With the advent of widespread online trading, stocks and options are more accessible than ever before. Our Market Chameleon review will tell you whether this research tool can pinpoint profitable insights and help you develop a more successful options trading strategy.

The stock market may seem like an endless portal of numbers and letters that are constantly in flux with no rhyme or reason.

How does anyone wrap their head around all of that information, especially during earnings season?

Research tools take all that data and distill it into something digestible.

But not all free or paid services are the same, so you may want to do some digging before committing your time and money to one.

This Market Chameleon review will dive deep into the details of this market research tool and break down all the platform has to offer.

What is Market Chameleon?

Market Chameleon is a web-based trading research site designed to take some guesswork out of stock and analyze options.

Accessibility is always at the forefront, which is why it offers newsletters and simple screeners through a free starter tier.

The service is a premier provider of options insights and uses data and analytics to help users make informed investment decisions.

Here’s just some of the great resources you can tap into to improve options strategies:

- Stock screening

- Price reactions

- Watch lists

- Earnings reports

- Dividend reports

The platform’s features and tools make it one of the best options strategy generation platforms in its class.

Market Chameleon tools make this a powerful options strategy generation platform packed to the brim with standout features.

The platform uncovers the latest stock and options opportunities that are making big moves in the market.

Some powerful tools include research, stock and option screeners, earnings, options volume, order flow, and much more.

What’s Included?

Keep reading our Market Chameleon review for a deep dive into each feature included on this platform.

Stock Research

This options research platform certainly has many features that traders can sink their teeth into.

Premarket and After Hours Trading

This interesting tool lists stocks that trade before or after the market day. You’re free to filter these stocks by sector, market cap, and several other metrics to help locate what you’re looking for.

Market Movers

Market Movers sheds some light into stocks with high trading activity during normal stock market hours. You can search by price, volume, and more to narrow down the list of securities meeting your parameters.

Morning Report and Company Events

These two sections capture major market news events, new stock listings, and tons of info about what that means for you. Similarly, it’s the spot to see upcoming public events like conferences that can move the needle of a stock considerably.

Dividend Reports

Another juicy tool within Market Chameleon’s suite is a detailed dividend calendar. It provides a streamlined view of payment frequency, current and historic yields, and growth rates over time. You can turn here for announcements or reports and save all data to a CSV file if you want to reference it later.

Options Research

Not to be outdone by stock research, Market Chameleon has several tools to keep options traders on the pulse of the options market.

In fact, there are many helpful features for investors looking to improve upon their strategies or find new trading ideas.

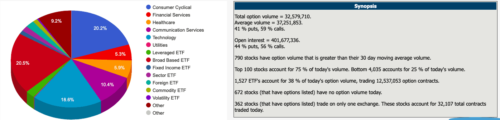

Unusual Options Volume Screen

The unusual options volume screen lets traders keep tabs on stocks that have options trading at higher volumes than expected against a 90-day average. It’s not a perfect science but still a great place to start looking for under-the-radar trading opportunities.

Implied Volatility Rankings Report

As the name suggests, you can run reports and see outcomes based on the implied volatility of options. Filters offer a chance to hone these searches down considerably, but keep in mind most require a paid membership.

Put Protection

Options can be quite risky, which is why Market Chameleon has a built-in put protection cost analysis. The tool helps hedge downside risk while keeping you in the know about stock movements on a high level.

Screeners

Screeners allow investors to identify trade opportunities across many different markets, and they can be used to screen pre-market or after-hours data. You can filter stocks by market cap, price, volume, and even different levels of volatility.

A handful of these are free, albeit with some limitations among search criteria. Still, even folks just checking the platform out can create screeners based on a number of metrics.

Stocks are a given, but you’re able to view options by expiration and block trades as well. There’s even a section dedicated to ETFs.

Results appear in table view with ample room for customization. You can download the screener’s findings into Google Sheets or Microsoft Excel if you want to refer back to it later.

Earnings Research

Market Chameleon’s earnings section is packed with a slew of tools for you to use. Perhaps most notable is an earnings calendar made available to both paid and free members.

Selecting a date and ticker symbol on the calendar unfurls details about how that particular stock fared on that day. It shows previous earnings moves and expected moves if you’re looking at today.

You can also see at a glance when future earnings reports are scheduled to hit the air. We all know how much these dates can affect the share price.

Paid subscriptions incorporate more features, such as future earnings dates with analyst insights. It’s also possible to tap into stock or options screeners based on earnings to gauge sentiment.

News

Press releases are one of the free tools that Market Chameleon offers to users at any account level. With a click, you can see the latest happenings from various internet sources.

Use the feed to find stocks you weren’t thinking about, or search up securities you’re interested in to see how they’re trending. Market Chameleon also features original articles with insights from the team.

Watch Lists

The watch list feature gives you the chance to build a selection of stocks you’re currently interested in. Here, you’re able to monitor how shares are moving within the market.

Pulling in stocks from different screens allows you to customize how the watch list looks and which data you’ll see when you log in. Customizable alert triggers exist to notify you when shares hit certain price targets or slide a certain way.

>> Like all that Market Chameleon has to offer? Click here to sign up for an account today! <<

Market Chameleon Additional Features

Historical Event Insights

Although technically a screener, Market Chameleon allows you to go back and research stock movements based on momentous past events. This could be anything from economic happenings to fluctuations in inflation or interest rates.

With this data in hand, users can make smarter decisions about upcoming events and the impact they could potentially have on specific stocks or the overall market.

Newsletters

The free section of the Market Chameleon site is home to a slew of newsletters to subscribe to.

Premarket Movers shares the largest movements before the opening bell and has custom alerts built-in based on the symbols in your watchlist.

Earnings Alerts is a daily email about upcoming earnings reports and which companies might be tracking higher or lower than expected.

Finally, Option Order Flow Sentiment contains updates on Bullish and Bearish insights surrounding order flow.

Comparison Tools

Mixed in with Market Chameleon’s other features are comparative tools for sussing out better picks among a sea of potential plays.

For stocks, the most commonly used comparison metric is for dividends. Using this tool, you can line up companies based on dividend payouts and view a range of other stats at the same time.

When it comes to options, a few more opportunities wiggle to the surface. Two of the most popular choices here are volatility and straddle.

Analysis Dashboard

The Analysis Dashboard captures a quick view of open interest metrics such as large percent gainers by expiration, option, or symbol. It’s more of a snapshot than a detailed list, but clicking on any of the stocks takes you to a detailed chart for that symbol.

Seasonality Information

We all know the time of year can have an impact on how a stock performs, but most platforms don’t take that into consideration. Market Chameleon has a specific section for tracking a security’s monthly performance and how seasonal trends may have an effect on the share price.

Market Chameleon Cancellation Policy

Market Chameleon offers a 7-day free trial that unlocks all the options tools on the website.

Better yet, there’s no fee for canceling during those first seven days.

Using the Market Chameleon free trial is an excellent opportunity to see everything the platform has to offer and to test if it can improve your option strategies.

All of its subscriptions are set up for monthly renewal, which is common with services that offer a paid subscription

There are no refunds for canceling during the middle of a billing cycle, but you can continue to use the service until the end of that billing month.

How Much Is Market Chameleon Review?

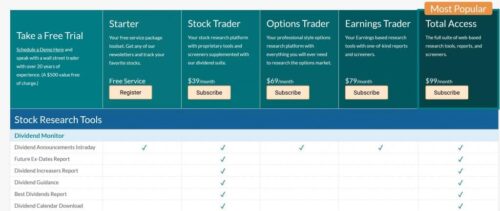

Market Chameleon pricing and the features available vary based on which of the five pricing tiers you choose to sign up for.

This provides new and experienced options traders with quite a bit of flexibility that most paid services do not offer.

Keep reading our Market Chameleon review to find out more about the pricing of each tier as well as what options tools are included with each one.

Market Chameleon Free Starter Subscription

The Starter Plan gives free access to a few tools in the form of stock and options information and articles.

There are also pre-set screens a trader can use for market research or trade ideas.

It’s a simple service, but it allows users to explore the platform and learn how the system works.

If nothing else, traders can come up with some trading ideas and create simple watch lists.

But if you want more features, like the Earnings Options Strategy Screener, you’ll need to dip your toes in the paid tiers.

Stock Trader Subscription

It probably comes as no surprise that the Stock Trader Plan focuses on all things stock market.

In addition to the screeners and long list of stock features, the Stock Trader Plan also has a few options breakdowns at a glance.

At $39 a month, this is the lowest you can spend on a paid plan on the platform.

Options Trader Subscription

Strangely enough, the Options Trader Plan contains the stock screener and other stock research tools except dividend reporting.

Though, the Options Trader Plan includes every options feature that the platform has in its repertoire, and its pricing reflects that.

At $69 per month, you are getting quite a bit of access to this market research tool.

Earnings Trader Subscription

The Earnings Trader Plan has most of the options tools from the Stock Trader Plan but omits some of the stock reports that the previous tier includes.

The Earnings Trader Plan provides the Earnings Options Strategy Screener, Earnings Stock Patterns Screener, and earnings report pattern tools for data collections and analysis.

A bit higher up the cost ladder, pricing for this tier is $79 per month.

Total Access Subscription

If you need more than Earnings Trader and the Market Chameleon free plan, you should definitely give the Total Access Plan a look.

The Total Access Plan is in no way a misnomer and does provide unfettered access to every one of the products on the Market Chameleon site.

Obtaining all these services in the Total Access Plan will cost you $99 per month.

>> Ready to get started with Market Chameleon? Click here to become a member NOW! <<

Is Market Chameleon Legit?

Market Chameleon is a solid research platform for anyone looking for new options trading opportunities.

This information platform goes above and beyond with free access to basic services and even customized watch lists to narrow down a search.

A platform just for research, none of your trading data or money ever passes through the site.

Market Chameleon Pros and Cons

The platform provides many incredible options tools right at your fingertips, but there are some downsides to consider.

We prepared a full list of all the pros and cons during our Market Chameleon review.

Pros

- A vast multitude of available tools for beginner and experienced options traders

- Easy to create watch lists and generate new trading ideas with market Chameleon tools

- Excellent earnings report pattern tools, including Earnings Calendar and Earnings Options Strategy Screener

- Powerful screeners with many customizable features

- Some tools offered for free

- Free 7-day trial

- Five different plans to choose from

Cons

- Website is a bit archaic

- No mobile app

- The best features are behind a paid subscription

Is Market Chameleon Right for Me?

Market Chameleon speaks the loudest to stock traders who focus on opportunities around earnings releases.

The site doesn’t offer much direction, so it’s more geared toward traders who are already at least somewhat experienced in options.

However, it does come with a number of helpful resources for anybody interested in learning more about stocks and options.

There’s also a bit of a learning curve to finding your way around the site, and doing that without any pre-existing knowledge may prove too difficult.

Once you get used to the platform, though, this isn’t really a big deal.

Market Chameleon Reviews by Subscribers

Here are a few user testimonials I found on Google.

I have traded for decades, but until now, there has been no data at this level with analysis of that data at a price that an individual investor could afford. Marketchameleon .com is a true game-changer for the individual investor in stocks or options or both. For any active trader, this is a must-have subscription. I have NO link to these wonderful nerds other than being a subscriber!

– C R, on Google

I started with the free trial and had some profitable trades come out of it, so I signed up. There is so much information, and they do want you to succeed if you watch some of the videos or take time and advantage of the research. I have only touched the tip of the iceberg. I recommend the service/site if you are serious about trading and learning.

– M F, on Google

Is Market Chameleon Worth It?

Unless you’re a brand-new trader, Market Chameleon has a slew of awesome tools that could improve your options trading.

Whether your focus is stocks, options, or on the earnings season, the site has so much information to plug into and digest.

You can also try the free 7-day trial to see which features you can’t live without and then select the plan that works best for you.

Most traders benefit from all the perks of the All-Access Tier, but don’t be afraid to start a little lower if you need to.

Since each subscription is monthly, you can jump up or down at any time.

We recommend at least trying out the free version for anyone looking to bolster their options trading strategies with a treasure trove of rich data.

Tags:

Tags: