Getting personalized investment advice from a trained financial advisor typically costs an arm and a leg. Luckily, Magnifi is a new name in town touting a much more affordable method to keep your investments in line. In this Magnifi review, I dive deep to see how it works and if the app is all it’s cracked up to be.

What is Magnifi?

Magnifi is a platform designed to help you compare investments and trade stocks. Unlike other investment accounts, it fully embraces the power of artificial intelligence (AI) in its decision-making prowess.

Think of Magnifi as a fully automated friend with your best interests in mind. As an AI assistant, it has no bias and strictly uses data to locate opportunities that align with your investment objectives.

You’ve got plenty of options when it comes to interacting with the app. It’s possible to research stocks, mutual funds, and ETFs from a list of more than 15,000 possibilities.

From there, Magnifi serves as an online brokerage account where you can actively buy or sell. There are also on-demand analytics along with news and insights from past and present publications.

The target audience here are financial advisors and regular folk like you and me looking to get ahead on the stock market without sinking all of our time into the process. In addition to the AI, you’ll have some handy tools at your fingertips to help with just that.

I’ll double down on many of the app’s top features in a bit. First, let’s take a closer look at Magnifi as a platform.

>> Save 21% when you join now! <<

Is Magnifi Trustworthy?

After my initial interactions with Magnifi, I’m convinced it’s a trustworthy app. It’s still relatively new, but the platform’s clear goal is to educate while making you wealthier.

Unlike the robo-advisor apps of old, you’re not handed mindless recommendations based on arbitrary data that may not even fit in with your strategy. Instead, you’re the one leading the discussion with the questions you ask about your goals.

There are no managed portfolios here, meaning you’re still fully in charge of everything that happens with your brokerage account. You authorize any and all trades that take place, whether you’re in line with the AI platform or not.

Your money is no less safe on Magnifi than on any other internet site as long as you’re responsible with your username and password. The app is integrated with industry-leading tech partners like Plaid and Okta to keep your data safe from their side.

There are facilities to protect you in case an issue does arise. Magnifi uses Apex Cleaning Corporation, which is a member of the Securities Investor Protection Corporation (SIPC), to handle claims of up to $500,000.

What Makes Magnifi Different?

Magnifi stands out most for its ingenious use of AI in every aspect of the platform. Financial advisors are great, but there’s nothing quite like having a computer crunch millions of data points for you in seconds.

You’re still always in control of your Magnifi account, though. This differs from the average robo-advisor, which signs you up for stocks sometimes seemingly without rhyme or reason.

It’s also the only site I know of where you can get a personalized experience without spending a lot of money on a traditional advisor. As it learns your investment style, the AI may teach you a thing or two as well.

If that wasn’t enough, Magnifi works with other software as well. The platform lets you integrate multiple brokerage accounts and analyze them right within the app.

>> Get personalized AI-driven investment advice. Start now! <<

How Does Magnifi Use AI?

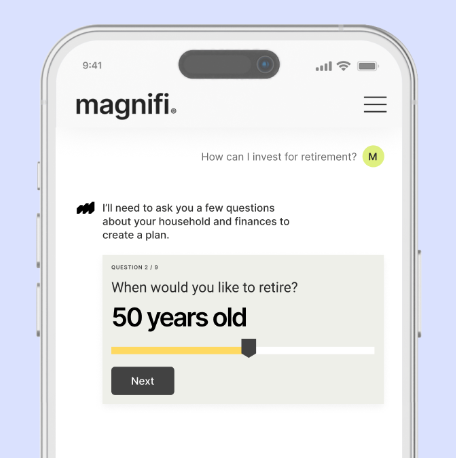

Think of Magnifi as your Siri or ChatGPT that graduated with honors from investment school. You’re able to feed it questions and sit back as the answers roll in.

Because this is AI, you don’t have to be super direct with your inquiries. Ask something like “How should I invest $1,000?” or “Should I diversify more?” and the app will give you insights you can actually work with.

You can get information too, if that’s what you’re after. With voice-to-text, you can hear Apple’s current share price or Meta’s PE ratio without having to look anything up. From what I’ve been able to see, the sky’s the limit here.

I love how Magnifi incorporates this because it learns about you and your style as you go. Over time, the app can play off your unique strategy and tailor recommendations or suggestions accordingly.

>> Ready to let AI optimize your investments? Join now! <<

Magnifi’s Main Features:

Check out the main features in Magnifi’s toolbox:

AI Assistant

The AI Assistant is undoubtedly what makes Magnifi such a powerful tool. It blows me away that you can ask just about anything investment-related and get a detailed and actually helpful response.

If it’s stock or fund information you’re looking for, the app can gather years of data in mere moments. The amount of time you save here alone is worth the price of admission.

I stopped using robo-advisors because they were too hands-off, but I don’t feel that way here at all. The experience is similar to chatting with a very knowledgeable friend who wants me to succeed.

6It’s obvious you’re dealing with AI, but Magnifi never tries to hide that fact. From what I’ve seen, the sooner you start trusting it, the sooner it can start elevating your investment game.

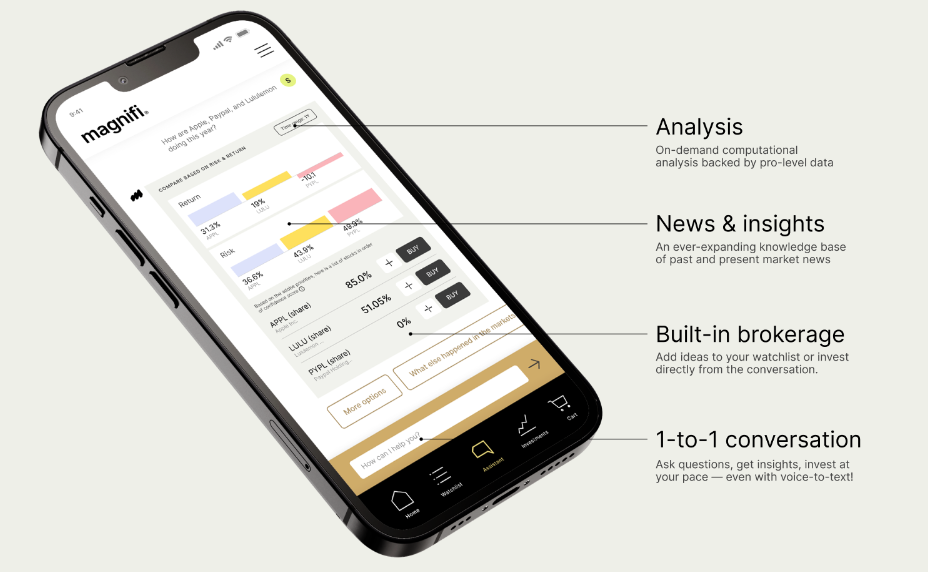

Analysis

Since Magnifi integrates with 200+ investment accounts, including Schwab, TD, and Robinhood, you’re able to see all your data right from your accounts dashboard.

This is super helpful for tracking individual returns or your overall win/loss rate among all your managed portfolios.

Magnifi takes AI to the next level, though, with pro-level analysis and insights across all your current stocks and funds. It can clue you in to hidden risks or opportunities you may never have discovered on your own.

Whether you act upon those insights is completely up to you, but it’s a blessing to see things from another perspective. Heck, the thing even found some fees for me that I wasn’t aware I was paying.

>> Explore AI investment assistance and pro-level analytics. Sign up now! <<

News and Insights

You’re not alone if you’ve stayed up late reading article after article in hopes of finding that breakthrough piece of information. With Magnifi, you no longer have to.

AI is, at its core, a system for data processing. Magnifi takes full advantage of this to collect information from an ever-expanding library of market news.

Because it works so quickly, feel free to have the app search past and present stories pertinent to the stock or fund you’re curious about. The AI doesn’t mind a little additional legwork.

Depending on the questions you ask, Magnifi can pull out insights or even recommendations based on what it finds in the news. The more it learns about how you operate, the better these insights should be.

Built-In Brokerage

Research apps are great, but it’s always been a pain point for me to have to open different software and invest there. Magnifi lets you do both from one convenient location.

During the setup process, you’re free to open a Magnifi investment account with all the standard protocols. You will have to provide details like your Social Security Number per SEC requirements.

As you build out a portfolio based on AI’s recommendations, you can choose to buy stocks, ETFs, or mutual funds with little more than a tap on the screen. Obviously, you’re in complete control of what makes the cut.

Alternatively, you can add those ideas to a watchlist and keep tabs on how they’re doing.

Buying and selling on Magnifi is commission-free, so you’re free to invest at the speed that best suits you.

Mobile App

It’s entirely possible to use the gamut of Magnifi’s features from the website, but it’s clear the Magnifi team had mobile devices in mind when they designed this.

The entire platform and communication with your AI counterpart works so smoothly from your smartphone. It feels very similar to texting someone the latest tips. You can even use voice-to-text for an entirely hands-free approach.

All the graphs, charts, and the like look great on your phone’s screen. There are no cut corners or formatting issues to deal with when looking through content.

Plus, you can still buy or sell assets straight from the device. You’re no longer bound to a computer screen and can effectively trade from anywhere with mobile coverage.

>> Access exclusive features and bonuses when you sign up now <<

Pros and Cons of Magnifi

Here are the top pros and cons I uncovered while reviewing what Magnifi has to offer:

Pros

-

Handy AI assistant

-

More than 15,000 stocks and funds in the database

-

Incredibly simple to use

-

Built-in online brokerage account

-

Detailed, pro-level analytics

-

Commission free investing

-

Excellent mobile app

Cons

-

Doesn’t work with options or futures

-

No human advisors to talk to

Is Magnifi Right for Me?

I’d wager almost everyone can benefit from some or all of the features within the Magnifi app.

Having an AI helper on hand adds something akin to another pair of eyes on every decision you make and may be privy to impactful data you didn’t find during your own research. At worst case, it serves as an unbiased check before you pull the trigger on a trade.

The app itself is a huge time-saver, pulling together information that would take a lot longer on your own. Unless you really enjoy all that time in front of a computer, this alone makes Magnifi worth a closer look.

One thing you won’t find here are unsolicited recommendations. You’ll need to put in some time and effort, asking questions and considering the responses on your own. This requires at least some knowledge of your investment strategy and how you plan to play the market.

Also, not everyone can hire human financial advisors. This makes Magnifi a good option for those needing a lower price point.

>> Try Magnifi AI assistant NOW <<

How Much Is Magnifi?

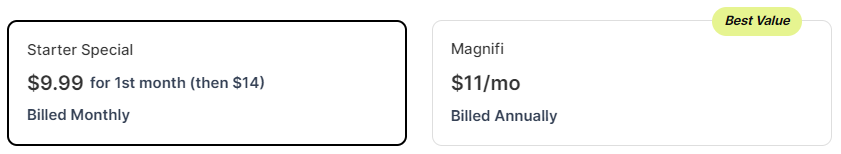

You’ve got two options for getting started with Magnifi. A normal month-to-month membership will set you back $14, but purchasing a year upfront reduces that price to $11.

Anyone signing up right now can get that first month of service for just $9.99 as part of this special deal. It may not be much, but it lowers the bar slightly if you’re on the fence about seeing what Magnifi can really do.

>> Get your personal AI investment assistant now for just $9.99 <<

Is Magnifi Worth It?

I thoroughly enjoyed my time with Magnifi and my AI sidekick. After a while, it really does start to feel like you’re just chatting up a friend for tips on how to improve your portfolio.

Good luck finding questions to throw it for a loop, too. With more than 15,000 assets in the system, it likely has what you’re looking for. More often than not, it shared something I hadn’t unearthed on my own.

Once you add top-tier analysis and a built-in brokerage, Magnifi is a one-stop shop for all your investment needs. You can—and probably should—keep all your trades in-house so the AI has your back.

I haven’t used Magnifi for long, but it’s neat to see the AI evolve based on my inputs. Over time, I’d envision its suggestions to be even more personalized than they already are.

The low monthly fee really cements the platform for me. Everything you do is commission-free, allowing you to invest as you see fit.

If you’re looking for something to take your investing prowess to the next level, Magnifi is definitely worth a look. Sign up today to unlock the special offer and see what AI can do for you.

Tags:

Tags: