AI stocks are everywhere right now, and Louis Navellier’s name often comes up when you dive into tech investments. But with all the hype surrounding AI, it’s tough to tell what’s real and what’s just noise. So, are Louis Navellier’s AI stock picks for 2025 the real deal or just another market trend? Let’s break it down and find out if they’re worth your attention.

Louis Navellier isn’t just another name in investing—he’s been in the game for over four decades and has earned a reputation as a top money manager. His journey started in college, where he used a Wells Fargo mainframe to build a portfolio that beat the market.

He’s made some impressive calls, like recommending Apple at $1.49 and Microsoft at 39 cents, which established him as a savvy tech stock picker.

Dubbed “the King of Quants” by Forbes for his data-driven approach, Navellier’s track record makes him someone worth listening to, especially when it comes to AI stocks.

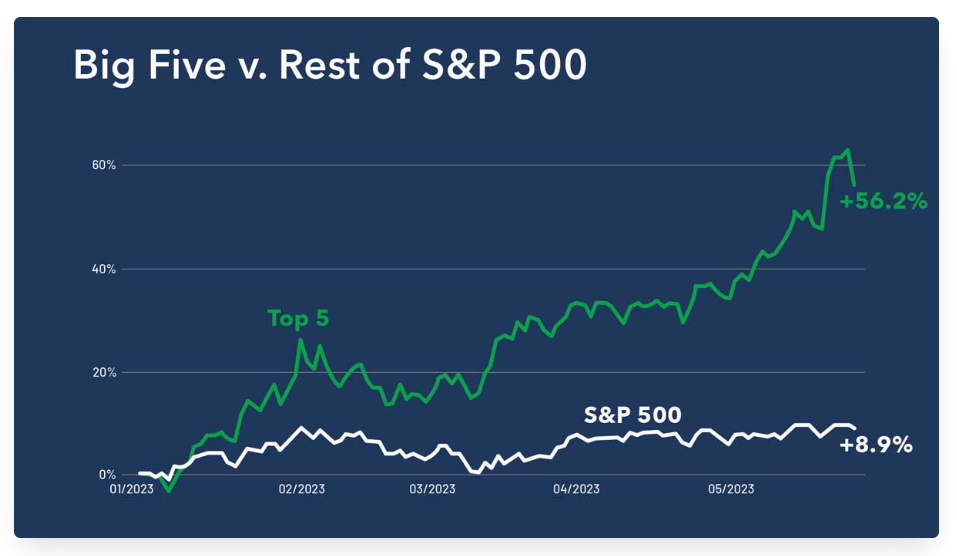

Navellier’s been ahead of the curve for years, with some of his stock picks giving everyday folks the chance to see massive gains. For example, his call to buy NVIDIA in 2019 saw gains as high as 2,000%.

Over a 20 year period, His proprietary stock rating system outperformed the market 3-to-1. While not every pick is a home run, Navellier has given his followers the chance to see huge gains over the yearsespecially in tech and AI—makes him a trustworthy source.

>> Access Navellier’s latest recommendations now! <<

What Is “The Next Phase of the AI Boom?”

So, what’s all this talk about the “next phase” of the AI boom? In a nutshell, Navellier believes we’re standing on the verge of something big. According to him, the artificial intelligence sector is about to see an explosion of growth, driven in part by a potential shift in political leadership.

He’s predicting that Donald Trump’s return to office could spark a surge in AI-related stocks, and he’s already identified six companies he believes will soar.

His presentation doesn’t just stop at general predictions, either. He lays out a detailed case for why AI data centers, energy infrastructure, and AI’s military applications are poised to drive stock prices skyward.

For Navellier, this isn’t just another market cycle—it’s a major shift that could bring extraordinary returns for investors who get in early.

In his special reports, Navellier outlines exactly which stocks he thinks will benefit from this AI boom, giving you a roadmap to follow. Whether you agree with his political views or not, it’s hard to deny that his predictions have been eerily accurate in the past.

>> Secure your access at 60% off now! <<

What Is “Trump’s First Executive Order?”

So, why all the talk about Trump and AI stocks? According to Louis Navellier, if Trump takes office in 2025, his first executive order will be a game-changer for AI. Navellier believes Trump’s focus won’t just be on traditional political issues but will instead target the AI industry—particularly AI data centers, which are the backbone of all things AI.

Now, if you’re wondering why Navellier is so sure Trump will win, it’s because he’s basing this on current polling trends and the idea that people are fed up with the current administration’s policies. But it’s not just about politics.

Navellier believes that Trump’s pro-business stance will trigger significant shifts in the tech sector—especially AI. He thinks Trump’s first move could spark a huge boost in AI infrastructure, particularly by addressing the energy demands these AI data centers need to run.

In other words, Trump’s executive order could mean more natural gas and energy projects, which is great news for AI companies relying on heavy data processing. So, if Trump makes this move right out of the gate, it could cause certain AI stocks to skyrocket.

Why It Could Send These Stocks Soaring

Here’s where things get interesting. Navellier has identified six AI stocks he believes will ride this wave of change if Trump issues his executive order. These aren’t your typical tech stocks, either. We’re talking about companies tied to AI data centers, energy infrastructure, and even AI’s military applications.

What makes this even more intriguing is how quickly these stocks could take off. According to Navellier, the stock market tends to move fast when a political shift becomes inevitable.

And here’s the thing: these stocks aren’t household names yet, but Navellier sees them as having the potential to grow into major players in the next few years—much like NVIDIA did when he called it back in 2019.

He’s already teased companies that specialize in AI data center infrastructure and those solving the energy bottleneck AI currently faces. If his predictions are right, these could be the next big things in tech investing.

>> Get Louis Navellier’s top six AI picks now! <<

Louis Navellier’s top 6 AI stocks are available to members of his Growth Investor service. As part of your subscription, you’ll get full access to his research and additional benefits.

Navellier’s Growth Investor service is built for those who want in-depth stock analysis paired with a clear, actionable game plan. Every month, subscribers receive a new stock pick, carefully explained in a detailed newsletter. I’ve gone through a few of these issues myself, and I can say that his writing style is both informative and easy to follow.

He doesn’t talk down to you, but he also doesn’t flood you with jargon. Instead, you get solid reasoning behind each recommendation, which makes it easier to follow along—even if you’re not a market expert.

What I like most about Growth Investor is how it keeps you updated with trade alerts and model portfolios. Whether a stock is a buy, hold, or sell, you’ll know exactly what’s happening. And the weekly updates give you a snapshot of what’s been going on in the market, helping you stay informed without feeling overwhelmed.

If you’re someone who likes to keep a pulse on your investments but doesn’t want to sift through endless market reports, this service hits the right balance.

>> Subscribe NOW and SAVE 60%! <<

The Trump AI Boom: 3 Data Center Stocks With Extreme Upside Potential

One of the standout reports in the Growth Investor package is The Trump AI Boom: 3 Data Center Stocks With Extreme Upside Potential. This report takes a closer look at three companies that Navellier believes are perfectly positioned to benefit from the coming AI data boom—especially if Trump’s policies play out the way he predicts.

Navellier dives into why data centers are the backbone of AI and why companies involved in building and maintaining these centers could see explosive growth. It’s not just about the big names you’ve heard of—Navellier identifies companies that are flying a little under the radar but could potentially be the next NVIDIA or Amazon.

I found the level of detail in this report refreshing. It gives you not just the “what” but the “why,” making it easier to see the potential these stocks hold.

How to Profit on Trump’s First Executive Order

Another report that caught my eye is How to Profit on Trump’s First Executive Order. In this one, Navellier explains why he thinks Trump’s return to office could spark an energy boom that will directly benefit AI-related companies.

He’s betting that Trump’s first executive order will focus on ramping up natural gas production, and if that happens, several energy companies could see a significant uptick in stock prices.

This report breaks down which companies Navellier believes are best positioned to profit from this potential shift. He lays out his reasoning clearly, showing how energy and AI are intertwined, especially when it comes to powering data centers.

What’s interesting is how he connects the dots between policy changes and stock market movements—something that not every analyst does well.

The Top 3 AI Military Stocks

Navellier doesn’t just stop at data centers and energy. In The Top 3 AI Military Stocks, he digs into how AI is transforming military technology and why that could lead to big gains for investors. The report highlights three companies that are heavily involved in AI-powered military projects, from defense systems to autonomous weapons.

The report is intriguing because it focuses on a niche that not everyone is paying attention to yet. Navellier shows how these companies could benefit from increased military spending on AI, which could happen if Trump’s pro-defense policies come into play. If you’re interested in the intersection of AI and military tech, this report is a goldmine of information.

>> Access the top three military AI stocks now! <<

How to Grow Wealthy With Quantum Computing

Quantum computing is still in its infancy, but Navellier is already looking ahead with his report on How to Grow Wealthy with Quantum Computing. In this one, he explores a company that he believes could be the next big player in quantum computing—a technology that has the potential to revolutionize industries in the same way AI has.

The thing I appreciate most about this report is how Navellier breaks down complex ideas into something digestible. Quantum computing can feel like something out of a sci-fi movie, but he does a good job of explaining why it matters and how this specific company could be at the forefront of this tech wave. If you’re looking for a long-term investment opportunity, this report gives you plenty to think about.

BONUS: Access to Louis’ Exclusive Stock Ratings Tool

One of the perks of joining Growth Investor is getting access to Louis Navellier’s stock-rating tool. This is a tool that lets you check the ratings of over 6,000 stocks, giving you a sense of whether a stock is a buy, hold, or sell.

I’ve found this feature to be incredibly helpful, especially if you like doing your own research. It’s like having a second opinion on hand, and it can give you extra confidence when making investment decisions.

>> Get all these reports and more when you sign up now! <<

One thing I appreciate about Louis Navellier’s Growth Investor is the peace of mind that comes with it. If you’re worried about jumping into a subscription, Navellier offers a 90-day money-back guarantee.

Basically, this means you get to try out the service, dive into the stock picks, and see how it fits your investment style—without any financial pressure. If at any point within those 90 days you feel like it’s not working for you, you can ask for a full refund on your subscription, no questions asked.

It’s a generous deal, especially in the world of financial services, where refunds aren’t always an option. This guarantee makes it feel like you’re covered, even if you’re a bit unsure about the initial commitment. It’s rare to find that level of flexibility, which tells me they’re confident in what they’re offering.

>> Join under Navellier’s guarantee <<

Let’s talk pricing. If you’re thinking about getting access to Louis Navellier’s AI stock picks and research, the regular cost of a one-year subscription to Growth Investor is $499. But here’s the thing: right now, they’re offering a pretty hefty discount. You can sign up for just $199, which works out to be a 60% discount off the sticker price.

When you break it down, that’s just a little over $16 per month for a full year of stock picks, market updates, and access to those special reports we talked about earlier.

Considering the potential upside from even one winning pick, it feels like a pretty reasonable price for the level of insight and guidance you’re getting.

So, is it worth it? Here’s my take: if you’re someone who’s interested in AI stocks and you want detailed guidance on which companies could really take off, then Navellier’s Growth Investor is definitely worth considering.

You’re not just getting stock picks—you’re getting a detailed explanation of why each stock is a good choice, along with ongoing updates and alerts to keep you in the loop.

Navellier’s track record speaks for itself. He’s made some bold predictions in the past, and many of them have paid off big time. The current AI boom is no different—he’s identified companies that are poised to benefit from AI’s growing influence, especially if Trump takes office and follows through on the policies Navellier predicts.

On top of that, the discount pricing and 90-day money-back guarantee make it a low-risk opportunity. You’ve got time to test it out, explore the reports, and see if his picks resonate with your own investment strategy. If it’s not a fit, you can simply get your money back, no harm done.

For me, the combination of expert insight, potential upside, and a solid guarantee make this deal hard to ignore. If AI stocks are on your radar, this might be a great time to explore what Navellier has to offer.

Tags:

Tags: