Legendary investor Louis Navellier claims we’re entering into the largest wealth transfer in history, and the repercussions could be devastating.

Large money swings could destroy portfolios faster than we ever thought possible, but a quick reaction now could actually position you to ride the shift to impressive gains.

In this Louis Navellier Stock Grader review, I examine whether Navellier’s fears are truly worth paying attention to.

>> Get Louis Navellier’s Stock Grader Today <<

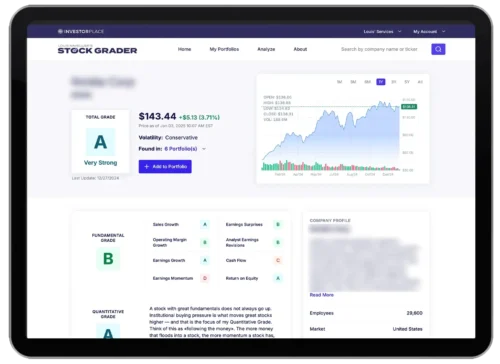

The Louis Navellier Stock Grader is the analytical backbone of Growth Investor, designed to sort through thousands of stocks and rank them using objective financial data.

Each stock receives a simple letter grade, making it easier to spot which names are improving and which ones are quietly falling out of favor.

Access to the Stock Grader comes bundled with the broader Growth Investor service, which includes regular research updates, curated stock ideas, a model portfolio, and you can set up ongoing alerts when grades change.

In all my years, I’m not sure I’ve ever seen such a straightforward system for determining the best stocks to invest in.

Everything flows from a consistent framework that updates as new data comes in.

If you’re looking for a more structured way to approach growth stocks, this system offers a disciplined alternative to chasing headlines.

>> Join Growth Investor With Louis Navellier <<

What Is the “$7 Trillion Wealth Transfer” About?

Louis Navellier believes many people are unknowingly caught on the wrong side of a major market shift already in progress.

He refers to it as a $7 trillion wealth transfer, not because money is disappearing, but because it’s quietly moving away from familiar stocks and into less obvious places.

It’s scary because most of us assume that sticking with well-known names is the best approach. Navellier argues that this assumption is precisely what’s holding us back.

All Eyes on Artificial Intelligence

It came as no surprise to me that Navellier cites artificial intelligence as the cause of these woes.

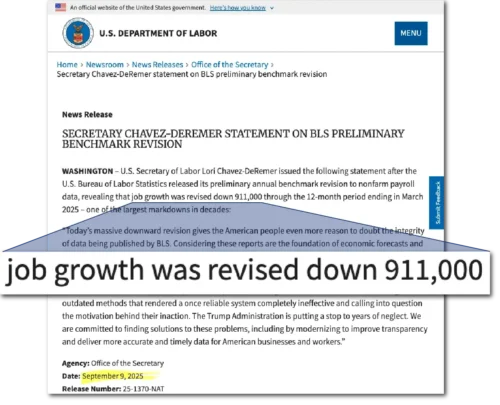

Jobs are down across multiple sectors, and it’s because companies know software can do the work that many laborers once held.

We’re in a season of jobless growth, as these ventures can expand without the cost of bringing new people on board.

Amazon is an obvious example, but smaller companies are following suit.

We’re losing customer support teams, IT departments, and even seeing bots replace more fundamental roles.

Everyone’s heading there; are you coming along for the ride?

The Pattern Behind Capital Rotation

I’ve seen Louis deliver on his research time and again, and the pattern his Stock Grader uses to detect these massive shifts is his secret sauce.

Institutional money flow, like what we’re seeing with AI, doesn’t happen randomly.

That’s what makes Navellier’s Stock Grader so powerful. Not only does it locate this information for one stock, it scans more than 6,000 every single day.

It quickly identifies factors like profitability, growth, and earnings beats to create clear reasons for money to flow.

By the time most of us see the move happening, we’ve completely missed the investment boat.

How to Profit From the Wealth Transfer

What we’re looking at isn’t about predicting a collapse or abandoning the market.

It’s about understanding where strength is building now and where it’s fading.

The $7 trillion figure represents years of gradual repositioning, quietly happening behind the scenes.

Yet, Louis figured it out through careful calculation, research and you can reap the potential benefits here if you gain access to it.

Fortunately, Navellier includes his Stock Grader with his Growth Investor service, along with a ton of other content you can unwrap right now.

Next, I want to look at what all these features are and how you can put them to good use for your portfolio.

>> Access The Louis Navellier Stock Grader <<

Joining Growth Investor gives you access to the Stock Grader system and a steady flow of research designed to help you stay aligned with institutional money as market conditions change.

Each component plays a specific role, working together rather than standing alone.

Full Stock Grader Access

Full Stock Grader Access

Full access to the Stock Grader allows you to look up and track roughly 6,000 U.S.-listed stocks, each ranked with a clear A–F grade.

The team bases these grades on factors like earnings strength, sales growth, cash flow, and price momentum, all of which tend to matter most to large institutions.

What makes this useful in practice is how dynamic it is. Grades update as company data and market conditions change, so you’re not relying on outdated opinions.

If you made it through any level of school, you’ll understand the rating system. The best part though is that you can look up stocks any time you want, making the Stock Grader incredibly valuable as long as you put it to use.

12 Monthly Growth Investor Issues

The monthly Growth Investor issues serve as the strategy layer built on top of the grading system.

Each issue highlights where institutional money appears to be flowing and explains how those trends are shaping Navellier’s current outlook.

Navellier runs the Grader himself and lists the biggest opportunities he sees here, saving you time if you don’t want to look up some A+ bangers on your own.

You’ll see top-rated stocks, a model portfolio, and commentary on why certain areas look stronger than others based on the data.

You can typically see a small handful of recommendations each month, meaning you’re not overwhelmed with every stock that qualifies as an A.

The team sorts through the data to find only the biggest plays before sending them out.

Weekly Market Updates & Urgent Alerts

Markets rarely move on a neat monthly schedule, which is where the weekly updates and urgent alerts come in.

These communications flag meaningful grade changes, shifts in market conditions, or situations where a stock’s profile has materially improved or weakened.

Most tips prompt some type of action while keeping you informed, as it’s best practice to pick up a stock right when the system upgrades it.

Having these updates is also especially helpful for avoiding situations where a stock quietly slips from strength to weakness while attention elsewhere distracts you from what the data is showing.

Special Market Podcasts

The special market podcasts add a more conversational layer to the research.

In these sessions, Navellier expands on current conditions, explains how he’s interpreting recent data, and provides additional perspective that doesn’t always fit neatly into written updates.

Hearing insight straight from a guru himself adds a lot to a bundle like this, offering a way to better understand the thought process behind portfolio moves and broader market themes.

They’re not required listening, but they can help connect the dots between grades, trends, and real-world market behavior in a more accessible way.

>> Start Using Growth Investor Now <<

Along with ongoing research and Stock Grader access, the offer includes several bonus reports and tools designed to deepen your understanding of where institutional money is moving and how to manage risk more effectively:

Bonus Report #1: The New Energy Barons

The New Energy Barons focuses on companies positioned to benefit from the growing demand for power and infrastructure tied to data centers, AI expansion, and grid modernization.

Instead of spotlighting well-known technology names, the report looks at energy producers and infrastructure firms that supply the electricity and equipment required to support these trends.

You won’t find many mainstream names here, especially as big money moves away from them.

Instead, most of the names I’ve seen on this list are overlooked businesses that institutions are eyeing right now, before broader market attention catches up.

Bonus Report #2: The AI Wealth Divide

In The AI Wealth Divide, Navellier draws a clear line between AI stocks attracting real institutional interest and those driven largely by speculation.

The report explains how many people end up chasing popular names while missing companies with stronger financial profiles and quieter accumulation.

It’s designed to help readers better understand where capital is actually flowing within the AI space, rather than assuming all exposure is created equal.

You’ll get the names and ticker symbols of five companies in particular with high Stock Grader ratings I think you’ll want to pay close attention to.

Bonus Report #3: The Critical Minerals Advantage

The Critical Minerals Advantage examines companies tied to materials essential for electrical infrastructure, energy storage, and modernization efforts.

These resources often sit at the foundation of large-scale projects but receive far less attention than end products.

The report highlights why supply constraints and long-term demand matter in this area and how institutions tend to position themselves well before shortages or pricing pressure become obvious.

Like most picks on Navellier’s radar, these recommendations sit quietly off to the side, making them that much more appealing.

Complimentary Bonus: One-Year Membership to TradeStops Basic

Complimentary Bonus: One-Year Membership to TradeStops Basic

The offer also includes a one-year membership to TradeStops Basic, a portfolio management and risk-monitoring tool.

TradeStops is designed to help track positions, manage downside risk, and identify potential exit points based on volatility and price behavior.

I find that it works great alongside the Stock Grader to add an extra layer of discipline, especially when markets become choppy or uncertain.

>> Try Louis Navellier’s Stock Grader Risk-Free <<

Refund Policy

Refund Policy

The Growth Investor subscription is backed by a 90-day money-back guarantee, which gives ample time to explore the service without feeling locked in.

During this period, you can use the Stock Grader, read the monthly issues, follow the updates, and review all bonus materials to see how the system fits your approach.

If you decide it’s not for you, you can request a full refund within 90 days.

According to the offer details, you’re still allowed to keep the reports you received, which makes this a low-pressure way to evaluate the service firsthand.

>> See What Growth Investor Offers Today <<

Pros and Cons

I’ve spent quite a bit of time testing out the Stock Grader, and here are my pros and cons:

Pros

- Unrestricted access to the Stock Grader tool covering thousands of stocks

- One year of Growth Investor issues

- Frequent podcasts, updates, and alerts

- Clear, rules-based system that helps remove emotional bias

- Multiple bonuses included

- Strong 90-day money-back guarantee

Cons

- Best suited for those comfortable following research and a system

- Not designed for short-term speculation

- Requires patience during rotation phases

Track Record and Past Performance

I wanted to highlight just a few of the successful recommendations from Stock Grader, such as Palantir that enjoyed a 1,330% gain in the 2 years following a rating upgrade.

Other stocks came through in big ways too, like Applovin and Carvana.

What caught my attention the most was that the Stock Grader saw in advance Carvana’s fall in 2021 and subsequent rise in 2023.

Not every stock will have this same level of success, and I get that.

Still, this is why the process emphasizes discipline and timely exits as conditions change.

>> Unlock Louis Navellier’s Stock Grader System <<

How Much Does Growth Investor Cost?

Under normal circumstances, Growth Investor runs $499 per year, which reflects full access to the Stock Grader system, monthly issues, ongoing updates, alerts, and bonus materials.

However, the current promotion significantly reduces that cost to $79 for the entire year, bringing the effective monthly price down to just a few dollars.

That’s a nearly 85% discount for the complete package, lowering the rate to just over $1.50 per week.

The service renews at $199 when the time comes, which is still a great price point for the content you receive.

>> Discover Louis Navellier’s Growth Investor <<

This is far from the first time I’ve reviewed one of Louis Navellier’s products, and he comes through once again here.

The Stock Grader is built for people who prefer clear signals and discipline instead of chasing headlines or short-term excitement, and that stability matters.

Having such a powerful tool at your side is a game-changer if you use it to its full potential.

The additional included materials take the service to the next level. Having a constant flow of new recommendations without having to even fire up the Stock Grader is a huge perk on its own.

As this Louis Navellier Stock Grader review shows, the system is designed to help you stay focused on measurable strength and step away when conditions change, which can be refreshing in noisy markets.

Sign up today to capitalize on the $7 trillion money transfer before it’s too late.

Tags:

Tags: