all point to a firm built for traders who already take their process seriously.

My FTUK review makes one thing clear: the firm isn’t trying to promise easy money.

Instead, it offers a cleaner, more efficient route to funded capital for those who can manage risk and follow rules.

The range of entry points and fees keep the door open for traders at just about any financial stage, delivering just the portion size you need for your current appetite.

FTUK FAQs

Is FTUK real or simulated capital?

FTUK provides simulated trading capital, but profits earned under the rules are paid out in real money once payout conditions are met.

How quickly can I withdraw profits from FTUK?

Eligible accounts can request payouts on demand, with processing times typically much faster than traditional prop firms once requirements are satisfied.

Does FTUK allow news trading and flexible strategies?

Yes, FTUK allows news trading and flexible trade management, provided overall drawdown rules and risk limits are respected at all times.

Can I scale my account size with FTUK?

FTUK offers a structured scaling plan that increases account size over time for traders who remain profitable and consistently follow risk rules.

Tags:

Tags: