Joel Litman and Rob Spivey claim a massive economic reset is coming that could completely flip your finances on its head if you don’t prepare.

Are these gurus spot on in their assessment, or are they completely out in left field?

I investigate the answer and whether this service is worth your attention in this Hidden Alpha review.

>> Check Joel Litman’s Best Stock Picks Here <<

What is Hidden Alpha?

Hidden Alpha is a monthly newsletter and investment research service from Joel Litman and Rob Spivey. It’s published by Altimetry.

Joel has extensive experience as a forensic accountant, and he uses his skills to identify overlooked large-cap opportunities and market trends that could be on the path to breakout growth.

Subscribers receive these through the platform’s robust feature set, starting with its namesake newsletter.

Overview of the Hidden Alpha Newsletter

Each month, members receive a new recommendation backed by clear analysis, plus access to tools that help them understand the bigger picture.

The service also tracks an active model portfolio and provides timely alerts when market conditions shift.

Hidden Alpha speaks to me because it isn’t just about stock tips; it is about uncovering opportunities before they ever reach the mainstream news.

With credibility built through years of research for top institutions, the team now makes that same insight available to those of us looking to position ourselves for growth in sectors like energy and AI.

>> Sign up NOW and SAVE 84% <<

What Is “Alpha”?

Alpha is a term that describes the margin of difference between an investment’s performance and that of the overall market.

This metric basically quantifies how much a particular investment is outperforming the market as a whole. Typically, achieving alpha returns is the primary objective when investing.

Hidden Alpha gets its name from Joel and Rob’s ability to spot alpha opportunities that the market is overlooking using sophisticated forensic accounting analysis.

Is Hidden Alpha Legit or a Scam?

I’ve had the privilege of using Hidden Alpha for quite some time, and there’s nothing unscrupulous here.

The platform consists of a team of more than 100 financial analysts, accountants, and the like who specialize in locating these off-the-beaten-path opportunities.

While I won’t list them all here, some of the service’s biggest wins include Meta, Novawax, and AMD before they each enjoyed quadruple-digit gains.

Perhaps even more important are the big losses they’ve steered readers away from in 2008 and 2020.

The pièce de résistance, though, is the proprietary Altimeter system that filters promising picks in a way I’ve yet to see another service do.

Who Is Behind Hidden Alpha?

Let’s look a bit more closely at our gurus now:

Joel Litman

Joel Litman is the co-founder of Altimetry and serves as the Chief Investment Strategist of Hidden Alpha.

He is a Certified Public Accountant with a BS in Accounting from DePaul University and an MBA from Northwestern’s Kellogg School of Management.

In addition to his work with Hidden Alpha, Joel serves as the President and CEO of Valens Research. And he also sits on the board of directors at COL Financial Group, an Asian brokerage firm.

Over the years, Litman has consulted for global financial institutions, hedge funds, and even U.S. government agencies like the Pentagon and the FBI.

Joel’s also a member of the Association of Certified Fraud Examiners, a professional trade group focusing on forensic accounting.

Over the course of his career, he had stints at Credit Suisse, Diamond Tech Partners, Deloitte, American Express, and other prestigious institutions.

With decades of experience in forensic accounting and equity analysis, Litman has built a reputation for spotting hidden value in companies long before Wall Street catches on.

>> Get Joel’s current investment recommendations now! <<

Is Joel Litman Legit?

Joel Litman is as legit as they come.

His professional credentials are remarkable, and many prominent outlets have solicited him for his forensic accounting expertise.

Barron’s has quoted his work in the past, and he’s made appearances on CNBC. Forbes even interviewed him.

His research has been published in outlets such as Barron’s, Forbes, and Bloomberg, and he has co-authored books on accounting and valuation practices.

The guru has also taught courses at Harvard Business School and the Wharton School.

He has also worked as a Professor at Hult International Business School, which was named a top-ranked international MBA program by Financial Times and The Economist.

Few research services can claim to have such a prominent expert on their roster.

In short, Joel’s a respected voice on Wall Street with the experience, expertise, and skill you want to see in an analyst.

Rob Spivey?

Rob Spivey enters the picture as Alimetry’s Director of Research. His background as a chartered financial analyst really shines through here.

During his career, Spivey has held prominent positions at The Abernathy Group, Legacy Capital Management, and Credit Suisse.

The small financial “think tank” he founded has since grown to have offices all over the world.

His knowledge of how market trends unfold allows him to leverage both the buy-side and sell-side of finance to bring himself and his audience gains.

An avid podcaster, Spivey has also presented his wisdom at higher learning institutions around the country.

Is Rob Spivey Legit?

Yes. Spivey has built his career by producing research used by some of the biggest asset managers globally.

His team’s work has been trusted by firms like Fidelity and Vanguard, and he has contributed to analyses that shaped investment decisions worth billions.

Sought after for his skills, Spivey has appeared on CNBC and been quoted in Barron’s, Bloomberg, Forbes, and a slew of other publications.

He’s even presented at prestigious schools such as DePaul University and the HULT International Business School.

With a CFA designation, Wall Street experience, and a track record of market calls, Spivey has proven himself a credible voice in financial research.

What Type of Stocks Does Hidden Alpha Focus On?

Hidden Alpha shies away from smaller, more speculative plays in favor of large-cap stocks that somehow manage to stay under Wall Street’s radar.

These companies typically have the foundation I’d like to see, but come with the positioning and fundamentals to pave a path to much higher growth than anyone anticipates.

It’s like an incredible tourist destination that only gets a few visitors each year. Once the word gets out, the location will never be the same. Best to see it while you can.

I like this approach because it does away with the large amounts of risk small ventures can produce that seem just as likely to grow as collapse.

What Is Altimetry?

Altimetry is a leading research publisher and the company behind Hidden Alpha.

It also offers several additional services, including Microcap Confidential, High Alpha, The Altimeter, and more.

Altimetry puts sophisticated, professional-grade research into the hands of everyday folks. And the firm’s expertise gives members valuable market insight.

Its research team specializes in financial analysis and accounting, which helps them identify hidden gems on the stock market.

Altimetry’s approach offers an additional lens to distinguish genuine opportunity from market hype.

Numbers don’t lie, and the firm’s accounting-based approach has produced opportunities for enormous gains.

Now that you know the main beats, let’s take a look at Hidden Alpha‘s latest presentation.

>> Join now for 84% off TODAY <<

What is the “Deregulation Day” Presentation?

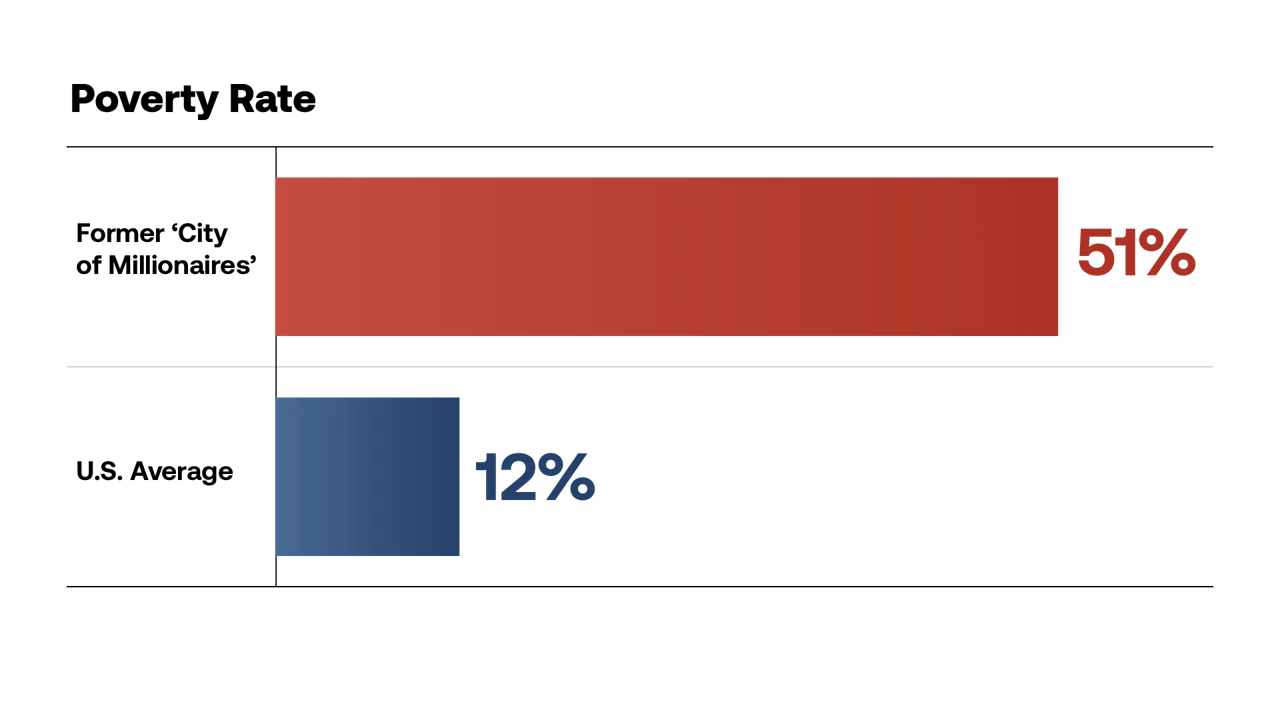

While America has been kind to a select few, many of us are feeling the effects of a failing system.

People can’t afford houses, the dollar’s purchasing power is in the tubes, and don’t even get me started on medical bills.

It’s still shocking news, even when you consider the fact that we’ve enjoyed a special place in history over the last 250 years.

Spivey believes we’ve simply been held back from enjoying the fruits that our country has to offer, but that’s all about to change.

With a big shift on the horizon, there are incredible new opportunities for wealth – if you know where to look.

Energy Under Lock and Key

You see, Spivey points out that America is sitting on vast reserves of oil, gas, and other natural resources, yet bureaucratic bottlenecks have kept much of it locked away.

He highlights how past deregulation waves, like those under Reagan, Bush, and Trump’s first term, created explosive gains for natural resource companies.

Local companies thrive when they can access what’s right under our feet, but it’s never that easy.

Unfortunately, the biggest bottleneck is an organization called the Federal Energy Regulatory Commission, or FERC.

The FERC keeps a lid on many of our biggest energy plays to the point where America is struggling with energy problems.

Red tape is everywhere, and Spivey argues that these blockages are affecting all of us, at least to some degree.

If he’s right, though, that’s all about to change.

The Modern World Demands More

Artificial intelligence is not a new concept anymore, but it’s reaching critical mass.

The demand for energy to power the rise of this technology is through the roof, and limited access to the power to run them leaves much of it dead in the water.

We should be living in a historic boom if Spivey’s research is on point, but the FERC is simply saying “no”.

With concerns over getting fuel from the Middle East and America’s stake in AI, President Trump and his team are simply left with no choice.

What makes this occasion momentous is that Rob predicts the end of the FERC is at our doorstep.

Unjustified regulations will be removed, paving the way for a renaissance of energy within our shores.

How to Profit From Deregulation Day

With AI’s insatiable demand for power now colliding with the need for deregulation, the stage is set for another round of outsized returns.

That means certain companies could surge while others collapse under the weight of a repricing event.

The key is knowing where to put your money before the shift begins. Spivey stresses that timing is critical and that those who move early stand to gain the most.

Spivey and crew have already done the heavy lifting to locate the companies best placed to win as this transformation unfolds.

You can get instant access to these picks by becoming a Hidden Alpha member.

Hidden Alpha Review: What Comes With the Service?

A subscription to Hidden Alpha is packed to the brim with excellent features. Follow along for a look at each one.

One Full Year of Hidden Alpha

A full year of Hidden Alpha means you’re getting twelve monthly issues packed with detailed research.

Each edition doesn’t just tell you what stock to consider, it walks you through why the company is mispriced, how its fundamentals stack up, and what catalysts could drive it higher.

Joel and Rob enlist a small army to pore over documents, and then they filter findings through The Altimeter to find potential discrepancies between companies’ reported earnings and reality.

You’re getting the full scoop on quiet stocks with plenty of room to move, set up in a clear format.

Having this level of structure makes it easier to act with confidence rather than second-guessing every move.

It’s a unique system that appeals to me and anyone else searching for a fresh angle on market analysis.

Hidden Alpha: Special Updates & Alerts

Markets rarely move in a straight line, and oftentimes the difference between a win and a loss comes down to timing.

With Hidden Alpha, you’re not left waiting a full month from newsletter to newsletter for direction.

Whenever conditions change, whether it’s a new development in energy policy, earnings surprises, or a shift in AI demand, the team sends out alerts so you know how to react.

These updates explain why Rob and Joel are making a move and what action you should take, whether that’s buying more, trimming back, or selling entirely.

Having this real-time guidance helps you stay confident when markets get choppy.

It feels less like reading a static newsletter and more like having an experienced research team keeping watch over your portfolio and letting you know exactly when to act.

Hidden Alpha Model Portfolio

You can find Joel and Rob’s active recommendations in the model portfolio, and you get ongoing access as part of your member benefits.

Instead of trying to track each pick yourself, you can log in and see a clear overview of every active position, when they recommended it, the buy-up-to price, and how it has performed since.

As an added benefit, the model portfolio includes each stock with an active recommendation, so you can even tap into stocks that were featured before you joined.

You can also see closed positions, which helps you understand how the team manages risk and exits trades.

Having this transparency gives me a boost of confidence in my own investing because I can measure the platform’s track record for myself.

Access to Hidden Alpha’s Complete Archive

As a member, you can dig into years of back issues and dozens of special reports covering everything from past energy booms to warnings about overhyped tech stocks.

Reading through these gives you a chance to see how Joel Litman and Rob Spivey approached earlier market cycles, what signals they focused on, and how those calls played out.

You also have access to dozens of past reports covering relevant topics that may lead you to more winning opportunities.

Some of the insights go beyond recommendations, covering topics like timing your investments for maximum gains and other evergreen reads.

This affords me the “why” behind the advice, creating an extra layer of value that goes beyond monthly issues.

>> Access all these features and bonuses now at 84% off! <<

Joel’s Warnings and Predictions

For an entire year, Joel shares his latest predictions and warnings about potential stock market shakeups.

He has earned a reputation for his uncanny foresight into potential market-moving events.

Some of his previous predictions include:

- Warned of the 2008 crash

- Called the bottom of the 2020 crash

- Recommended a series of stocks after the 2020 crash that provided the opportunity for triple-digit gains

With a track record like this, Joel’s latest warnings are definitely worth a close watch.

One FREE Year of The TimeTable Investor

The Timetable Investor is an additional research service that new members receive for free during their first year.

Unlike Hidden Alpha, which zeroes in on individual stock ideas, Timetable Investor looks at the bigger picture of where the market is heading next.

This is my insight into market cycles, understanding when risk is rising, and how to recognize when opportunity is the strongest.

In all, it’s a monthly outlook on the market that’s broken down into three factors: credit, earnings, and valuation.

It also shares strategies about asset allocation in cash and bonds, as well as additional insights.

Timetable Investor complements Hidden Alpha really well in my opinion, adding a framework to investing that few services care to look at.

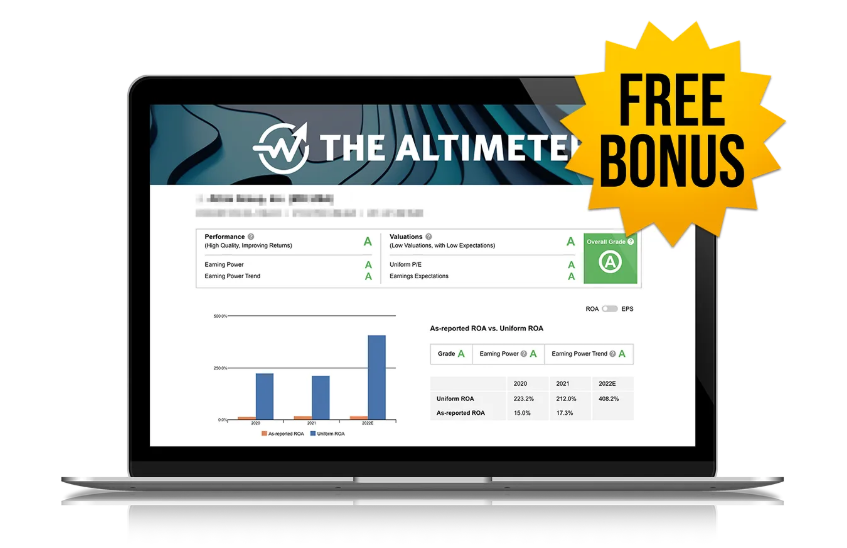

The Altimeter System

For an entire year, members have elite access to the same system that the Hidden Alpha team uses to vet their stock picks.

The Altimeter System covers hundreds of different stocks across a diverse range of sectors, and you have free rein to search them up any time you want

Simply type in one of the tickers supported, and it provides an estimate of a stock’s potential to surprise the market with earnings.

There’s no such thing as a stock market crystal ball, but I feel like the Altimeter is the next best thing.

I’ve personally used it to uncover some opportunities I hadn’t considered with my own research, and I am excited to see how they do.

Altimetry Daily Authority

Included in this Hidden Alpha bundle is the Altimetry Daily Authority, a daily newsletter that hits your inbox before markets open during the week.

Instead of sifting through endless news headlines, you receive a focused perspective on how policy changes, earnings reports, or global events may affect stocks.

I can give it a quick read before heading off to work so I can plan accordingly, without taking really any time out of my daily routine.

Who knows, even a stock pick or two may poke out of the pages that you can invest in if you so choose.

It certainly beats scouring the headlines every morning for some news I can work with to expand my portfolio.

It’s a way to stay informed and confident without spending hours glued to financial news.

>> Access Joel’s latest reports and more HERE <<

Bonuses and Additional Research

When you join Hidden Alpha, you’ll also receive the following bonuses at no extra cost:

How to Profit From Your American Right to Wealth

This bonus is designed to show readers how deregulation could spark a new wave of gains in U.S. natural resource stocks.

It explains that America’s vast reserves of oil, gas, and other commodities have been held back by decades of regulatory red tape, and now those barriers are being rolled back.

The report identifies specific companies positioned to benefit when this energy wealth is unlocked, drawing parallels to how past deregulation cycles created fortunes for early movers.

It’s presented as a way for each of us to tap into a proven historical pattern, profiting from America’s resources at moments when government policy shifts in their favor.

From my standpoint, it offers a clear and actionable roadmap to participate in what could be one of the biggest opportunities of this decade.

Get Rich in the U.S. of A.I. (8 Companies To Buy Right Away)

This special report captures all the companies Spivey predicts will rise the most as America embraces the rise of artificial intelligence.

AI requires massive computing power, and with new energy capacity coming online, certain companies are poised to become the backbone of this growth.

The report outlines which firms stand to benefit most from the next AI boom and why they could rival the performance of past winners like Nvidia and SuperMicro.

You’ve got several to choose from, and Spivey shares each name, ticker symbol, and a detailed report of why each one made the list.

I’d recommend poring over this report before you do anything else, as many of these recommendations are very time-sensitive.

It’s an easy read with plenty of actionable items for anyone to take advantage of.

10 Widely Held Stocks to Sell Immediately

This report serves as a defensive play, helping readers identify which companies may be more of a liability than an opportunity.

Joel Litman and Rob Spivey detail ten stocks that are widely owned but, in their view, dangerously overvalued based on forensic accounting analysis.

They explain why these names could face sharp declines as the market adjusts to new deregulation and energy shifts, echoing past cases where their warnings preceded significant losses.

If you want to protect yourself from fallout, cut ties with these stocks that could drag down your portfolio if left unchecked.

I’m always skeptical about these particular reports, but the team makes some very compelling points you won’t want to miss.

The #1 A.I. Stock of 2025

This bonus zeroes in on a single company that Litman and Spivey call the “Nvidia of government.”

The gurus ran out of room listing all its potential uses in the government sector, meaning it could easily 4x your investment in record time.

After reading the report, Joel and Rob make flawless points that have me really excited about this opportunity.

The report provides a full breakdown of the company’s fundamentals, growth prospects, and why it could multiply in value.

>> Join now to dump these “Time Bombs” before it’s TOO LATE <<

The Artificial Intelligence Ecosystem

This report pulls back the curtain on how major institutions are allocating capital into AI.

Originally prepared for Altimetry’s institutional clients, it’s now available to anyone who subscribes.

The analysis looks at the broader AI ecosystem, chipmakers, software developers, and infrastructure players, and explains where the smartest money is going.

Most folks would have to pay a lot of money for this type of content, making it a powerful addition to an already solid service.

There are plenty of tips and insights you can glean from a read-through that you can put directly into practice with your own investments, too.

From where I’m sitting, it offers a rare look at strategies used by the largest funds in the world, giving them a chance to align their approach with professional-grade insights.

>> Sign up for latest Hidden Alpha Research under Joel’s guarantee <<

Pros and Cons of Hidden Alpha

Hidden Alpha is a solid service with a lot going for it, but there are a few rough edges to keep in mind.

| Category | Details |

|---|---|

| Pros |

• One year of Hidden Alpha newsletter • Model portfolio and frequent updates • Alimetry Daily Authority • Full archive of content • Research-backed analysis trusted by top institutions • Multiple high-value bonus reports • Free access to the Altimeter Forensic Database • Insights and recommendations from two gurus • 84% discount on the first year • 30-day money-back guarantee |

| Cons |

• No community forums • Focused heavily on energy + AI • Discount only applies to the first year |

Who Should Consider Hidden Alpha?

Hidden Alpha could be well-suited for a wide range of folks in search of top-tier analysis and insights.

It digs into both mid to large-cap stock recommendations. So the research covers a good blend of companies that could have lower volatility and others that might have more room to grow.

While Joel and Rob do not typically focus on smaller-cap companies, their latest research bundle does offer special reports about microcaps. So that camp is accounted for to some degree.

The newsletter also comes with one year of access to the team’s prized Altimetry System. This powerful tool could help members spot their own opportunities outside of the team’s picks.

However, monthly picks are not a good fit for day trading.

Most newsletters of its ilk are not particularly suited for this type of trading, so I wouldn’t count it as a point against Hidden Alpha.

Hidden Alpha Performance and Track Record

Joel Litman and Rob Spivey have highlighted a series of calls that turned out to be highly profitable for early readers.

The track record of Hidden Alpha is one of its strongest selling points.

Claimed Returns and Performance Metrics

They pointed to Meta back in 2012, years before its explosive growth, and recommended AMD in 2014 when it was trading for just a few dollars a share. Both calls went on to deliver multi‑thousand‑percent gains.

In 2020, the team also flagged Novavax as a breakout opportunity, and that stock went on to soar more than 3,000%.

Beyond big winners, their warnings have also been timely.

They raised red flags before the 2008 financial crisis and again ahead of the 2020 crash, helping readers sidestep major losses.

For subscribers, this blend of finding hidden growth stories and issuing early alerts on risks has built confidence in the consistency of the research.

Can Hidden Alpha Results Be Verified?

I’ve not found a way to verify the claims Hidden Alpha makes outside of its platform, but Alimetry’s longevity and large member list speak to its credibility.

My top source for checking up on results is the model portfolio, which shows current and past picks from the gurus.

I can see the gains (or losses) of any stock from the time it first appears to present, and that transparency speaks volumes.

Hidden Alpha vs Other Stock Newsletters

If Hidden Alpha’s setup doesn’t resonate with you, consider one of these other platforms I’ve reviewed. Note that each of these are unique services and aren’t affiliated with one another.

Hidden Alpha vs Motley Fool

I find Hidden Alpha and Motley Fool to run in some of the same lanes, trying to unearth stock picks with potential before all that growth happens. How they go about it is a big different, but both have a team of analysts looking through all the noise for these opportunities.

Motley Fool’s Stock Advisor is probably the closest comparison, and it does tend to offer a few more stock picks than Hidden Alpha each month. The research you receive is a bit more surface-level though, and there’s no Altimeter to do your own research with.

Hidden Alpha vs Similar Alpha-Focused Services

Hidden Alpha has carved out a unique niche among services targeting alpha stocks thanks to its forensic accounting (their words, not mine) approach to finding mispriced or undervalued stocks. I will say that the picks I see here rarely fall into portfolios from other platforms, for better or for worse.

Morningstar and Zacks have large databases and a huge reach, but don’t match Hidden Alpha’s depth of research into its findings. If you want a wide range of opportunities, you may want to look elsewhere. If you want conviction behind recommendations, stay right here.

Hidden Alpha Pricing and Subscription Details

How Much Does Hidden Alpha Cost?

The standard list price for a year of Hidden Alpha is $499, but right now, there is a steep discount available that makes it far more accessible.

New members can join for just $79 for the first year, an 84% savings compared to the regular cost. In the end, you’re paying just $1.50 per week.

This entry price includes every part of the service: the monthly newsletter, real‑time alerts, access to the model portfolio, and all of the bonus reports.

On top of that, you get that full year of the Timetable Investor and unlimited use of the Altimeter database that normally have huge price tags.

Once the first year is complete, you can re-up your service for $199, which still represents a substantial value given the breadth of resources provided.

Refund Policy and Guarantees

Every subscription to Hidden Alpha is covered by a 30‑day, 100% money‑back guarantee.

That means you have a full month to explore the research, test the Altimeter database, and review the bonus reports with no risk.

If you decide the service isn’t for you, a simple call or email to the customer service team will get you a prompt refund, and you can still keep all the reports you’ve received.

However, similar services in this newsletter’s price range also offer 30-day refunds. So I usually wouldn’t give extra brownie points for following the norm.

That said, I do appreciate that Hidden Alpha offers unrestricted access to the Altimeter System during the satisfaction guarantee period.

It’s a unique tool for vetting stocks that tacks on a lot of value to the overall package.

Final Verdict: Is Hidden Alpha Worth It in 2025?

Hidden Alpha is priced to give readers access to institutional-level research at a fraction of what professionals pay.

For $79 in the first year, members receive monthly issues, trade alerts, a model portfolio, six bonus reports, and full access to the Altimeter database.

That database alone costs institutional clients tens of thousands, making the subscription’s value clear.

The service also has a verifiable track record. Joel Litman and Rob Spivey have identified major winners like Meta, AMD, and Novavax long before they became household names, and they’ve issued timely warnings that helped readers avoid steep market losses.

For readers weighing price against proven results, this Hidden Alpha review shows the service offers practical research at a fair cost, especially for those interested in the intersection of energy and AI.

Join now to get ahead of Trump’s big deregulation move before this shot at wealth slips through your fingers.

>> Join now to SAVE 84% on Hidden Alpha stock picks! <<

Hidden Alpha FAQ

What does “alpha” mean in the context of Hidden Alpha?

In investing, “alpha” refers to returns that outperform a benchmark like the S&P 500. Hidden Alpha aims to identify stocks that have the potential to generate excess returns through under-the-radar opportunities rather than widely followed market trends.

How early does Hidden Alpha typically identify stock opportunities?

Hidden Alpha often focuses on companies before they receive widespread analyst coverage or media attention, which means recommendations may come well ahead of mainstream recognition but can require patience.

Does Hidden Alpha rely more on fundamental analysis or technical indicators?

The strategy is primarily fundamentals-driven, emphasizing company financials, competitive positioning, and growth catalysts. Technical indicators may be referenced, but they are not the core decision-making tool.

Are Hidden Alpha stock picks meant to be bought all at once or gradually?

Many subscribers choose to scale into positions over time, especially during market volatility. While the newsletter presents buy recommendations, execution timing is left to individual investors.

How volatile are Hidden Alpha recommendations compared to blue-chip stocks?

Hidden Alpha picks can be more volatile than large-cap blue-chip stocks, particularly when focusing on smaller or emerging companies. This volatility is part of the trade-off for higher potential upside.

Does Hidden Alpha invest in specific sectors more than others?

While sector exposure can change over time, Hidden Alpha often leans toward growth-oriented industries, such as technology, innovation-driven businesses, and emerging market leaders.

How does Hidden Alpha handle losing recommendations?

When a recommendation underperforms or the original thesis changes, updates are typically issued explaining what went wrong and whether the stock should still be held, helping subscribers reassess their positions.

Is Hidden Alpha suitable for investors with a short time horizon?

Hidden Alpha is generally not designed for short-term trading. Investors with a time horizon of several years are more likely to align with the newsletter’s strategy and expectations.

Does Hidden Alpha provide guidance during market downturns?

During periods of market stress, Hidden Alpha typically emphasizes thesis-based decision-making rather than reacting to short-term price movements, helping investors avoid emotionally driven trades.

How much research detail does Hidden Alpha include with each pick?

Each recommendation usually includes context around the business model, growth drivers, and risks, giving readers enough information to understand why the stock was selected.

Can Hidden Alpha recommendations overlap with popular market picks?

Occasionally, a recommendation may later become more widely discussed as the company gains traction. However, the goal is to identify opportunities before they become consensus trades.

Does Hidden Alpha adjust its strategy based on market conditions?

Yes, market conditions such as interest rates, liquidity, and investor sentiment are considered, especially when they materially affect growth-oriented stocks.

How hands-on does an investor need to be when following Hidden Alpha?

Hidden Alpha is suitable for semi-hands-off investors who can review updates periodically without needing to monitor markets daily.

Are Hidden Alpha picks appropriate for taxable accounts?

They can be held in taxable accounts, but because recommendations may involve long holding periods, investors should consider potential capital gains implications when selling.

How does Hidden Alpha fit into a diversified portfolio?

Hidden Alpha is often used as a satellite allocation, complementing core holdings like index funds or dividend stocks to add growth potential without dominating the entire portfolio.

Tags:

Tags: