Gerardo Del Real’s latest research package is zeroing in on an emerging opportunity in uranium. But is his analysis the real deal? Tune in to my Junior Resource Monthly review for the full scoop.

What Is Junior Resource Monthly?

Junior Resource Monthly is an investment newsletter written by Gerardo Del Real and published by Digest Publishing.

It provides members with monthly trade ideas, sell alerts, and research reports.

Gerardo zeros in on opportunities in the base, precious, and energy metals sectors. As the name suggests, the stocks featured in the analysis encompass a broad swath of junior resource companies.

This unique focus helps members tap into a relatively underserved niche in the investing space.

While the research covers a broad range of junior players in the industry, the newsletter’s lead is especially bullish on an up-and-coming opportunity in uranium.

I’ll dig into the whole package shortly. First, let’s take a look at the mind behind the service.

>> Sign up NOW and SAVE 50% <<

Who Is Gerardo Del Real?

Gerardo Del Real is a veteran analyst specializing in the resource sector and the co-founder of Digest Publishing.

Given the publisher’s penchant for spotlighting opportunities in precious metals and energy, his extensive experience makes him a natural fit.

During his time dishing out insights behind the scenes to his high net-worth clientele, Gerardo has built a strong network of industry insiders.

These connections coupled with his boots-on-the-ground investigative approach give him an edge over many of his peers.

He currently helms three services under the Digest Publishing banner, where he shares his analysis with his growing reader base.

Is Gerardo Del Real Legit?

There’s little doubt in my mind that Gerardo Del Real is one of the most legitimate investors out there.

My mind keeps going back to how he’s always willing to get out of his comfort zone and look into opportunities in person rather than rely on research alone.

To that end, he recommended a lithium play called Patriot Battery not far back that led to 10,000% gains for hungry readers.

Perpetua Resources proved to be another win after the gold miner went big this summer, and that’s just naming a few of his recent exploits.

>> Access Gerardo’s latest insights and recommendations now! <<

Gerardo Del Real Prediction: “The Giant in the Jungle”

I’ve been interested in commodities for a while, both as an alternate investment opportunity and a traditional hedge against inflation.

Imagine my surprise when I heard that Gerardo Del Real had found a rare discovery in South America that could create vast new amounts of wealth for anyone getting in on the ground floor.

While most gurus share their recommendations from the comfort of their homes, Del Real is one of the few willing to literally go the extra mile to investigate.

I had to find out what he uncovered while boots-on-ground and how folks like us can take advantage of what’s hiding down below the surface.

The Copper Opportunity

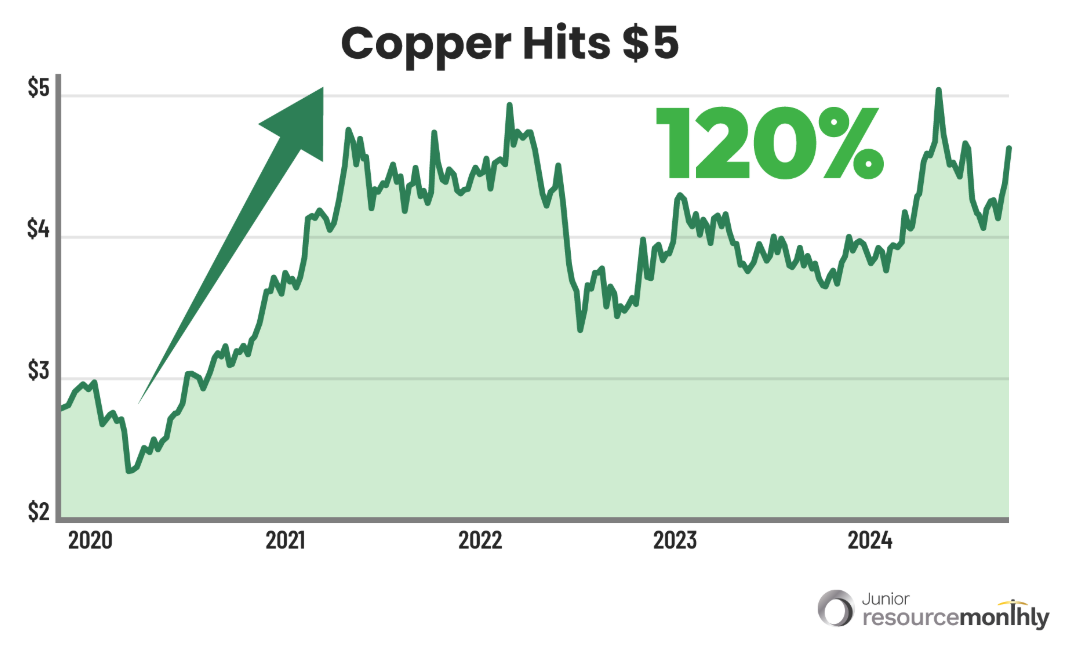

Copper prices fell to a surprising low in the early part of 2020, settling in at just over $2 per pound.

It’s risen more than 120% since, kissing the $5 mark on more than one occasion this year.

The increase is being driven by a widening supply deficit of the reddish-brown metal as its part in the global energy transition becomes clear.

As it turns out, copper plays a crucial part in several industries, from building our power grid to wind and solar power generation.

Copper is also needed for transport and has a ton of uses in other sectors as well.

By the time we reach 2050, Gerardo Del Real estimates we’ll need more than 60 million metric tons just to keep up with current demand.

Mining companies are frantically on the hunt for copper reserves and are willing to pay top dollar.

All this is why Del Real’s latest find couldn’t have come at a better time.

What is the Giant in the Jungle?

What Gerardo Del Real calls the Giant in the Jungle is a massive gold and copper deposit deep in the heart of Peru.

During his time down there, the guru had to hike for miles to access it. On the way, he saw these precious metals actually oozing from the rock.

If he’s right, this area could become one of the largest gold and copper mines in the world today. Other precious metals are likely present as well.

Although it is in the middle of nowhere, drug cartels used the area for growing cocaine until the government cleared them out over the last few years.

Now, several ventures are working hard to take advantage of this key region that most of the world still knows nothing about.

>> Don’t miss the chance to ride the next copper bull market! <<

How to Capitalize on the Resource Boom

According to Gerardo, one company looks to be perfectly positioned to move in first.

They plan to start drilling in the next several months as permits start rolling in. The more copper and gold they find, the higher their valuation will likely be.

Wait too long, and you’ll miss your chance to grab shares of this enterprise while it’s still cheap.

Because the entire operation is still hush-hush, you’ll need Del Real and his research reports for the full scoop.

Luckily, you can get immediate access to this mining company and quite a bit more by signing up for Junior Resource Monthly.

Join me as I investigate everything that comes with the service.

>> Get the full scoop on the best copper stocks now! <<

Junior Resource Monthly Review: What Comes with the Service?

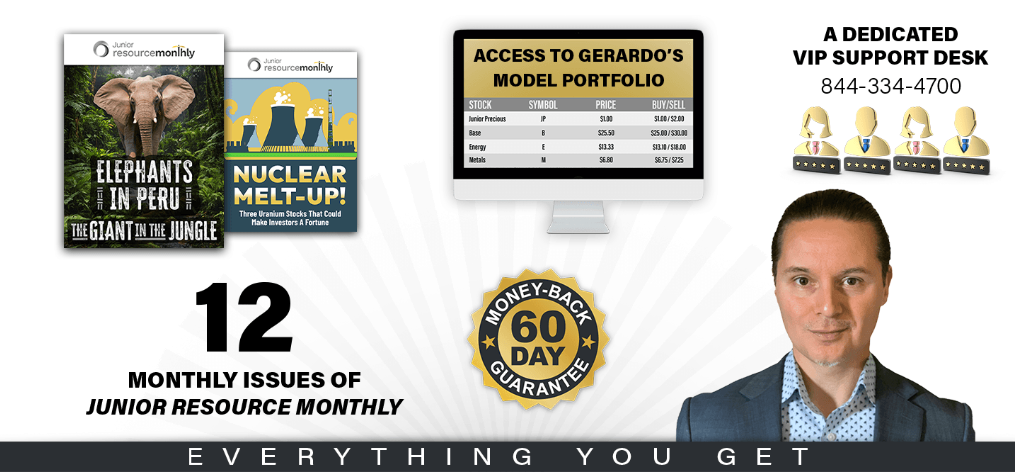

Here’s what you get when you join under the latest deal:

12 Issues of Junior Resource Monthly

The monthly newsletter is your direct line to Gerardo’s latest insights in the metals industry.

Each issue provides one trade idea, market commentary, and supporting research.

The team also archives every issue. This lets you check in on the original investment thesis and see if it still maps on to current market conditions.

A big plus of the newsletter is Gerardo’s expertise in the industry.

His analysis digs much deeper than gurus tackling a broader scope. He lives and breathes resource investing, and it shows in the quality of his analysis.

>> Get a full year of Junior Resource Monthly for half off today! <<

Flash Alerts

One month can feel like a lifetime on the stock market.

Fortunately, the team keeps members up to date between issues with buy and sell alerts.

The alerts are sent out through emails. All you need to do is keep an eye on your inbox here and there to make sure you are up to speed.

They are a welcomed bonus that allow you to go about your day knowing that the team has a close watch on the markets.

Model Portfolio

All open positions recommended by Gerardo are logged into the team’s model portfolio.

So you won’t need to wait for the latest issue to get a shortlist of solid stocks.

It’s a handy resource that makes it easy for new members to jump in and start comparing their own metals portfolio with the team’s recommendations.

Previous issues of the newsletter are available as well, which lets you quickly run through this list of opportunities and see if they’re a good fit for your risk profile and investment objectives.

>> Get exclusive monthly trade ideas and market insights <<

Access to Gerardo’s Natural Resource Wealth Library

Members also receive exclusive access to Gerardo’s growing archive of special reports.

Special reports are a bit different from the standard rec and often come with additional analysis.

For example, the current deal provides special reports on companies involved in uranium, lithium, and precious metals.

These stocks represent opportunities that the team is especially bullish on.

Much like the model portfolio, newcomers who want to stock up on picks will want to dig into these resources as well.

Dedicated Customer Service Team

The support team is ready and available to help you with any questions regarding your subscription.

Simply send an email, and they will follow up with a prompt reply.

While I prefer phone support, email is often more than enough to get the job done.

It’s important to remember that the support is for questions about a subscription. They do not offer guidance on trade recommendations.

>> Access these features and more for 50% OFF <<

“The Giant in the Jungle” Bonuses

If you sign up now, you’ll also get access to three additional bonus reports as soon as you join.

Elephants in Peru: The Giant in the Jungle

This special report reveals the name and ticker symbol of the sub-$1 stock slated to skyrocket once news of the gold and copper deposit in Peru goes public.

Gerardo Del Real shares the story of his time there, what he saw, and all his experiences along the way.

The guru adds in a thorough profile of the company, including his observations while working with them down in the jungle.

He even shares interviews with its management team and why this is such a rare opportunity. You can’t find this info anywhere else.

It’s a quick read, but I found myself so enthralled with the content I couldn’t put it down anyway.

Once you’re done reading, you’ll have everything you need to add this investment to your portfolio.

NUCLEAR MELT-UP! Three Uranium Stocks That Could Make Investors A Fortune

Gold and copper aren’t the only big players in the numerous energy metals sectors popping up.

Del Real believes there’s a new uranium bull market underway, and now’s the time to get plugged in there as well.

In this bonus report, he unveils three companies from the industry with the biggest potential to bring profits as uranium goes full steam.

He offers the names and ticker symbols of each venture before providing all the details of why he chose each one.

I always appreciate how thorough Del Real’s research is. He is, after all, one of the few willing to actually investigate in person, and that comes through in a big way here.

After reading this cover to cover, you’ll know exactly how to invest for a shot at a piece of the action.

>> Get all these bonus reports free when you sign up now! <<

100% Money-Back Guarantee

Gerardo offers a generous money-back guarantee with every new subscription to Junior Resource Monthly.

Right now, you can try out the service for roughly two months before making any kind of commitment.

If you’re not completely satisfied anywhere during that window, you can reach out for a complete refund of the subscription fee.

That’s a very generous proposition, considering he’s handing you the names of his top uranium stocks the moment you sign up.

Best of all, you get to keep any materials you’ve already received should you decide to cancel.

>> Join risk-free under Gerardo’s guarantee <<

Is Junior Resource Monthly Legit?

Junior Resource Monthly is a legit investment newsletter.

Gerardo helms several high-caliber investment newsletters and has earned his reputation as a sophisticated analyst.

Also, his six-month cashback refund policy shows that he stands by his work.

Is This Service Right For Me?

Junior Resource Monthly is best-suited for folks searching for quality plays in the mining and resource sectors.

Gerardo Del Real’s strict focus means that the service alone isn’t enough to build a diversified portfolio. That said, it could help diversify an established portfolio that’s light on metal miners or refiners.

This might also provide the basis for a new portfolio with ample room to tap into other sectors.

Pros and Cons

The newsletter’s insights are top-notch, but it could improve in some areas.

Pros

- Reputable publisher

- Features 3 exclusive bonus reports

- Monthly newsletter with new stock picks every month

- Led by resource expert Gerardo Del Real

- 60-day money-back guarantee

- Accessibly priced

Cons

- Strict focus on mining and natural resource sector investments

- No community forum or chat.

>> Access Gerardo’s top stock recommendations now! <<

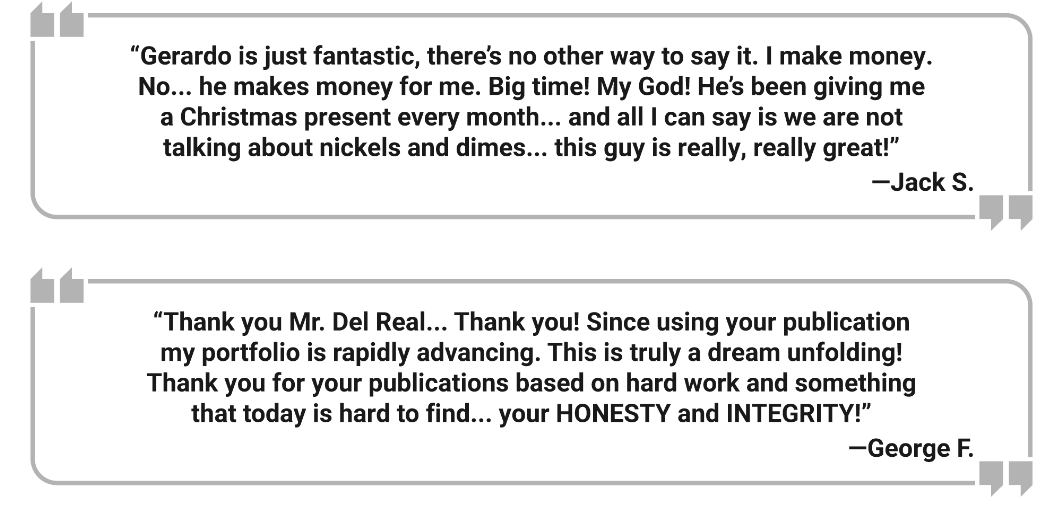

Junior Resource Monthly Reviews by Real Members

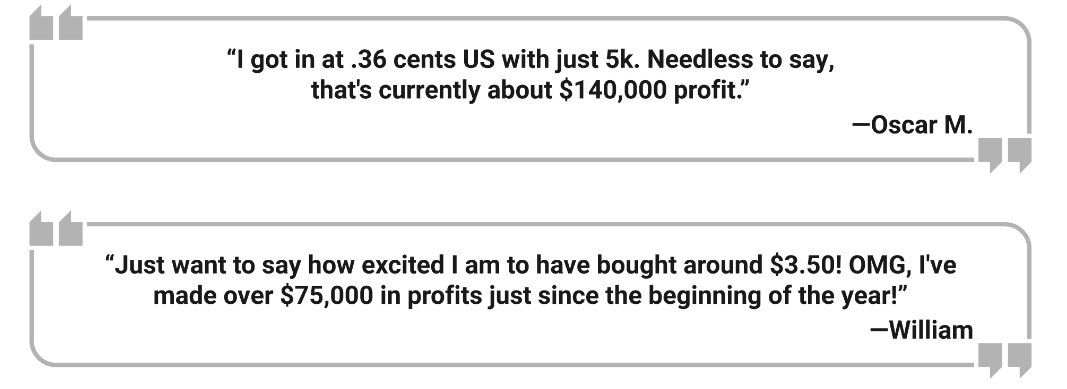

Don’t just take our word for the potential Del Real’s Junior Resource Monthly has. Check out these reviews from actual customers pulled straight from his latest presentation:

As you can see, members rave about the kind of returns they’re seeing from Del Real’s research. I can’t guarantee you’ll see the same results, but this feedback certainly is encouraging.

I also appreciate the mention of Del Real’s honesty and integrity. The fact that someone took the time to call this out really speaks to how the guru conducts himself.

How Much Does Junior Resource Monthly Cost?

Junior Resource Monthly normally retails for $399, but you can get a full year for $199 right now as part of this special deal. That’s 50% off the cover price!

You’re paying just over $16 per month for access to all the content I covered above, which is quite a steal.

Bonus reports aside, any one of the monthly recommendations could earn you back your membership fee and then some.

The best part is that, by signing up now, you’re locking in this low $199 rate for as long as you remain a subscriber.

Is Junior Resource Monthly Worth It?

I’ve looked through every nook and cranny of Junior Resource Monthly, and I’m stoked about what I see.

Del Real has been at the forefront of metals investing for a long time, and he’s got the success to prove it.

Hearing his take on the market and new opportunities every month can open the door to some major gains.

I love how he keeps everything fresh with frequent portfolio updates and flash alerts to capture big gains as they present themselves.

The bonus reports are some of the best I’ve ever seen, both well-written and full of some of the biggest money-making recommendations available right now.

A huge discount coupled with a 60-day money-back guarantee are amazing extras that should eliminate any hurdles folks have to signing up.

If you’ve been hoping to take advantage of some of the biggest precious metals opportunities on the market right now, Junior Resource Monthly is likely your best bet.

Sign up today before Del Real’s incredible mining opportunity takes off without you.

Tags:

Tags: