If you’ve been searching for a smarter way to invest for your family without all the financial clutter, FutureMoney might be exactly what you need.

This investment app takes a fresh approach to building long-term wealth with tax-efficient tools designed for parents, couples, and kids.

In this FutureMoney review, I’ll break down everything you should know before getting started.

>> Start investing today with FutureMoney <<

What is FutureMoney?

FutureMoney is a modern investment app built around one idea: making it simple for families to build lasting wealth together.

At its core, it’s a goal-based platform designed to help you invest for your child, your partner, or even yourself, all with powerful tax advantages baked in.

Whether you’re starting a Junior Roth IRA for your newborn or setting up a shared investing goal with your partner, FutureMoney brings everything under one roof.

It’s especially appealing if you’ve struggled to find an investing tool that feels built for your life stage. Parents can automate savings, relatives can chip in with ease, and couples can grow toward shared milestones.

And while it’s beginner-friendly, it still offers smart investing tools and SIPC protection to keep your money secure.

If you want a hands-off, low-stress way to invest for the future, FutureMoney delivers just that, without the noise.

>> Join FutureMoney and secure your family’s future <<

Who is Behind FutureMoney?

FutureMoney was created by Philip Barrar, a fintech founder known for his work in several startups.

His journey began with a Bachelor of Commerce and Management from Concordia University, giving Barrar the tools needed to be a successful entrepreneur.

Those skills came to fruition when Philip founded Moka (formerly Mylo) in 2016, growing it into a major financial tracking and investing app.

He sold the company to Mogo in 2021 for nearly $64 million CAD, which was a testament to his hard work.

Barrar takes this same skillset for growing a business well into FutureMoney, continuing his desire to help people and families build wealth with the right tools.

Who is FutureMoney For?

FutureMoney: Parents & Future Parents

FutureMoney was clearly built with parents in mind. One of its standout offerings is the Junior Roth IRA™, which allows you to invest up to $35,000 on behalf of your child with no earned income requirement.

That means even infants can have retirement savings growing tax-free. It starts as a 529 plan and eventually converts into a Roth IRA when the child comes of age.

This feature alone offers massive tax advantages that most parents don’t even realize they can access, starting kids out on the right foot early on.

Parents can also pursue traditional 529 plans for future education expenses or even general investing accounts that come without restrictions.

There’s even a Custodial Roth IRA option, which works well for parents who pay their kids for household jobs using FutureMoney’s Household EIN setup.

Add in goal-based planning tools for everything from college to a first home, and it’s easy to see why this platform stands out for parents thinking long term.

FutureMoney: Gifters

This is where FutureMoney gets creative. Grandparents, godparents, and even family friends can contribute directly to a child’s investment goals through personalized gifting links.

What makes this even better is that gifters can actually track how their money is helping.

Whether it’s for a future college fund, a car, or even retirement, they get to see progress toward real milestones.

It turns what would normally be a one-time gift into a long-term contribution to someone’s future, and that’s a big deal.

FutureMoney: Couples

FutureMoney doesn’t just focus on kids. If you’re in a relationship and saving toward something big, a house, a wedding, or even early retirement, the platform offers joint investment accounts to keep you on track together.

Couples can set shared goals, automate deposits, and monitor progress in real time. It’s designed to reduce the friction that comes with combining finances and makes it easier to talk about money.

Each partner can contribute at their own pace while still working toward a common objective.

It’s the kind of financial teamwork that a lot of apps overlook, but FutureMoney makes it seamless.

FutureMoney: FutureMoney: General Investors

Not a parent or a couple? You’re still covered. FutureMoney offers traditional and Roth IRAs, as well as general investing accounts that suit solo investors.

If you’re someone who wants to build wealth steadily, but without the noise of stock picking or market timing, there’s still plenty of value here.

Everything is built on passive, index-based investing and automated contributions, which means your portfolio runs in the background while you focus on other things.

Even if you’re just getting started, you can set up multiple goals, like saving for a home, education, or travel, and assign different investment plans to each one. It’s goal-based investing without the confusion.

>> Open your Junior Roth IRA™ today <<

FutureMoney Review: All Core Features Breakdown

FutureMoney isn’t just about making investing easier; it’s about making it more intentional, especially for families.

The platform offers some truly unique tools that make long-term wealth-building more accessible, even if you’re just getting started. Here’s a deeper look at its standout features.

Junior Roth IRA™

The Junior Roth IRA™ is one of FutureMoney’s most compelling features. It allows parents to invest up to $35,000 for their child, completely tax-free, without the child needing any earned income.

This is a huge deal, because most Roth IRAs require the beneficiary to have income from a job to start investing. FutureMoney bypasses that by starting the account as a 529 college savings plan, which later rolls over into a Roth IRA when the child reaches adulthood.

Not only does the money grow tax-free, but it can also be withdrawn tax-free in retirement, a rare combo.

One thing that makes this even more powerful is its favorable treatment under the FAFSA financial aid system.

Because assets owned by the student reduce a student’s financial aid to the greatest degree, the Junior Roth IRA can be a smart workaround. The parent is the account owner, which reduces FAFSA impact initially, and once the assets rollover to the Roth IRA, they are excluded from FAFSA calculations.

Contributions don’t count against FAFSA in the same way as they would for other accounts like UTMA/UGMA that are owned directly by the child, making it a great tool for families thinking ahead.

The platform also automates the entire process. You choose the goal, automate the contributions, and FutureMoney handles the investment management through low-cost index funds.

No confusing paperwork, no account hopping, and no need to master complex tax rules. It’s all rolled into one streamlined solution.

Custodial Roth IRA

If your child has earned income, even from small household jobs, you can open a Custodial Roth IRA on their behalf.

However, most parents don’t know how to document that income in a way that satisfies IRS rules.

FutureMoney offers a creative solution: a Household EIN feature that allows you to act as an employer for your child, making the earned income legitimate in the eyes of the IRS.

With this setup, your kid can do age-appropriate chores or work in a family business, and you can pay them through FutureMoney’s platform.

Those earnings are then eligible for Roth IRA contributions. This gives your child a head start on tax-free retirement savings while teaching them real-world money skills early on.

The service includes tools to track and log work hours, payments, and even create simple job descriptions, all designed to keep things compliant.

The Custodial Roth IRA is currently available only in select states, but it’s expanding. For families who want to reward their child’s effort with long-term financial growth, this feature is hard to beat.

FutureMoney rethinks how family and friends contribute to a child’s future. Instead of giving a toy or a check for birthdays and holidays, gifters can contribute directly to a child’s investment account.

With a personalized gifting link, anyone can send a monetary gift that goes straight toward a child’s financial goal, whether it’s education, a first car, or long-term savings.

Even better, contributors can track the impact of their gifts over time, which adds a rewarding, long-term layer to the experience.

This feature is especially helpful for extended families. Grandparents can be involved in meaningful ways. Godparents, aunts, and uncles can give smarter gifts.

It turns occasional generosity into a structured plan for generational wealth. It also opens the door to bigger conversations around money, goals, and values at a young age, without being preachy or complicated.

529 Plan

FutureMoney integrates traditional 529 college savings plans in a seamless, modern way. Parents can open a 529 through the platform to save for education expenses while benefiting from potential state tax advantages.

What makes this approach unique is the ability to roll 529 assets into a Junior Roth IRA™ down the line, meaning if your child doesn’t use all their education funds, the remaining balance can continue growing tax-free for retirement.

This flexibility eliminates one of the biggest downsides of traditional 529s, where unused funds often incur penalties. It’s a smarter, more adaptable way to prepare for both college and long-term financial security.

Traditional IRAs

Beyond its child-focused tools, FutureMoney also supports Traditional IRAs for adults who want to manage their own tax-deferred retirement savings.

These accounts follow the standard contribution limits and IRS rules but come with the same automation and goal-tracking that make the platform so easy to use.

Whether you’re just starting to save or rolling over an old retirement account, FutureMoney ensures your investments align with your timeline and risk profile.

It’s ideal for users who prefer a simple, transparent way to manage retirement contributions alongside family investing.

General Investing Accounts

For those who want maximum flexibility, FutureMoney’s general investing accounts provide a non-retirement option with no withdrawal restrictions.

These accounts are perfect for medium-term goals like a down payment, wedding, or major purchase. They still benefit from automated investing, low-cost ETFs, and tax optimization strategies built into the platform.

You can set multiple goals within one profile and watch each grow over time. It’s practical, easy to manage, and an excellent complement to the platform’s tax-advantaged accounts.

>> Get started free with FutureMoney <<

How FutureMoney Invests

The way FutureMoney handles investing is refreshingly simple yet surprisingly effective.

Its philosophy centers around low-cost, automated, and diversified portfolios that align with long-term goals.

Here’s how each part of its investment approach works in practice.

Index Fund-Based Portfolios

FutureMoney doesn’t chase hot stocks or market trends. Instead, it uses index funds, the same kind of broadly diversified investments favored by top financial advisors.

You can tailor these accounts to meet your investment goals based on your risk tolerance and goals.

The platform then automatically selects a mix of funds that align with your timeline and investment profile.

This not only minimizes costs but also reduces risk through diversification.

By avoiding individual stock picks, FutureMoney makes investing predictable and easier to stick with.

It’s a strategy backed by decades of market research, and it forms the backbone of every goal you set on the app.

Automatic Dividend Reinvestment

Whenever your investments earn dividends, FutureMoney doesn’t just let them sit in cash. Instead, those dividends are automatically reinvested back into your portfolio. This compounding effect can add significant value over time.

For long-term mindsets, especially kids with decades ahead of them, this means their money keeps working harder behind the scenes.

Reinvestment helps you stay fully invested and prevents cash drag, which can slow down your returns. Best of all, this happens entirely in the background without you lifting a finger.

Regular Rebalancing

Markets shift. Some assets grow faster than others, which can throw your portfolio out of balance. FutureMoney monitors this for you and automatically rebalances your holdings as needed.

This means it adjusts your investments to keep them aligned with your risk profile and timeline. You don’t need to worry about overexposure to stocks during a market rally or being too conservative too early.

It’s a system that prioritizes consistency over hype, helping your money stay on track toward its long-term purpose.

This kind of disciplined investing is what separates successful savers from anxious market watchers.

>> Create your child’s future—sign up today <<

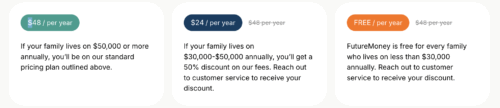

FutureMoney: Pricing & Fee Structure

FutureMoney accounts over $20,000 pay a 0.25% management fee, while accounts below this asset level pay an initial 2% management fee by default, and can change at any time to a flat subscription fee model..

For accounts under $20,000 opting in for the flat subscription fee model, pricing is tiered by household income: families earning $50,000 or more pay $5 per month or $48 annually; families between $30,000 and $50,000 pay $2 per month (50% discount); and families under $30,000 pay $0 per month.

This makes the service accessible even if you’re just getting started or your budget is tight.

Importantly, there are no per‑account charges: access to the Junior Roth IRA™, Custodial Roth IRA, 529s, general investing, and joint accounts is included across plans, and there’s no upsell wall for core features.

The value proposition is straightforward, with transparent fees, full feature access, and a clear path from starter balances to larger portfolios.

Pros and Cons

After exploring what FutureMoney has to offer, here are my top pros and cons for the service:

Pros

- Plans for folks at different stages of life

- Junior Roth IRA with no earned income requirement

- Custodial Roth IRA with Household EIN option

- SIPC-insured and Altruist custody

- Supports gifting and shared goals

- Index-based, passive investing

- Accessible pricing with income-based discounts

Cons

- No custom investment choices

- Still a newer platform with limited performance data

Is FutureMoney Safe and Legit?

FutureMoney operates with the kind of transparency and compliance you’d expect from a serious financial platform.

The company holds all accounts through Altruist, one of the most trusted custodians in the world, ensuring assets are secure and properly managed.

In addition, accounts are SIPC insured for up to $500,000, which protects against broker failure (though not against market losses).

FutureMoney is an SEC-registered Investment Advisor across all 50 states. From a regulatory and operational standpoint, FutureMoney checks all the right boxes.

The company clearly outlines risks and disclosures on its website, avoids hidden fees, and provides direct access to customer support through its app and website.

These safeguards, combined with its partnerships with established financial institutions, make it as legitimate as any major robo-advisor on the market.

Is FutureMoney Worth It? (My Verdict)

After exploring its tools, pricing, and safety, this FutureMoney review makes one thing clear: it’s one of the few platforms built specifically to help families invest together without unnecessary complexity.

For parents, the ability to open a Junior Roth IRA™ or Custodial Roth IRA gives their child a financial head start that most kids never get.

The automated investing strategy and gifting options make it easier for relatives to contribute meaningfully to a child’s future rather than giving one-time cash gifts that lose value over time.

For couples, FutureMoney serves as a joint wealth-building hub that takes the stress out of long-term planning.

The user experience is clean, the pricing is fair, and the security structure is on par with top-tier financial platforms.

While it’s not designed for active traders or anyone chasing short-term market trends, it’s perfect for people who value consistency and want a reliable way to grow wealth over decades.

Overall, FutureMoney stands out because it’s intentional about who it serves, families, not day traders.

Its simplicity, transparency, and thoughtful design make it a smart choice for anyone serious about building generational wealth the right way.

.jpg)

.png)

Tags:

Tags: