Love him or not, Elon Musk has created some profitable businesses that either stayed private or have already seen explosive stock growth.

While those opportunities are gone, Addison Wiggin believes there’s a rising star he’s calling the next Elon Musk that could give us another shot at fortune.

Who is this figure, and what does he have in the works?

In this Grey Swan Bulletin review, I take a closer look at whether any of this is worth paying attention to.

What is the Grey Swan Bulletin?

Grey Swan Bulletin is a relatively new research service built around the concept of a grey swan: events unlikely to occur that make a huge impact when they actually do.

Edited by Addison Wiggin, the bulletin focuses on large-scale shifts already in motion, especially those backed by policy decisions and long-term funding commitments.

Instead of reacting to headlines or short-term price moves, the service looks at where money is steadily flowing and what that could mean several steps down the line.

Members receive ongoing research that connects the dots between government priorities, emerging technologies, and the public companies positioned to benefit indirectly.

There are a series of other goodies sprinkled in to offer more flavor, like weekly Zoom chats and frequent updates.

I’ll get much more into that shortly, but first I want to understand a bit more about our guru.

>> Sign up now and save 66%! <<

Who is Addison Wiggin?

Addison Wiggin is the founding director of the Grey Swan Investment Fraternity and has been active in the financial scene for more than three decades.

Early on, he co-founded The Daily Reckoning with Bill Bonner, widely recognized as the longest-running financial newsletter on the internet.

His focus then shifted to another startup called Agora Financial, where Wiggin served as executive publisher for nearly 20 years.

Agora and its spinoff publications are highly lauded, encompassing over 1.2 million readers.

Wiggin has never been afraid to stand against mainstream thinking, making his numerous victories and predictions stand out that much more.

As a writer and publisher, Addison has penned three New York Times best-selling books on various financial topics.

Now, Wiggin focuses his time and energy on helping his Grey Swan Investment Fraternity readers survive and thrive in our current economic climate.

Is Addison Wiggin Legit?

There’s little doubt that Addison Wiggin is legit.

On top of his three best-selling works, he’s made multiple appearances on CNN, Fox Business, ABC News, and more for his unique insights.

He’s made several eerily accurate predictions over the years that shook the financial world to its core, such as the DotCom crash, the 2008 crisis, the rise of Bitcoin, and even the global pandemic.

Most recently, he anticipated President Biden dropping out of the presidential race and the ramifications such a move would have.

His ability to forecast has allowed Wiggin to work with other greats of our time, including Ron Paul, Steve Forbes, Alan Greenspan, and the legendary Warren Buffett.

>> Get Wiggin’s latest insights and forecasts now! <<

Is the Grey Swan Investment Fraternity Legit?

The Grey Swan Investment Fraternity dates back to the late 1930s when writers of the day predicted Hitler’s invasion of Poland two years before the event took place.

Over the next 80 years, the platform was ahead of major global events from the fall of the Berlin Wall to the dotcom bubble burst and the landscape of this year’s U.S. presidential election.

It finally opened its doors to the public in July of this year, marking the first time every day Americans can anticipate grey swans before they take place.

What Is Addison Wiggin’s “Next Elon Musk” Presentation About?

Addison Wiggin believes the United States is already in the middle of a major defense transformation, even if most people don’t realize it yet.

Our “next Elon Musk” is right in the heart of it all, using ingenuity like nothing I’ve ever seen to shape our government’s defense landscape for the future.

He’s setting out to rewrite a multi-trillion-dollar market, and that’s something I want to be along for the ride on.

Color me intrigued, but I definitely need more information to see how this is going to play out.

>> Access Addison’s latest predictions <<

Looking Through the Eyes of an Entrepreneur

Spoiler alert: Addison’s big defense guru is a man by the name of Palmer Luckey.

Maybe you’ve heard of him, maybe you haven’t. He’s actually the brain behind the Oculus VR device that he funded, designed, and then sold to Meta for a mere $2.4 billion.

I would have walked away at that point, but I am not Palmer Luckey.

He went back to the drawing board and set out to build a defense network through his company Anduril.

The tech they’re working on is pretty mind-blowing. Autonomous air vehicles, unmanned helicopters, drones, and a helmet that serves as a mobile command center.

If even one of these advanced technologies take off (perhaps literally), there could be a ton of money here.

Reading Between the Lines

Zero in on this with me for a minute – the defense sector throws a lot of cash around, but it’s not the only industry with potential windfalls from Palmer’s progress.

Luckey is also tapping into artificial intelligence with his tech, effectively doubling the potential reach of his products.

As great as Anduril is shaping up to be, though, Wiggin is certain our chance at the biggest returns won’t come from there.

Transformative companies like these never operate alone – they rely on a specific set of partners to develop components and meet deadlines from contracts.

I’ve seen it happen countless times with Elon’s companies (and even benefited from a few myself, so I know this thought process works.

How to Profit From the Next Elon

Anduril is not a public company, and by the time it ever gets there, Wiggin thinks it’ll be too late to reap the rewards of the early stage it’s in now.

Many of these partners, however, are readily accessible on major exchanges even now.

That, at least according to Addison, is the sweet spot to pursue right now.

While we have no idea what these companies are, Wiggin says he has the inside scoop.

Even better, he’s sharing his research with members of his Gray Swan Bulletin right now.

Next, I’ll dive into the service and show you what all comes with it.

>> Get Addison’s solutions to protect your wealth <<

Grey Swan Bulletin Review: What Comes With the Offer?

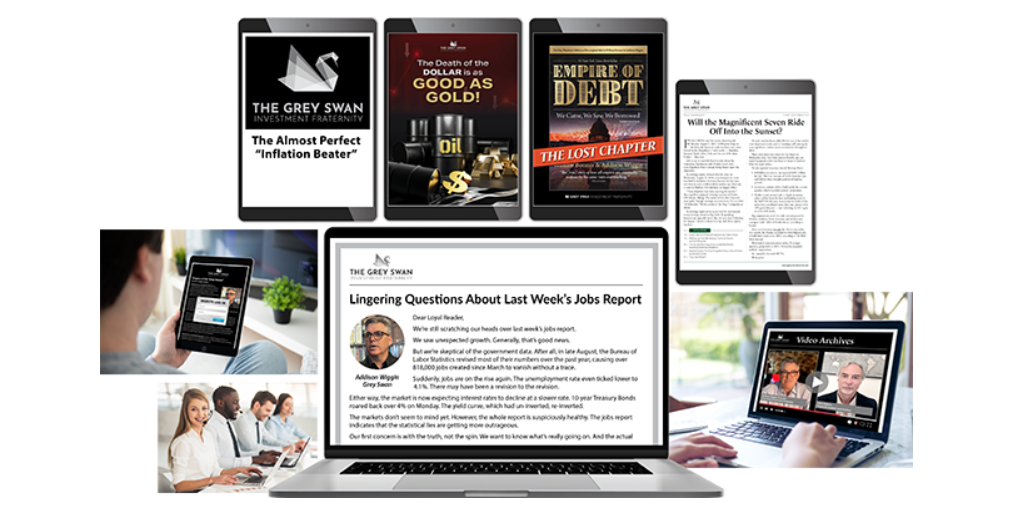

Joining Grey Swan Bulletin isn’t about receiving a single idea and being left on your own.

The service is structured to keep readers informed, supported, and engaged as major themes develop over time.

Monthly Grey Swan Bulletin Newsletter

The monthly Grey Swan Bulletin newsletter is the backbone of the service.

Each issue focuses on a specific, real-world disruption that is already unfolding but not yet fully reflected in market behavior.

Looking at some of the list, there are definitely names you won’t find in the Wall Street Journal or Economist.

Since they’re not obvious picks, they often create unusual opportunities for large returns.

While Parker and his projects revolve around defense, the newsletter does not.

You’ll find topics from whatever sector has the biggest pull, including areas like commodities that don’t always end up on the radar.

Grey Swan Live!

Grey Swan Live! adds a more immediate and personal layer to the experience.

These sessions give you direct access to ongoing commentary around current events, macro shifts, and developing opportunities tied to the Grey Swan framework.

Instead of waiting for the next monthly issue, you can directly listen to timely insights as conditions change.

The tone is explanatory rather than urgent, which helps clarify how new information fits into the bigger picture.

It serves well to bridge the gap between long-term research and real-world headlines, making it easier to stay oriented without feeling overwhelmed by constant noise.

>> Save 66% when you sign up now! <<

Access to the Wisdom of Top Income, Momentum, Commodity, and Crisis Investors

Consider this your secret invitation into a world of the sharpest minds in finance.

These gurus specialize in income strategies, momentum trends, commodities, and crisis-driven markets, and you get to sit in on the discussion.

I’ve seen new predictions, some stock recommendations, and tips that can help steer investment moves that are above and beyond the newsletter.

Having this extra content can be especially valuable during uncertain periods, helping visualize how one trend may affect multiple areas of the market rather than existing in isolation.

Regular E-mail Updates

Between newsletters and live sessions, regular email updates help keep members informed as developments unfold.

These snippets are designed to highlight what has changed, why it matters, and whether it alters the broader outlook.

They aren’t constant alerts or day-to-day market chatter. Instead, they act as checkpoints, keeping readers aligned with the research as new data emerges.

I love having these so I can stay informed without having to monitor the markets all day.

>> Get the full scoop on the inflation beater <<

The Edge

The Edge is where shorter, focused insights live.

It often addresses timely observations, connections between events, or second-order effects that don’t require a full newsletter issue.

I find this useful for sharpening my understanding of goings-on without adding complexity. Think of it as commentary that helps refine how to view a situation instead of just mentioning what to do.

Over time, The Edge helps develop a more intuitive sense of how Grey Swan events tend to evolve.

The Daily Catalogue

The Daily Catalogue serves as a curated stream of relevant ideas, commentary, and external perspectives tied to the service’s core themes.

Instead of searching endlessly for quality information, members are presented with material already filtered through the Grey Swan lens.

This saves time and reduces distraction while still encouraging independent thinking.

It’s particularly helpful if you enjoy staying informed but prefer guidance on what’s worth your attention.

A Robust Customer Care Team

Behind the research is a dedicated customer care team focused on access and usability.

Whether it’s help navigating the members’ area, resolving account questions, or clarifying how to find specific content, support is readily available.

This may seem secondary, but it plays a meaningful role in the overall experience, especially for folks like me who want frictionless access to everything included.

Members-Only Website Access

All features are housed in a secure, members-only section of the website.

This portal keeps newsletters, updates, live content, and archived materials organized and easy to revisit.

I’m an organized guy, and stuff like this makes me really happy. Some services are on the struggle bus when it comes to sharing content, but that’s not the issue here.

>> Get all these features and reports now! <<

Grey Swan Bulletin Bonus Reports

Beyond the core research, Grey Swan Bulletin includes several bonus reports designed to expand on adjacent opportunities tied to the same macro forces:

Bonus Report #1: How to 10X Your Money with the Secret Suppliers of Anduril

Bonus Report #1: How to 10X Your Money with the Secret Suppliers of Anduril

This is the centerpiece bonus and the one most closely aligned with the core Grey Swan thesis.

The report digs deeper into how modern defense platforms are actually built, shifting attention away from the headline company and toward the lesser-known public firms that make these systems work.

It explains why companies supplying networking hardware, specialized components, and critical infrastructure often experience sustained growth once long-term government contracts kick in.

What stands out is how the report connects historical supplier success stories to the current defense cycle, which plants this firmly in reality for me.

The focus is on positioning early, before supplier relationships become widely recognized and fully priced into the market.

Bonus Report #2: The Stablecoin Profit Report

Bonus Report #2: The Stablecoin Profit Report

The Stablecoin Profit Report explores a very different sector through the same Grey Swan lens.

Instead of defense, the focus here is on digital dollars and the growing role stablecoins play in global finance.

The report explains why governments, financial institutions, and large corporations are increasingly relying on stablecoins for settlement, liquidity, and cross-border transactions.

Even if you’re still uncertain about the space, Wiggin does a nice job of explaining why this is worth a closer look.

It’s a ground-floor way to benefit from specific parts of the market that support issuance, custody, and transaction flow, offering another example of how visible adoption can still be underappreciated.

Bonus Report #3: Trump’s $102 Billion Backdoor Deal

Bonus Report #3: Trump’s $102 Billion Backdoor Deal

Here, Addison centers on a major government-driven technology initiative tied to Washington’s expanding digital infrastructure.

The guide outlines how a single tech firm is positioned to play an outsized role inside one of the most powerful federal agencies, backed by massive funding commitments that stretch years into the future.

The emphasis isn’t on politics, but on incentives. When budgets reach this scale, they tend to reshape entire markets around them.

By the time you put it down, you’ll have a better understanding of why this type of arrangement can create durable revenue streams and why companies embedded early often gain advantages that competitors struggle to replicate later.

Refund Policy

Refund Policy

Grey Swan Bulletin comes with a clear 30-day money-back guarantee, which gives you time to review the research without feeling rushed.

From the moment you join, you have a full month to explore the bulletin, bonus reports, and members-only resources.

If at any point during those 30 days you decide the service isn’t the right fit, you can request a full refund by contacting customer support.

There’s no need to justify your decision.

This policy allows you to evaluate the research calmly and decide whether the approach aligns with how you prefer to make decisions, even if it falls on the shorter side

>> Subscribe risk-free for 30 days <<

Pros and Cons of Grey Swan Bulletin

After a thorough review, here are my top pros and cons for Grey Swan Bulletin:

Pros

- Monthly Grey Swan Bulletin newsletter

- From the mind of a 30-year financial veteran

- Frequent impactful email updates

- Three bonus reports

- Includes the Daily Missive Letter at no extra charge

- Unique insights from the community of readers

- 30-day money-back guarantee

Cons

- No community chat/forum

- Offers some unusual strategies for gains

>> Join now and get 66% off! <<

Grey Swan Bulletin Track Record and Past Performance

Addison’s Grey Swan Bulletin promo doesn’t offer much on how the service performs. I’ve been able to see some things from the inside, but I can’t share those here

That said, Wiggin points to companies like Arista Networks, which rose roughly 3,800% over a decade as a critical supplier to Microsoft, or Skyworks Solutions, which returned more than 4,800% after becoming essential to Apple’s early iPhone ecosystem.

Cirrus Logic is another cited case, delivering over 4,000% by quietly supplying core components to major tech leaders.

These examples aren’t framed as promises, but as proof that the underlying strategy, following who supplies the disruption rather than chasing the headline name, has worked repeatedly across industries.

How Much Does Grey Swan Bulletin Cost?

Grey Swan Bulletin is currently offered with two straightforward membership options, depending on how much time you want to commit upfront.

The shorter option is a 3-month membership priced at $49, which works well if you want to explore the research style, themes, and ongoing updates before committing longer term.

This plan includes full access to the newsletter, bonus reports, live content, and the members-only area during the three-month period.

For those who prefer a longer runway, the 1-year membership is priced at $297.

While the price is higher, Addison throws in four additional secret bonus reports that you’ll have to discover on your own.

When it comes time to renew, you’ll get a bill for $99 for three additional months, which still fits the service well.

Is Addison Wiggin’s Grey Swan Bulletin Worth It?

If the idea of spotting the next Elon Musk–style opportunity before it becomes obvious appeals to you, Grey Swan Bulletin is worth serious consideration.

This service is built around understanding how large, visible shifts, especially those backed by government money, create winners behind the scenes.

In this Grey Swan Bulletin review, the real value comes from learning how to identify those moments early and focus on the companies quietly positioned to benefit.

Between monthly bulletins, access to financial experts, and the bonus reports, there’s plenty to sink your teeth into that you can digest as you have time.

The price is right whether you go short or long, and don’t forget about the 30-day trial period to fall back on.

If you’ve been looking for a way to recognize the next big story before it dominates headlines, this service offers a thoughtful, grounded way to do exactly that.

Tags:

Tags: